U.S. hiring stalled and unemployment jumped in July – The Department of Labor and Statistics reported that 114,000 new jobs were added in July, well below the 185,000 new jobs forecasted by economists. The unemployment rate rose to 4.3% in July, its highest level since October 2021, and up from 4.1% in June. The lack of hiring and rise in the unemployment rate shocked investors. Stock markets dropped sharply as the three-month average unemployment rate exceeded a .5% increase from the previous three-month average. Under the Sham Rule Threshold, a .5% increase in the 3-month average unemployment rate for two consecutive 3-month periods often indicates the start of a recession. Average hourly wages increased 3.6% year-over-year in July, down from a 3.9% annual increase in June, and a 4.1% increase in May. This was not a good report. It panicked investors that fear that the Fed has left interest rates at 24-year highs for too long and that even a drop in September may be too late to avoid a recession. On a positive note, bond yields and mortgage rates dropped sharply on Friday after the jobs report was released. Bond yields and mortgage rates are now at their lowest levels in one year.

Stock markets dropped sharply this week on recession fears – The Dow Jones Industrial Average closed the week at 39,727.26, down 2.1% from 40,589.34 last week. It is up 5.4% year-to-date. The S&P 500 closed the week at 5,346.56, down 2.1% from 5,459.10 last week. The S&P is up 12.2% year-to-date. The Nasdaq closed the week at 16,776.16, down 3.5% from 17,357.88 last week. It is up 11.8% year-to-date

U.S. Treasury bond yields dropped sharply this week – The 10-year treasury bond closed the week yielding 3.80%, down from 4.20% last week. The 30-year treasury bond yield ended the week at 4.11%, unchanged from 4.45% last week. We watch bond yields because mortgage rates follow bond yields.

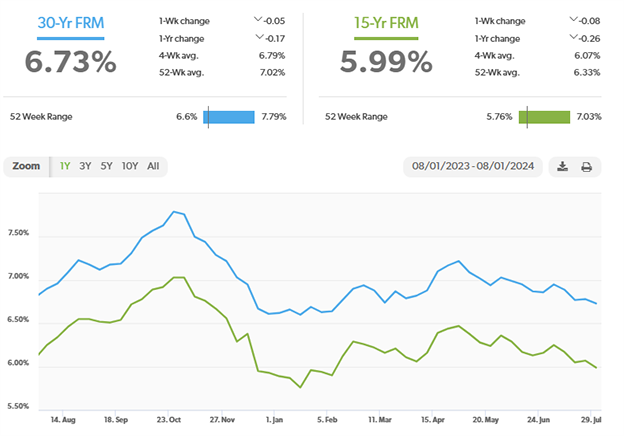

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of August 1st, 2024, were as follows: The 30-year fixed mortgage rate was 6.73%, down from 6.78% last week. The 15-year fixed was 5.99%, down from 6.07% last week. Rates dropped sharply on Thursday and Friday. We were seeing rates closer to 6% after the job’s report was released on Friday.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

Have a great weekend!