| It was a wild first week of the year. It began with US military action in Venezuela with the promise of returning US oil companies to run oil production, in what is believed to be the largest reserves of oil in the world. Followed by an announcement by President Trump to purchase mortgage securities to drop long-term interest rates, an estimate of fourth-quarter GDP that was off the charts, and a mixed December jobs report. This all caused stocks to surge to record highs.

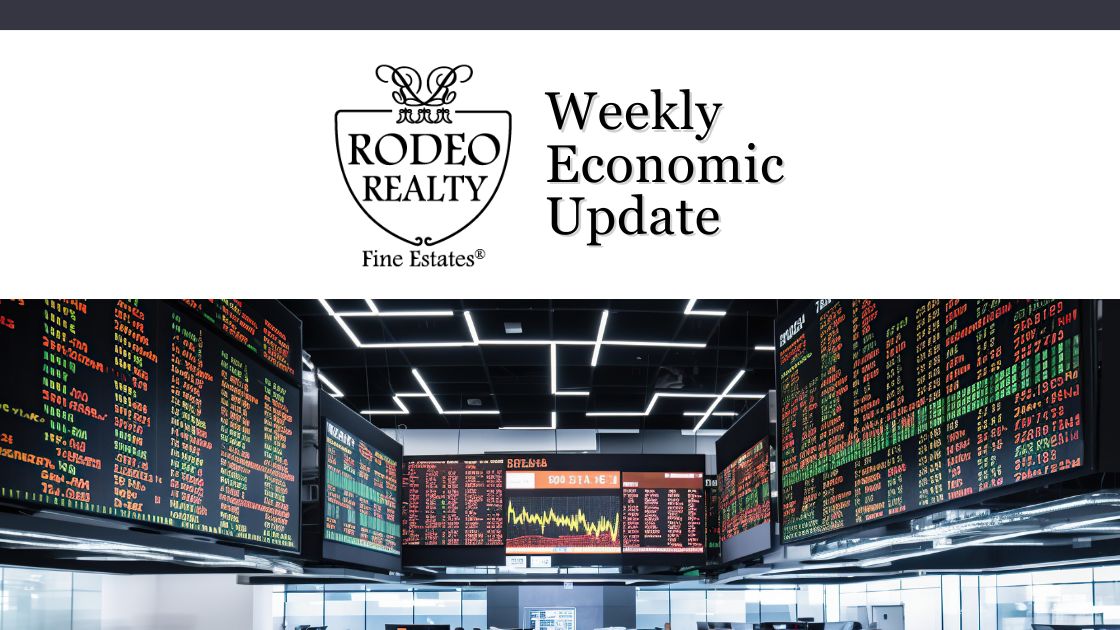

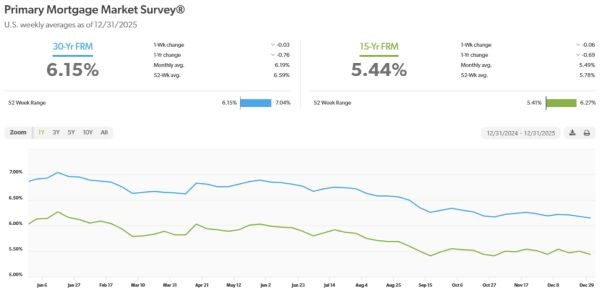

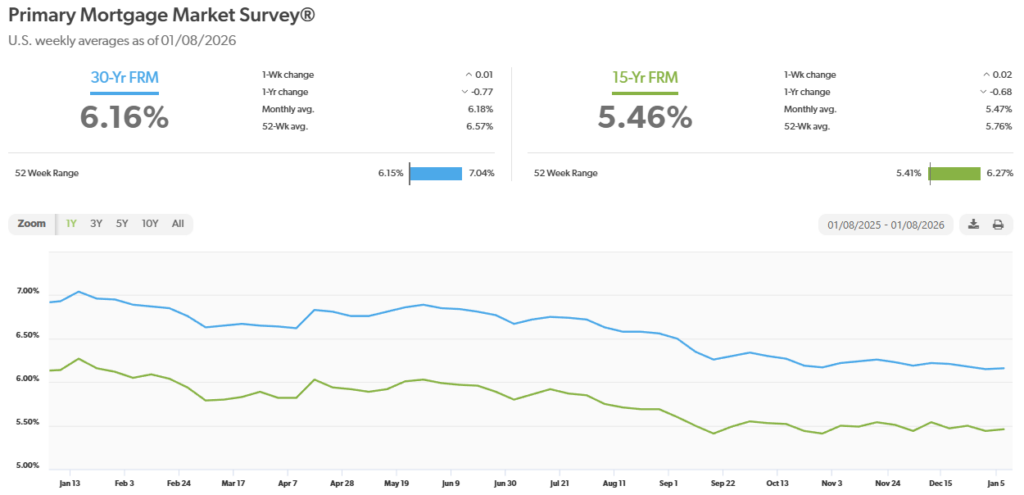

Housing & Mortgage Rates: President Trump announced a plan directing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities, a move aimed at putting downward pressure on mortgage rates and improving affordability. The idea is to help offset the Federal Reserve’s ongoing pullback from the mortgage market and narrow the spread between mortgage rates and Treasury yields. Still, the announcement has been viewed positively by markets as a signal of increased policy support for housing. We saw 30-year mortgage rates drip to under 6% on Friday after Thursday’s announcement, the lowest rate since 2022. Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of January 8, 2026, were as follows: The 30-year fixed mortgage rate was 6.16%, nearly unchanged from 6.15% last week. The 15-year fixed was 5.46%, nearly unchanged from 5.44% last week. If Friday’s rates hold, we will see a big dip in next week’s survey rates. The graph below shows the trajectory of mortgage rates over the past year.

