Stock markets dropped again this week and interest rates moved higher due to continued reports that indicate that inflation may be picking back up. It has been a tenuous month. This month the CPI (Consumer Price Index), the broadest measure of inflation, rose for the second straight month. It had dropped every month for a year from a high of 9.1% in June 2022 to 3% in June 2023. That streak ended in July when the CPI increased to 3.2%. It increased again to 3.7% in August. The Fed has increased interest rates over the past year and a half to combat inflation. They had hopes that these increases would slow the economy, curtail consumer spending, and reduce the rate of inflation. This week Fed Chairman Powell left rates unchanged but signaled that there would be another rate increase at the end of the year. He also reiterated his commitment to bringing inflation down to the Fed’s 2% target. The latest jobless claims, people going on unemployment for the first time, dropped to the lowest level of the year. The Fed has also been trying to get the unemployment rate up, because a shortage of labor pushes wages up and encourages consumer spending, which are both inflationary. The Dow Jones Industrial Average closed the week at 33,963.84, down 1.9% from 34,618.24 last week. It is up 2.5% year-to-date. The S&P 500 closed the week at 4,320.06, down 2.9% from 4,450.32 last week. It is up 12.5% year-to-date. The Nasdaq closed the week at 13,211.81, down 3.6% from 13,704.34 last week. It is up 26.2% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.44% up from 4.33% last week. The 30-year treasury bond yield ended the week at 4.53%, up from 4.42% last week. We watch bond yields because mortgage rates follow bond yields.

Mortgage rates – The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of September 21, 2023, were as follows: The 30-year fixed mortgage rate was 7.19%, unchanged from 7.18% last week. The 15-year fixed was 6.54%, almost unchanged from 6.51% last week.

U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 4.04 million units on a seasonally adjusted annualized rate in August, down 15.3% from an annualized rate of 4.77 million in August 2022. The median price for a home in the U.S. in August was $407,100, up 3.9% from $391,700 last August. There was a 3.3-month supply of homes for sale in August, up from a 3.2-month supply last August. First-time buyers accounted for 29% of all sales. Investors and second-home purchases accounted for 16% of all sales. All cash purchases accounted for 27% of all sales. Foreclosures and short sales accounted for 1% of all sales.

California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 254,740 on a seasonally adjusted annualized basis in August, down 5.3% month-over-month from July and down 19% from a revised 314,270 annualized sales pace last August. It should be noted that last August the number of sales was down from August 2021 making the number of sales lower than they were in 2021. August marked the eleventh straight month in sales dropping under 300,000 on an annualized basis. Year-to-date the number of homes sold was down 29.2% from the first eight months of 2022. The statewide median price paid for a home in July was $859,800, up 3.3% from July, and up 3.3% from $834,740 a year ago. There was a 2.4-month supply of single-family homes for sale in August, down from a 2.8-month supply one year ago.

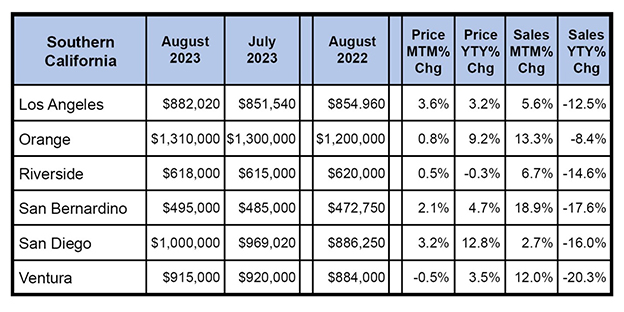

The graph below has sales data for Southern California by region. This was compiled by the California Association of Real Estate.