Explore our website for the most up-to-date information on real estate data and local news!

News & Media

Explore our website for the most up-to-date information on real estate data and local news!

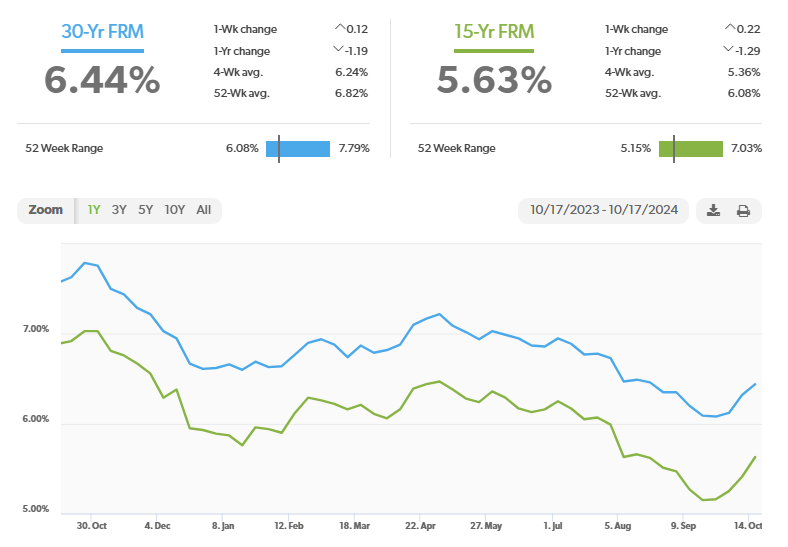

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of October 17, 2024, were as follows:

The 30-year fixed mortgage rate was 6.44%, up from 6.32% last week. The 15-year fixed was 5.63%, up from 5.41% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

Stay up to date with the latest in tech and innovation. From Apple’s new customization tools to stylish Prada spacesuits and clean energy initiatives, we’ve got the top headlines for you. Check out the week’s biggest tech news below!

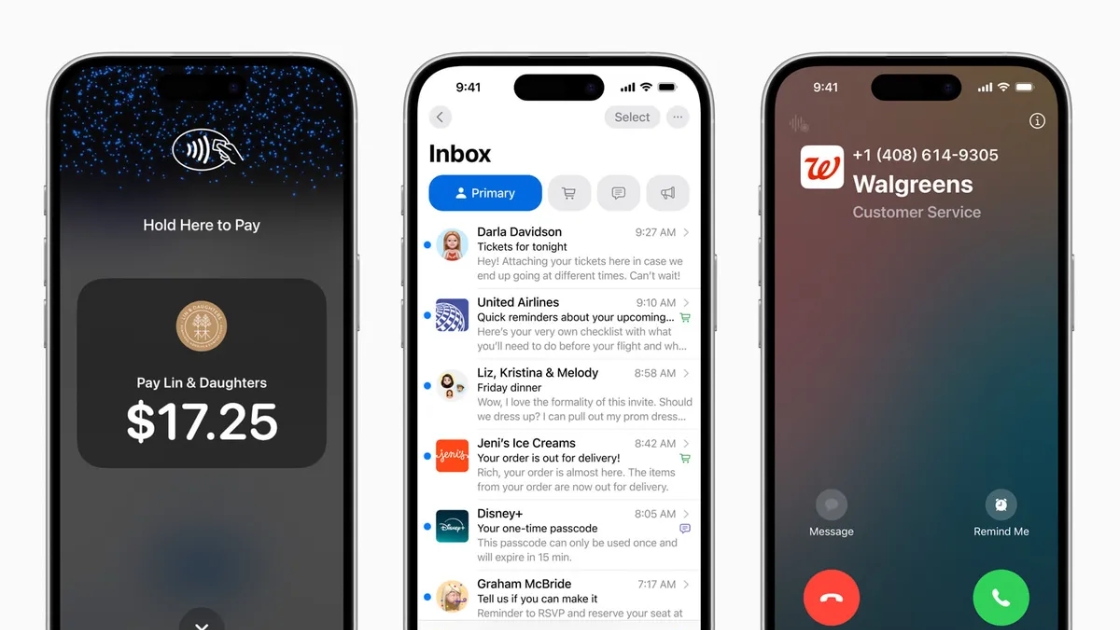

Apple will soon allow businesses to customize their brand’s appearance in emails, phone calls, and payments on iPhones. Through its Business Connect tool, companies can add logos and brand names to be displayed in apps like Mail, Phone, and Wallet. The new Branded Mail feature and Business Caller ID aim to make businesses more identifiable and reduce spam confusion, with the updates rolling out later this year and next. Additionally, businesses using Tap to Pay will be able to display their logos during transactions.

Prada and Axiom Space have teamed up to design the Axiom Extravehicular Mobility Unit (AxEMU). The sophisticated new Prada spacesuit will be for NASA’s Artemis III mission. Of course, the suit will be built to withstand the harsh conditions of the lunar South Pole. In addition, the Prada suit combines high-performance materials and advanced features with a touch of Prada’s style. It includes custom-made gloves, lunar-ready boots, and a helmet with lights, an HD camera, and 4G/LTE communication. The AxEMU will debut on the moon no earlier than September 2026.

Following Google’s recent deal, Amazon has announced new agreements to develop small modular reactors (SMRs) for clean energy. Amazon is partnering with Energy Northwest to fund and build four SMRs in Washington by the early 2030s, with potential expansion to generate 960MW. Amazon is also investing in X-energy, a startup working on advanced nuclear reactor designs, to support additional SMR projects across the U.S. by 2039. These efforts aim to provide carbon-free electricity to help Amazon and other tech companies meet their climate goals while addressing the energy demands of data centers.

