Stock markets slid in June – Stock markets closed the first half of 2022 with their largest losses in 50-years – June was a tumultuous month for the stock markets. Stocks, bond yields, and mortgage rates stabilized in May. That was because economic data showed inflation moderating in April. For example, the CPI in March was 8.5%, the highest rate since 1982. In April, the CPI dropped to 8.3% leaving investors feeling that rate hikes and other tightening measures the Fed enacted were working. In the second week of June May’s CPI reading of 8.6%, the highest rate of inflation since 1981, was released. Stocks immediately began to sink and treasury bond yields and mortgage rates rose, as the economy had not slowed in a way to tame inflation as previously hoped. In a response to the May CPI report the Federal Reserve increased its key rates by .75%, the highest single meeting increase in decades. Consumer confidence also slipped to the lowest level in forty years as consumers are feeling the impact of higher prices. The June CPI report will be released on July 13. Other data over the last week of June points to some moderating of inflation. If that data turns out to be correct, stocks may recover some of their losses. Bond yields and mortgage rates dropped significantly in the final days of the month based on expectations that a slowing economy will tamper information. If the CPI stays at 8.6% or increases, we would expect stocks to fall further and bond yields and mortgage rates to increase. The Dow Jones Industrial Average closed the month at 30,776.43, down 6.7% from 32,990.12 on May 30. It’s down 15.3% year-to-date. That is the worst performance for the Dow for the first half of a year since 1962. The S&P 500 closed the month at 3,785.39, down 8.4% from 4,132.15 last month. The S&P is down 20.6% year-to-date. This marked the worst performance for the S&P over the first half of a year since 1970. The NASDAQ closed the month at 11,028.74, down 8.3% from 12,081.39 last month. It is down 29.5%, year-to-date. It was the worst first half of a year ever for the NASDAQ.

U.S. Treasury bond yields – The 10-year treasury bond closed the month yielding 2.98%, up from 2.85% last month. The 30-year treasury bond yield ended the month at 3.14%, up from 3.07% last month. We watch bond yields because mortgage rates often follow treasury bond yields. Bond yields dropped sharply over the last week of the month. The 30-year peaked at 3.45%, and the ten-year hit 3.49% in the middle of June.

Mortgage rates – The Freddie Mac Primary Mortgage Survey reported that mortgage rates as of June 30, 2022 for the most popular loan products were as follows: The 30-year fixed mortgage rate was 5.70%, up from 5.09% at the end of May. The 15-year fixed was 4.83% up from 4.31% last month. The 5-year ARM was 4.50%, up from 4.20% last month. Rates dropped quite a bit on Wednesday and Thursday. Currently the 30-year is under 4.5%. Next week’s survey rates will be back down in that range.

The June jobs report will be released on Friday June 8. This is the May report

The U.S. economy added 390,000 new jobs in May – The Department of Labor and Statistics reported that 390,000 new jobs were added in May. The unemployment rate held steady at 3.6%. The labor-force participation rate (the share of workers with a job or actively looking for a job) increased to 62.4% in May, up from 62.2% in April. It is well below the 63.6% level before the pandemic. Average hourly wages increased 5.2% from May 2021, down from a 5.5% year-over-year increase in April which is another sign that inflation may be moderating.

Home sales figures are released in the third week of the month for the previous month. These are May’s results.

U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 5.41 million units on a seasonally adjusted annualized rate in May, down 3.4% month-over-month from the annualized number of sales in April. Year-over-year sales were down 8.6% from the annualized rate of 5.92 million in May 2021. The median price of a home in the U.S. in April was $407,600, up 14.8% from $355,000 one year ago. May marked a record 123 consecutive month of year-over-year increases in the median price. Inventory levels increased 12.6% from April, but are still 4.1% below the amount of homes for sale in May 2021. There was a 2.6-month supply of homes for sale in May, up slightly from a 2.5 month supply last May. First-time buyers accounted for 27% of all sales. Investors and second-home purchases accounted for 16% of all sales. All-cash purchases accounted for 25% of all sales. Foreclosure and short-sales accounted for less than 1% of all sales remaining at a historic low.

California home sales drastically declined while prices continued to surge in May – The California Association of Realtors reported that existing-home sales totaled 377,790 on a seasonally adjusted annualized rate in May, down 9.8% from April, and down 15.2% from last May. Existing-home sales year-to-date through May are down 8.9% from the number of homes sold in the first five months of 2021. The statewide median price paid for a home in May was $898,980, up 1.9% from April, and up 9.9% from May 2021. There was a 2.1-month supply of homes for sale in May, up from a 1.8-month supply of homes for sale in April, and a 1.8-month supply in May 2021. While up slightly a 2.1-month supply is still a historic low level. A normal market has a 5-6 month supply of homes on the market. Pending sales which represent new contracts signed declined 30.6% in May. That’s an alarming drop which is similar to what we saw in the first month of the pandemic when the shutdown was announced. We watch pending sales to forecast sales 30-60 days later. This is due to a shortage of homes for sale, increasing interest rates, lower affordability, and some erosion of confidence, but it’s impossible to say which of these factors are most impactful, especially with prices climbing at such a accelerated rate.

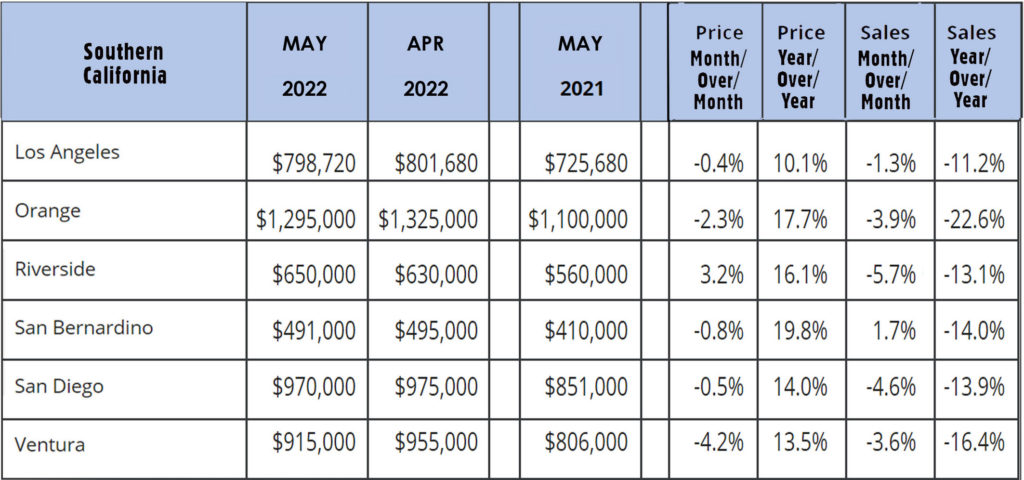

The graph below shows regional figures by county in Southern California.