Economic news this week – As Real Estate Brokers we are focused on inflation. Higher inflation drives mortgage interest rates higher. Higher mortgage rates make homes less affordable. This week there was more evidence that inflation is cooling. On Thursday, the Consumer Price Index (CPI) was released for June. Month-over-month the CPI dropped 0.1%, its first month-over-month decrease since May 2020, at the peak of the pandemic. Year-over-year the CPI rate was 3%, its lowest in three years, and down from a 3.3% increase in May. Core CPI, which excludes volatile food and energy costs was up 3.3% year-over-year, its smallest increase since April 2021. These readings were well below economists’ expectations. Friday the Producer Price Index (PPI) was released. Unfortunately, it climbed 0.2% month-over-month in June. That was above the 1% rise economists expected. Year-over-year wholesale prices are up 2.6%, also above expectations. The Michigan survey of consumer sentiment hit an 8-month low. In this bad news is good news for a rate cut environment, that brought rates down further. Next week we will get retail sales figures. If those follow consumer sentiment, we will see rates continue to drop. Several Fed officials also spoke this week and even the most hawkish ones expressed their satisfaction with the direction of inflation and inflationary pressures. The Fed has left its key rates at the highest levels in 25 years for almost a year. They have stated that a cycle of cuts will begin as soon as they feel inflation is under control. Experts gave a 97% chance of a Fed rate cut in September.

Stock markets – The Dow Jones Industrial Average closed the week at 40,000.90, up 1.6% from 39,375.87 last week. It is up 6.1% year-to-date. The S&P 500 closed the week at 5,615.35, up 0.9% from 5,567.19 last week. The S&P is up 17.7% year-to-date. The Nasdaq closed the week at 18,398.45, up 0.3% from 18,352.67 last week. It is up 22.6% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.18%, down from 4.28% last week. The 30-year treasury bond yield ended the week at 4.39% down from 4.47% last week. We watch bond yields because mortgage rates follow bond yields.