December Jobs report shows hiring was sluggish while the unemployment rate dipped – Recent labor market data point to a continued moderation in U.S. hiring activity. The Bureau of Labor Statistics reported that 50,000 new jobs were added in December. That was below analyst’s expectations of 70,000. Revisions to the prior two months reduced reported job gains by a combined 76,000. As a result, average monthly job growth for 2025 stands at 49,000, down from 168,000 in 2024, and the three-month average has turned modestly negative. For the year employers added just 584,000 jabs last year, down from 2.2 million new jobs in 2024, marking its worst non-recession year of job growth since 2003. At the same time, the unemployment rate dropped to 4.4% in December, down from a revised 4.5% in November. That is better than economists’ expectations of 4.5% and below the long-term historical average of approximately 5.5%. Despite the slowdown in hiring, average hourly earnings rose 3.8% compared to one year ago. Estimated 4th quarter U.S. GDP suggest a surge in output – The Federal Reserve Bank of Atlanta’s GDPNow model sharply revised its estimate for U.S. fourth-quarter GDP growth to 5.4% annualized, up from roughly 2.7% just days earlier, driven by an unexpected plunge in the U.S. trade deficit and stronger consumer spending data. This dramatic jump reflects the trade gap narrowing to its lowest level since 2009, turning what had been a drag on growth into a significant contributor. While the GDPNow figure is a real-time nowcast rather than an official BEA release, it signals potentially robust economic momentum as we close out 2025 and reshapes market and policy expectations heading into 2026. Oil industry news – President Trump announced a US military action in Venezuela capturing and arresting President Nicolas Maduro over narcotic trafficking charges. This laid the groundwork for President Trump to announce that the US had control over Venezuelan oil and that US oil companies, who’s interests and investments in oil production was taken from them in 1976 when then President Carlos Andres Perez nationalized the oil industry, would be returned to US companies. Venezuela has the largest known oil reserves in the world. On Friday Trump hosted oil executives to formulate a plan to encourage investment to US oil companies into Venezuela promising security and cooperation from the Venezuelan government. The Dow Jones Industrial Average closed the week at 49,504.07 up 2.3% from 48,382.39 last week. It is already up 3% from 48,063.29 on December 31, 2025. The S&P 500 closed the week at 6,966.28, up 1.6% from 6,858.47 last week. The S&P is up 1.8% from 6,845.50 on December 31, 2025. The Nasdaq closed the week at 23,702.88, up 2% from 23,235.63 last week. It is up % from 23,241.99 on December 31, 2025. The 10-year treasury bond closed the week yielding 4.18%, almost unchanged from 4.19% last week. The 30-year treasury bond yield ended the week at 4.82%, down from 4.86% last week. We watch bond yields because mortgage rates follow bond yields. Have a Great Weekend! |

From Nintendo My Mario Merch to Microsoft CoPilot and More! | Tech News

Dive into this week’s leading tech news headlines. From Nintendo My Mario Merch to Microsoft CoPilot and more, we have you covered on the latest news. Check out what’s happening from across the web!

Microsoft’s Copilot now lets you buy without leaving chat

Microsoft unveiled Copilot Checkout, a new in-chat purchase flow that surfaces “Buy” buttons inside Copilot so you can choose a product, enter shipping and payment details, and complete checkout without opening a retailer’s site. The feature is rolling out with select partners (think Urban Outfitters, Anthropologie, and some Etsy sellers) and taps payment providers like PayPal, Stripe, and Shopify to power transactions. It’s part of a larger trend—agents moving from suggestion to action—so expect more assistants to blur discovery and commerce into one conversational loop. For shoppers, the convenience is obvious; for merchants, it’s a new placement to win conversions (and a new place to think about brand control and data). Keep an eye on how receipts, returns, and post-purchase service get handled when the cart never actually leaves the chat.

Nintendo brings My Mario merch to the U.S. Market

Nintendo is expanding its My Mario line in the U.S. next month with apparel, toys, books, and a mobile app. Likewise, this debut from Nintendo packages the brand’s cozy, character-driven merch into an owned-brand moment. The Nintendo initiative feels designed to turn fandom into low-friction, everyday touchpoints. Of course, think soft hoodies you actually want to wear and small toys that make for shareable social posts. For brand teams, it’s a reminder that IP monetization now lives across product, content, and companion apps rather than just game sales. The move by Nintendo also taps into nostalgia and collectible culture. If you’re curating lifestyle content, expect a new wave of Nintendo Mario-themed flatlays and influencer fits.

Bose open-sources old SoundTouch smart speakers

Bose surprised many by choosing to open-source the software for older SoundTouch smart speakers that were losing official cloud support, giving owners and hobbyist devs a route to keep devices useful rather than forcing e-waste. The code release lets community maintainers run local or self-hosted services, effectively turning obsolescence into an opportunity for DIY longevity. It’s a rare corporate move that respects customer hardware investments and empowers privacy-minded users to retain features without vendor lock. For the sustainability crowd, this is an encouraging precedent: when companies can’t or won’t keep cloud hooks live, handing control back to users is a practical, less-wasteful path. Watch whether other audio and smart-home brands follow Bose’s example when clouds fade.

