Economic news this week This week the Labor Department’s November jobs report was released. Even though the number of new jobs was higher than expected and job gains for September and October were revised higher, bond yields and mortgage rates remained at their lowest levels in six weeks. The unemployment rate ticked up a little and wage increases were higher than the Fed target. Several Fed governors and Fed Chairman Powell also spoke this week. They all spoke of the strength of the economy and cautioned that while rates may drop it will not be as quickly as expected in September, as the economy has picked up steam and inflation has risen recently. Next week the November Consumer Price Index and the Producer Price Index will be released. That will show the trend of inflation. November home sales figures will be released the week after next from the California Association of Realtors and the National Association of Realtors. Local November home sales data will be available Sunday for your city or zip code at RodeoRe.com. It’s compiled from the same data source that the California Association of Realtors uses.

U.S. job growth rebounded in November – The Department of Labor and Statisticsreported that 227,000 new jobs were added in November, up from the revised 36,000 new jobs added in October when two hurricanes and strikes stalled hiring. Economists surveyed expected 214,000 new jobs in November. The unemployment rate ticked up to 4.2% in November from 4.1%, in September and October. Average hourly wages increased 4% year-over-year in November, matching October’s increase.

Stock markets -The Dow Jones Industrial Average closed the week at 44,642.52, down 0.6% from 44,910.65 last week. It is up 18.4% year-to-date. The S&P 500 closed the week at 6,090.27, up 1% from 6,032.38 last week. The S&P is up 27.7% year-to-date. The Nasdaq closed the week at 19,859.77, up 3.3% from 19,218.17 last week. It is up 32.3% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.15%, down slightly from 4.18% last week. The 30-year treasury bond yield ended the week at 4.34%, down slightly from 4.36% last week. We watch bond yields because mortgage rates follow bond yields.

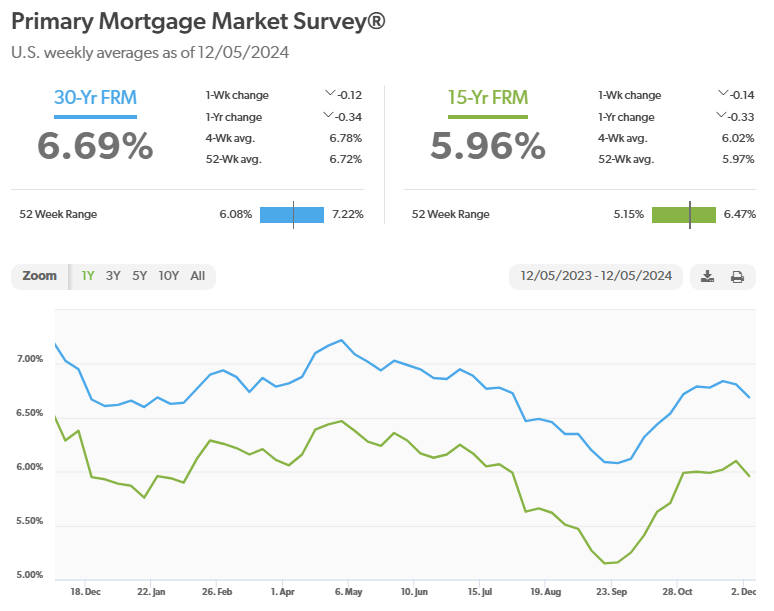

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of November 21st, 2024, were as follows: The 30-year fixed mortgage rate was 6.69%, down from 6.81% last week. The 15-year fixed was 5.96%, down from 6.10% last week.

The graph below shows the trajectory of mortgage rates over the past year.