Explore our website for the most up-to-date information on real estate data and local news!

News & Media

Explore our website for the most up-to-date information on real estate data and local news!

Economic news for the week – Following last Friday’s jobs report where the unemployment rate came in at 4.3% a panic hit global markets. This was not due to 4.3% being a high unemployment number, it was because of the speed in which the unemployment rate has risen from 3.6%, a 60-year low, to the current 4.3%. In the past, a .5% jump in the unemployment rate average in a 3-month period over the previous 3-month period was a signal of a recession starting. Global and US markets sold off on Monday due to fears that the U.S. may be heading to a recession. For example, the Dow was down 1,000 points on Monday after falling over 700 points last Friday. Fortunately, by Tuesday investors were beginning to feel that recession fears were overblown and that the Sham Rule, named after the person, who found that a .5% jump in unemployment over consecutive 3-month periods signals a recession, may not be something to rely upon when the initial 3-month period begins with near-historic low unemployment levels. On Tuesday markets began to settle. On Thursday markets jumped and made up most of Monday’s huge losses when first-time unemployment claims came in well below expectations, solidifying the feeling that unemployment fears were overblown. Next week is going to be a big week for economic news. We have two inflation gages coming out. PPI (Producer Price Index) which shows wholesale price inflation and CPI (Consumer Price Index) which shows consumer price inflation. The Fed will be lowering interest rates. Depending on the level of inflation, and the unemployment rate, it’s just a matter of how far and how fast they will come down from the current “restrictive” 25-year highs to less restrictive levels.

Stock markets dropped sharply this week on recession fears – The Dow Jones Industrial Average closed the week at 39,497.54, down 0.6% from 39,727.26 last week. It is up 5.4% year-to-date. The S&P 500 closed the week at 5,344.16, unchanged from 5,346.56 last week. The S&P is up 12.2% year-to-date. The Nasdaq closed the week at 16,745.30, unchanged from 16,776.16 last week. It is up 11.8% year-to-date.

U.S. Treasury bond yields dropped sharply this week – The 10-year treasury bond closed the week yielding 3.94%, up from 3.80% last week. The 30-year treasury bond yield ended the week at 4.23%, up from 4.11% last week. We watch bond yields because mortgage rates follow bond yields. Even though bond yields are up for the week, they are well below where they were two weeks ago. Last Friday, the 10-year dropped from 4.18% the week before to 3.8% within hours after the unemployment rate was released. On Monday, the 10-year hit 3.68%, its lowest level in a year. Unfortunately, as investors began to feel that the panic was overblown, they left the safety of bonds and went back to stocks. As stock markets recovered U.S. bond yields went back up.