Disney Plus tests vertical video to meet the short-form moment

Disney Plus is experimenting with vertical video formats — a nod to short-form viewing habits — so that bite-sized, portrait-first clips can live inside the streaming app alongside traditional widescreen fare. This is about more than orientation: it’s a play to surface snackable moments from franchises and to keep eyeballs inside Disney’s ecosystem when users are in a scroll mindset. Creators and social teams will appreciate another official home for repurposed clips and discovery loops that feed back into long-form viewing. For viewers, the experience should feel more native for mobile-first browsing, though the challenge is preserving cinematic intent while slicing content into portrait frames. Expect creative teams to test repackaged scenes, micro-edits, and vertical trailers as the format matures.

Bluetti lets you fast-charge power stations from your car at up to 1,200W

Bluetti updated its car-charging support so compatible power stations can now accept up to 1,200W from a vehicle’s inverter, dramatically cutting refill times on road trips and emergency runs. That change turns a car into a far more useful mobile charging hub for large batteries, making portable power stations actually practical for overnight uses or power interruptions while traveling. The tradeoffs are about vehicle wiring and inverter quality—this kind of throughput demands robust electrical systems and safe cabling—so installers and users should proceed with care. For overlanders, vanlifers, and emergency planners, the feature meaningfully shrinks the “refill” pain point and makes off-grid power more usable without long wait times. It’s another small step toward making portable energy feel less like camping gear and more like dependable mobile infrastructure.

L’Oréal’s Light Straight uses infrared to speed hairstyling

At CES, L’Oréal demoed Light Straight, a handheld styler that leverages targeted infrared heat to smooth hair faster with less thermal exposure than traditional flat irons. Early hands-on notes highlight quicker styling passes and a gentler feel on brittle hair, suggesting that light-based thermal strategies might be a real haircare innovation rather than a gimmick. For beauty tech product teams, the gadget is proof that category incumbents can meaningfully reengineer everyday rituals with science-backed heating methods. Consumers should expect premium pricing at first, but if the tech proves kinder to hair over time, adoption could spread beyond early adopters. Regulatory and safety testing will be important to watch as the category shifts from brute-force heat to smarter thermal delivery.

Amazon refreshes the Dash Cart for Whole Foods

Amazon unveiled a redesigned Dash Cart for Whole Foods that’s lighter, carries more, and includes tap-to-pay so shoppers can breeze through checkout even more smoothly than before. The cart’s iteration leans into convenience: improved sensors, better ergonomics, and a payment flow that reduces friction for fresh grocery runs. For retailers and in-store marketers, the cart remains an experiment in blending physical retail with digital ease—data from instrumented carts can inform aisle layout, promotions, and inventory. Privacy questions linger about in-store tracking, but the value proposition for a frictionless grab-and-go experience is undeniable for busy shoppers. Expect Amazon to keep iterating on the hardware and software interplay as it learns usage patterns at scale.

Mortgage Rate Update | January 8, 2026

Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of January 8, 2026 were as follows:

The 30-year fixed mortgage rate was 6.16%, nearly unchanged from 6.15% last week. The 15-year fixed was 5.46%, nearly unchanged from 5.44% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Weekend Events | January 9 – January 11

As January continues, it’s time to check out all of the local weekend fun. From family festivals to the LA Art Show and more, there is something for all to enjoy! Check out what’s happening in your neighborhood from January 9 through January 11.

Los Angeles Weekend Events | January 9 – January 11

Oshogatsu Family Festival

When: January 11, 2026

Where: Little Tokyo

What: Ring in the Year of the Horse with a free, family-friendly celebration at the Japanese American Cultural & Community Center, filled with hands-on activities and lively performances. Expect horse‑themed crafts and origami for kids, plus rice‑pounding rituals, calligraphy, and candy‑sculpture demos, live music, and comedy from beloved improv group Cold Tofu.

The Notebook

Where: Hollywood

When: Through January 25, 2026

What: See a stage adaptation of The Notebook, based on Nicholas Sparks’ best-selling novel and reimagined as a musical. Featuring music and lyrics by Ingrid Michaelson, this emotional production brings the sweeping romance of Allie and Noah to life with stirring songs and heartfelt performances.

LA Art Show

Where: DTLA

When: Until January 11, 2026,

What: The Los Angeles Art Show returns for its 31st year, showcasing an expansive mix of contemporary, modern, and historic works from galleries around the world. This year includes the debut of a Latin American Pavilion and the first major solo exhibition of Sylvester Stallone’s abstract paintings. Also featured: DIVERSEartLA’s exploration of how biennials and museums shape the contemporary art landscape.

Westside & Beach Communities Weekend Events | January 9 – January 11

Polar Bear Plunge

When: January 10, 2026

Where: Santa Monica

What: If you didn’t make it to the New Year’s Day plunge, don’t sweat it—Santa Monica’s Annenberg Community Beach House is hosting a chilly do-over on January 10 from 10am to 2pm. For just $10, you can brave the brisk Pacific, then cozy up in the heated pool afterward. It’s a fun, refreshing way to start the year (even if you’re a little fashionably late).

Astra Lumina

When: Until January 31, 2026

Where: Rancho Palos Verdes

What: Wander through a glowing garden of stars at South Coast Botanic Garden’s year-end light show, where nine celestial-themed installations illuminate a dreamy Palos Verdes trail. While it’s not a traditional holiday display, the experience is both mesmerizing and meditative, especially with optional pre-walk breathwork classes offered on select nights. Expect a tranquil, wellness-inspired spin on L.A.’s after-dark botanical trend.

