| Economic highlights this week – It was a volatile week on Wall Street, bond markets, and mortgage markets. Stocks ended the week sharply lower despite rebounding slightly on Friday. The volatility centered around the Trump Administration’s tariffs. A 25% tariff on imports from Canada and Mexico and a 20% tariff on imports from China went into effect on Tuesday. On Wednesday some of the tariffs, like automobiles from Canada, the U.S.’s largest trading partner were postponed for a month. There were also comments from Treasury Sectary, Scott Bessent, and others in the administration that suggested that these tariffs would not last long while comments from President Trump suggested that more tariffs are coming. All in all, it was a confusing week that left investors and corporations uncertain on what was ahead. It is difficult for businesses to plan when they do not know what the future holds for tariffs. Uncertainty caused fear and the stock markets dropped sharply this week. Bond yields and mortgage rates also fluctuated this week as investors wondered if the tariffs could cause a recession which would raise the unemployment rate, slow the economy, curtail consumer spending, and lower inflation, or if tariffs would just make everything more expensive and boost inflation.

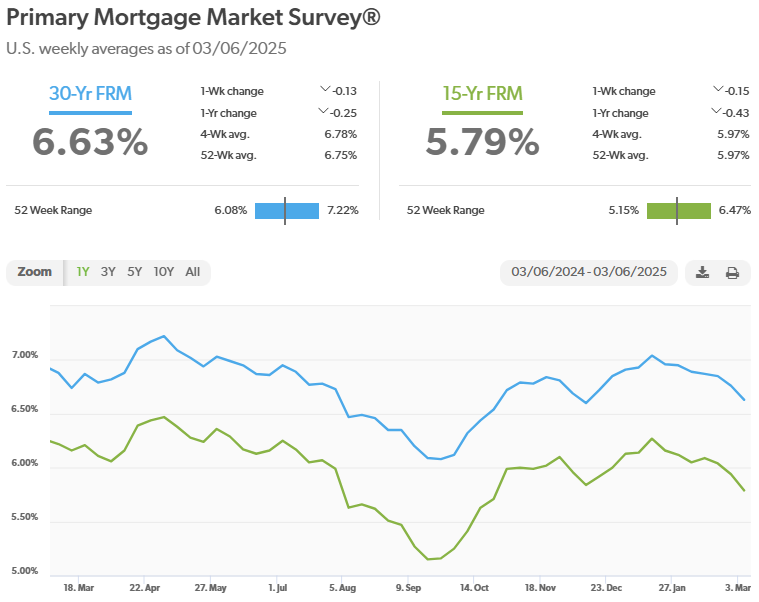

151,000 new jobs were added in February – The Department of Labor and Statistics reported that 151,000 new jobs were added in February, up from a revised 125,000 new jobs added in January. While that was below the 160,000 economists had forecasted, the government shed 10,000 jobs, so 161,000 non-government jobs were added. The unemployment rate ticked up to 4.1%, from 4% in January. It was 4.1% in December. Average hourly wages increased 4% in February from one year ago, down slightly from a 4.1% annual increase in January. Stock markets – The Dow Jones Industrial Average closed the week at 42,801.72, down 2.4% from 43,840.91 last week. It is up 0.6% year-to-date. The S&P 500 closed the week at 5,710.20, down 4.1% from 5,954.50 last week. The S&P is down 2.9% year-to-date. The Nasdaq closed the week at 18,196.22, down 3.5% from 18,847.28 last week. It is down 6.8% year-to-date. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.32%, up from 4.24% last week. The 30-year treasury bond yield ended the week at 4.62%, up from 4.51% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of March 6, 2025, were as follows: The 30-year fixed mortgage rate was 6.63%, down from 6.76% last week. The 15-year fixed was 5.79%, down from 5.94% last week. The graph below shows the trajectory of mortgage rates over the past year Have a Great Weekend! |

News & Media