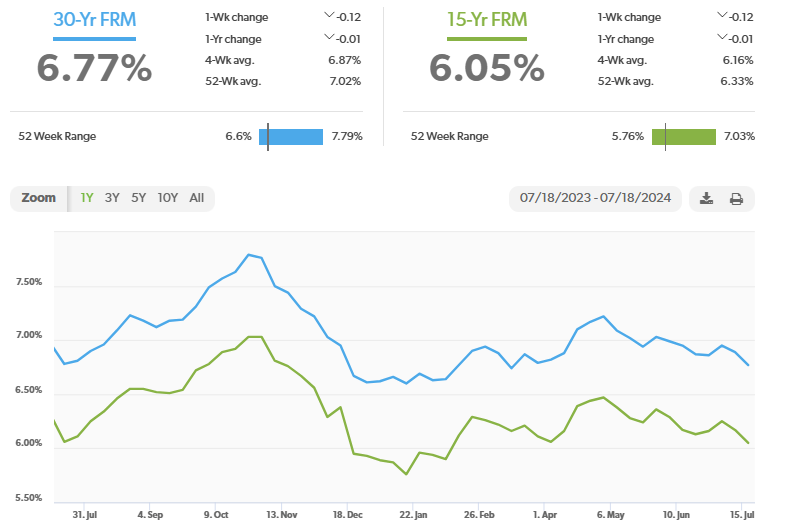

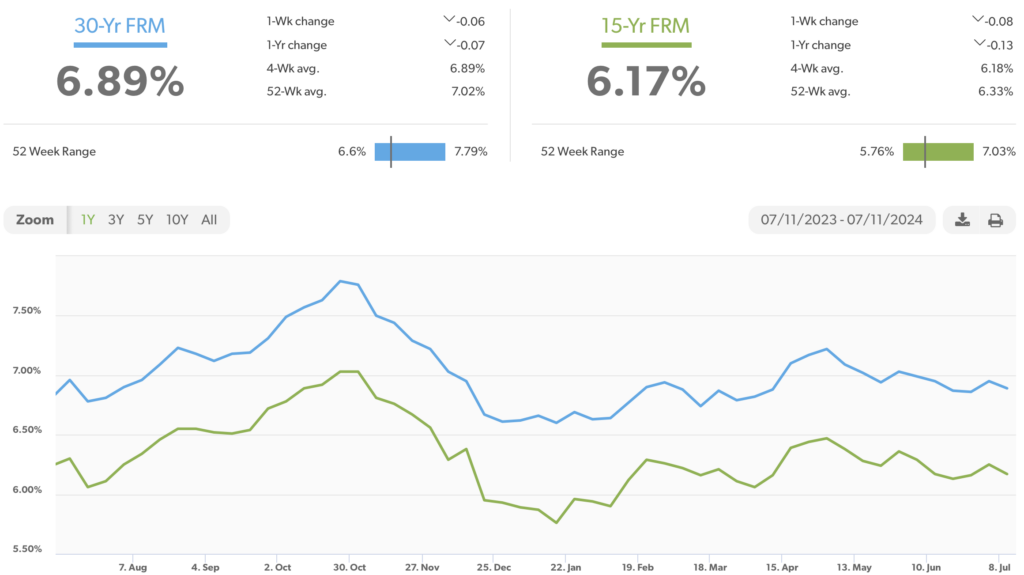

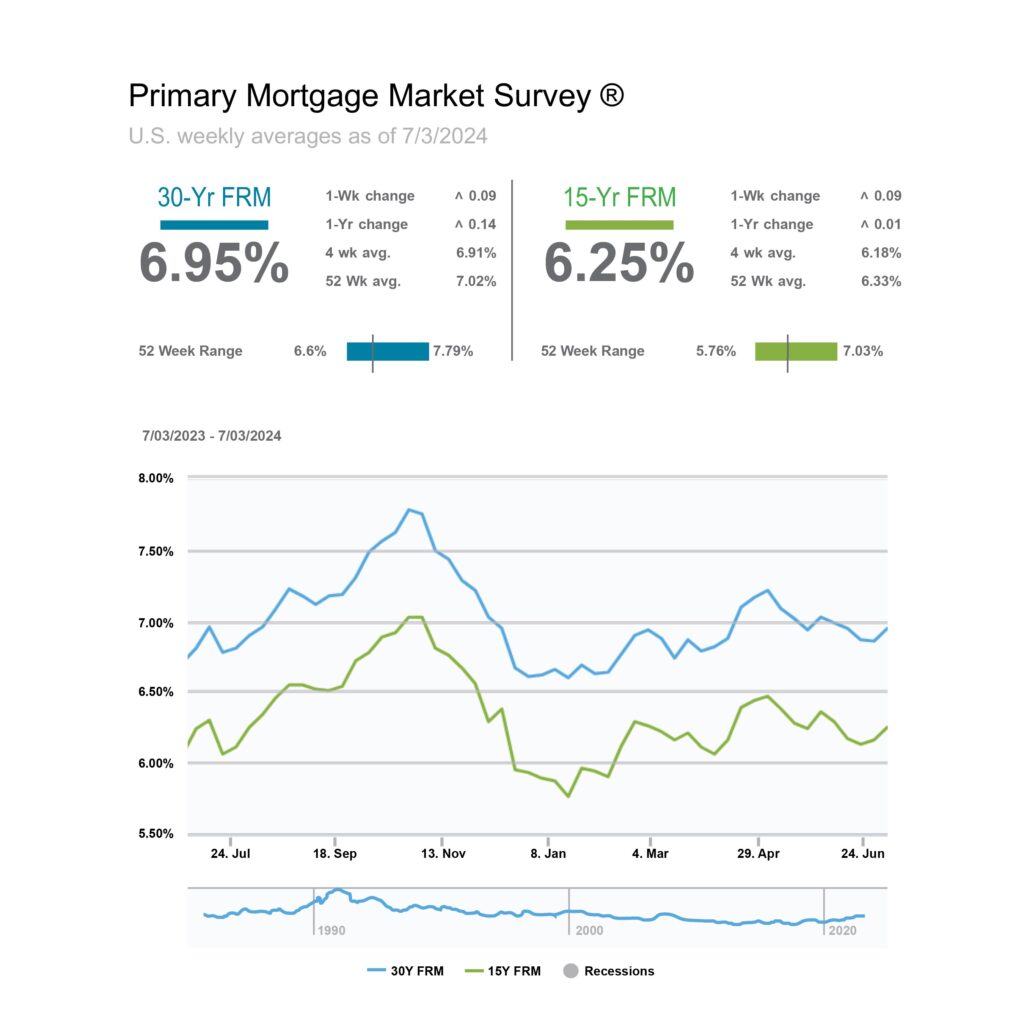

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of July 11, 2024, were as follows: The 30-year fixed mortgage rate was 6.89%, down from 6.95% last week. The 15-year fixed was 6.17%, down from 6.25% last week.

The graph below shows the trend of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

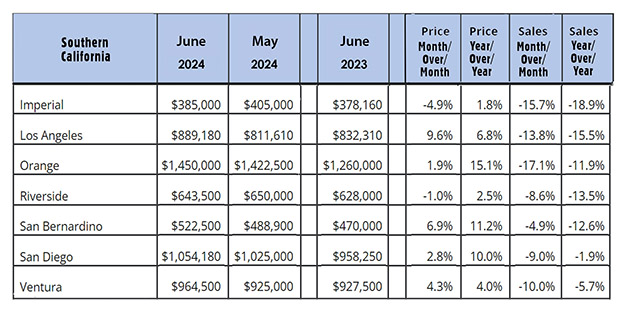

June home sales figures will be released next week by the California Association of Realtors and the National Association of Realtors. You can get that data now for your county, city, or zip code at RodeoRE.com.

Have a great weekend!