Connect with this week’s major tech news headlines! From Threads Edit Feature to Starlink’s Cell Plan and more, we have you covered. Check out this week’s blog below for the tech news you won’t want to miss.

Threads Introduces an Edit Feature

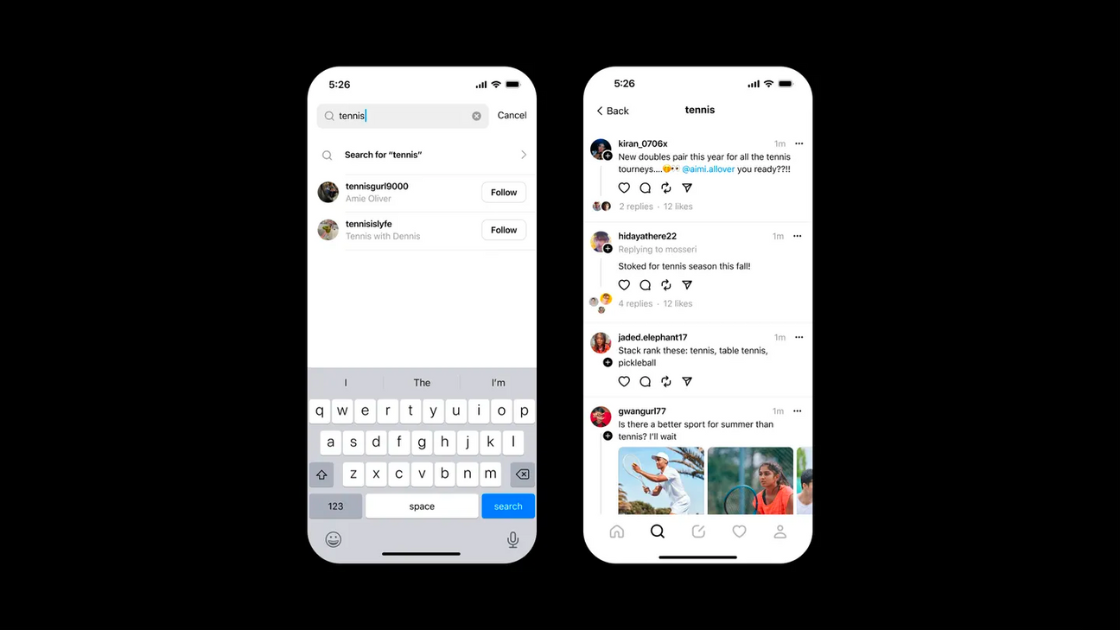

Meta is introducing two significant updates to its Threads platform, according to CEO Mark Zuckerberg. The first is an edit feature that allows Threads users to modify their posts within five minutes of publication, without requiring a subscription fee like Twitter’s Blue service. Edited posts will be indicated with an icon next to the timestamp, although an edit history feature is not currently available. The second feature is “Voice Threads,” enabling users to create voice posts. This feature, available on the iOS app, allows users to record their voice, with the spoken text highlighted in the post as it plays. Meta has been consistently expanding Threads’ capabilities since its launch, including adding a chronological following feed, a web client, and post search functionality.

Meta is introducing two significant updates to its Threads platform, according to CEO Mark Zuckerberg. The first is an edit feature that allows Threads users to modify their posts within five minutes of publication, without requiring a subscription fee like Twitter’s Blue service. Edited posts will be indicated with an icon next to the timestamp, although an edit history feature is not currently available. The second feature is “Voice Threads,” enabling users to create voice posts. This feature, available on the iOS app, allows users to record their voice, with the spoken text highlighted in the post as it plays. Meta has been consistently expanding Threads’ capabilities since its launch, including adding a chronological following feed, a web client, and post search functionality.

Adobe Develops Generative AI for Video Manipulation

Adobe unveiled Project Fast Fill, an experimental AI tool for video manipulation, showcased at the MAX conference. It can add or remove objects in videos with ease, akin to Google’s Magic Editor but for video. This feature is being considered for integration into Premiere Pro and After Effects. Adobe is actively developing AI editing tech for various media, including audio, 3D design, and voice translation. With AI tools for both photos and videos becoming more accessible, questions about media authenticity arise. Fast Fill marks a significant step toward broader AI-driven video manipulation.

Google’s AI-Enhanced Search Can Now Generate Images

Google is introducing its Search Generative Experience (SGE), allowing users to generate images from text prompts starting Thursday. This move follows Microsoft’s introduction of a similar feature in Bing Chat using OpenAI’s DALL-E model earlier this year. With SGE, users opted into Google’s Search Labs program can enter a query in the search bar, and the AI-powered tool generates images based on the prompt. The tool is powered by the Imagen family of AI models. Google also emphasizes responsible use, embedding metadata and watermarking to denote AI-generated images and preventing violations of its prohibited use policy. Additionally, Google is introducing draft generation tools using SGE for written content, allowing users to export drafts to Google Docs or Gmail.

Starlink Unveils New Page to Promote Upcoming Cellular Service in 2024

SpaceX has launched a new webpage to promote its upcoming “Starlink Direct to Cell” service, which aims to provide cellular connectivity to existing LTE phones using satellite technology. Initially, the service will focus on texting in 2024, with voice and data functionality planned for 2025, along with support for IoT devices. The service will work with existing LTE phones without the need for hardware, firmware changes, or special apps, offering seamless access to text, voice, and data. While the service may have relatively slower speeds of two to four megabits per second compared to terrestrial networks, it will provide extensive coverage, including remote areas in the continental US, Hawaii, parts of Alaska, Puerto Rico, territorial waters, and beyond T-Mobile’s network signal. Satellite connectivity for smartphones is becoming increasingly important, with companies like Apple and AST SpaceMobile exploring satellite-based solutions for emergency communication and 5G connectivity.

TikTok Revamps Payment System for Creators of Popular Filters and Effects

TikTok is introducing significant changes to its creator fund. This will be specifically for those who develop popular filters and effects on the platform. The Effect Creator Rewards program, is expanding to more regions, including Australia, Brazil, Canada, Japan, and the Philippines. The eligibility requirements have also been revised. Now creators can join with just five published filters, with at least three of them used in 1,000 videos. The payment structure will shift from a flat fee to a variable rate depending on factors like the region. These changes aim to make it easier for a wider range of effects creators to participate and potentially earn money from their creations. Previously, creators were often making filters without compensation, and the new system seeks to improve their monetization opportunities.

Uber Eats Introduces Multi-Store Ordering Feature

Uber Eats has introduced a new feature called “multi-store ordering.” The feature allows customers to order from two different stores or restaurants simultaneously without an extra fee. This feature comes in handy when, for example, one person craves tacos while another wants pizza. Customers can select items from a store’s menu. At the bottom of the menu, they will find a button to bundle their order with items from another store. This feature, while convenient for customers, may pose challenges for delivery drivers.