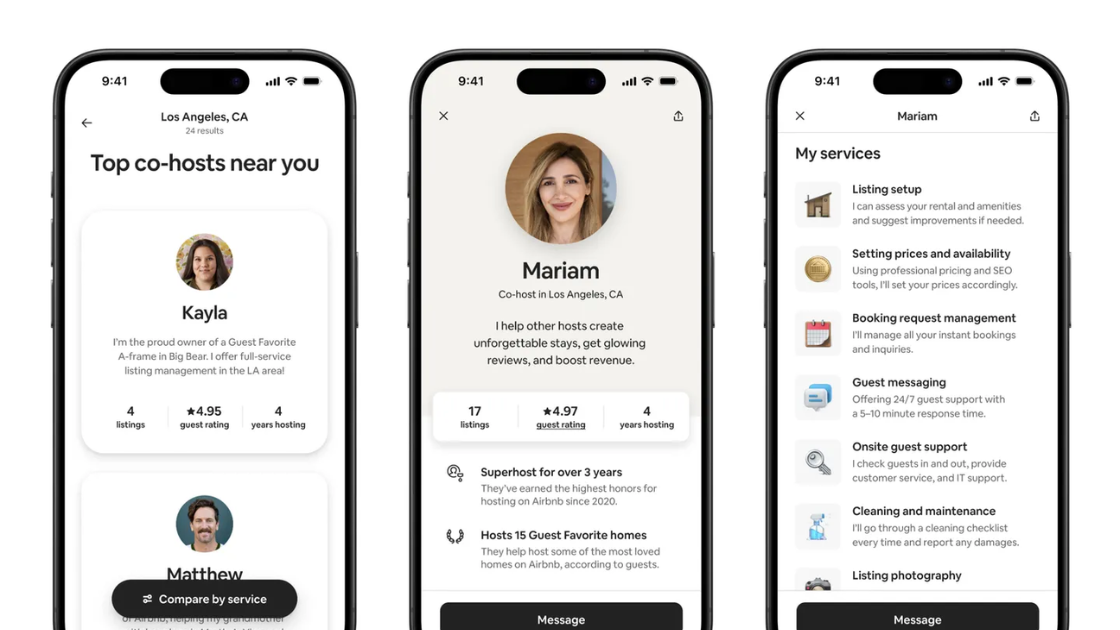

Airbnb has introduced its new “Co-Host Network,” allowing hosts to find and hire co-hosts directly through the app. Co-hosts can assist with tasks like managing listings and communicating with guests, with various payout options available. The network, which has been piloted for years, is now available in countries like the U.S., Canada, and the UK. This update is part of Airbnb’s 2024 Winter Release, which includes additional guest-focused upgrades.

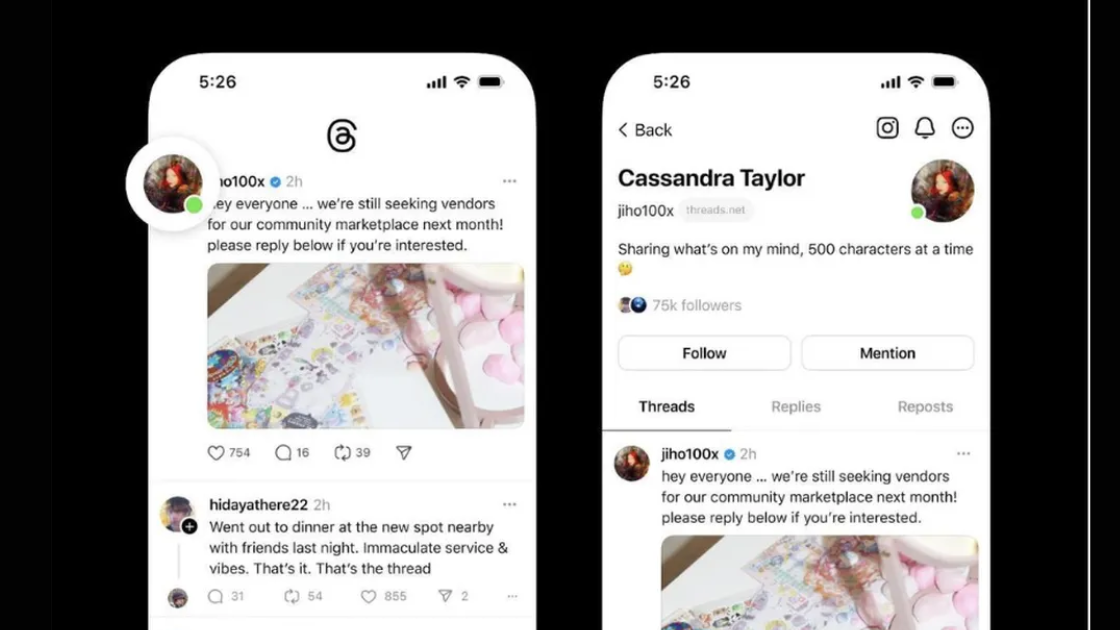

Meta is introducing an “activity status” feature to Threads, allowing users to see who is currently online by displaying a green bubble next to their profile picture. This feature, aimed at encouraging real-time engagement, can be toggled on or off in the settings. Despite the absence of direct messaging on Threads, Meta hopes the feature will enhance user interaction. Additionally, the platform is working on a Community feature that could further leverage the online status for group-based communication.