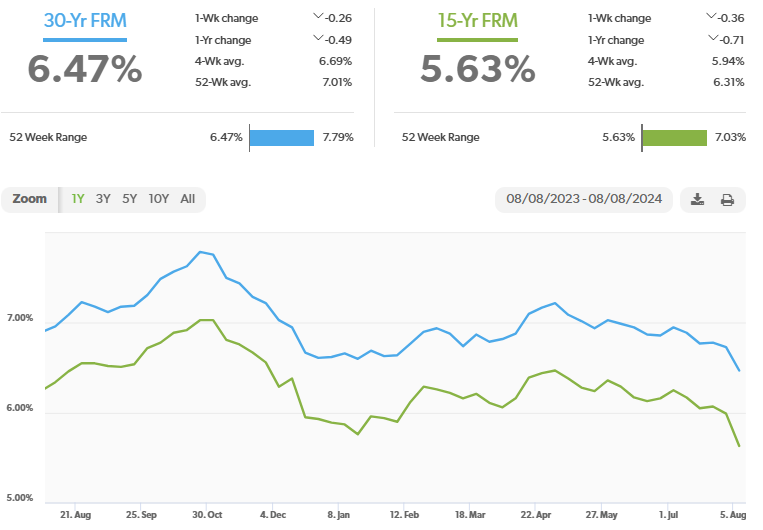

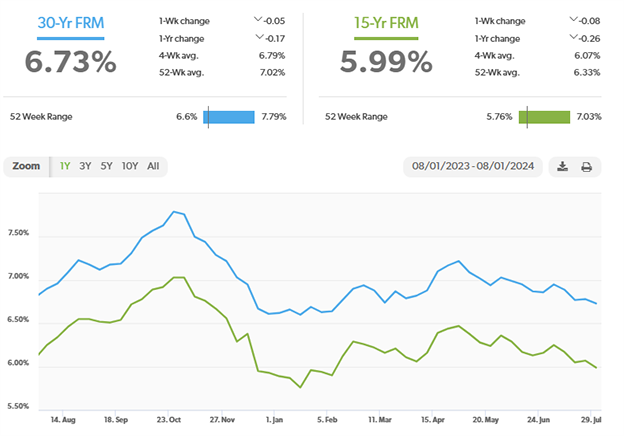

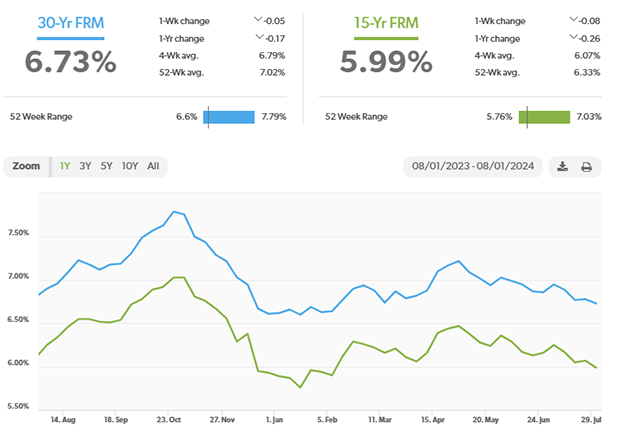

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of August 8th, 2024, were as follows: The 30-year fixed mortgage rate was 6.47%, down from 6.73% last week. The 15-year fixed was 5.63%, down from 5.99% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

July home sales figures will be released next week by the California Association of Realtors and the following week by the National Association of Realtors. You can get that data now for your county, city, or zip code at RodeoRE.com.

Have a great weekend!

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

Explore our website for the most up-to-date information on real estate data and local news!

U.S. hiring stalled and unemployment jumped in July – The Department of Labor and Statistics reported that 114,000 new jobs were added in July, well below the 185,000 new jobs forecasted by economists. The unemployment rate rose to 4.3% in July, its highest level since October 2021, and up from 4.1% in June. The lack of hiring and rise in the unemployment rate shocked investors. Stock markets dropped sharply as the three-month average unemployment rate exceeded a .5% increase from the previous three-month average. Under the Sham Rule Threshold, a .5% increase in the 3-month average unemployment rate for two consecutive 3-month periods often indicates the start of a recession. Average hourly wages increased 3.6% year-over-year in July, down from a 3.9% annual increase in June, and a 4.1% increase in May. This was not a good report. It panicked investors that fear that the Fed has left interest rates at 24-year highs for too long and that even a drop in September may be too late to avoid a recession. On a positive note, bond yields and mortgage rates dropped sharply on Friday after the jobs report was released. Bond yields and mortgage rates are now at their lowest levels in one year.

Stock markets dropped sharply this week on recession fears – The Dow Jones Industrial Average closed the week at 39,727.26, down 2.1% from 40,589.34 last week. It is up 5.4% year-to-date. The S&P 500 closed the week at 5,346.56, down 2.1% from 5,459.10 last week. The S&P is up 12.2% year-to-date. The Nasdaq closed the week at 16,776.16, down 3.5% from 17,357.88 last week. It is up 11.8% year-to-date

U.S. Treasury bond yields dropped sharply this week – The 10-year treasury bond closed the week yielding 3.80%, down from 4.20% last week. The 30-year treasury bond yield ended the week at 4.11%, unchanged from 4.45% last week. We watch bond yields because mortgage rates follow bond yields.

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of August 1st, 2024, were as follows: The 30-year fixed mortgage rate was 6.73%, down from 6.78% last week. The 15-year fixed was 5.99%, down from 6.07% last week. Rates dropped sharply on Thursday and Friday. We were seeing rates closer to 6% after the job’s report was released on Friday.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

Have a great weekend!

