Stock markets ended the week lower – Stock markets dropped again last week. While investors are concerned with higher interest rates, inflation, labor and supply shortages, and possible tensions in Ukraine, it should be noted that on December 31, 2021, the NASDAQ had risen 74%, the Dow had risen 27%, and the S&P had risen 47% since December 31, 2019. Those represent pretty hefty two-year increases! Perhaps these stocks, especially the tech-heavy NASDAQ were overvalued. The Dow Jones Industrial Average closed the week at 34,079.18, down 1.9% from 34,738.06 last week. It is down 6.21% year to date. The S&P 500 closed the week at 4,348.87, down 1.6% from 4,418.64 last week. The S&P is down 8.8% year to date. The NASDAQ closed the week at 13,548.07, down 2.5% from 13,751.19 last week. It is down 13.4% year to date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 1.90%, down slightly from 1.93% last week. The 30-year treasury bond yield ended the week at 2.24%, unchanged from 2.24% last week. We watch bond yields because mortgage rates often follow treasury bond yields.

Mortgage rates – The February 17, 2022, Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products were as follows: The 30-year fixed mortgage rate was 3.92%, up from 3.69% last week. The 15-year fixed was 3.15%, up from 2.93% last week. The 5-year ARM was 2.98%, up from 2.80% last week.

January California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 444,540 on a seasonally adjusted annualized rate in January. That marked a 3.4% month-over-month increase from the number of homes that closed escrow in December 2021. The median price paid for an existing home in January was $765,580, up 9.4% from last January when the median price was $699,920. There was a 1.8-month supply of homes for sale in January, up from 1.4 months in January 2021.

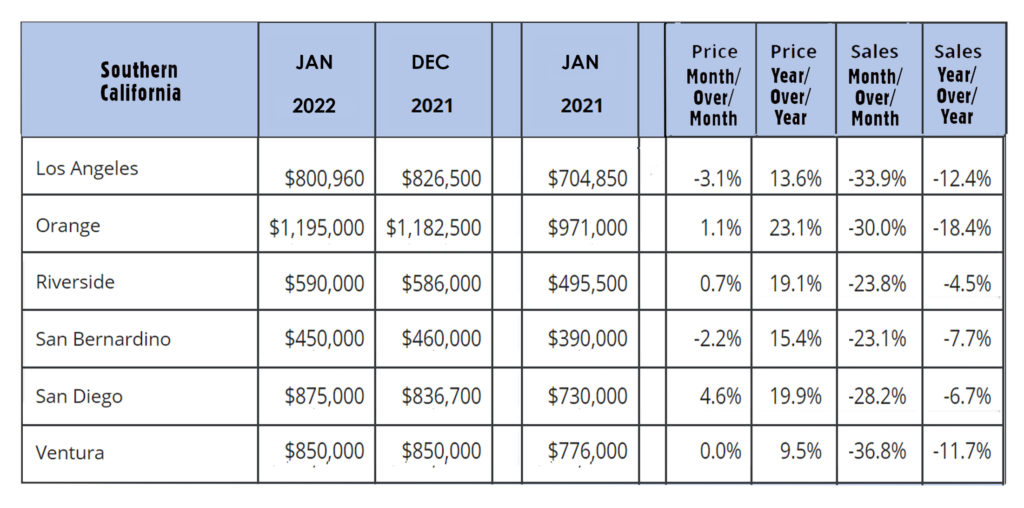

Although California as a whole had a month-over-month increase in sales, Southern California saw a dramatic drop in sales. The chart below shows regional figures