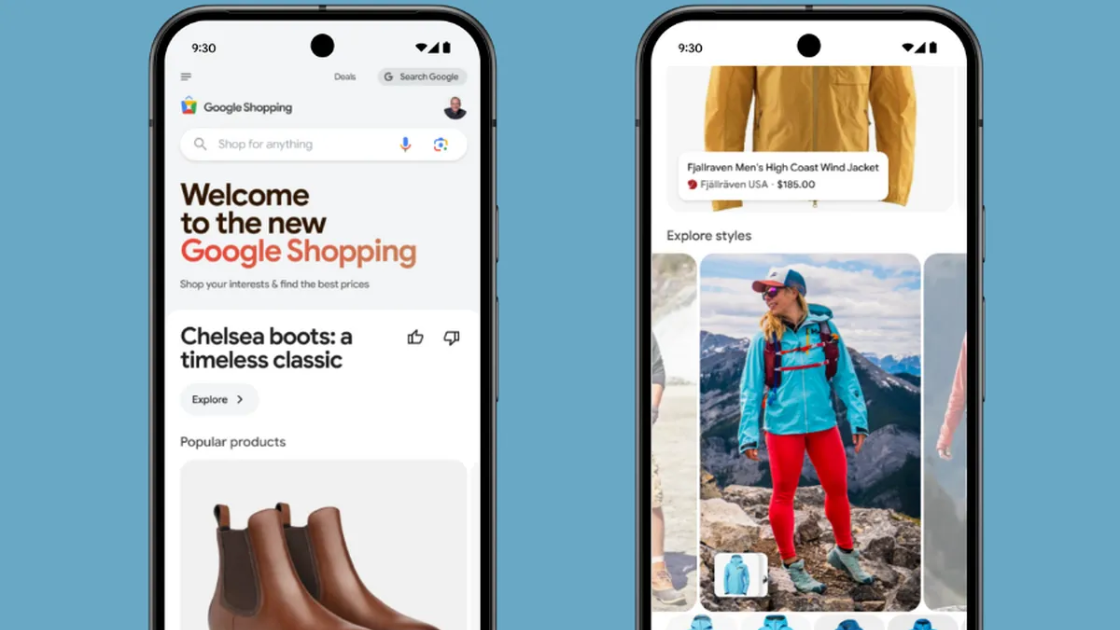

Google Shopping is launching a personalized feed on mobile and desktop, offering users product recommendations based on their recent searches and YouTube activity. The feed includes recently viewed items, suggested products, and in-line videos, with options to refine preferences through a “thumbs-down” feature. Additionally, Google is rolling out a personalized deals tab and AI-generated product summaries, providing tailored shopping tips and recommendations. These updates are rolling out in the U.S. over the coming weeks.

October fun is in full swing! From pumpkin fest to local frights, and more, there are plenty of things to do this fall. Check out what’s happening in the neighborhood from October 18 through October 20.

When: October 19

Where: DTLA

What: For one afternoon, Bunker Hill’s institutions will offer free performances, exhibitions, and tours along Grand Avenue. Highlights include a singing workshop at the Colburn School, LA Opera recitals at the Dorothy Chandler Pavilion, and a Day of the Dead celebration at Grand Park. Participating venues include the Broad, MOCA, and the Walt Disney Concert Hall.

When: October 11 – October 19

Where: Heritage Square Museum

What: Similar to its Yuletide Cinemaland series, Street Food Cinema is transforming Heritage Square Museum into a spooky, cinematic wonderland for Halloween. Each night, you can enjoy a different double feature, with movie selections like Paranormal Activity and The Ring or X and Pearl. Alongside the films, you’ll have the chance to explore haunted home tours, indulge in adult trick-or-treating, and browse food trucks, a bar, and various market vendors.

When: October 19 – November 2

Where: DTLA

What: Grand Park’s two-week display of 20 altars, created by local artists and community organizations, kicks off with Grand Ave Arts: All Access. For the first time, the opening festivities will span two days, starting on October 19 with face painting, live music, and poetry, followed by a festival and inaugural parade on October 20. The celebration concludes with an outdoor film screening on November 2, presented by the GuadaLAjara Film Festival.

When: October 17 – August 2025

Where: The Skirball Museum | Westside

What: Explore over 50 garments from Diane von Furstenberg, including her iconic wrap dress, in this career-spanning exhibition at the Skirball. The show also highlights her philanthropic work and the impact of her upbringing as the daughter of a Holocaust survivor, alongside artwork and fabric swatches.

When: October 19 – December 1

Where: Downtown Santa Monica

What: Cirque du Soleil brings its high-flying show KOOZA to the beach, leaving DTLA for Santa Monica. This marks the troupe’s first performance under the big top by the Santa Monica Pier since 2014.

When: Until October 27

Where: Rancho Palos Verdes

What: South Coast Botanic Garden’s popular dog-walking hours expand to every weekend in October for the new Dogtoberfest. Along with dog-friendly walking paths, the event features an Oktoberfest-inspired pub crawl for humans, offering free beer samples at four stations (with full pours, pretzels, and bratwurst available for purchase). The fun continues for pups with a “dance pawty,” obstacle course, and a marketplace.

When: October 19

Where: Glendale

What: Enjoy a fun-filled day for the whole family at Chatsworth Oktoberfest, featuring a beer tent, kids’ area, vendors, and games. Highlights include live German music by the Big Lucky Band and more festivities throughout the day.

When: Until November 2

Where: Glendale

What: Step into a Glendale theater (324 N Orange St, Glendale) for a supernatural soirée filled with magic, hauntings, and mystery that will send shivers down your spine. House of Spirits offers a two-hour immersive experience where you can explore eerie performances and macabre pop-ups, all while sipping on themed drinks. Each ticket includes four mini cocktails to accompany your chilling adventure.

