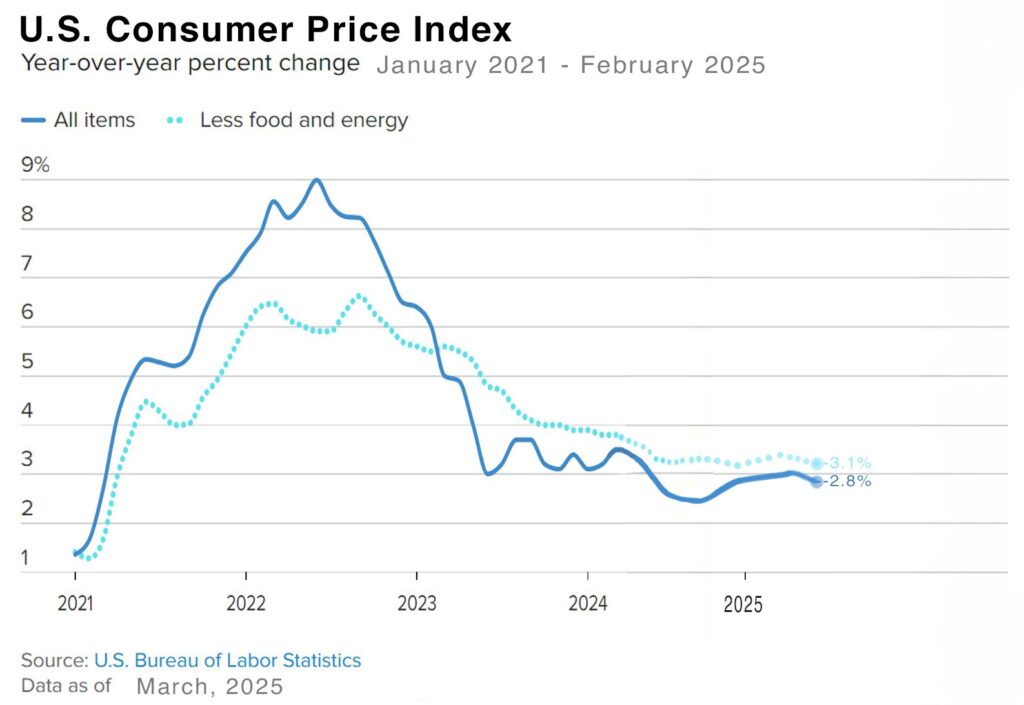

| Inflation eased in February – The Consumer Price Index (CPI) rose 2.8% in February from one year earlier, down from a year-over-year increase of 3% in January. The CPI rate had increased steadily since hitting a 3 ½ year low of 2.4% in September until February. Perhaps it will continue to tick down. Core CPI, which excludes volatile food and energy prices, rose 3.1% year-over-year, down from a 3.3% annual rate in January. That marked the smallest yearly increase in Core CPI since April 2021. The Producer Price Index (PPI) rose 3.2% from one year earlier, down sharply from a 3.7% year-over-year increase in January. The PPI gauges wholesale inflation which is considered an indicator of future consumer inflation as wholesale costs are often passed on to consumers.

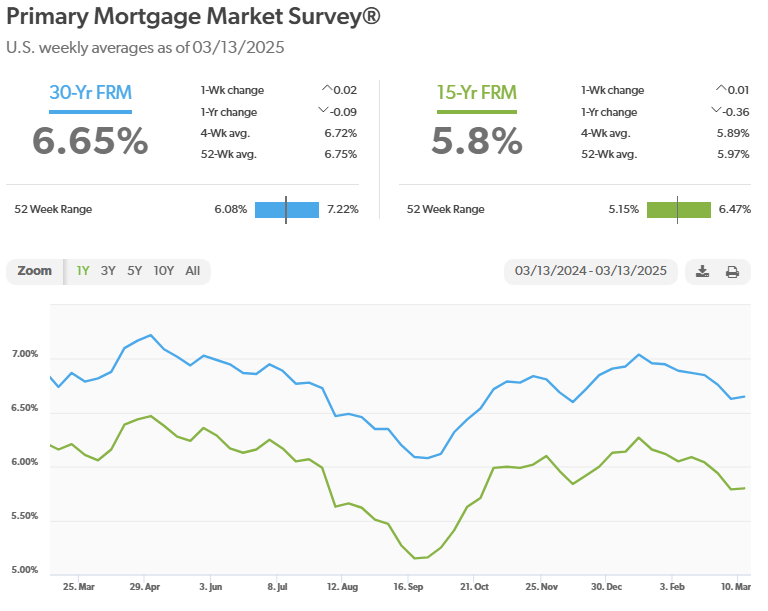

U.S. Treasury bond yields – Usually when stock markets drop investors rush to the safety of treasury bonds and yields fall. Additionally, when inflation drops bond yields and mortgage rates drop as well. That did not happen in the last two weeks because investors are worried that tariff costs will be passed along to consumers and inflation will reignite. The 10-year treasury bond closed the week yielding 4.31%, unchanged from 4.32% last week. The 30-year treasury bond yield ended the week at 4.62%, unchanged from 4.62% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of March 13, 2025, were as follows: The 30-year fixed mortgage rate was 6.65%, almost unchanged from 6.63% last week. The 15-year fixed was 5.8%, unchanged from 5.79% last week. The graph below shows the trajectory of mortgage rates over the past year.

Have a Great Weekend! |

If you’d like to unsubscribe and stop receiving these emails click here .