Ice at Santa Monica

When: Until January 19, 2026

Where: Santa Monica

What: Just steps from the beach, Ice at Santa Monica brings festive winter fun to the coast with its 8,000-square-foot outdoor skating rink. Open daily through mid-January at Fifth and Arizona, admission is $24 for a one-hour session with skate rentals included. Expect seasonal treats, cozy fire pit rentals, and themed events like classical music Sundays.

San Fernando Valley Weekend Events | January 9 – January 11

Winter Pruning Workshop

Where: Cottonwood Urban Farm | 8380 Ventura Canyon Avenue

When: January 10, 2026

Get hands-on with orchard care during this Winter Pruning Workshop focused on shaping healthy, productive fruit trees. You’ll learn essential techniques like the 4 D’s of pruning, proper tool use, and how to make clean cuts—all grounded in classic orchard wisdom. Open to all experience levels, this workshop includes in-orchard practice and is donation-based with tools provided.

LACOS Winter 2026 CE Symposium

When: January 11

Where: Skirball Cultural Center | North Sepulveda Boulevard

What: Join the LACOS Winter 2026 CE Symposium at the Skirball Cultural Center for a day of learning, networking, and professional growth. This in-person event features expert-led presentations, interactive workshops, and opportunities to connect with industry peers. Don’t miss your chance to expand your knowledge and make new connections.

Second Saturday Jazz ft. Angela O’Neill

When: January 10

Where: The Velvet Martini Lounge | 4349 Tujunga Avenue

What: Swing into your Saturday with Angela O’Neill & the Outrageous8 as they celebrate a decade of big band jazz, energy, and unforgettable tunes. This month’s special guest, the dazzling Keri Kelsey, brings her Broadway-caliber vocals and colorful life story to the stage. With LA’s top musicians, custom arrangements, and a $35 food and beverage minimum, it’s set to be a lively afternoon of music and memories.

Conejo Valley Weekend Events | January 9 – January 11

Stagecoach Inn Museum 150 Years Celebration

When: January 10, 2026

Where: 51 S Ventu Park Rd, Newbury Park

What: Celebrate the Stagecoach Inn Museum’s 150th anniversary with a family-friendly afternoon of local history, live music, crafts, and games on Saturday, January 10, from 1–4pm. Originally built in 1876 as the Grand Union Hotel, the Inn has been a cornerstone of Newbury Park’s story, rebuilt after a fire and rededicated in 1976 thanks to the community. Admission is $10 for adults and $5 for children ages 5–12, with a commemorative ribbon-cutting at 1:30pm.

Dream, Sip, Create: Vision Board Workshop

When: January 10, 2026

Where: Four Seasons Hotel Westlake Village

What: Set your intentions for 2026 in style at the Dream, Sip, Create Vision Board Workshop, hosted at the Four Seasons Hotel Westlake Village. This luxe, in-person experience blends creative art therapy with holistic wellness—complete with mimosas, mindful connection, and hands-on vision board making. Leave feeling inspired, aligned, and ready to manifest a radiant new year.

Giessinger Comedy Night

When: January 10, 2026

Where: Giessinger Winery & Cidery | 3059 Willow Lane, Westlake Village

What: Laugh the night away at Giessinger Comedy Night—where the wine is smooth, and the punchlines are even smoother. Happening January 10 at Giessinger Winery in Westlake Village, the evening features stand-up talent from Netflix, BET, and Prime Video. Doors open at 7pm, show starts at 7:30pm—tickets are $10 online, $15 at the door.

Enjoying Afternoon Tea Around Town | L.A. Eats

If you’re in the mood for a midday escape filled with scones, finger sandwiches, and a touch of elegance, you’re in luck. The city offers an impressive array of destinations for afternoon tea in Los Angeles, ranging from classic hotel lounges to eclectic modern tearooms. Here are some of the best places to sip and savor in style.

The Living Room at Hotel Bel-Air

Location: 701 Stone Canyon Road, Los Angeles, CA, 90077

For the ultimate in luxury, the Hotel Bel-Air’s afternoon tea is a serene and indulgent experience. Served Friday through Sunday at 3 p.m., the $350 tea for two includes scones with Devonshire cream, Jidori chicken salad tea sandwiches, and salted caramel cream puffs. Nestled in a lush canyon, the ambiance is unmatched.

Waldorf Astoria Beverly Hills

Location: 9850 Wilshire Boulevard, Beverly Hills, CA 90210

Afternoon tea at the Waldorf Astoria is an opulent affair with a live harpist setting the mood. Enjoy traditional finger foods served on tiered trays, with a selection of Tea Leaves blends or Champagne from Veuve Clicquot. Prices start at $135 per person.

The Peninsula Beverly Hills

Location: 9882 Santa Monica Boulevard, Beverly Hills, CA 90210

Tea at The Peninsula is as glamorous as you’d expect, with live harp music and plush seating. Enjoy finger sandwiches, pastries, and scones starting at $125 per person, or upgrade for bottomless Champagne. Likewise, multiple seating times are available daily.

Palma at the Santa Monica Proper Hotel

Location: 700 Wilshire Boulevard, Santa Monica, CA 90401

Palma puts a chic twist on afternoon tea in Los Angeles with modern bites like lobster rolls and duck confit baguettes. The stylish spread starts at $85 with prosecco and rises to $150 for bottomless Champagne. Expect inventive sweets and cozy coastal ambiance.

