| This week investors were very unsure of what to expect from the economy due to several factors. One was inflationary pressure due to the strength of the economy. At the end of 2023, it appeared that the economy was finally slowing, inflation was dropping, and the labor market was beginning to cool. Investors were expecting the Fed to shift from a restrictive monetary policy to a more neutral one and begin to cut rates in March. In the first three months of the year, the economy has picked up steam. Inflation reports show that the inflation rate which had steadily worked its way down from its peak 9.1% year-over-year increase in June 2022 to about a 3% year-over-year increase by the end of 2023, has now stalled remaining mostly unchanged through the first quarter. Hiring has picked up and job gains have far outpaced expectations. Experts have given up hopes of four rate cuts this year and now expect one to three without the first cut until June or July. That has increased bond yields and mortgage rates to their highest levels since last fall. Oil prices have also risen to their highest levels in over six months due to geopolitical tensions in the Middle East.

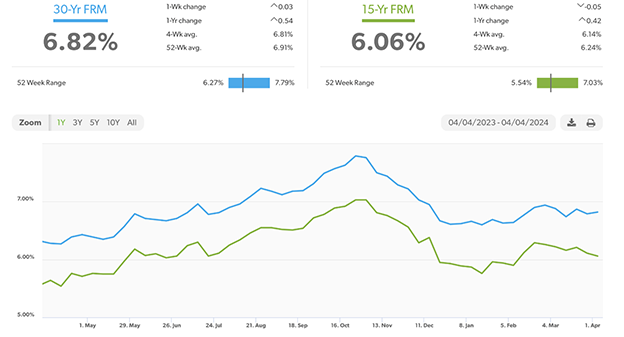

Employers added another 303,000 new jobs in March – The Department of Labor and Statistics reported that 303,000 new jobs were added in March. That blew away the 200,000 new jobs that analysts expected, and it marked the fourth straight month with job gains above 200,000 and the 39th consecutive month of job growth. The unemployment rate dropped to 3.8% in March, down from 3.9% in February, marking 26 straight months of unemployment below 4%. That has not happened since the 1960s. Investors are puzzled as to how the economy and labor market have remained so strong after 11 rate hikes and the highest Fed interest rates in 24 years. Average hourly wages increased 4.1% year-over-year in March, down from 4.3% in February, which was the only part of the report that does not put pressure on inflation. Bond yields and mortgage rates ended the week at their highest levels since last October. Stock markets – The Dow Jones Industrial Average closed the week at 38,904.04, down 2.3% from 39,807.37 last week. It is up 3.2% year-to-date. The S&P 500 closed the week at 5,204.34, down 1% from 5,254.46 last week. The S&P is up 9.1% year-to-date. The Nasdaq closed the week at 16,248.52, down 0.8% from 16,379.46 last week. It is up 8.2% year-to-date. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.39%, up from 4.22% last week. The 30-year treasury bond yield ended the week at 4.54%, up from 4.39% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of April 4, 2024, were as follows: The 30-year fixed mortgage rate was 6.82%, up from 6.79% last week. The 15-year fixed was 6.06%, down from 6.11% last week. The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S. |

Have a great weekend!