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of August 1st, 2024, were as follows: The 30-year fixed mortgage rate was 6.73%, down from 6.78% last week. The 15-year fixed was 5.99%, down from 6.07% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

| Economic news this week – As Real Estate Brokers we are focused on inflation. Higher inflation drives mortgage interest rates higher. Higher mortgage rates make homes less affordable. Key economic reports released in July confirmed that inflation has cooled to levels that are more acceptable to the Federal Reserve. The Consumer Price Index (CPI) for June came in better than expected. Month-over-month the CPI dropped 0.1%, its first month-over-month decrease since May 2020, at the peak of the pandemic. Year-over-year the CPI rate was 3%, its lowest level in three years, and down from a 3.3% increase in May. Core CPI, which excludes volatile food and energy costs was up 3.3% year-over-year, its smallest increase since April 2021. The June Producer Price Index (PPI) showed year-over-year wholesale prices are up 2.6%. The Personal Consumption Expenditures Price Index (PCE), a key indicator for the Fed, showed that consumer prices rose 2.5% in June from one year ago. That is the lowest annual increase in two years. Core PCE, which excludes volatile food and energy prices, grew 2.6% year-over-year. While the Fed left interest rates unchanged from their 25-year high levels at their July meeting, they stated that rate cuts could start as soon as the next Fed meeting in September. They hinted that they did not want to seem political as a reason for not dropping rates in their July 31 announcement, so it’s possible that even though experts surveyed gave a 97% chance of rate drops beginning in September, the Fed waits until November. One thing is for sure, it’s not a matter of if a cycle of rate drops is coming, it is a matter of when the Fed will start. Mortgage rates dropped further after the Fed’s comments on July 31. In other news, the U.S. Gross Domestic Product GDP reading showed that the economy grew at a 2.8% annual pace in the second quarter, beating analysts’ expectations of a 2.1% jump. Perhaps the Fed will get inflation under control without causing a recession and pull off a “soft landing” after all.

The graph below shows the movement in the inflation rate since 2021.

Stock Markets – The Dow Jones Industrial Average closed the month at 40,842.79, up 4.4% from 39,118.86, on June 30, 2024. It is up 8.4% year-to-date. The S&P 500 closed the month at 5,522.30, up 1.1% from 5,460.48 last month. It is up 15.8% year-to-date. The NASDAQ closed the month at 17,599.40, down 0.8% from 17,732.60 last month. It is up 17.2% year-to-date. U.S. Treasury bond yields – The 10-year treasury bond closed the month yielding 4.09%, down from 4.36% last month. The 30-year treasury bond yield ended the month at 4.35%, down from 4.51% last month. We watch bond yields because mortgage rates often follow treasury bond yields. Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of July 25, 2024, were as follows: The 30-year fixed mortgage rate was 6.78%, down from 6.86% at the end of May. The 15-year fixed was 6.07%, down from 6.16% last month. The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S. Home sales data is released on the third week of the month for the previous month by the National Association of Realtors and the California Association of Realtors. These are June’s home sales figures. U.S. existing-home sales June 2024 – The National Association of Realtors reported that existing-home sales totaled 3.89 million units on a seasonally adjusted annualized rate in June, down 5.4% from an annualized rate of 4.11 million last June. The median price for a home in the U.S. in June was $426,900, up 4.1% from $410,109 one year ago. There was a 4.1-month supply of homes for sale in June, up from a 3.1-month supply one year ago. First-time buyers accounted for 29% of all sales. Investors and second-home purchases accounted for 16% of all sales. All cash purchases accounted for 28% of all sales. Foreclosures and short sales accounted for 2% of all sales. California home prices jumped 7.5% from one year ago in June – The California Association of Realtors reported that existing home sales totaled 270,200 on an annualized rate in June, down 2.7% from a revised 277,960 homes sold on an annualized basis last June. There was a 3-month supply of homes for sale, up from a 2.2-month supply one year ago. The statewide median price paid for a home in June was $900,720, up 7.5% from a revised median price of $837,850 one year ago. The graph below shows sales data by county in Southern California.

|

Thailand is home to the delightful foods that have made their way into South California. Regardless of location, you will find a luxurious place to enjoy an excellent rendition of Tom Khai Gai, Fragrant soups, Pak Phuk Tong, Yam Pla Dook Foo, and other staple dishes from Thai cuisine.

Read on for our top picks to enjoy around town!

Location: 9043 Sunset Blvd, West Hollywood, CA 90069

West Hollywood residents enjoy Thai cuisine in an authentic restaurant. Night + Market is known for its flavorful and exotic food. A taste of chef Kris Yenbamroong’s talent will leave you wanting more. Make sure to order “Hidden Treasures” or a whole fish dish.

