Home mortgage rates dropped this week to the lowest levels of the year! This was due to a combination of some lower than expected profits on Wall Street, worries that the stock market may be topping out, and an influx of foreign money looking for safety. Money moving to treasury bonds rather than stocks drives rates down.

California reported that the economy added 56,100 jobs in April. This far exceeded the 14,600 added in March! The state unemployment rate dropped to 7.8%, a 6 year low!

In a positive sign for the economy, the number of Americans filing first-time jobless benefits fell last week to a seven-year low. Initial claims for unemployment benefits fell by 24,000 to a seasonally adjusted 297,000 in the week ended May 10, making this the lowest reading since May 2007. The number of continuing unemployment benefits also hit a new low, it fell by 9,000 to 2,667,000 in the week ending May 3 which marked the lowest level since December 2007.

However, a preliminary gauge of U.S. consumer sentiment showed a loss. The Thomson Reuters/University of Michigan’s preliminary May reading on the overall index on consumer sentiment came in at 81.8, down from 84.1 in the previous month and below expectations of economists who predicted an 84.5 reading. 58% of consumers did say the economy had improved, up from 49% in April.

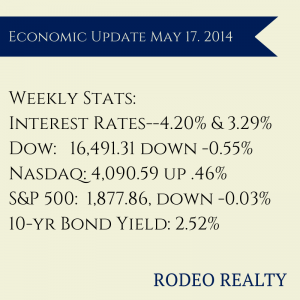

The Freddie Mac Weekly Primary Mortgage Market Survey showed that the 30-year-fixed rate hit a new low for the year, falling to 4.20% from 4.21% last week. The 15-year-fixed fell to 3.29% from last week’s 3.32%. A year ago the 30-year fixed was at 3.51% and the 15-year was at 2.69%. Loans over $417,000 are a little higher: 4.5% for 30 year fixed and 3.6% for 15 year fixed

The 10 year Treasury bond yield ended the week at 2.52%. It was 2.61% last Friday and 1.87% a year ago. Last May and June is when we saw a spike in interest rates last year, so the year over year increase will be gone by June. We will even see a year over year drop if rates stay stable or even rise slightly!

After a volatile week of ups and downs, the closing numbers on Friday showed little change. The Dow closed at 16,491.31 down –0.55% from last week’s close of 16,583.34. The Nasdaq closed at 4,090.59 up .46% from last week’s close of 4,071.87. The S&P 500 ended the week at 1,877.86, down –0.03% from last week’s 1,878.48.

DataQuick reported that the median sales price in the six-county Southland region rose 1% from March to $404,000 and up 13.2% from $357,000 in April 2013. The median price has risen on a year-over-year basis for 25 consecutive months. A total of 20,008 new and resale houses and condos sold in the Southland, up 13.4% from 17,638 sales in March but down -6.6% from 21,415 sales in April of last year. On average sales generally increased 1.4% between March and April since 1988 when DataQuick started counting these statistics. Southland sales have fallen on a year-over-year basis for seven consecutive months but last month’s was the smallest decline since last October and although April 2014 sales were lower than April 2013 sales they were higher than the amount of homes sold in both April 2012 and April 2011. In Los Angeles County alone, sales were down -7.0% year over year from 7,140 to 6,642 while the median price rose 11.6% from $395,000 to $441,000.

Respondents to Fannie Mae’s April 2014 National Housing Survey continued to express positive feelings about the real estate market. The amount of respondents who believe it is a good time to sell a house rose to an all-time high of 42%. The percentage of respondents who say it is a good time to buy a home held steady at 69%. Consumers are less optimistic about their ability to get a mortgage, 45% of respondents said it would be easy to get a mortgage today, down -7% from last month. Those who believe prices will rise was up to 50% from 48% and the expected price increase rose from 2.7% to 2.9%, Also, 52% expect mortgage rates will continue their rise, while only 7% believe mortgage rates will go down. Consumers who feel that the economy is on the right track was also up by 3% to 35%.

Data released by the National Association of Realtors® showed that the median price for an existing single-family home was up 8.6% year over year in the first quarter to a median price of $191,600.This was down from a 10.1% year-over-year increase in the fourth quarter. The median rose annually in 74% of the metropolitan areas tracked by the NAR and 22% saw double-digit price jumps. In the first quarter of 2013, 89% of all the tracked metros saw year-over-year price gains. For the first quarter of 2014 monthly inventory was at 1.99 million homes, a five-month supply and 3.1% higher than the first quarter of 2013. Existing-home sales fell -6.6% year over year for the quarter to a seasonally adjusted 4.6 million. The West saw a drop of -12.4% year over year in existing home sales and had the highest regional price increase, up 14% for the quarter to $282,100. The Los Angeles-Long-Beach-Santa-Ana region saw a median price increase year over year of 17.6% to $406,200.

