Explore our website for the most up-to-date information on real estate data and news!

News & Media

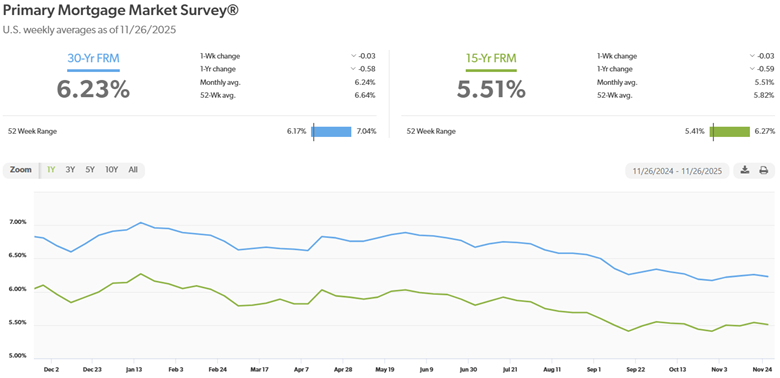

Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of November 26, 2025 were as follows:

The 30-year fixed mortgage rate was 6.23%, nearly unchanged from 6.26% last week. The 15-year fixed was 5.51%, up from 5.54% last week.

The graph below shows the trajectory of mortgage rates over the past year.

| The longest government shutdown in history ended on November 12, 2025 – As people were called back to work, there were a lot of questions as to how much the 43-day shutdown would impact the economy. According to the Congressional Budget Office (CBO), the disruption is expected to reduce fourth-quarter GDP growth by about 1.5 percentage points. All in all, tens of thousands of federal workers missed paychecks, contractors lost business, consumer spending was curtailed during the six-week interruption, and key data like jobs and unemployment, inflation, retail sales, etc., were not released as planned because the workers who tabulate the data were furloughed. Investors are anxious about how consumers will behave after six weeks of disrupted pay and routines. Many of those wages are lost (or delayed) and won’t get recycled instantly into restaurant meals, travel, shopping, etc. That means some spending is permanently displaced this quarter. That, in turn, is one reason stocks faltered despite the end of the shutdown.

