Stock markets – The Dow Jones Industrial Average closed the week at 40,257.53, up 0.6% from 40,000.90 last week. It is up 6.8% year-to-date. The S&P 500 closed the week at 5,505.00, down 2% from 5,615.35 last week. The S&P is up 15.4% year-to-date. The Nasdaq closed the week at 17,726.94, down 3.7% from 18,398.45 last week. It is up 18.1% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.25%, up from 4.18% last week. The 30-year treasury bond yield ended the week at 4.45% up from 4.39% last week. We watch bond yields because mortgage rates follow bond yields.

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of July 18, 2024, were as follows: The 30-year fixed mortgage rate was 6.77%, down from 6.89% last week. The 15-year fixed was 6.05%, down from 6.17% last week.

The graph below shows the trajectory of mortgage rates over the past year.

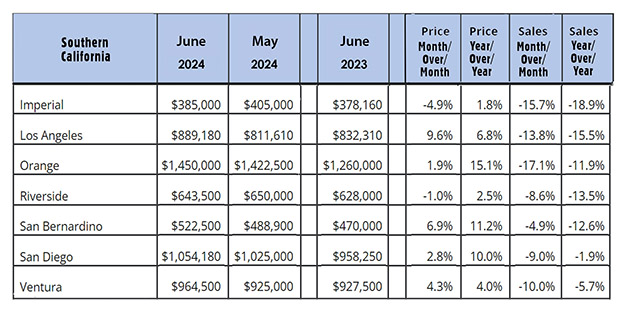

California home prices jumped 7.5% from one year ago in June – The California Association of Realtors reported that existing-home sales totaled 270,200 on an annualized rate in June, down 2.7% from a revised 277,960 homes sold on an annualized basis last June. There was a 3-month supply of homes for sale, up from a 2.2-month supply one year ago. The statewide median price paid for a home in June was $900,720, up 7.5% from a revised median price of $837,850 one year ago.

The graph below shows sales data by county in Southern California.

Have a great weekend!