|

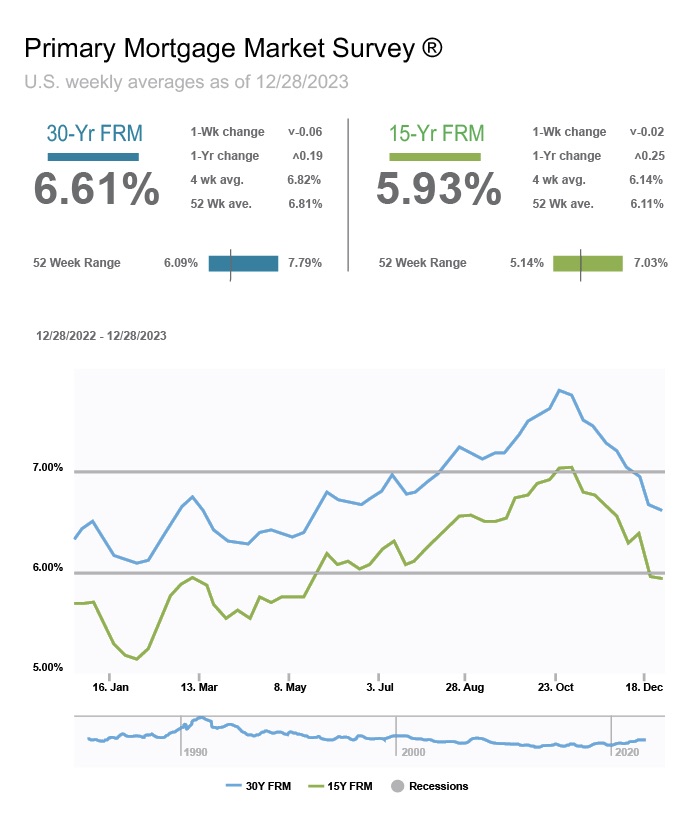

Stock markets ended the week almost unchanged to close out a banner year – The Dow Jones Industrial Average closed the week at 37,689.40, up 0.2% from 37,385.37 last week. It ended the year up 12.7%. The S&P 500 closed the week at 4,769.89, up 0.7% from 4,754.63 last week. It ended the year up 24.2%. The Nasdaq closed the week at 15,011.35, up 0.1% from 14,992.67 last week. It closed 43.4% up in 2023. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 3.88% down slightly from 3.90% last week. The 30-year treasury bond yield ended the week at 4.03%, down slightly from 4.05% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates are at their lowest point since June – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 28, 2023, were as follows: The 30-year fixed mortgage rate was 6.61%, down from 6.67% last week. The 15-year fixed was 5.93%, down from 5.95% last week. Rates dropped further at the end of the week. Next week’s 30-year should be close to 6.5%. The graph below shows the trajectory of mortgage rates over the past year.

Have a great weekend! |

Weekend Events | NYE 2024 Edition

As we bid farewell to another year and welcome the promise of a new one, Los Angeles comes alive with a plethora of events and celebrations to ring in New Year’s Eve 2024. From spectacular fireworks displays to themed parties and live performances, there’s something for everyone to enjoy. Here are some of the top local events to consider for your New Year’s Eve celebration:

Marina del Rey New Year’s Eve Fireworks

Where: Marina del Rey

When: December 31, 2023 What: Marina del Rey sets the night ablaze with two dazzling fireworks displays at 9 pm and midnight. These pyrotechnic spectacles light up the waterfront, near Burton Chace Park. If you’re looking for family-friendly fun, don’t miss the “glow party” at the park from 7 pm to midnight. While some restaurants offer ticketed dinners, you can also find free spots along the water to enjoy the fireworks.

N.Y.E.L.A.

Where: Downtown

When: December 31, 2023 What: For an affordable and family-friendly New Year’s Eve celebration, head to DTLA’s Grand Park. Surrounded by iconic landmarks like the Music Center and City Hall, Grand Park transforms into a cultural hub for the holiday. City Hall becomes a massive canvas for a countdown projection, making it a unique way to welcome the new year.

Prohibition NYE

Where: Downtown

When: December 31, 2023 What: Step back in time to the Roaring Twenties at this Prohibition era-themed NYE party held in the Art Deco marvel of Union Station. With a DJ set from Chromeo, live jazz, burlesque performances, and custom cocktails, it’s a glamorous affair. Dress to impress in your best 1920s attire and be part of the countdown as a 60-foot custom ball drops.