When: October 20

Where: Los Angeles Equestrian Center | 480 Riverside Drive Burbank

What: Join a relaxing and playful yoga session for all skill levels, led by a certified instructor. Friendly Nigerian Dwarf goats will accompany you, adding a fun challenge to your stretches, balance, and core strength, while bringing plenty of smiles along the way.

When: October 19

Where: 3370 Sunset Valley Rd, Moorpark

What: The 27th Annual Fall Harvest Festival returns to Underwood Family Farms in Moorpark from Saturday, September 28 to Thursday, October 31, 2024. The farm will become a sprawling Pumpkin Patch and Fall Harvest experience, complete with games, rides, photo opportunities, live entertainment, themed weekends, bands, and more. Festival hours are from 9am to 6pm daily.

When: October 19

Where: 2525 N. Moorpark Rd, Thousand Oaks

What: The Conejo Recreation & Park District is hosting a Halloween event for young children on Saturday, October 19, 2024, from 6:00-9:00pm at the Thousand Oaks Community Center. Highlights include the annual Haunted Trail hike, a costume contest, Trick-or-Treat Street, and a live reptile show. Tickets for the Haunted Trail are $5 and must be purchased in advance, while admission to other activities is free.

When: October 20, 10am – 5pm

Where: 3701 Lost Hills Road, Calabasas

What: The 2024 Calabasas Pumpkin Festival will take place on Sunday, October 20th, from 10 a.m. to 5 p.m. at Juan Bautista de Anza Park. Enjoy pumpkin-themed activities like pumpkin painting, a pumpkin patch, professional pumpkin carving, live music, food, and more. Tickets are $10 in advance online and $15 at the gate, with free admission for kids under 24 months.

In a city as vibrant and ever-evolving as Los Angeles, the bar scene is constantly raising the bar—quite literally. From rooftop retreats with panoramic views to intimate lounges tucked inside architectural landmarks, the latest crop of new bars offers something for everyone. Whether you’re craving inventive cocktails inspired by international flavors or a fresh take on classic libations, these top spots are redefining LA’s nightlife. Here are the most exciting new bars in town that are guaranteed to elevate your next evening out.

Location: 23 Windward Avenue, Venice, California 90291

When it comes to LA bars, Wes Whitsell’s latest creation is a cozy Italian dinner club nestled in Venice. At Mama’s Boy, beverage manager Dave Purcell crafts exceptional takes on classic cocktails. Settle in with the Satisfaction, a clever twist on the Old Fashioned, or the Rich Girl, a paloma made with your choice of tequila or mezcal. Pair these drinks with Whitsell’s “dad pie” topped with sausage, mushrooms, and jalapeño, or the rich smoked brisket agnolotti for a memorable evening.

Location: 2435 Main Street, Santa Monica, California 90405

Edgemar, housed in a striking Frank Gehry-designed building in Santa Monica, offers a cocktail experience as captivating as its architecture. Bartender Eugene Shaw, known for his stints at the Varnish and Scopa, has curated a menu that balances classic cocktails with inventive creations. The Birds of Paradise, with guava, Campari, and rum, is a refreshing delight, while the Saigon Taipei Connection’s mix of cold brew, aged rum, and coffee liqueur offers a more adventurous option.

Location: 9077 Santa Monica Boulevard, West Hollywood, California 90069

West Hollywood’s nightlife gets a soulful upgrade at Andy’s, a 1970s-inspired jazz and R&B club opened by Anderson .Paak and the Houston brothers. Devin Espinosa’s cocktail menu is as vibrant as the LA bars energy, featuring drinks like the bubbly Places to Be, made with clementine cordial and prosecco, and the bold Suede, a mix of amaro, mezcal, and vermouth. For groups, the Ape Shit—a rum, banana liqueur, and Aperol concoction—serves four and promises to elevate any night out.

Location: 460 South La Brea Avenue, Los Angeles, California 90036

At Leopardo, chef Joshua Skenes not only offers one of LA’s hottest new pizza spots but has also crafted a cocktail menu to match. Sip on the tropical Califobrian, a blend of rum, coconut, and stracciatella, or the elegant Kyoho Frosé, a fusion of pisco and asti spumante. Both pair perfectly with the restaurant’s delectable small plates, making Leopardo a must-visit for food and drink lovers alike.

Location: 6630 West Sunset Boulevard, Los Angeles, California 90028

In the heart of Hollywood, Rokusho’s brutalist design sets the stage for an inventive Japanese dining and cocktail experience. Felix Campos, formerly of Atla and Damian, delivers a cocktail menu that reinvents the classics. Try the Midorita, a vibrant margarita with a Midori twist, or the Umeroni, a refreshing take on the traditional Negroni. Pair these drinks with the restaurant’s wagyu carpaccio or otoro skewers for a sophisticated evening.

Location: 1430 North Cahuenga Boulevard, Los Angeles, California 90028

Laya Hollywood’s open-air patio, fire pits, and plush banquettes make it a standout spot for sipping cocktails under the stars. Chef Charbel Hayek’s Middle Eastern-inspired dishes are the perfect complement to the deep red Jinn Venom, a cocktail made with Andray scotch, Arak anise, pomegranate, and ginger. With its chic ambiance and intriguing menu, Laya sets a new standard for Hollywood’s bar scene.

Location: 939 South Figueroa Street, Los Angeles, California 90015

Deme at Hotel Figueroa draws inspiration from Greek mythology for its Mediterranean-themed cocktail menu. Bar director Milosz Cieslak has created drinks like the Iris, made with vodka, Strega, and rose, and the spicy Rhea, a blend of tequila, cucumber, and harissa. Whether you’re lounging poolside or enjoying the Grecian vibes, Deme offers a refreshing escape for downtown LA bars.

