| Stock markets dropped again this week – Recent data has shown that the economy has heated back. This has caused interest rates to rise further. Some data this month included: The number of new jobs created in August surged after falling in July. The CPI has risen for three consecutive months after dropping for twelve straight months prior to June. Retail sales jumped and increased in an amount that was more than double the increase that experts expected. Third quarter corporate profits have been stronger than expected. Jerome Powell spoke this week. Following his comments on bond yields, raising debt to finance, a tight labor market, and inflation, stocks dropped further and bond yields rose to their highest yields since the 2008 financial crisis. While economists are trying to stay out of politics, the situation in Israel and the infighting in the House of Representatives has to be looked at as well for the drop in stock prices and the rise in interest rates. The Dow Jones Industrial Average closed the week at 33,127.29, down 1.6% from 33,670.29 last week. It is down 0.1% year-to-date. The S&P 500 closed the week at 4,224.16, down 2.4% from 4,327.78 last week. It is up 10% year-to-date. The Nasdaq closed the week at 12,983.81, down 3.2% from 13,407.28 last week. It is up 24% year-to-date.

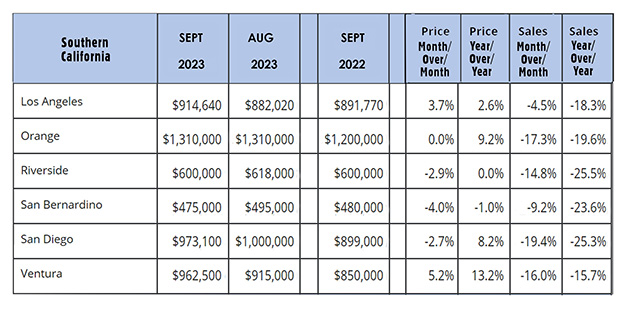

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.93%, up from 4.63% last week. The 30-year treasury bond yield ended the week at 5.09%, up from 4.78% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of October 19, 2023, were as follows: The 30-year fixed mortgage rate was 7.63%, up from 7.57% last week. The 15-year fixed was 6.92%, up from 6.89% last week. U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 3.96 million units on a seasonally adjusted annualized rate in September, down 15.4% from an annualized rate of 4.68 million in September 2022. The median price for a home in the U.S. in August was $394,300, up 3.2% from $383,500 last September. There was a 3.4-month supply of homes for sale in September, up from a 3.2-month supply last September. First-time buyers accounted for 27% of all sales. Investors and second-home purchases accounted for 18% of all sales. All-cash purchases accounted for 29% of all sales. Foreclosures and short sales accounted for 1% of all sales. California existing-home sales – The California Association of Realtors reported that existing–home sales totaled 240,940 on a seasonally adjusted annualized basis in September, down 5.4% month-over-month from August, and down 21.5% from a revised 307,000 annualized sales pace in September 2022. September marked the twelfth straight month with sales dropping under 300,000 on an annualized basis. Year-to-date, the number of homes sold was down 28.5% from the first nine months of 2022. The statewide median price paid for a home in July was $843,340, up 3.2% from $817,150 a year ago. There was a 2.8-month supply of single-family homes for sale in September. The graph below includes sales data by county in Southern California.

Have a great weekend! |

News & Media