NYEx10

Where: Los Feliz

When: December 31, 2023 What: Big Bar in Los Feliz offers a unique New Year’s Eve experience with 10 countdowns, each accompanied by original cocktails and themed playlists. This year’s event takes on an outer space theme, promising a celestial celebration. Admission is free, and there’s a complimentary champagne toast at midnight.

New Year’s Eve at Dynasty Typewriter

Where: Westlake

When: December 31, 2023 What: Dynasty Typewriter presents a comedy extravaganza for New Year’s Eve. Enjoy stand-up performances by talented comedians like Ify Nwadiwe, Luke Mones, Megan Gailey, Max & Nicky Weinbach, and Aparna Nancherla. Every ticket includes a champagne toast at the stroke of midnight.

EVE at Universal Studios Hollywood

Where: Universal City

When: December 31, 2023 What:Experience the thrill of New Year’s Eve at Universal Studios Hollywood. Enjoy the rides during the day and stick around for a spectacular midnight fireworks display. Multiple genre-themed party areas await you, complete with desserts, beer, wine, and champagne options.

New Year’s Eve at Knott’s Merry Farm

Where: Buena Park

When: December 31, 2023 What: Knott’s Berry Farm transforms into Knott’s Merry Farm during the holiday season. For New Year’s Eve, the park extends its hours, offering live music, a countdown to midnight, and a festive balloon drop at 9 pm. It’s a perfect way to celebrate with family and friends.

WeHo NYE Festival at E.P. & L.P.

Where: West Hollywood

When: December 31, 2023 What: E.P. & L.P. in Melrose hosts a rave-inspired party across its restaurant and rooftop levels. The evening starts with an optional open bar and passed appetizers, followed by DJ sets and a midnight balloon drop. Arrive before 10:30 pm for a complimentary drink.

Last Night with Rhonda

Where: West Hollywood

When: December 31, 2023 What: A Club Called Rhonda’s iconic New Year’s Eve party takes place beneath the disco ball ceiling at Sunset at EDITION. Enjoy sets from renowned DJs, including Carl Craig, Junior Sanchez, and Goddollars & Paradise, as you dance your way into 2024.

Holiday Ice Rink Pershing Square

Where: Downtown Financial District

When: Until January 7, 2024 What: Embrace the winter spirit in downtown LA at the Pershing Square outdoor holiday skating rink. Glide on the ice against the backdrop of skyscrapers and enjoy the festive atmosphere. Skate rentals are included with admission.

L.A. Kings Holiday Ice

Where: South Park

When: Until December 31, 2023 What: Head to L.A. Live for the annual L.A. Kings ice skating rink. Skate around the dazzling Christmas tree at the center of the outdoor rink and be enchanted by an LED holiday light show on the plaza screens.

New Year’s Eve at Skybar

Where: West Hollywood

What: December 31, 2023 What: Let Skybar at the Mondrian Hotel host your New Year’s Eve celebration. Your ticket includes a four-hour open bar and a midnight champagne toast. Enjoy panoramic views of the city from the rooftop bar while dressed in your cocktail attire.

Lightscape

Where: Arcadia

When: Until January 2, 2024 What: Immerse yourself in the second edition of Lightscape at the L.A. County Arboretum. Wander along a mile-long pathway adorned with illuminated installations and uplit trees. Capture stunning photos inside the cathedral-like light tunnel.

Pink Martini

Where: Downtown

When: December 31, 2023 What: Experience the enchanting sounds of Pink Martini at Disney Hall for a special New Year’s Eve performance. This “little orchestra” from Portland, Oregon, blends classical, jazz, pop, and international influences for a memorable musical evening.

What: Celebrate the arrival of 2024 at the 14th annual New Year’s Eve Celebration under the wings of Air Force One! Ring in the New Year at the Reagan Library, the only place to be this New Year’s Eve in Southern California. Enjoy an elaborate night of celebration, four-course served meal, and a champagne toast at midnight with all the party essentials-hats

As you plan your New Year’s Eve celebration, consider these exciting events across Los Angeles. Whether you prefer fireworks, live entertainment, or a themed party, there’s no shortage of ways to welcome 2024 in style.

Mortgage Rate Update | December 28, 2023

Mortgage rates are at their lowest point since June – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 28, 2023, were as follows: The 30-year fixed mortgage rate was 6.61%, down from 6.67% last week. The 15-year fixed was 5.93%, down from 5.95% last week. Rates dropped further at the end of the week. Next week’s 30-year should be close to 6.5%.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S. housing market.