Location: 8101 1/2 Beverly Blvd. Los Angeles, CA 90048

Vegans can visit Araya’s place for the vegan version of Thai Dishes. This family-owned eatery serves signature dishes, such as drunken mushroom noodles and avocado curry. You will find many cuisines to choose from on the menu.

Location: 7440 Santa Monica Blvd. West Hollywood, CA 90046

This WeHo eatery offers modern fusion dishes and traditional Thai favorites. Galanga is an unexpectedly pleasant restaurant that welcomes you with wall-mounted bud vases and traditional art. On the menu, you will get contemporary renditions of noodle-like shredded papaya and buffalo chicken wings.

Location: 11744 Ventura Blvd. Studio City, CA 91604

Talesai is known for clean, flavorful, upscale Thai cuisines that go beyond the norm. The menu here exceeds the predictable traditional cuisines around town. Consider ordering grilled lamb chops, grilled rib-eye steak, or pacific calamari and plum sauce for dessert when you visit this style-conscious contemporary restaurant.

Location: 1275 Westwood Blvd LA, CA 90024 Westwood

Visit Emporium Thai for authentic cooking. The restaurant was featured in U.S. top 100 best Thai restaurants for making popular dishes such as Pad See Ew, Southern Curry, and Pad Thai.

Location: Encino | Northridge | Woodland Hills

Get an authentic Thai experience from a crash course of delicious Thailand food in the heart of the San Fernando Valley. Top dishes at Lum Ka Naad include a fusion of northern and Southern Thailand foods. Northern cuisines include crossovers from China, Laos, and neighboring Burma. Order specialties such as Khai soy, pla pling, and Tai pla country soup.

Location: 5223 W Sunset Blvd, Los Angeles 90027-5709

You will find a 300-dish menu comprising rarely-seen specialties. This authentic Thai restaurant in East Hollywood serves specialties such as khua Kling phat tha lung, steamed green mussels, fried soft-shell crab, and deep-fried whole sea bass.

Explore our website for the most up-to-date information on real estate data and local news!

Economic news this week – The second quarter Gross Domestic Product (GDP) was released this week. It showed that the economy grew 2.8% in the second quarter, exceeding analysts’ expectations of a 2.1% increase. Technology stocks continued to drop for a third straight week. On the inflation front, the Personal Consumption Expenditures Price Index (PCE), a key indicator for the Fed, was released on Friday. It showed that consumer prices rose 2.5% in June from one year ago. That is the lowest annual increase in two years, another indication that inflation is cooling. Core PCE, which excludes volatile food and energy prices, grew 2.6% year-over-year. Economists surveyed gave just an 8% chance of a rate drop at the Fed meeting next week but gave a 92% chance of a rate drop at the September Fed meeting. All the experts agree that a rate drop cycle is not far off, as the Fed’s key rates currently at a 25-year high have successfully tamed inflation.

Stock markets – The Dow Jones Industrial Average closed the week at 40,589.34, up 0.8% from 40,257.53 last week. It is up 7.7% year-to-date. The S&P 500 closed the week at 5,459.10, down 0.8% from 5,505.00 last week. The S&P is up 14.5% year-to-date. The Nasdaq closed the week at 17,357.88, down 2.1% from 17,726.94 last week. It is up 15.6% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.20%, down from 4.25% last week. The 30-year treasury bond yield ended the week at 4.45%, unchanged from 4.45% last week. We watch bond yields because mortgage rates follow bond yields.

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of July 25, 2024, were as follows: The 30-year fixed mortgage rate was 6.78%, unchanged from 6.77% last week. The 15-year fixed was 6.07%, almost unchanged from 6.05% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

U.S. existing-home sales June 2024 – The National Association of Realtors reported that existing-home sales totaled 3.89 million units on a seasonally adjusted annualized rate in June, down 5.4% from an annualized rate of 4.11 million last June. The median price for a home in the U.S. in June was $426,900, up 4.1% from $410,109 one year ago. There was a 4.1-month supply of homes for sale in June, up from a 3.1-month supply one year ago. First-time buyers accounted for 29% of all sales. Investors and second-home purchases accounted for 16% of all sales. All cash purchases accounted for 28% of all sales. Foreclosures and short sales accounted for 2% of all sales.

Have a great weekend!