The CoreLogic Case-Shiller indexes show that home prices rose 11.3% in the fourth quarter of 2013 compared to the same time period a year ago. Overall home prices were up 20% over the low point reached in the fourth quarter of 2011 but were still -21% below the peak reached in the first quarter of 2006. It is predicted that price appreciation will slow to 5.3% annually for 2014 which is above the long-term annual average of 4.5% recorded since 1975. (I am not buying this! Even though its a national number.) For Los Angeles the fourth quarter change was 20.3% higher than the previous year and a 5.2% ( we have already far exceeded this, so I’m not buying it either!) overall price increase is predicted for the year. CoreLogic a source used to track foreclosure properties, which are no longer prevalent in the marketplace. They didn’t predict that too well either, as we never say the flood of shadow inventory they predicted. Nor did we see the years and years of foreclosures they predicted. Nor did the “new normal” where prices don’t rise come to fruition. I don’t know how long I am going to include them in my report!

U.S. homebuilders are less confident in the short term this month. The National Association of Home Builders/Wells Fargo builder sentiment index was down to 45 from the revised reading of 46 in April. This is the lowest level in 12 months and indicates more builders view conditions as poor rather than favorable. Builders are optimistic about prospects for the next six months, that index rose 1 point to 57.

The National Association of Realtors® delivered its predictions for 2014 during the Realtor Party Convention & Trade Expo. Lawrence Yun, NAR’s chief economist said existing home sales will probably be around -3% less than last year to just over 4.9 million but should rise to over 5.2 million in 2014.

The California Association of Realtors® reported that the statewide median price reached its highest level since December 2007. It was $449,360, up 3.2% from the March figure and up 11.6%over last April’s $402,830. The statewide median price has increased year over year for the past 26 months.

Closed sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 394,070 units in April, up 7.4% from 367,020 in March but down -7% from a revised 423,690 in April 2013.This was the ninth straight decline on a year-over-year basis.

Inventory was down to 3.5 months from March’s 4 months but still up from 2.8 months in April 2013. The median number of days it took to sell a single-family home fell to 33.8 days in April, down from 35 days in March but up from 27.9 days in April 2013. We really need to reach a 6 month supply to be in a normal market where prices stabilize.

For Los Angeles County the median sold price in April 2014 was $406,750, up 2.8% from March’s $395,660 and up 12.5% from April 2013’s $361,630. Sales were up 23.3% from March but down-6.3% compared to April 2013. The average amount of inventory was 3.5 months, down from 3.9 months in March but up from 2.6 months in April 2013. The median days on market was 39.5 days, up from March’s 39 days and from April 2013’s 29.2 days.

The Commerce Department reported that U.S. housing starts rose strongly in April and building permits hit their highest point in nearly six years. Starts rose 13.2% month over month to a seasonally adjusted annual pace of 1.07 million units which is the highest level since November 2013 and up26.4% over last April. Starts for single-family homes rose 0.8% but the real movement was in multi-family homes which rose 39.6% to a 423,000 unit rate. Groundbreaking for buildings with more than five units hit the highest level since January 2006. Permits to build homes rose 8% month over month and 3.8% year over year to a 1.08 million unit pace which is the highest since June 2008. Permits for single-family homes were up 0.3% while permits for multi-family homes rose 19.5%. Permits for buildings were up 21.8%.

We are still seeing rapid gains in prices in our marketplace. It’s hard to predict when these gains will begin to taper off. Many areas have exceeded their 2007 highs. Keep in mind that adjusted for inflation the same price in 2007 is about 19% lower today! We still have room to run! Eventually prices will need to stabilize. I would think we will begin seeing the gains start to taper in a way that appreciation is more in line with inflation in 2015 or 2016! Until then we are still going to have an inventory problem in which demand exceeds supply and drives prices up. Although we are off our lows in inventory, anyone on the street knows that there is a lot of homes that are severely overpriced. These people that would not waste their time in previous markets have an “who knows, I’ll sell if I get stupid money” attitude. Well priced homes are going quickly. Many with multiple offers! We will know that price gains are tapering when the multiple offers are less common, and well priced homes begin to take a little time to sell.