Find your November weekend fun in this week’s blog! From new art exhibits to wine fest and more, there are plenty of things to do. Check out what’s happening in your neighborhood from November 8 through November 10.

Los Angeles Weekend Events | November 8 – November 10

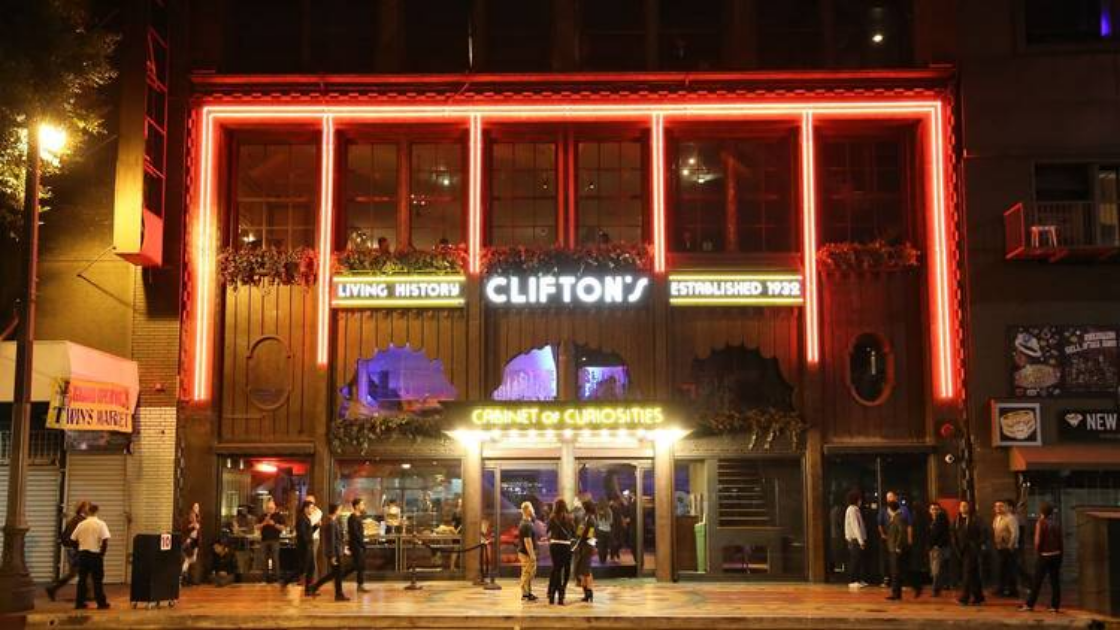

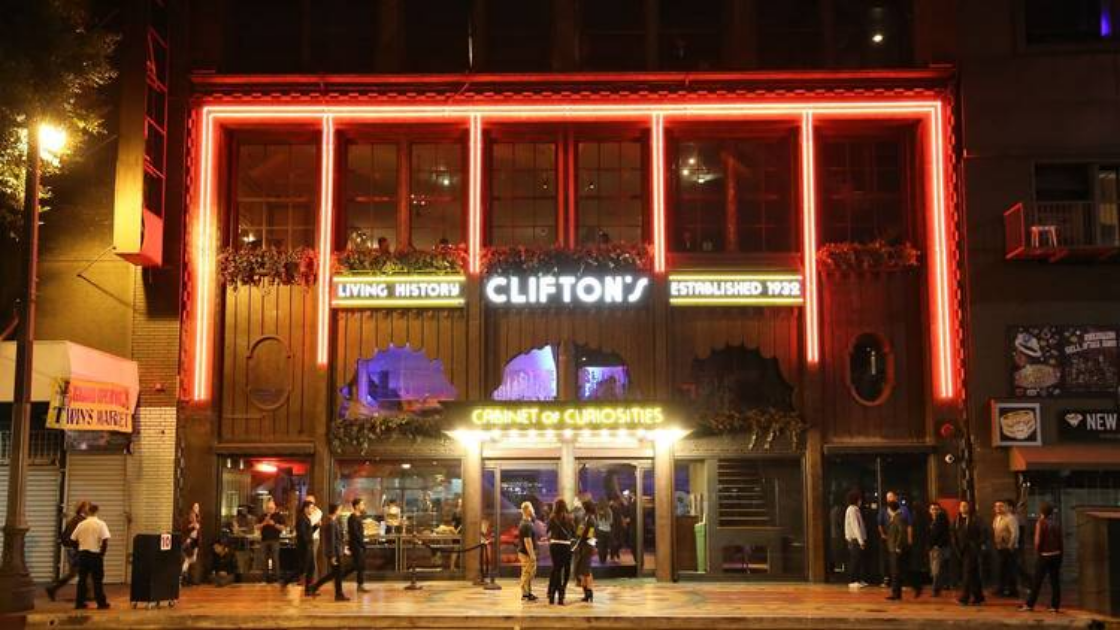

When: November 8

Where: Downtown LA

What: Recently reopened Downtown hotspot Clifton’s Republic is launching its arts and culture season with a unique, one-night-only collaboration with the Speranza Foundation. This immersive, choose-your-own-adventure experience will transform the multilevel venue with nine acts featuring poets, visual artists, musicians, cirque performers, and storytellers. The evening culminates in live music under “Monarch,” Clifton’s towering 40-foot faux redwood tree. Guests can also upgrade their tickets for access to an exclusive stage performance in the iconic Brookdale Ballroom.

When: Until November 16

Where: Hotel Figueroa | DTLA

What: Two Faced Ceramics is bringing its home studio poolside to DTLA’s Hotel Figueroa for a series of beginner-friendly classes. For $75, each session includes all materials and equipment, plus mimosas and a hotel tote bag. Every class explores a unique theme, with this weekend’s session focusing on an election-inspired design.

When: October 6 – July 13, 2024

Where: Academy Museum | Museum Row

What: “Color in Motion” showcases nearly 150 objects, including technology, costumes, props, and film posters, spanning from the 1890s to the present. Divided into six thematic sections, the exhibition explores the relationship between color, music, and movement, as seen in early dance performances and animated shorts. It delves into the evolution of color technologies, from Technicolor and Disney’s women-led Ink & Paint Department to modern digital techniques. The exhibition also highlights monochrome silent films, the narrative significance of color, and experimental art. The final gallery, the Color Arcade, is an interactive, neon-lit space featuring a corridor inspired by the stargate sequence from 2001: A Space Odyssey.

Westside and Beach Communities Weekend Events | November 8 – November 10

