| Economic news this week – Stock markets inched higher in a holiday-shortened week, making up some of last week’s losses. Mortgage interest rates and treasury bond yields increased further this week. They are now at their highest levels since July. It looks like they will end the year higher than at the start of the year. Experts still expect them to drop next year, but not as quickly as they thought they would drop just a few weeks ago, as inflation and the economy have shown signs of heating up.

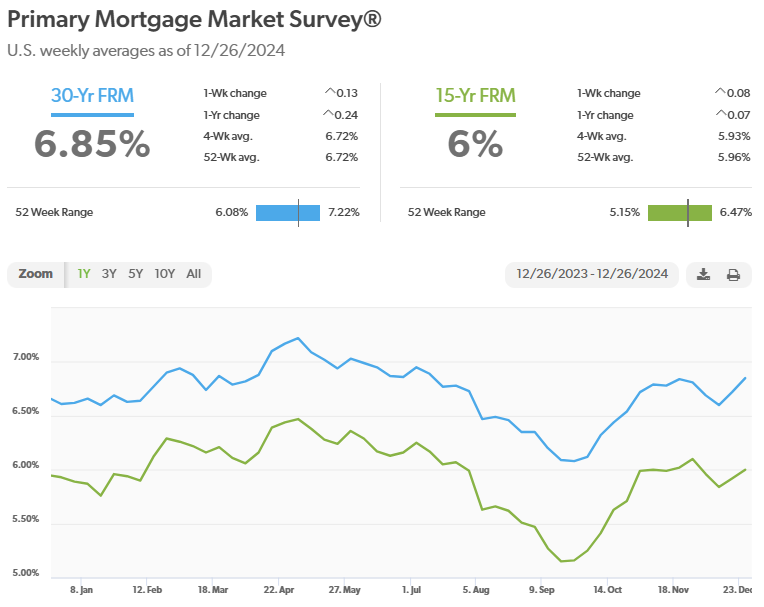

Stock markets – The Dow Jones Industrial Average closed the week at 42,992.21, up 0.4% from 42,840.26 last week. It is up 14.1% year-to-date. The S&P 500 closed the week at 5,970.84, up 0.7% from 5,930.55 last week. The S&P is up 25.2% year-to-date. The Nasdaq closed the week at 19,722.02, up 1% from19,572.60 last week. It is up 31.4% year-to-date. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.62%, up from 4.52% last week. The 30-year treasury bond yield ended the week at 4.82%, up from 4.72% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 26th, 2024, were as follows: The 30-year fixed mortgage rate was 6.85%, up from 6.72% last week. The 15-year fixed was 6%, up from 5.92% last week. The graph below shows the trajectory of mortgage rates over the past year.

Happy New Year! |

News & Media