Ye Olde King’s Head

Location: 116 Santa Monica Boulevard, Santa Monica, CA 90401

A classic British pub, Ye Olde King’s Head, offers traditional tea Monday through Saturday. For $37, guests enjoy a set menu of tea, sandwiches, and scones, or can opt for a la carte options. Of course, it’s a casual, cozy choice steps from the beach.

The London West Hollywood

Location: 1020 N. San Vicente Boulevard, West Hollywood, CA 90069

Partnering with the Rare Tea Company, The London serves a refined afternoon tea experience on weekends. Priced at $84 per person, the menu includes time-honored British favorites and elegant surroundings with views of the Hollywood Hills.

The Cat and Fiddle Pub

Location: 742 N Highland Avenue, Los Angeles, CA 90038

This longtime pub adds a relaxed flair to tea time. The $45 weekend service includes a sausage roll, scones, and an assortment of sandwiches. It’s a great pick for a casual outing with friends.

Rose and Blanc Tea Room

Location: 301 S. Western Avenue, Ste 202, Los Angeles, CA 90020

Koreatown’s Rose and Blanc charms with its pastel decor and Instagram-worthy table settings. Tea starts at $38 and includes sweet and savory bites like macaroons and dill cucumber sandwiches. Likewise, reservations are required.

Dahlia Lounge at Downtown L.A. Proper

Location: 1100 S. Broadway, Los Angeles, CA 90015

Inside the Downtown L.A. Proper hotel, Dahlia offers a $70 tea menu. The spread features sandwiches with wagyu beef and smoked salmon, plus desserts like mocha praline tarts. In addition, they offer vegan options, and cocktails are also available.

The T Room

Location: 2405 Honolulu Avenue, Montrose, CA 91020

A hidden gem in Montrose, The T Room serves up classic tea service for just $34. Expect scones, pastries, and signature lingonberry chicken sandwiches in a family-run setting open daily.

Whether you’re searching for grandeur or a quiet local nook, these destinations offer the best selections. Sip slow, snack well, and let the tradition transport you.

Rodeo Realty’s 2025 Holiday Party Recap

This year’s Rodeo Realty holiday party was truly one to remember! From great company to festive moments throughout the night, the celebration was a blast from start to finish. In case you missed it—or just want to relive the fun—here are some memorable snapshots from the event. Cheers to a wonderful season and an even brighter year ahead!

Cozy SoCal Weekend Getaways | Out & About

The holidays may be over, but sometimes the best way to start the new year is with a quick reset. Enter: cozy weekend getaways under three hours from L.A. Whether you’re craving snow-dusted cabins or a blissed-out spa moment, the options are endless. Southern California is filled with charming small towns and tucked-away destinations that let you breathe a little deeper.

Here are four low-key escapes that are perfect for a winter weekend recharge.

Ojai Weekend Getaways: For Slow Living and Spa Serenity

Distance from L.A.: approx. 1.5–2 hours

Nestled in a sun-soaked valley surrounded by the Topatopa Mountains, Ojai is ideal. This coastal haven is perfect for those looking to unwind in style. Known for its boutique hotels and spiritual wellness scene, it’s a perfect choice for a cozy weekend getaway focused on relaxation. Book a stay at the Ojai Valley Inn. Once there, you can schedule a facial at their dreamy spa or soak in a private tub overlooking the hills. Spend your afternoons exploring Ojai’s charming downtown with its artisan shops. Or explore its wine tasting rooms and farm-to-table eateries. Likewise, don’t skip The Dutchess or Farmer and the Cook. And if you time it right, you’ll catch Ojai’s signature “pink moment” as the sun sets and bathes the mountains in a rose-hued glow.

Idyllwild Weekend Getaways: For Cabin Vibes and Pine-Scented Peace

Distance from L.A.: approx. 2–2.5 hours

Craving crisp mountain air and a rustic cabin retreat? Head to Idyllwild, a quaint alpine village tucked in the San Jacinto Mountains. It’s the kind of town where cell service is spotty (in the best way), fireplaces are a given, and the pine trees do all the talking. Book a log cabin with a hot tub or stay at a woodsy B&B like Strawberry Creek Inn. Stroll the town’s cozy center for vintage shops and coffee, or explore winter hiking trails in Idyllwild Park and Humber Park. Come evening, warm up with comfort food at Gastrognome, and stargaze from your porch with a wool blanket and a mug of something hot.

Solvang Weekend Getaways: For European Charm and Danish Pastries

Distance from L.A.: approx. 2.5 hours

Solvang is like stepping into a snow globe—but make it Danish. This kitschy-cute town in the Santa Ynez Valley is beloved for its old-world architecture, windmills, and family-run bakeries serving up æbleskivers and kringle. Cozy up at a wine country inn like The Landsby, and sip your way through the region’s tasting rooms—many within walking distance. When you’re not wine tasting or pastry sampling, explore local boutiques or visit the nearby Elverhøj Museum for a dose of cultural history. It’s the perfect cozy weekend getaway for food lovers and anyone with a Pinterest board full of fairy-tale towns.

Temecula Weekend Getaways: For Vineyards, Hot Air Balloons, and Wine Country Luxe

Distance from L.A.: approx. 1.5–2 hours

If your idea of a cozy weekend getaway includes a wine glass and a vineyard view, Temecula delivers. This SoCal wine country staple blends the best of Napa vibes with SoCal ease. Stay at South Coast Winery or the luxe Bottaia Winery Villas, and start your day with a hot air balloon ride over rolling hills. During winter, the crowds thin and the chill makes those bold reds taste even better. Don’t miss the chance to unwind at Grapeseed Spa before heading home relaxed, recharged, and slightly buzzed.