Location: 2201 West Washington Boulevard, Los Angeles, California 90018

The team behind Hilltop Coffee + Kitchen has taken their talents skyward with the Lost Rooftop Cocktail + Taco Bar. Perched atop their Downtown location, this bar serves up stunning views alongside an impressive mezcal, rum, and tequila-heavy cocktail menu. Sip on the Up In The Sky, with Sigiloso mezcal, pineapple juice, and Chareau aloe liqueur. Or enjoy the Loose Ends, a mixture of Hennessy, Italicus apertivo, honey, and lemon, while taking in the cityscape.

Location: 5022 York Boulevard, Highland Park, California 90042

Highland Park favorite Belle’s Bagels has expanded into Belle’s Delicatessen & Bar. Likewise, Belle’s offers not only deli classics but also a playful, Jewish-inspired cocktail menu. Sip on the Tekiah Negroni, a twist on the classic made with Amaro Angeleno. Consider the Mezcal Tov, featuring mezcal, manzanilla sherry, celery shrub, and lime. Belle’s also boasts a full martini menu, making it a go-to for those craving both tradition and innovation.

With Halloween getting closer, you are probably looking for the best haunted houses and spooky attractions in the Los Angeles area. Check out our list of top choices to provide tons of Halloween fun for you and your family!

Dates: Until November 3

Universal offers visitors a spooky encounter with its classic and iconic monsters, including Michael Myers, as well as several different “scare zones” and ghostly mazes. Ticket prices vary depending on the night you choose to go, but make sure to book early and get an Express Pass if you can, it will be well worth the extra expense.

Dates: Until November 3

“Delusion,” the pioneer of immersive theater, returns with a new storyline at the historic Stimson House in Los Angeles. Running select nights from September 20th to November 3rd, audiences become key players in a thrilling hour-long adventure.

Dates: Until November 2

Head over to the Old Zoo at Griffith Park for a hay ride unlike any other that will bring you face-to-face with ghouls and demons in a fictitious town reminiscent of the 1980s pop culture. Enjoy the festival’s different attractions, which include, among others, a spooky maze and a haunted house.

Dates: Until November 2

Encounter an army of monsters and other scary creatures at the Buena Park location in a terrifying collection of haunted attractions, including mazes, a twisted carnival, and a space station that has been taken over by scary aliens. As a reminder, all guests aged 17 or younger must be accompanied by an adult 21 years or older.

Dates: Until November 2

With more than 100 rooms to explore, this 23,000-square-foot haunted house located in Thousand Oaks, promises a night of terror and spooky encounters. Admission starts at $42 and there is also a “lights on” option for parents with small children who could get nervous about the setting.

Fall is the perfect time to prepare your home for cozy gatherings and elevated dinner parties. Likewise, the heart of any luxurious entertaining space is the kitchen. Whether you’re hosting intimate dinners or lavish soirées, a well-designed, upgraded kitchen can set the tone for the entire experience. For luxury homeowners in Southern California, where indoor-outdoor living is a key feature, incorporating seasonal elements and high-end upgrades can elevate fall hosting to new heights.

Here are some top tips for upgrading your luxury kitchen this fall, focusing on high-end kitchenware, cutting-edge appliances, and stylish décor that blend function with fall-inspired elegance.

One of the easiest ways to upgrade your kitchen for fall entertaining is to invest in statement kitchenware that combines elegance with practicality. High-end brands like Le Creuset and Staub offer timeless cast iron cookware in seasonal colors like deep amber, burnt orange, and classic black. These pieces not only cook beautifully but also serve as stunning centerpieces on your dining table.

For table settings, consider fine bone china or handcrafted ceramics that feature intricate detailing, adding a touch of sophistication to any meal. Pair them with gold-plated cutlery and crystal glassware to create a luxurious, cohesive look. When you choose kitchenware with both form and function, you elevate your entire dining experience while making a stylish statement.

When it comes to luxury entertaining, having top-of-the-line appliances can make all the difference. This fall, consider upgrading to smart, high-performance appliances that streamline the cooking process and enhance your culinary creativity.

Smart ovens like those from Wolf or Miele offer precise temperature control and pre-set cooking modes, making it easy to bake perfectly browned pies or roast meats to perfection. For wine lovers, a built-in wine fridge from Sub-Zero ensures that your guests are always served at the ideal temperature, while a temperature-controlled warming drawer keeps dishes hot without overcooking, allowing for more relaxed, stress-free hosting.

Additionally, incorporating a built-in coffee station from brands like Thermador or Gaggenau ensures that your guests are treated to barista-level coffee and espresso, perfect for after-dinner indulgence. These high-end appliances not only improve functionality but also add a sleek, professional aesthetic to your kitchen.

Seasonal décor is a great way to infuse your kitchen with the spirit of fall while maintaining an air of elegance. Opt for subtle, sophisticated touches that reflect the season without overwhelming your space.

Consider swapping out summer linens for rich, fall-inspired table runners and napkins in earthy tones like deep burgundy, burnt sienna, and forest green. Marble or brass serving trays with seasonal accents such as small pumpkins, fall foliage, or elegant candleholders can add warmth and charm to your countertop or island without sacrificing luxury.

For a more dramatic upgrade, you could even introduce a custom fall floral arrangement, featuring autumnal blooms like dahlias, chrysanthemums, or amaranth, arranged in a designer vase. This adds a touch of natural beauty and seasonal flair to your kitchen.