When: November 8 – November 9

Where: Huntington Beach

What: Enjoy a weekend of wine and ocean views at this Huntington Beach festival. Kick off with Friday evening’s Sunset Rare & Reserve Tasting, where wine enthusiasts can savor rare trophy wines, exclusive tasting-room selections, and limited-production gems. On Saturday, the alfresco Beachside Wine Festival offers the perfect blend of sun, surf, food, wine, and live music. Sample hundreds of California varietals, local craft brews, and appetizers from top Orange County restaurants.

When: October 17 – August 2025

Where: The Skirball Museum | Westside

What: Explore over 50 garments from Diane von Furstenberg, including her iconic wrap dress, in this career-spanning exhibition at the Skirball. The show also highlights her philanthropic work and the impact of her upbringing as the daughter of a Holocaust survivor, alongside artwork and fabric swatches.

When: October 19 – December 1

Where: Downtown Santa Monica

What: Cirque du Soleil brings its high-flying show KOOZA to the beach, leaving DTLA for Santa Monica. This marks the troupe’s first performance under the big top by the Santa Monica Pier since 2014.

San Fernando Valley Weekend Events | November 8 – November 10

When: November 9

Where: Intramural Field | 21726 Placerita Canyon Rd Santa Clarita

What: Fall Fest 2024 is here with a full lineup of seasonal fun! Dive into the festivities with live music, line dancing, classic carnival games, and delicious food. Capture the moment at the photo booth, take a spin on the Ferris wheel, and enjoy many more family-friendly activities throughout the day.

When: November 9

Where: Morton’s Steakhouse | Burbank

What: Experience an unforgettable evening of fine dining as Morton’s The Steakhouse presents A Taste of Two Legends Wine Dinner, featuring the exceptional wines of Duckhorn Vineyards. Join us on Saturday, November 9, 2024, at 6:30 p.m. for a multi-course menu, where each dish is expertly paired with select Duckhorn wines, from the ‘Decoy’ Brut Cuvée to the renowned ‘Three Palms’ Merlot and Cabernet Sauvignon. Enjoy a range of exquisite pairings, from smoked salmon hors d’oeuvres to prime New York strip, in a setting crafted for wine enthusiasts and food lovers alike.