Whether you’re looking to sip, soak, or snooze your way through the weekend, these cozy weekend getaways are your invitation to escape the city grind without straying too far. Sometimes all you need is a tank of gas, a great playlist, and a change of scenery to reset your soul.

Economic Update | Week Ending January 3, 2026 & Year Ending December 31, 2025

| Stocks surged and Stock markets hit record highs in 2025 – All three indexes hit record highs in 2025 but closed the year slightly off their record highs. AI and robust economic growth fueled the rise in stock prices. The Dow Jones Industrial Average ended the year at 48,063.29, up 13% from 42,544.72 on December 31, 2024. The S&P 500 closed the year at 6,845.50, up 16.4% from 5,881.63 on December 31, 2024. The NASDAQ closed at 23,241.99, up 20.4% from 19,310.79 at the end of 2024. For the week ending January 3, 2026 – The Dow Jones Industrial Average closed the week at 48,382.39 down 0.7% from 48,710.87 last week. The S&P 500 closed the week at 6,858.47, down 1% from 6,929.94 last week. The Nasdaq closed the week at 23,235.63, down 1.5% from 23,593.10 last week.

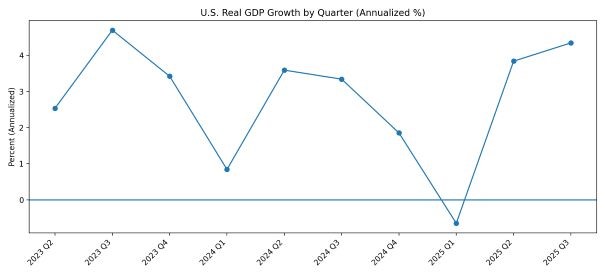

GDP surged in the third quarter of 2025 – The U.S. Gross Domestic Product (GDP), the broadest measure of goods and services in the economy, grew at a staggering 4.3% annualized rate in the third quarter of 2025. Earlier in the year some economists had predicted that the economy was stalling and that a recession could be coming. The pickup in GDP has demonstrated that the economy has remained strong. This was one of the factors that propelled the stock markets this year. The graph below shows the GDP rate over the past three years

U.S. Treasury Bond Yields – Treasury bond yields ended the year with short term yields lower and long-term about the same as they were at the beginning of the year – The 10-year U.S. treasury bond yield closed the year at 4.18%, down from 4.58% On December 31, 2024. The 30-year treasury yield ended the year at 4.84%, up from 4.78% on Dec. 31, 2024. For the week – The 10-year treasury bond closed the week yielding 4.19%, up from 4.14% last week. The 30-year treasury bond yield ended the week at 4.86%, up from 4.81% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates dropped in 2025 – Experts expect them to drop further in 2026 – The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 31, 2025, were as follows: The 30-year fixed mortgage rate was 6.15%, down from 6.85% on December 26, 2024. The 15-year fixed was 5.44%, down from 6% on December 26, 2024. The graph below shows the trajectory of mortgage rates over the past year.

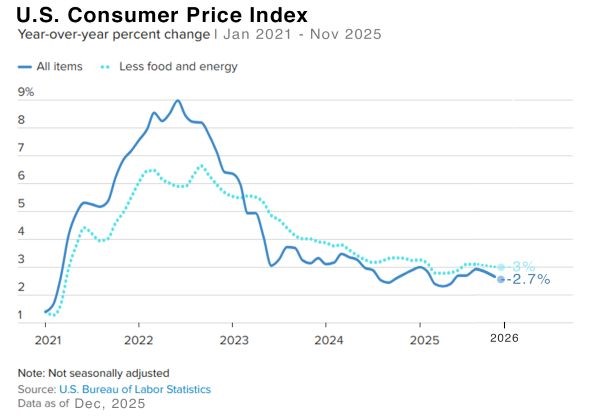

Inflation – We watch inflation because mortgage interest rates are tied to inflation. The higher the inflation rate, the higher mortgage rates are. As inflation cools, mortgage rates drop. While we look at many different inflation reports, we have less data this year than we normally have because key indexes have not been released due to the government shutdown. One report, the Consumer Price Index (CPI) for November was released. It showed that consumer prices rose 2.7% from one year ago in November. While still far from the Fed’s 2% annual target it was much lower than the 3.1% that economists polled expected. The CPI rate peaked at 9.1% in June 2022 and worked its way down to 2.3% in April. Unfortunately, the CPI rate began to increase from there and peaked at 3% in September, which economists attribute to tariff costs being passed on to consumers, before dropping to 2.7% in November. The core CPI rate, which excludes volatile food and energy prices rose 2.6% from one year ago, also below economists’ expectations. This gave hope to investors that inflation may be cooling enough for the Fed to continue to lower rates. The Fed’s favorite measures of inflation is the Personal Consumption Expenditure Index (PCE). Unfortunately, due to the shutdown, the October and November numbers are still being tabulated and are scheduled for release with the December figures at the end of January. For September, it showed that headline PCE rose 0.3% in September from August. That was in-line with economists’ expectations. On an annual basis PCE rose 2.7% from one year earlier, below the 2.8% expected. Core PCE, which does not include food and energy prices because those tend to be more volatile, increased 0.2% month-over-month in September. On an annual basis it was up 2.8% from one year earlier. That was below the 2.9% economists expected.