Lighting plays a crucial role in creating the right ambiance for fall entertaining. Consider upgrading your kitchen lighting to create a warm, inviting atmosphere for your guests. Pendant lights over kitchen islands in luxe materials like brass or matte black can serve as both functional lighting and stylish décor.

Incorporate dimmable LED lights to control the brightness, allowing you to set the perfect mood as the evening transitions from casual cocktails to a formal dinner. For an extra touch of elegance, consider adding under-cabinet lighting or even upgrading to smart lighting systems that let you adjust color temperature based on the occasion.

A well-stocked beverage station is a must-have for fall entertaining. Consider setting up a designated space for mixing cocktails, serving coffee, or offering fine wines. High-end bar carts with brass detailing or custom-built beverage centers can serve as focal points, while adding function to your hosting setup. Stock the station with beautiful glassware, artisan spirits, and a selection of wines and mixers to keep your guests satisfied throughout the evening.

Preparing your luxury kitchen for fall entertaining involves more than just upgrading your appliances—it’s about creating a space that marries function with elegance. From top-of-the-line kitchenware to cutting-edge appliances and sophisticated seasonal décor, these luxury upgrades will ensure your fall gatherings are as effortless as they are unforgettable. By investing in these thoughtful touches, your kitchen becomes not only a hub of culinary creativity but also the centerpiece of your fall hosting.

| Economic news – This week the September Consumer Price Index (CPI) and the Producer Price Index (PPI) were released. The CPI, one of the broadest measures of inflation showed that consumer prices increased 2.4% from one year ago, down from a 2.5% annual increase in August. The 2.4% increase in September marked the smallest annual increase in inflation since February 2021. The PPI, a measure of wholesale prices, showed prices for goods and services that producers pay increased by 1.8% from last September. These reports were quite favorable to investors and stocks rallied to end the week higher. After last week’s jobs report that showed employers added 254,000 new jobs in September and that wages rose more than 4% year-over-year investors feared that inflation could reignite. More people working and higher wages lead to more consumer spending which can cause higher inflation. At least for September, inflation continued to cool. Bond yields and mortgage rates continued to increase. Investors and lenders will need to see more evidence that the jobs market is not heating back up again and that inflation is not about to pick back up before those long-term rates come back down.

The graph below shows the history of the Consumer Price Index since 2021.

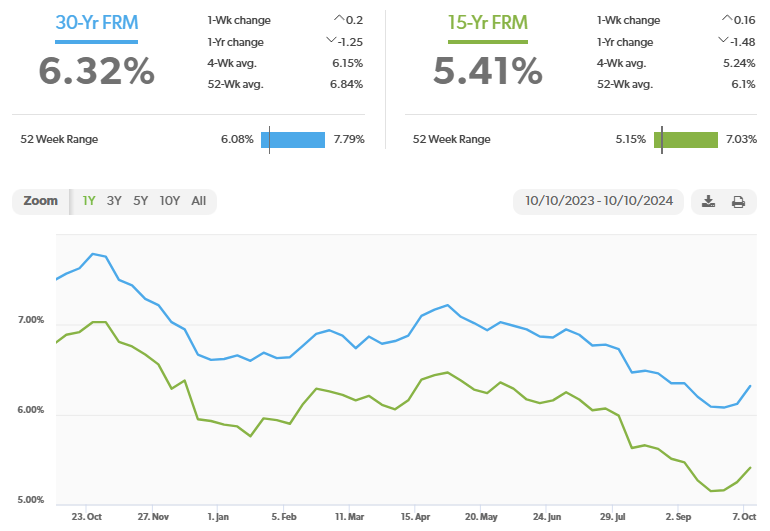

Stock markets – The Dow and the S&P 500 closed the week at record highs, while the Nasdaq closed just off its record high set in July as investors reacted to positive inflation data. The Dow Jones Industrial Average closed the week at 42,863.86, up 1.2% from 42,352.75 last week. It is up 13.7% year-to-date. The S&P 500 closed the week at 5,815.03, up 1.1% from 5,751.07 last week. The S&P is up 21.9% year-to-date. The Nasdaq closed the week at 18,342.94, up 1.1% from 18,137.85 last week. It is up 22.2% year-to-date. U.S. Treasury bond yields jumped on Friday after the September jobs report was released – The 10-year treasury bond closed the week yielding 4.08%, up from 3.89% last week. The 30-year treasury bond yield ended the week at 4.39%, upfrom 4.26% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of October 10, 2024, were as follows: The 30-year fixed mortgage rate was 6.32%, up from 6.12% last week. The 15-year fixed was 5.41%, up from 5.25% last week. The graph below shows the trajectory of mortgage rates over the past year. Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S. Have a great weekend! |

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of October 10, 2024, were as follows:

The 30-year fixed mortgage rate was 6.32%, up from 6.12% last week. The 15-year fixed was 5.41%, up from 5.25% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

Stay connected with the latest tech news from across the World Wide Web. From a Nintendo Alarm to Zoom AI and more, we have you covered! Check out the top tech and media headlines of the week below.

Nintendo has announced a new gadget, Alarmo, a motion-controlled alarm clock set to release in early 2025 for $99.99. This unique Nintendo device allows users to snooze with a gesture or stop the alarm by getting out of bed. In addition, the Nintendo gadget features sounds from popular Switch games like Breath of the Wild and Super Mario Odyssey. It also includes sleep tracking, customizable alarm modes, and soothing bedtime sounds. While not a new console, the Nintendo Alarmo adds an interactive twist to waking up, with Switch Online subscribers getting early access to the device.