Blended Worlds: Experiments In Interplanetary Imagination

When: Until January 4, 2025

Where: Glendale

What: In this collaborative exhibition in Glendale, artists, and JPL scientists unite as 11 creatives across various mediums showcase their interpretations of how nature and the night sky spark wonder within us.

Conejo Valley Weekend Events | November 8 – November 10

When: November 9

Where: Channel Islands Maritime Museum

What: The Channel Islands Maritime Museum welcomes back its popular Art Comes Alive event on November 9 & 10, 2024, from 12:00 to 4:00 PM. Explore the museum’s acclaimed galleries and encounter historical characters brought to life by actors, including legendary figures like boat model maker Edward Marple and the notorious pirate Anne Bonny. With themed photo stations, family-friendly games, costume try-ons for kids, and much more, this immersive experience is perfect for visitors of all ages. Tickets are available online and at the door, with discounts for members, seniors, military families, and early buyers.

When: November 8 – November 9

Where: 7075 Campus Rd, Moorpark

What: Moorpark College’s most thrilling student concert is back by popular demand, and it’s set to be more spectacular than ever! After two sold-out performances last time, now’s your chance to experience the magic live. Prepare to be amazed by the incredible talent within our student body, with performances ranging from powerful rock anthems to soulful ballads. Whether you love indie vibes, hip-hop rhythms, or timeless classics, this concert has something for everyone—don’t miss this unforgettable event!

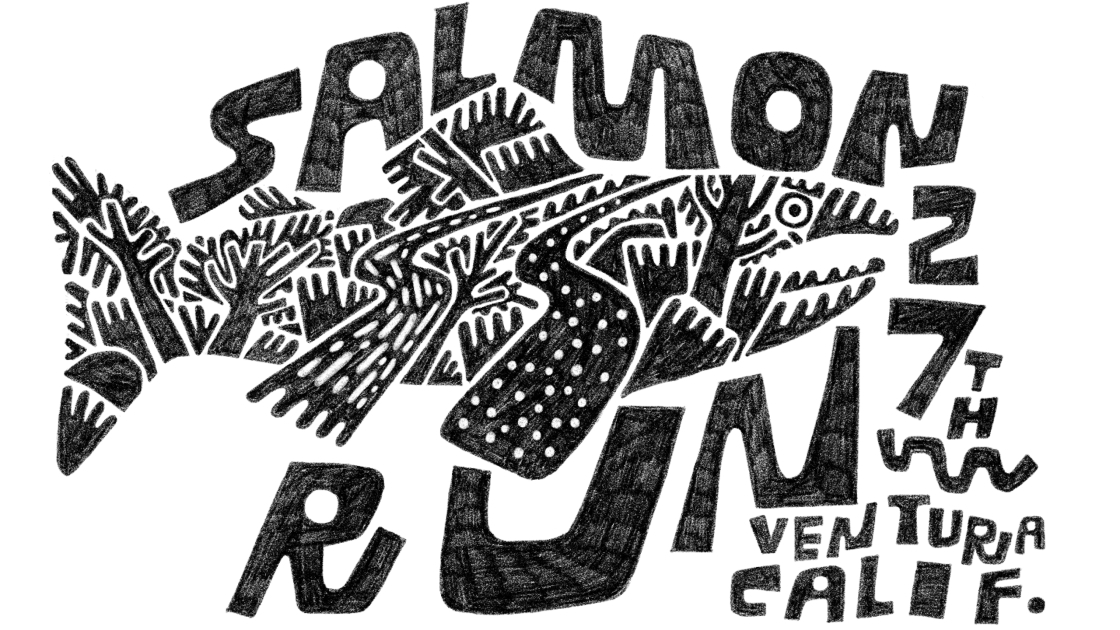

When: November 10

Where: 5721 N. Ventura Avenue | Ventura

What: Join the 28th Annual Patagonia Salmon Run on Sunday, November 10, 2024, at 8 a.m. in Ventura for a scenic 5K along the Ventura River on a certified, flat dirt course. This popular event typically sells out, so be sure to register in advance—no race-day signups are available!