Mortgage Rate Update | December 21, 2023

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 21, 2023, were as follows: The 30-year fixed mortgage rate was 6.67%, down from 6.95% last week. The 15-year fixed was 5.95%, down from 6.38% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S. housing market.

November Home Sales and Price Report | December 20, 2023

California Association of Realtors November existing-home sales report:

The California Association of Realtors reported that existing home sales totaled 223,940 units on a seasonally adjusted annualized basis in November, down 7.4% from October. November marked the third straight month of the annualized sales rate dropping under 250,000, a level that was thought could never happen, and the 29th straight month of year-over-year declines in sales. Year-to-date, the number of homes sold was down 25.9% in November.

Prior to 2022 home sales have not dropped below 400,000 in decades. High-interest rates have caused many potential home sellers to put off their move. In a normal year about 50% of sales are what we call move-up buyers. Those are people selling a home to purchase another. When your mortgage is at a 3% rate, it’s difficult to sell it and purchase another with a mortgage at a 7% rate. For example, if you own a $2 million dollar home with a $1 million mortgage at 3%, your payment with taxes and insurance is about $4,500. If you put your $1 million in equity down on your new $4 million dollar home and obtained a $3 million loan at 6.5% (down from almost 8% two months ago) your payment with tax and insurance would be around $24,000 a month. That’s a big jump. When people put off their move it reduces the number of homes for sale. This is exactly what is happening now.

The statewide median price paid for a home in November was $822,200, up 6.2% from a revised $774,150 a year ago.

There was a 3-month supply of homes on the market, up from a 2.7-month supply of homes for sale in October, and down from a 3.2-month supply one year ago.

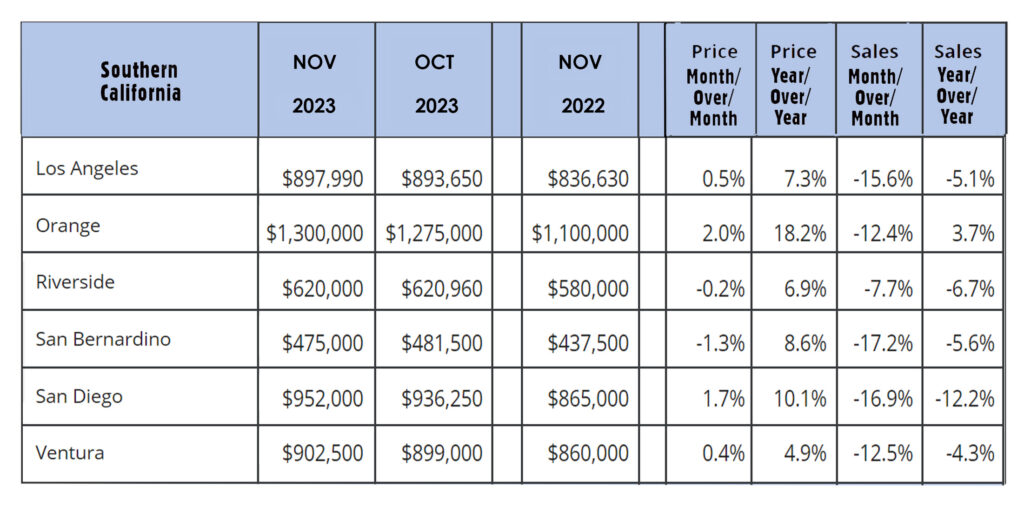

The graph below shows sales data by county in Southern California.