X is changing how creators earn money by shifting from ad revenue based on verified users to payouts tied to engagement with content from Premium subscribers. This new system means the more Premium users interact with each other’s content, the more creators can earn. However, with Premium subscribers already prioritized in replies, it’s unclear if this will lead to higher payouts. Starting November 8th, revenue from verified ad impressions will no longer count, and up to 25% of Premium subscriptions will go directly to creators.

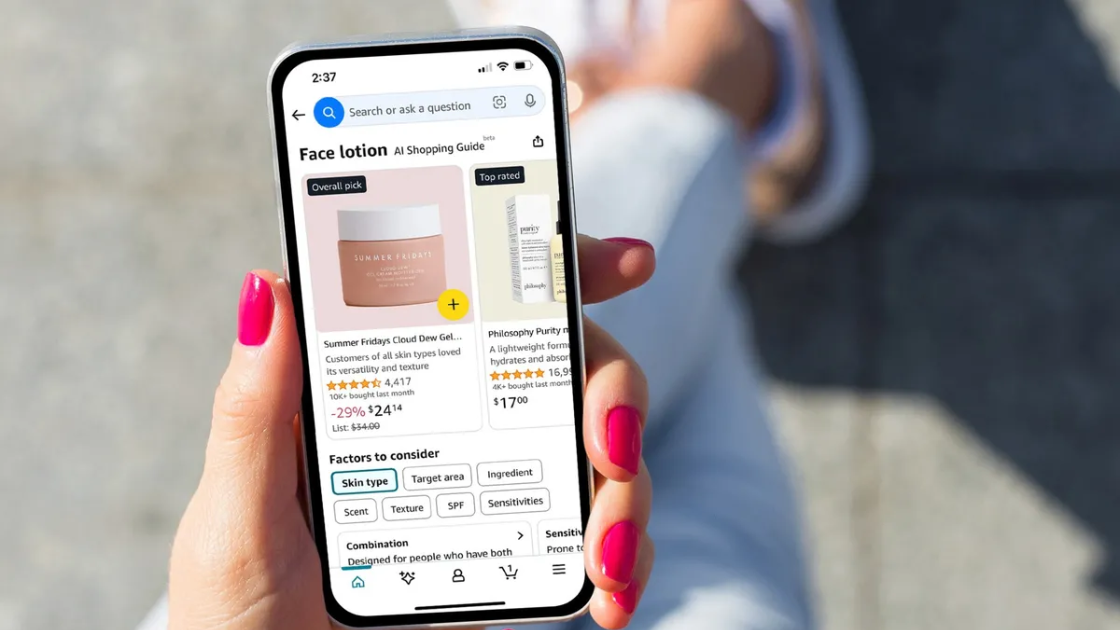

Amazon has launched AI-powered “Shopping Guides” on its mobile website and apps, designed to help users quickly find products based on specific features. Available for over 100 product types, including TVs, headphones, and skincare, these guides offer educational content and customer insights to assist in making informed purchases. By selecting a guide, shoppers receive personalized product recommendations based on factors like brand, use case, and connectivity, offering a more visual and intuitive way to filter options compared to traditional menus.

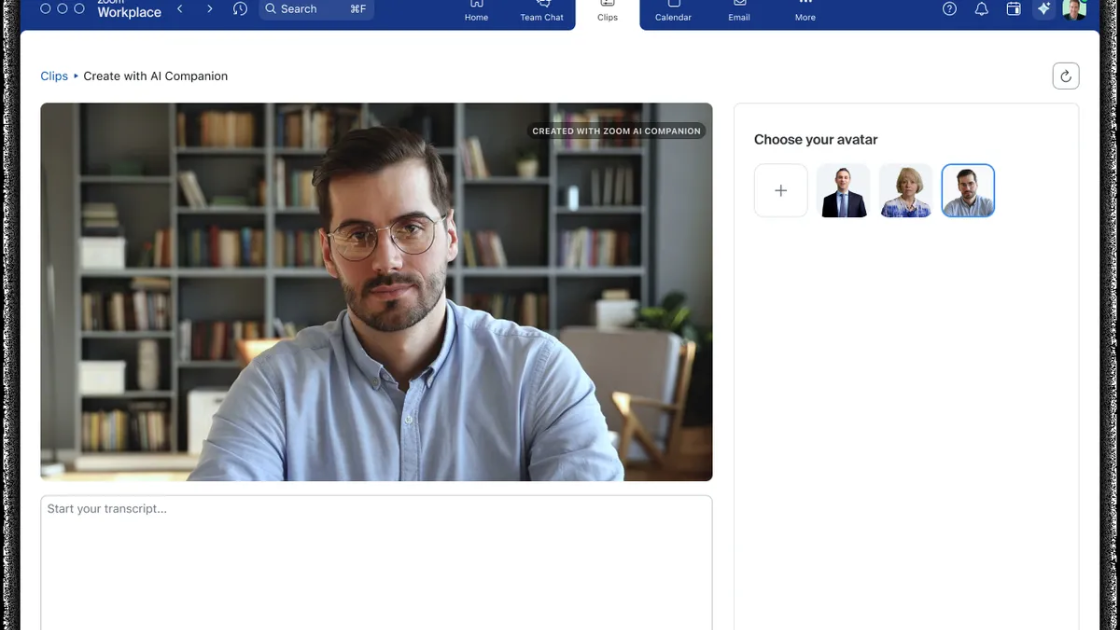

Zoom is set to introduce AI avatars that can attend meetings for you by delivering brief messages on your behalf. To create an avatar, users record a video of themselves, which Zoom’s AI uses to generate a digital likeness that looks and sounds like them. This feature, available through Zoom’s Clips, will be part of a custom AI Companion add-on launching next year for $12 per month. Zoom is addressing concerns about deepfakes with advanced authentication and watermarking technology, ensuring secure use of the avatars.