U.S. job growth picked up in September – The September jobs report was released on November 20, after being delayed by the shutdown – The Bureau of Labor Statistics reported that 119,000 jobs were added in September, up from a revised loss of 4,000 jobs in August. This report points to a healthy pre-shutdown gain in employers’ confidence to increase hiring. The October jobs report will not be released. They will issue the unemployment rate with the November report in December. Part of the report is derived from surveys that were not done in October, which is the reason that a full report cannot be done for October. The unemployment rate increased to 4.4%, up from 4.3% in August, its highest level since 2021. Stock markets rebounded to end the month with the best week since April 2025 on hopes of a December rate cut to end the month almost unchanged from their record highs at the start of November – It was a wild month on Wall Street. Stocks fell through the first half of the month as the federal government shutdown dragged on, delaying the September and October jobs reports as well as several key inflation releases. The only major data point that arrived was the Consumer Price Index (CPI), which was required to calculate the annual Social Security cost-of-living adjustment. The end of the government shutdown did not help the markets. Stocks continued to tumble for nearly two more weeks as investors were left without critical economic data. It wasn’t until the final days of the month that sentiment shifted. Several Federal Reserve officials softened their tone, pointing to weakening labor-market indicators and inflation that appears to be leveling off. This was a reversal from comments from Fed Chairman Powell and other Fed members early in the month that indicated that the Fed would not drop interest rates in December. Those comments ignited a sharp rebound as investors and economists interpreted the comments as indicating another ¼% rate drop would come in December. That helped stock markets end the month with their strongest weekly gain since April 2025, snapping a deep two-week slide and restoring some stability heading into December. The Dow Jones Industrial Average ended the month at 47,716.42, up 0.3% from 47,562.87 on October 31, 2025. The Dow is up 7.1% year-to-date. The S&P 500 closed the month at 6,849.09, up 0.1% from 6,840.20 on October 31, 2025. It is up 13.4% year-to-date. The NASDAQ closed at 23,365.69, down 1.3% from 23,724.96 at the end of October. It is up 29% year-to-date. U.S. Treasury Bond Yields – The 10-year U.S. Treasury bond yield closed the month at 4.02%, down from 4.11% on October 31, 2025. The 30-year treasury yield ended the month at 4.67%, unchanged from 4.67% on October 31, 2025. We watch bond yields because mortgage rates often follow treasury bond yields. Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of October 30, 2025, were as follows: The 30-year fixed mortgage rate was 6.23%, up from 6.17% last month. The 15-year fixed was 5.51%, up from 5.41% last month. Rates fell in the last two days of November and were pretty much at the same rates they ended last month at. The graph below shows the trajectory of mortgage rates over the past year. October home sales – The California Association of Realtors and the National Association of Real Estate release home sales data on the third week of each month for the previous month. Here is the October 2025 home sales recap. You can run a report on your city or zip code with the same data at RodeoRe.com U.S. existing-home sales – October 2025 – The National Association of Realtors reported that existing-home sales totaled 4.10 million units on a seasonally adjusted annualized rate in October, up 1.2% from the number of homes sold in September and up 1.7% from the number of homes sold last October. The median price paid for a home sold in the U.S. in October was $415,200, up 2.1% from $406,800 one year ago. There was a 4.4-month supply of homes for sale in October, up from a 4.1-month supply last October. First-time buyers accounted for 32% of all sales, up from 30% last month. Investors and second-home purchases accounted for 16% of all sales, down from 15% in August. All cash purchases accounted for 39% of all sales, up from 30% last month. Foreclosures and short sales accounted for 2% of all sales California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 285,590 on an annualized basis in October, up 1.9% from 277,410 in September. Year-over-year sales were up 4.1% from a revised 271,370 annualized home sales last October. The statewide median price paid for a home in was $886,960 in October, down 0.2% from 888,740 in October 2024. The unsold inventory index showed that there was a 3.1-month supply of homes for sale in October. These numbers are a little deceiving. Prices have dropped more than the median price indicates. The median price is the midpoint of all homes sold. Basically, it’s the point where one half of the homes sold for more and one half of the homes sold for less. Usually, the median price is a good indicator of prices across the board. There are times when conditions impact that. This is one of those times. With stock market values at all-time highs, which they were in October, people who invested in the stock market are flusher than people who are not. Additionally, many of the factors that impact people’s ability and desire to buy a home affect people more in the lower income range than they affect people in higher income ranges. That’s happening now. Sales are down in all price ranges compared to any time prior to interest rates rising in mid-2022, but sales in the lower price ranges as a percentage of all sales are fewer than we would normally see, as those people are more impacted by inflation, don’t have stocks, etc. The graph below shows CAR sales data by county for Southern California. |

| Stock markets rebounded with their best week since April 2025 on hopes of a December rate cut – It was a wild month on Wall Street. Stocks fell through the first half of the month as the federal government shutdown dragged on, delaying the September and October jobs reports as well as several key inflation releases. The only major data point that arrived was the Consumer Price Index (CPI), which was required to calculate the annual Social Security cost-of-living adjustment. The shutdown finally ended on November 20, the longest government shutdown in U.S. history, but that news didn’t help the markets. Stocks continued to tumble for nearly two more weeks as investors were left without critical economic data. On November 20, the September jobs report was released showing that the pre-shutdown labor market had picked up. It wasn’t until the final days of the month that sentiment shifted. Several Federal Reserve officials softened their tone, pointing to weakening labor-market indicators and inflation that appears to be leveling off. This was a reversal from their September comments that seemed to indicate that there would be no rate drop in December. Those comments ignited a sharp rebound as investors and economists interpreted the comments indicated another ¼% rate drop would come in December. That helped stock markets end the month with their strongest weekly gain since April 2025, snapping a deep two-week slide and restoring some stability heading into December.