Economic Update | Week Ending December 16, 2023

|

Stock markets – Dow and Nasdaq near all-time highs – While the CPI (Consumer Price Index) showed that year-over-year inflation remained at 3.1% in November, unchanged from October, Fed Chairman Powel announced that the Fed would leave rates unchanged for the third straight meeting. He also stunned the markets by stating that the Fed’s efforts to reduce inflation had taken hold and that he felt that inflation was now dropping faster than anticipated. He even left the door open for rate drops next year. It was a complete reversal from statements made in October where he was threatening more rate hikes. Retail sales also jumped in November. Investors rushed back to stocks and bond yields and mortgage rates fell significantly. The Dow Jones Industrial Average closed the week at 37,309.22, up 2.8% from 36,247.87 last week. It is up 12.6% year-to-date. The S&P 500 closed the week at 4,719.07, up 2.5% from 4,604.37 last week. It is up 22.9% year-to-date. The Nasdaq closed the week at 14,813.92, up 2.8% from 14,403.97 last week. It is up 41.5% year-to-date. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 3.91%, down from 4.23% last week. The 30-year treasury bond yield ended the week at 4.00%, down from 4.31% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates drop below 7% -Every Thursday Freddie Mac publishes home mortgage interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 14, 2023, were as follows: The 30-year fixed mortgage rate was 6.95%, down from 7.03% last week. The 15-year fixed was 6.38%, up from 6.26% last week. It was 6.56% two weeks ago. Rates were lower at the end of the week. We saw lenders quoting 30-year loans in the mid to low 6% range on Friday. The graph below shows the trajectory of mortgage rates over the past year. Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S. housing market. November home sales data for California and the U.S. will be released next week by the California Association of Realtors and the National Association of Realtors. You can get November data now for your city or zip code on our website, RodeoRe.com. Have a great weekend! |

Mortgage Rate Update | December 14, 2023

Mortgage rates drop below 7% –Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 14, 2023, were as follows: The 30-year fixed mortgage rate was 6.95%, down from 7.03% last week. The 15-year fixed was 6.38%, up from 6.26% last week. It was 6.56% two weeks ago. Rates were lower at the end of the week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S. housing market.

Economic Update | Week Ending December 9, 2023

|

Stock markets – Stock markets were relatively flat this week following almost two months of weekly gains. Mortgage rates and bond yields dropped further this week before settling back to last week’s rates and yields following the November Jobs report. It was widely felt that hiring was stalling, and that the unemployment rate was rising from near-historic lows but hiring ticked up in November and the unemployment rate dropped. The Fed is looking to cool the job market because the low unemployment rate is causing a labor shortage. This encourages consumer spending which fuels inflation because when people are not worried about losing their jobs, they spend money. It remains to be seen how the Fed interprets this jobs report, but it’s certainly not something that would cause the Fed to feel the economy was slowing and moving toward a recession. If the Fed felt the economy was slowing, they would need to cut rates from their current 22-year high levels. The Dow Jones Industrial Average closed the week at 36,247.87, almost unchanged from 36,254.50 last week. It is up 9.4% year-to-date. The S&P 500 closed the week at 4,604.37, up 0.2% from 4,594.63 last week. It is up 19.9% year-to-date. Nasdaq closed the week at 14,403.97, up 0.4% from 14,350.03 last week. It is up 37.6% year-to-date. Job growth heated up in November – The Department of Labor and Statistics reported that 199,000 new full-time jobs were added in November, up from 150,000 new jobs in October. The unemployment rate dropped to 3.7% in November, down from 3.9% in October. Average hourly wages increased 4% year-over-year, the smallest year-over-year increase since 2021, yet exceeding the inflation rate. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.22%, unchanged from 4.22% last week. The 30-year treasury bond yield ended the week at 4.41%, almost unchanged from 4.40% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates -The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 7, 2023, were as follows: The 30-year fixed mortgage rate was 7.03%, down from 7.22% last week. The 15-year fixed was 6.29%, down from 6.56% last week. Rates were lower at the end of the week. The 30-year dropped under 7% on Friday. Have a great weekend! |

Economic Update | Week Ending December 2, 2023

Stock markets – Stock markets rose for the seventh consecutive week as inflation has moderated, and bond yields and mortgage rates have dropped. On Thursday the Personal Consumption Expenditures Price Index (PCE), a gauge of inflation that the Fed relies on when setting monetary policy came in at a 3% year-over-year increase, the core PCE was 3.5%. That marked the smallest increase since 2021. On Friday Fed Chairman Powell suggested that the Fed may be done raising rates, but said it was “too early to guess when rates will fall.” Even speaking about rates falling was something that nobody could have imagined Powell discussing just two months ago. He also spoke about progress in cooling inflation and the jobs market. Stocks jumped on Thursday and Friday. The Dow gained almost 800 points in the two days. Next Friday the November jobs report will be released. Investors are eagerly awaiting the number of new jobs created and the amount that wages have increased. The Dow Jones Industrial Average closed the week at 36,254.50, up 2.4% from 35,390.15 last week. It is up 9.4% year-to-date. The S&P 500 closed the week at 4,594.63, up 0.8% from 4,559.34 last week. It is up 19.7% year-to-date. The Nasdaq closed the week at 14,350.03, up 0.7% from 14,250.85 last week. It is up 37.1% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.22%, down from 4.47% last week. The 30-year treasury bond yield ended the week at 4.40%, almost unchanged from 4.60% last week. We watch bond yields because mortgage rates follow bond yields.