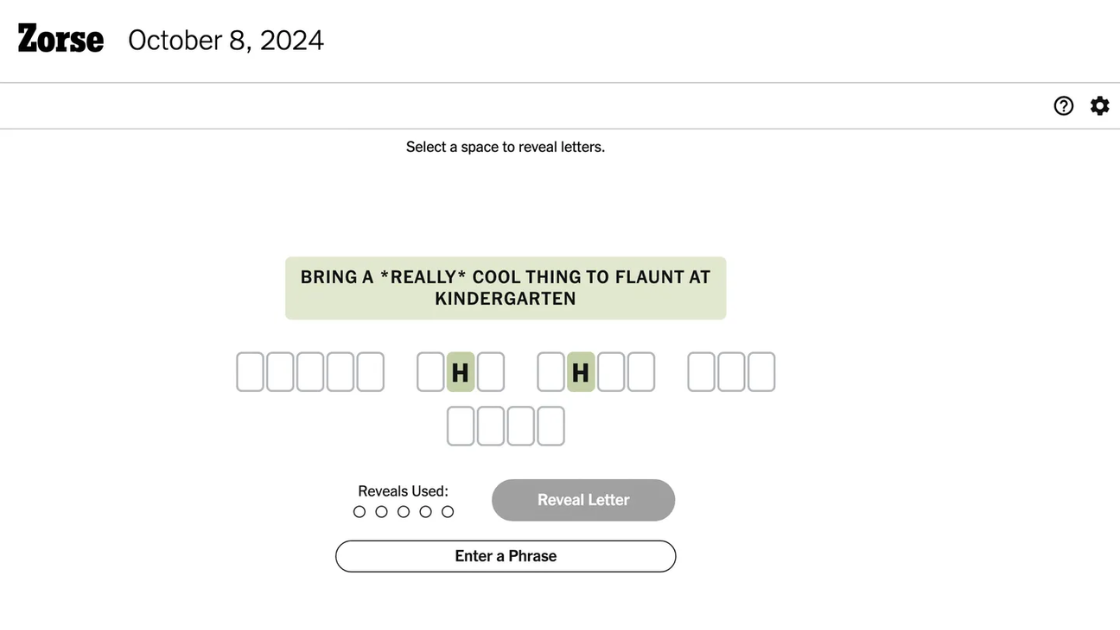

The New York Times is beta testing a new puzzle game called “Zorse”. The phrase-guessing game blends two phrases into one, focusing on wordplay. Currently available only in Canada, Zorse offers clues and a series of blank tiles. Players use the tiles to reveal and solve the puzzle. Likewise, the format resembles a mix of Wheel of Fortune and word games like Wordle. The game is part of the NYT’s ongoing expansion into puzzle games, with hopes of a wider release soon.

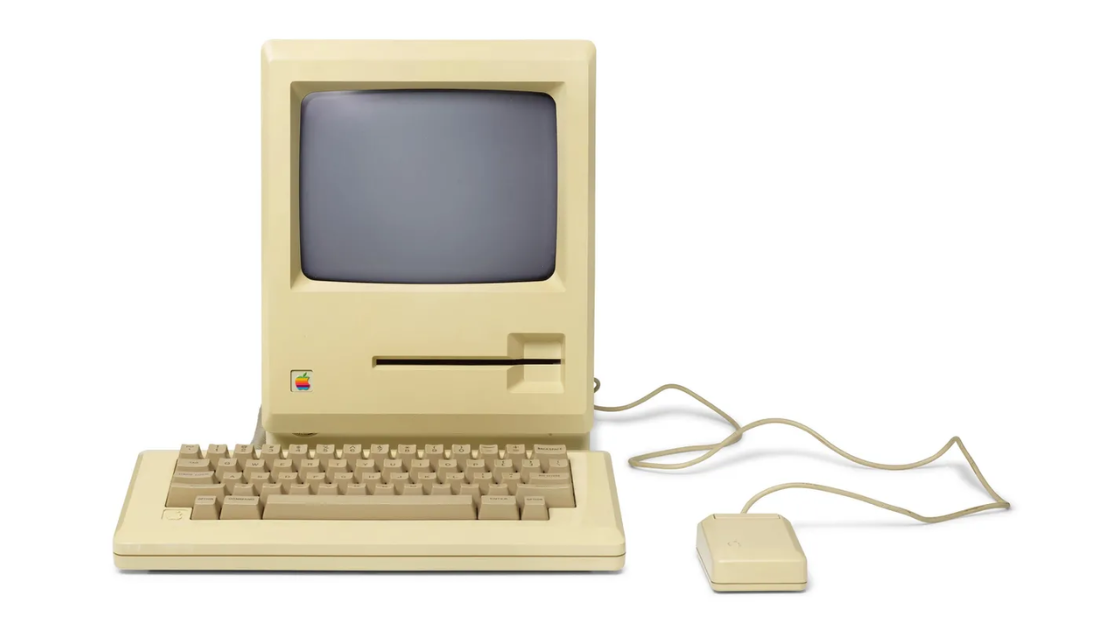

A rare prototype of the original Apple Macintosh is set to be auctioned. The prototype features a 5.25-inch disk drive instead of the later 3.5-inch model. The auction will occur through Bonhams’ History of Science and Technology collection. This prototype is one of less than five known to exist and carries the model number #M0001. It is known as the “Twiggy Macintosh” because it uses the unreliable 5.25-inch drives from the Apple Lisa. Previously sold for $150,075, the prototype is expected to fetch between $80,000 and $120,000 this time.