Stock Markets – The Dow Jones Industrial Average closed the week at 47,716.42, up 3.2% from 46.245.41 last week. Year-to-date, it is up 7.1% from 44,544.66 on December 31, 2024. The S&P 500 closed the week at 6,849.09, up 3.7% from 6,602.99 last week. Year-to-date, the S&P is up 13.4% from 6,040.53 on December 31, 2024. The Nasdaq closed the week at 23,365.69, up 4.9% from 22,273.08 last week. Year-to-date, it is up 19% from 19,627.44 on December 31, 2024. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.02%, down from 4.06% last week. The 30-year treasury bond yield ended the week at 4.67% down from 4.71% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of November 26, 2025, were as follows: The 30-year fixed mortgage rate was 6.23%, nearly unchanged from 6.26% last week. The 15-year fixed was 5.51%, up from 5.54% last week. Rates dropped at the end of the week and Friday’s 30-year rate was close to 6%. The graph below shows the trajectory of mortgage rates over the past year. U.S. existing-home sales – October 2025 – The National Association of Realtors reported that existing-home sales totaled 4.10 million units on a seasonally adjusted annualized rate in October, up 1.2% from the number of homes sold in September and up 1.7% from the number of homes sold last October. The median price paid for a home sold in the U.S. in October was $415,200, up 2.1% from $406,800 one year ago. There was a 4.4-month supply of homes for sale in October, up from a 4.1-month supply last October. First-time buyers accounted for 32% of all sales, up from 30% last month. Investors and second-home purchases accounted for 16% of all sales, down from 15% in August. All cash purchases accounted for 39% of all sales, up from 30% last month. Foreclosures and short sales accounted for 2% of all sales Have a Great Weekend! |

| The September jobs report was released this week after being delayed by the shutdown – U.S. job growth picked up in September – The Bureau of Labor Statistics released its September jobs report, which was scheduled for release on October 3rd but was delayed by the government shutdown. They reported that 119,000 jobs were added in September, up from a revised loss of 4,000 jobs in August. This report points to a healthy pre-shutdown gain in employers’ confidence to increase hiring. The October jobs report will not be released. They will issue the unemployment rate with the November report in December. Part of the report is derived from surveys that were not done in October, which is the reason that a full report cannot be done for October. The unemployment rate increased to 4.4%, up from 4.3% in August, its highest level since 2021.

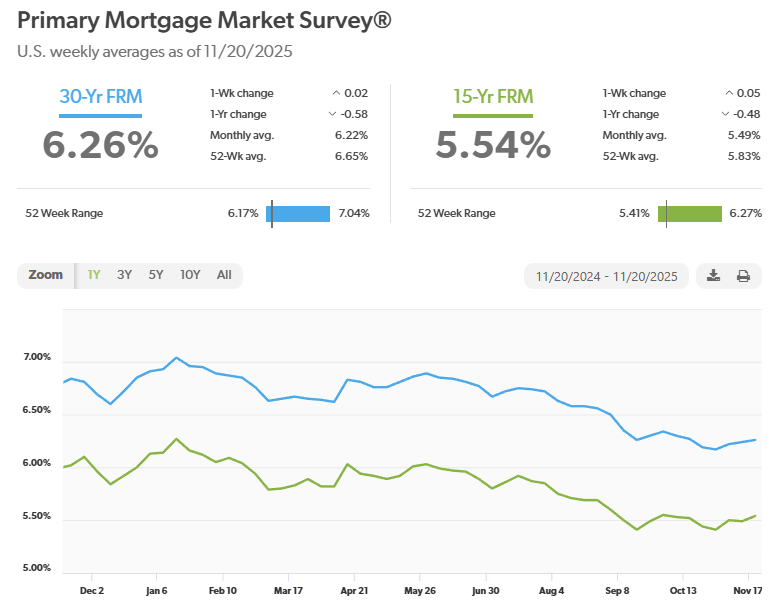

Stock Markets – The Dow Jones Industrial Average closed the week at 46,245.41, down 1.9% from 47,147.48 last week. Year-to-date, it is up 3.8% from 44,544.66 on December 31, 2024. The S&P 500 closed the week at 6,602.99, down 2% from 6,734.11 last week. Year-to-date, the S&P is up 9.3% from 6,040.53 on December 31, 2024. The Nasdaq closed the week at 22,273.08, down 2.7% from 22,900.59 last week. Year-to-date, it is up 13.5% from 19,627.44 on December 31, 2024. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.06%, down from 4.14% last week. The 30-year treasury bond yield ended the week at 4.71% down slightly from 4.74% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of November 20, 2025, were as follows: The 30-year fixed mortgage rate was 6.26%, nearly unchanged from 6.24% last week. The 15-year fixed was 5.54%, up from 5.49% last week. The graph below shows the trajectory of mortgage rates over the past year.