Mortgage rates -The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of November 30, 2023, were as follows: The 30-year fixed mortgage rate was 7.22%, down from 7.29% last week. The 15-year fixed was 6.56%, down from 6.67% last week. Rates were lower at the end of the week. The 30-year dropped under 7% on Friday.

Have a great weekend!

Economic Update | Month Ending November 30, 2023

| Stock markets soared in November – Stock markets notched seven straight weeks of gains as key reports indicated that inflation was cooling. The October Consumer Price Index (CPI) showed that consumer prices in October had climbed 3.2% from one year earlier. While the Fed target is 2% this was a step in the right direction. Inflation peaked in June 2022 at 9.1% and worked its way down every month for a year hitting 3% in June 2023. In July, August, and September the year-over-year inflation rate worked its way back up. It was 3.7% in September, so dropping to 3.2% in October was welcome news to investors. The Producer Price Index and Personal Compensation Expenditures Price Index also showed that inflation tamed in October. The jobs market cooled as well with 150,000 new jobs created in October, about ½ the number of new jobs created in September. This news led investors to feel that the economy was slowing, and inflation was taming. Bond yields and mortgage rates fell steadily in November with the 30-year mortgage ending the month about one full percentage point below its 23-year high in mid-October. Experts feel that rate hikes are behind us and that there may even be a Fed rate reduction next year. The Dow Jones Industrial Average closed the month at 35,950.89, up 8.8% from 33,052.87 on October 31. It is up 8.5% year-to-date. The S&P 500 closed the month at 4,567.80, up 8.9% from 4,193.80 last month. It is up 19% year-to-date. The NASDAQ closed the month at 14,262.22, up 11% from 12,851.24 last month. It is up 36.3% year-to-date.

U.S. Treasury bond yields dropped in November – Cooling inflation led to lower bond yields marking the largest monthly drop in yields of the year. The 10-year treasury bond closed the month yielding 4.38%, down from 4.88% last month. The 30-year treasury bond yield ended the month at 4.54%, down from 5.04% last month. We watch bond yields because mortgage rates often follow treasury bond yields. Mortgage rates – The Freddie Mac Primary Mortgage Survey reported that mortgage rates as of November 30, 2023, for the most popular loan products were as follows: The 30-year fixed mortgage rate was 7.22%, down from 7.79% at the end of October. The 15-year fixed was 6.56%, down from 7.03% at the end of October. The 30-year fixed rate peaked at around 8.25% in mid-October, a 23-year high.

Home sales data is released by the National Association of Realtors and the California Association of Realtors on the third week of the month for the previous month. Below are the October results. U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 3.79 million units on a seasonally adjusted annualized rate in October, down 14.6% from an annualized rate of 4.44 million in October 2022. The median price for a home in the U.S. in October was $391,800, up 3.2% from $378,800 last October. There was a 3.6-month supply of homes for sale in October, up from a 3.3-month supply last October. First-time buyers accounted for 28% of all sales. Investors and second-home purchases accounted for 15% of all sales. All cash purchases accounted for 29% of all sales. Foreclosures and short sales accounted for 2% of all sales. California third quarter housing affordability – The California Association of Realtors released their housing affordability index. It included that single-family detached-home affordability dropped to 15% in the third quarter of 2023, down from 16% in the second quarter and down from 18% one year ago. An income of $221,200 was needed to qualify for the monthly payment of $5,530 to purchase a $843,600 median-priced home. Affordability for a condo or townhome dropped to 23% in the third quarter. An income of $170,400 was needed to qualify for the $4,200 payment to purchase a $650,000 median-price condo or townhome. California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 241,710 units on a seasonally adjusted annualized basis in October, down 11.9% from a revised 274,410 annualized sales pace in October 2022. October marked the thirteenth straight month of the annualized sales rate dropping under 300,000 on an annualized basis, and the second consecutive month of sales dropping below 250,000 annualized sales, a level that was thought could never happen. Year-to-date, the number of homes sold was down 27.2% in October. The statewide median price paid for a home in October was $840,360, up 5.3% from a revised $798,140 a year ago. There was a 2.7-month supply of homes for sale in October, down from a 3.1-month supply one year ago. The graph below shows sales data by county in Southern California.

|