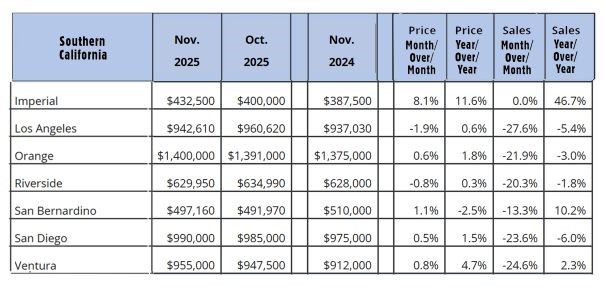

November home sales – The California Association of Realtors and the National Association of Real Estate release home sales data on the third week of each month for the previous month. Here is the November 2025 home sales recap. You can run a report on your city or zip code with the same data at RodeoRe.com U.S. existing-home sales – November 2025 – The National Association of Realtors reported that existing-home sales totaled 4.13 million units on a seasonally adjusted annualized rate in November, up 0.5% from the number of homes sold in October and down 1% from the number of homes sold last November. The median price paid for a home sold in the U.S. in November was $409,200, down from $415,200 in October, but up 1.2% from $404,400 one year ago. There was a 4.2-month supply of homes for sale in November, up from a 3.8-month supply last November. First-time buyers accounted for 30% of all sales, up from 30% last month. Investors and second-home purchases accounted for 18% of all sales, down from 15% in August. All cash purchases accounted for 27% of all sales, up from 30% last month. Foreclosures and short sales accounted for 2% of all sales. California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 287,940 on an annualized basis in November, up 1.9% from 285,590 in October. Year-over-year sales were up 2.6% from a revised 280,530 annualized home sales last November. The statewide median price paid for a home in was $852,680 in November, down 3.9% from 886,960 in October. Year-over-year the median price was almost unchanged from $852,880 last November. The unsold inventory index showed that there was a 3.1-month supply of homes for sale in October. These numbers ae a little deceiving. Prices have dropped more than the median price indicates. The median price is the mid-point of all homes sold. Basically, it’s the point where one half of the homes sold for more and one half of the homes sold for less. Usually, the median price is a good indicator of prices across the board. There are times when conditions impact that. This is one of those times. With stock market values at all-time highs, which they were in October, people invested in the stock market are flusher than people that are not. Additionally, many of the factors that impact people’s ability and desire to buy a home affect people more in the lower income range than they affect people in higher income ranges. That’s happening now. Sales are down in all price ranges compared to any time prior to interest rates rising in mid-2022, but sales in the lower price ranges as a percentage of all sales are fewer than we would normally see as those people are more impacted by inflation, don’t have stocks, etc. The graph below shows CAR sales data by county for Southern California. Have a Great Weekend! |

New Year, New Home Refresh | Home Tips

There’s something about the start of a new year that makes you want to hit the reset button. And while we can’t promise a complete life overhaul, giving your home a refresh might be the next best thing. If you’re craving a change but don’t have the time (or budget) for a full-scale renovation, don’t worry, you can refresh your space with simple updates that make a surprisingly big impact.

From upgraded lighting to a strategic furniture swap, here are some luxe yet approachable ways to elevate your interiors as you step into the new year.

1. Swap Out Your Hardware

An easy, inexpensive way to refresh your space is by updating cabinet knobs, drawer pulls, and door handles. Matte black, aged brass, and even lucite options can instantly modernize your kitchen or bathroom without replacing a single cabinet. Think of hardware as jewelry for your home; the right pieces add polish and personality.

2. Reimagine Your Lighting

If you’ve been living with the same builder-grade fixtures for years, it might be time to let there be light; beautiful, flattering, conversation-starting light. A statement pendant in the dining room or sculptural sconces in the hallway can do wonders for a home refresh. For a cozy glow, layer in floor lamps and table lamps with warm, diffused bulbs to refresh your space with ambiance and intention.

3. Reupholster, Don’t Replace

Before you ditch that old accent chair or dated ottoman, consider giving it new life with fresh upholstery. A luxe velvet, textured linen, or playful pattern can completely transform a piece of furniture—and your entire room. Bonus points if you use this as an opportunity to add a pop of color or bring in a new texture.

4. Edit and Rearrange

Sometimes, refreshing your space simply means letting it breathe. Start the new year with a decluttering session—donate, store, or repurpose items you no longer love. Then try rearranging your existing furniture for better flow. Float a sofa away from the wall, angle your armchairs, or place your bed on a different wall to re-energize the layout without spending a dime.

5. Upgrade Your Soft Goods

New throw pillows, updated bedding, or a modern area rug can completely shift the vibe of a room. For a quick home refresh, choose a new palette or mix of patterns to layer in personality. Focus on plush, touchable textures to add warmth and make the space feel renewed and inviting.

6. Bring in Nature

Biophilic design isn’t going anywhere. Bring the outdoors in with leafy houseplants, sculptural branches, or even just fresh flowers. Natural elements help refresh your space both visually and energetically, adding life, movement, and mood-boosting properties to any room.

7. Accent Walls Without the Paint Fumes

If you’re not ready to commit to painting, try peel-and-stick wallpaper, wall decals, or even large-scale art panels. These can offer color and dimension, and they’re renter-friendly and easy to update when your tastes evolve.

8. Scent Is the Silent Decorator

Don’t underestimate the power of scent to refresh your space. Swapping out seasonal candles, diffusers, or essential oils can signal a new chapter and evoke a sense of luxury. Opt for uplifting scents like citrus, sage, or cedarwood to invite clarity and calm.