California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 285,590 on an annualized basis in October, up1.9% from 277,410 in September. Year-over-year sales were up 4.1% from a revised 271,370 annualized home sales last October. The statewide median price paid for a home was $886,960 in October, down 0.2% from 888,740 in October 2024. The unsold inventory index showed that there was a 3.1-month supply of homes for sale in October. These numbers are a little deceiving. Prices have dropped more than the median price indicates. The median price is the mid-point of all homes sold. Basically, it’s the point where one half of the homes sold for more and one half of the homes sold for less. Usually, the median price is a good indicator of prices across the board. There are times when conditions impact that. This is one of those times. With stock market values at all-time highs, which they were in October, people who invested in the stock market are flusher than people that are not. Additionally, many of the factors that impact people’s ability and desire to buy a home affect people more in the lower income range than they affect people in higher income ranges. That’s happening now. Sales are down in all price ranges compared any time prior to interest rates rising in mid-2022, but sales in the lower price ranges as a percentage of all sales are fewer than we would normally see, as those people are more impacted by inflation, don’t have stocks, etc.

Have a Great Weekend! |

Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of November 20, 2025 were as follows:

The 30-year fixed mortgage rate was 6.26%, nearly unchanged from 6.24% last week. The 15-year fixed was 5.54%, up from 5.49% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

The longest government shutdown in history ended this week – Stock markets were almost unchanged this week following last week’s sell-off off which marked the worst week for stock markets in seven months. The week started off well. Stock markets rallied to near record highs when a deal to reopen the government was reached. As people were called back to work, there were a lot of questions as to how much the 43-day shutdown would impact the economy. According to the Congressional Budget Office (CBO), the disruption is expected to reduce fourth-quarter GDP growth by about 1.5 percentage points. All in all, tens of thousands of federal workers missed paychecks, contractors lost business, consumer spending was curtailed during the six-week interruption, and key data like jobs and unemployment, inflation, retail sales, etc., were not released as planned because the workers who tabulate the data were furloughed. Investors are anxious about how consumers will behave after six weeks of disrupted pay and routines. Many of those wages are lost (or delayed) and won’t get recycled instantly into restaurant meals, travel, shopping, etc. That means some spending is permanently displaced this quarter. That, in turn, is one reason stocks faltered despite the end of the shutdown. Additionally, investors are worried about comments from Fed Chairman Powell and other Fed members that alluded to no Fed interest rate drop in December. Investors felt that another drop in December was almost certain until Powell and other Fed members’ comments.

Stock Markets – The Dow Jones Industrial Average closed the week at 47,147.48, up 0.3% from 46,987.10 last week. Year-to-date, it is up 5.8% from 44,544.66 on December 31, 2024. The S&P 500 closed the week at 6,734.11, up 0.1% from 6,728.80 last week. Year-to-date, the S&P is up 11.5% from 6,040.53 on December 31, 2024. The Nasdaq closed the week at 22,900.59, down 0.5% from 23,004.54 last week. Year-to-date, it is up 16.7% from 19,627.44 on December 31, 2024.

U.S. Treasury bond yields – The 10-year Treasury bond closed the week yielding 4.14%, up from 4.11% last week. The 30-year treasury bond yield ended the week at 4.74%, up from 4.70% last week. We watch bond yields because mortgage rates follow bond yields.

