Employees added 177,000 jobs in April despite tariff uncertainty – The Department of Labor and Statistics reported that 177,000 new jobs were added in April. That was slightly lower than a revised 185,000 new jobs added in March, but it far exceeded economists’ expectations of 130,000 new jobs. The unemployment rate remained unchanged at 4.2%. The labor participation rate increases slightly as more workers entered the workforce. Average hourly wages increased 3.8% year-over-year in April, unchanged from March’s annual increase.

Stock markets have rebounded – Stock markets have rebounded over the past two weeks with the S&P up about 8%. While stock markets were on track for their worst April since the depression following the announced tariffs, they have jumped higher over the past two weeks at the highest rate since late 2020 when they rebounded from the drop due to the pandemic. The Dow Jones Industrial Average closed the week at 41,317.43, up 3% from 40,113.50 last week. It is down 7.2% from 44,544.66 on December 31, 2024. The S&P 500 closed the week at 5,686.67, up 2.9% from 5,525.21 last week. The S&P is down 5.9% from 6,040.53 on December 31, 2024. The Nasdaq closed the week at 17,977.73, up 3.4% from 17,382.94 last week. It is down 8.4% from 19,627.44 on December 31, 2024.

U.S. Treasury bond yields jump – The 10-year treasury bond closed the week yielding 4.33%, up from 4.29% last week. The 30-year treasury bond yield ended the week at 4.79%, up from 4.74% last week. We watch bond yields because mortgage rates follow bond yields.

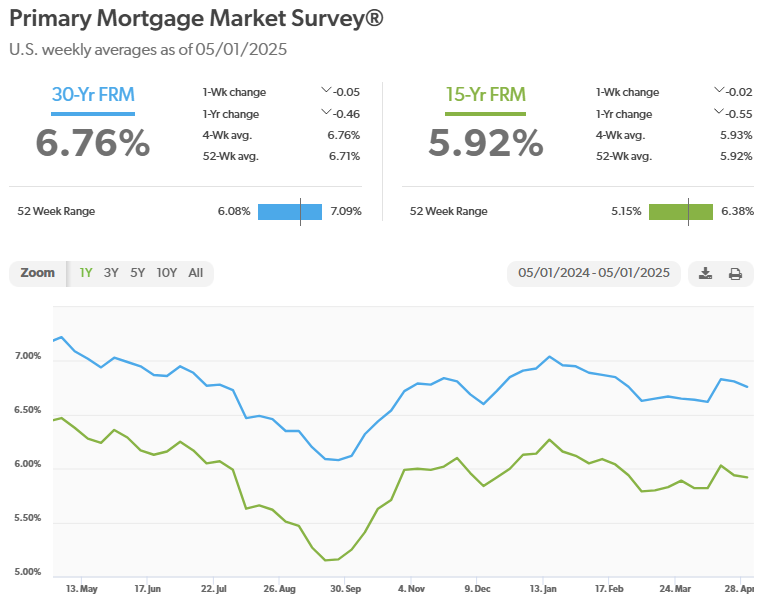

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of May 1, 2025, were as follows: The 30-year fixed mortgage rate was 6.76%, down from 6.81% last week. The 15-year fixed rate was 5.92%, nearly unchanged from 5.94% last week.

The graph below shows the trajectory of mortgage rates over the past year.