You don’t need to demo walls or install custom cabinetry to feel brand new in your space. Sometimes, the simplest updates are the most impactful. So as you toast to new beginnings this year, take a moment to refresh your space and set the tone for everything you’re manifesting in 2026; one stylish corner at a time.

Economic Update | Month Ending December 31, 2025

| Stocks surged and Stock markets hit record highs in 2025 – All three indexes hit record highs in 2025 but closed the year slightly off their record highs. AI and robust economic growth fueled the rise in stock prices. The Dow Jones Industrial Average ended the year at 48,063.29, up 13% from 42,544.72 on December 31, 2024. The S&P 500 closed the year at 6,845.50, up 16.4% from 5,881.63 on December 31, 2024. The NASDAQ closed at 23,241.99, up 20.4% from 19,310.79 at the end of 2024. GDP surged in the third quarter of 2025 – The U.S. Gross Domestic Product (GDP), the broadest measure of goods and services in the economy, grew at a staggering 4.3% annualized rate in the third quarter of 2025. Earlier in the year, some economists had predicted that the economy was stalling and that a recession could be coming. The pickup in GDP has demonstrated that the economy has remained strong. This was one of the factors that propelled the stock markets this year.

The graph below shows the GDP rate over the past three years

U.S. Treasury Bond Yields – Treasury bond yields ended the year with short-term yields lower and long-term about the same as they were at the beginning of the year – The 10-year U.S. Treasury bond yield closed the year at 4.18%, down from 4.58% on December 31, 2024. The 30-year treasury yield ended the year at 4.84%, up from 4.78% on Dec. 31, 2024. We watch bond yields because mortgage rates often follow Treasury bond yields. Mortgage rates dropped in 2025 – Experts expect them to drop further in 2026 –The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 31, 2025, were as follows: The 30-year fixed mortgage rate was 6.15%, down from 6.85% on December 26, 2024. The 15-year fixed was 5.44%, down from 6% on December 26, 2024. The graph below shows the trajectory of mortgage rates over the past year. Inflation – We watch inflation because mortgage interest rates are tied to inflation. The higher the inflation rate, the higher the mortgage rates are. As inflation cools, mortgage rates drop. While we look at many different inflation reports, we have less data this year than we normally have because key indexes have not been released due to the government shutdown. One report, the Consumer Price Index (CPI) for November, was released. It showed that consumer prices rose 2.7% from one year ago in November. While still far from the Fed’s 2% annual target, it was much lower than the 3.1% that economists polled expected. The CPI rate peaked at 9.1% in June 2022 and worked its way down to 2.3% in April. Unfortunately, the CPI rate began to increase from there and peaked at 3% in September, which economists attribute to tariff costs being passed on to consumers, before dropping to 2.7% in November. The core CPI rate, which excludes volatile food and energy prices, rose 2.6% from one year ago, also below economists’ expectations. This gave hope to investors that inflation may be cooling enough for the Fed to continue to lower rates. The Fed’s favorite measure of inflation is the Personal Consumption Expenditure Index (PCE).Unfortunately, due to the shutdown, the October and November numbers are still being tabulated and are scheduled for release with the December figures at the end of January. For September, it showed that headline PCE rose 0.3% in September from August. That was in line with economists’ expectations. On an annual basis, PCE rose 2.7% from one year earlier, below the 2.8% expected. Core PCE, which does not include food and energy prices because those tend to be more volatile, increased 0.2% month-over-month in September. On an annual basis, it was up 2.8% from one year earlier. That was below the 2.9% economists expected.

November home sales – The California Association of Realtors and the National Association of Realtors release home sales data on the third week of each month for the previous month. Here is the November 2025 home sales recap. You can run a report on your city or zip code with the same data at RodeoRe.com U.S. existing-home sales – November 2025 – The National Association of Realtorsreported that existing-home sales totaled 4.13 million units on a seasonally adjusted annualized rate in November, up 0.5% from the number of homes sold in October and down 1% from the number of homes sold last November. The median price paid for a home sold in the U.S. in November was $409,200, down from $415,200 in October, but up 1.2% from $404,400 one year ago. There was a 4.2-month supply of homes for sale in November, up from a 3.8-month supply last November. First-time buyers accounted for 30% of all sales, up from 30% last month. Investors and second-home purchases accounted for 18% of all sales, down from 15% in August. All cashpurchases accounted for 27% of all sales, up from 30% last month. Foreclosures and short sales accounted for 2% of all sales. California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 287,940 on an annualized basis in November, up 1.9% from 285,590 in October. Year-over-year sales were up 2.6% from a revised 280,530 annualized home sales last November. The statewide median price paid for a home was $852,680 in November, down 3.9% from 886,960 in October. Year-over-year, the median price was almost unchanged from $852,880 last November. The unsold inventory index showed that there was a 3.1-month supply of homes for sale in October. These numbers are a little deceiving. Prices have dropped more than the median price indicates. The median price is the mid-point of all homes sold. Basically, it’s the point where one half of the homes sold for more and one half of the homes sold for less. Usually, the median price is a good indicator of prices across the board. There are times when conditions impact that. This is one of those times. With stock market values at all-time highs, which they were in October, people who invested in the stock market are flusher than people who are not. Additionally, many of the factors that impact people’s ability and desire to buy a home affect people more in the lower income range than they affect people in higher income ranges. That’s happening now. Sales are down in all price ranges compared to any time prior to interest rates rising in mid-2022, but sales in the lower price ranges as a percentage of all sales are fewer than we would normally see, as those people are more impacted by inflation, don’t have stocks, etc. The graph below shows CAR sales data by county for Southern California. |