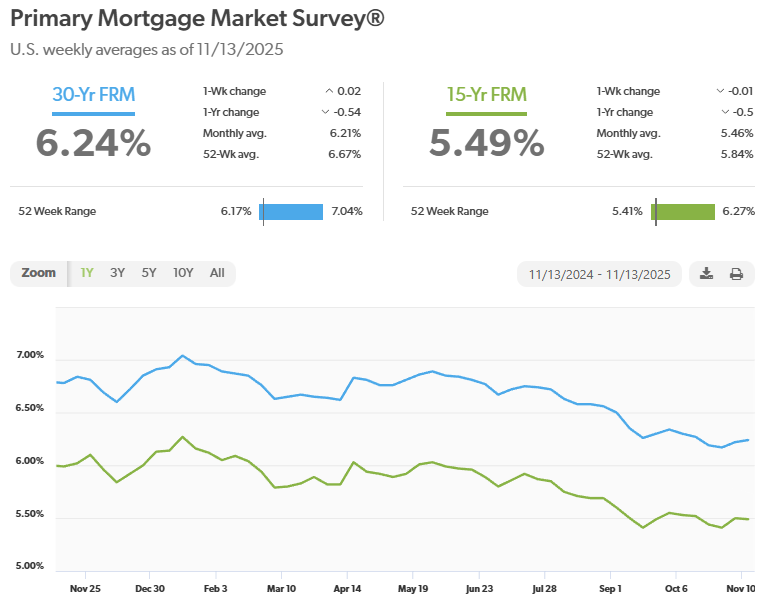

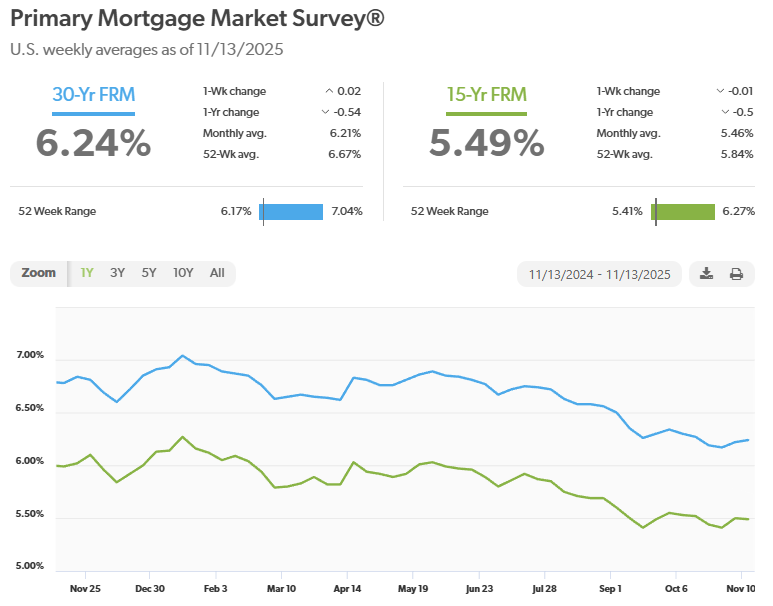

Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of November 13, 2025, were as follows: The 30-year fixed mortgage rate was 6.24%, nearly unchanged from 6.22% last week. The 15-year fixed was 5.49%, nearly unchanged from 5.5% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Have a Great Weekend!

Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of November 13 2025, were as follows:

The 30-year fixed mortgage rate was 6.24%, nearly unchanged from 6.22% last week. The 15-year fixed was 5.49%, nearly unchanged from 5.5% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

Thanksgiving is just two weeks away—have you made your plans yet? If the idea of cooking a massive feast or entertaining a house full of guests sounds more stressful than soulful, it might be time to trade tradition for relaxation. Luckily, Southern California offers a wealth of luxurious Thanksgiving getaways near Los Angeles, all within a few hours’ drive. Whether you’re craving a chef-led holiday meal, a spa sanctuary in the desert, or coastal charm with a side of Cabernet, these destinations are booking up fast. Now’s the moment to reserve your spot for a cozy, unforgettable holiday weekend.

Nestled in the Topatopa Mountains, Ojai is a picturesque escape known for its artsy charm and serene energy. Stay at Ojai Valley Inn, an award-winning resort with Spanish-style architecture, luxe spa treatments, and a Thanksgiving feast at The Farmhouse led by renowned chefs. Explore the charming village for boutique shopping and olive oil tastings, or simply unwind under the oaks with a glass of wine. Book early—holiday weekends fill quickly in this tucked-away haven.

