| Stock markets sold off on Friday as new data suggested that the economy was slowing, while inflation was rising. A slowing economy causes inflation to drop, but that has not been the case according to recent data. In the late 1970’s economists had to come up with the term stagflation because the economy was stagnant, and inflation was rising. That’s something that had never happened before. Investors fear that we may be heading into a period like that, but it’s too early to tell. The University of Michigan consumer sentiment index fell to 64.7 in February, a decline of almost 10%. This shocked experts and stock markets dropped sharply with the Dow dropping 700 points, its worst day of 2025. Last Friday it was reported that retail sales unexpectedly fell in January, and retail stocks dropped this week as Walmart forecasted that future sales would be weaker than expected. Often inflation data runs a couple of months behind economic data. The economy has been very strong until these recent reports. Stock markets have increased sharply since the election last November as investors expect lower tax rates and less regulation. Tariffs are another concern, but it is quite probable that if the economy does cool consumers will stop spending and inflation rates will drop. Thinking otherwise is very premature.

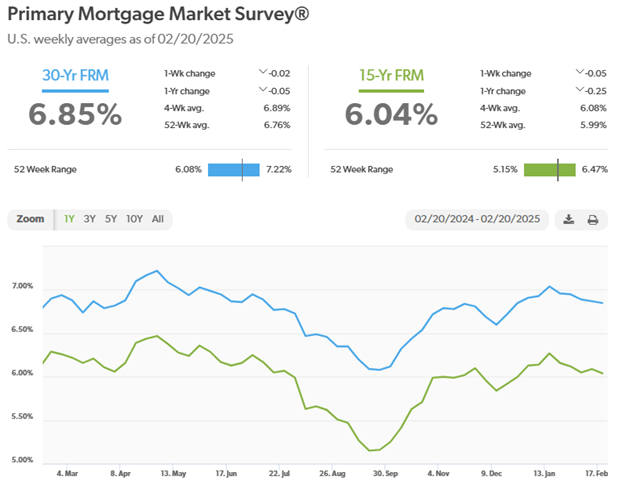

Stock markets – The Dow Jones Industrial Average closed the week at 43,428.02, down 2.5% from 44,546.08 last week. It is up 2.1% year-to-date. The S&P 500 closed the week at 6,013.13, down 1.7% from 6,114.63 last week. The S&P is up 2.2% year-to-date. The Nasdaq closed the week at 19,524.01, down 2.5% from 20,026.77 last week. It is up 1.1% year-to-date. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.42%, down from 4.47% last week. The 30-year treasury bond yield ended the week at 4.67%, down slightly from 4.69% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of February 20, 2025, were as follows: The 30-year fixed mortgage rate was 6.85%, down slightly from 6.87% last week. The 15-year fixed was 6.04%, down slightly from 6.09% last week. The graph below shows the trajectory of mortgage rates over the past year

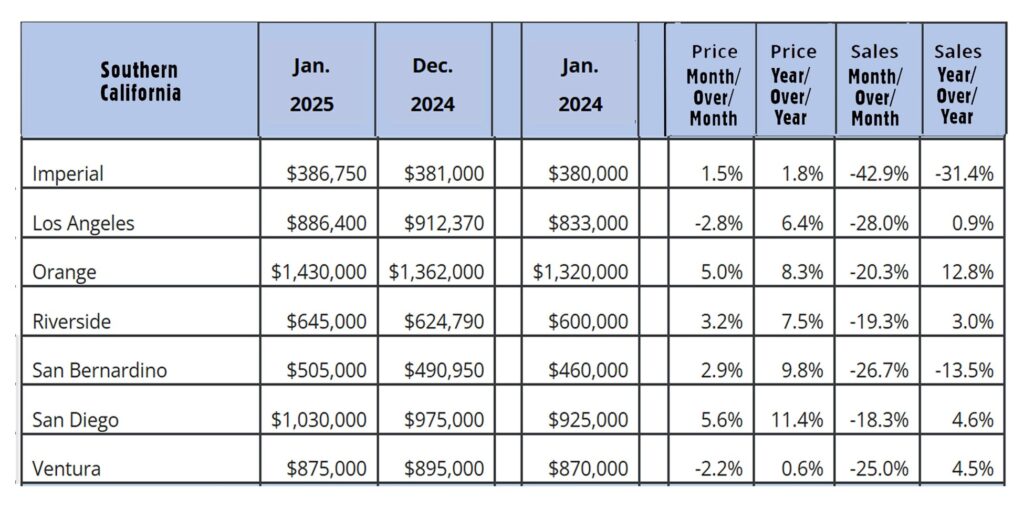

Home sales data is released on the third week of the month for the previous month by the California Association of Realtors and the National Association of Realtors. These are January’s home sales figures. U.S. existing-home sales January 2025 – The National Association of Realtors reported that existing-home sales totaled 4.08 million units on a seasonally annualized rate in January, up 2% from an annualized rate of 4 million units last January. The median price for a home sold in the U.S. in January was $396,900, up 4.8% from $378,600 one year ago. There was a 3.5-month supply of homes for sale in January, up from a 3-month supply one year ago. First-time buyers accounted for 28 % of all sales. Investors and second-home purchases accounted for 17% of all sales. All cash purchases accounted for 29% of all sales. Foreclosures and short sales accounted for 3% of all sales. California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 254,110 on an annualized basis in January, down 1.9% from a revised 259,160 homes sold on an annualized basis last January. The statewide median price paid for a home in was $838,850 in January, up 6.3% from $789,480 one year ago. There was a 4.1-month supply of homes for sale in January, up significantly from a 2.7-month supply of homes for sale in December and up from a 3.2-month supply in January 2024. The graph below lists home sales data by county in Southern California

Have a Great Weekend! |

News & Media