Carmen Mormino of Rodeo Realty held his 2nd annual “Holiday Clothing/Toy Drive” on December 13th in Westlake Village. All donations were dispersed to the Children’s Hospital Los Angeles, along with shelters in the area. Carmen reports over 50 people donated toys to the cause, and their support is greatly appreciated. Prior to the event, Carmen encouraged participants to donate items like clothing and/or toys to help those in need this holiday season. ”I know, as a community, how fortunate we all are to live where we live, and live the life we do. I feel that by doing this, we can possibly make this holiday a bit better for those in need.” Last year, the inaugural drive generated an overwhelming amount of donations, but luckily the chilly weather did not stop those from coming out to support Carmen and his cause. Carmen, his wife Mary Lee, and daughters Mia and Lola made it even more of a festive turnout by having fresh baked cookies, coffee from Starbucks, and piping hot chocolate for patrons. Carmen added, “The weather made it all the more special, and truly brought out the holiday spirit in all!”

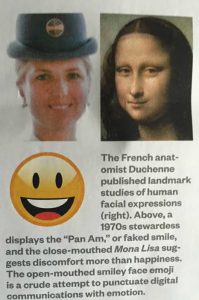

RODEO REALTY STUDIO CITY AGENT & FORMER "PAN AM" FLIGHT ATTENDANT CHERYL ACREY, LANDS HER SMILE IN AWARD WINNING SMITHSONIAN MAGAZINE

Cheryl Acrey, Studio City agent and former “Pan Am” flight attendant was astounded to see that her photo was being used as an example for her smile. The article on the psychology of smiling discussed different smiles of communication, and Acrey’s smile was noted as the “Fake Pan Am” smile.” Ironically, this is the same smile Cheryl was born with. The article pointed out that you will seem more trustworthy and have credibility if you simply smile more. What could be easier than that? Although the article was stating, “Is it the “Fake PAN AM smile” that will conquer the business world or the grimace of the Mona Lisa, Acrey states,”HER smile will now be her marketing tool! With article in hand and the “Pan Am” smile on her face, Cheryl is getting her name out in the real estate business one smile at a time.” Kudos to Cheryl Acrey and her “Pan Am” smile.

RODEO REALTY CALABASAS HOSTED "COMFORT FOR COURT KIDS" FUNDRAISER AT THE HOME OF CALABASAS AGENT, IOANNA KAMAR

On December 10th, 2015 Rodeo Realty agents attended Calabasas agent, Ioanna Kamars annual fundraiser to benefit “Comfort for Court Kids.” The evening event took place at the home of Ioanna in beautiful Bell Canyon. The charity event started at 5:00 PM and ended at 10:00 PM. Ioanna stated, “The event brought in an undisclosed amount in donations for this amazing charity.” “Comfort for Court Kids” was established in 1992 for the specific mission of helping abused and neglected children. According to a spoksperson at the organization, “We have at times been referred to as the Teddy Bear Foundation. Part of this generous donation will go to purchase bears for our children.” The event brought in over 50 agents! Ioanna sends a big thank you to all that attended.

RODEO REALTY WESTLAKE VILLAGE AGENT, CARMEN MORMINO HELD HIS 2ND ANNUAL HOLIDAY TOY DRIVE

On Sunday, December 13, 2015 Westlake Realtor Carmen Mormino of Rodeo Realty held his 2nd annual holiday toy drive in Westlake Village. Mormino had this to say. “We as a community are so fortunate, and during this holiday season it is important to reach out and help others.” Over 50 people arrived with toys in hand. The rainy weather did not stop the crowd, thanks to the yummy donuts and coffee courtesy of the Mormino family. Children’s Hospital Los Angeles (CHLA) will be one of the recipients of the toy drop off, along with local shelters. A spokesperson at CHLA had this to say upon hearing of the toys being dropped off. “Donations like this help bring smiles and hope to our children during the holidays.” Thank you for all that showed up and gave from the heart. What a wonderful way to celebrate the season!

Ben Bacal Tops MSN Money's "2015's Celebrity Real Estate Winners" List for his Listings with Jason Statham

Help Support Rodeo Realty, Sunset Office by Donating Canned Goods by This Friday

Encore Escrow Sherman Oaks Receives Shining Reviews From Joe Diab's Happy Client

Hi Donna, Amanda and Sam,

I just wanted to thank all of you for your assistance. Encore should be proud to have you on

their team. I hope you all have a very nice holiday and I hope Santa treats you well.

Thanks again,

Manny Herrera

Syd and the rest of Rodeo Realty are thrilled to have such a talented group of ladies on our side!

Encore Escrow Co., Inc.

15300 Ventura Blvd. #202, Sherman Oaks, CA 91403

818-981-9814 phone 818-981-9815 facsimile

Hours: Mon-Fri 9am-5pm

Teresa Todd, Branch Manager of Rodeo Realty, Inc. and the Northridge Office is having their annual charity drive for “Hathaway-Sycamores Adopt-A-Family program through 12/15/2015

For over 8 years the Northridge RODEO office, has been involved with Hathaway-Sycamores Adopt-A-Family program.

This year 3 families have been adopted by the Northridge Office. This charity drive will provide each family a Christmas tree, lights, decorations, holiday meal and gifts for each of the family members. Clothing and Household items are graciously needed.

Teresa stated, “One of the families did not have bedroom furniture”. One of our LA Mortgage reps heard of this and donated a ‘near new’ Trundle bed for the family! Wonderful!

Cultivating hope and resilience to enrich the well-being of children, adults, families and communities is so important year round. But at the Holiday Season is a Blessing that will stay with these families for months to come!

The last day to drop off donations is Tuesday 12/15/15.

Clarence Williams of Rodeo Realty to Host West Valley food Drive

Clarence Williams, a realtor with the Calabasas office, will be hosting a food drive for the upcoming holiday season to help benefit the West Valley Food Pantry. The Food Pantry serves over 3,000 people a month in the area and provides over 26,000 meals in that time; this is due to groceries that are given to the pantry, as well as items that are purchased from the LA Food Bank. Clarence is asking for help feeding those in need by donating any non-perishable food items during his benefit, volunteers can do so by leaving the items on their doorsteps, or by contacting him so that he can arrange to pick them up. If anyone has any questions he can be reached at 818.667.2627 regarding the upcoming event date of December 15th.