The American Riviera is a timeless destination for a holiday getaway. Stay at The Ritz-Carlton Bacara or Belmond El Encanto, where ocean views, elevated amenities, and curated Thanksgiving menus make the weekend feel special without lifting a finger. Whether you stroll along Butterfly Beach, enjoy a wine tasting in the Funk Zone, or indulge in a spa day, Santa Barbara brings a sense of laid-back luxury perfect for the season.

If poolside lounging and sunny skies sound like your ideal holiday, Palm Springs offers a glamorous Thanksgiving alternative. Book a stay at Korakia Pensione for Moroccan-inspired serenity or check into Parker Palm Springs for maximalist style and impeccable dining. Many resorts host holiday dinners with gourmet twists on classic favorites, while spas offer seasonal treatments to help you unwind. Make reservations early—Palm Springs is a holiday hotspot.

For a coastal getaway closer to home, Laguna Beach offers the perfect blend of ocean air and artistic flair. Check into Montage Laguna Beach, where oceanfront rooms, gourmet dining, and holiday experiences create a memorable Thanksgiving weekend. Enjoy a scenic hike in Heisler Park or explore the galleries and boutiques that line Pacific Coast Highway. Be sure to reserve your Thanksgiving dinner at Studio or Harvest early—these tables don’t last long.

Venture north to Paso Robles for a Thanksgiving steeped in rustic elegance and wine country charm. Cozy up at Allegretto Vineyard Resort or Hotel Cheval, both offering refined lodging and close proximity to some of California’s top vineyards. Local wineries often host Thanksgiving weekend tastings, and many nearby restaurants offer prix fixe holiday menus. Just be sure to book your accommodations and dinner reservations ahead of time—it’s one of the most popular weekends of the season.

Whether you’re seeking relaxation or a new holiday tradition, these Thanksgiving getaways offer something for every luxury-minded traveler. With just two weeks to go, now’s the time to book that boutique hotel or reservation at the chef’s table. Your stress-free holiday weekend awaits.

| This week marked the 39th day of the government shutdown, the longest shutdown in U.S. history. Investors, who had shaken off the shutdown until this week, sold stocks in the worst stock market week since April, fearing that the shutdown would slow the economy. The University of Michigan consumer sentiment report showed that consumer confidence hit its lowest level since June 2022, when inflation peaked at 9.2%. The Bureau of Labor Statistics did not release its Jobs and unemployment report, which was due Friday, November 7 for the second consecutive month due to the shutdown. Limited economic data has investors confused about the state of the jobs market, inflation, retail sales, and other factors that they routinely watch to determine the state of the economy.

Stock Markets – Stock markets had their worst week since April. The Dow Jones Industrial Average closed the week at 46,987.10, down 1.2% from 47,562.87 last week. Year-to-date, it is up 5.5% from 44,544.66 on December 31, 2024. The S&P 500 closed the week at 6,728.80, down 1.6% from 6,840.20 last week. Year-to-date, the S&P is up 11.4% from 6,040.53 on December 31, 2024. The Nasdaq closed the week at 23,004.54, down 3% from 23,724.96 last week. Year-to-date, it is up 17.2% from 19,627.44 on December 31, 2024. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.11%, unchanged from 4.11% last week. The 30-year treasury bond yield ended the week at 4.70% up slightly from 4.67% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of November 6, 2025, were as follows: The 30-year fixed mortgage rate was 6.22%, up from 6.17% last week. The 15-year fixed was 5.5%, up from 5.41% last week. The graph below shows the trajectory of mortgage rates over the past year. Housing became more affordable in the third quarter of 2025 – The California Association of Realtors reported that 17% of California households could afford to purchase the $887,380 median-priced home in the third quarter of 2025, up from 15% in the second quarter of 2025, and up from 16% in the third quarter of 2024. A minimum annual income of $223,600 was needed to make monthly payments of $5,590, including principal, interest, taxes, and insurance on a 30-year fixed-rate mortgage at a 6.67 percent interest rate. Twenty-seven percent of home buyers were able to purchase the $649,990 median-priced condo or townhome. A minimum annual income of $163,600 was required to make a monthly payment of $4,090. Have a Great Weekend! |