| Economic news this week – After last week’s favorable inflation data showing that inflation levels were at 3-year lows, the Federal Reserve elected to hold its key interest rates at the current level for the fourth consecutive meeting. Investors and economists were disappointed with that decision as inflation has tamed, and the U.S. rates are well below the rates in other major countries, and the economy has slowed. Usually, these factors would lead to the Fed dropping rates to more neutral levels from the current restrictive levels that have been in place to slow inflation. Unfortunately, the Fed felt that the risk of tariff induced future inflation and the risk of rising oil prices due to the war in the Middle East warranted leaving rates unchanged at this time.

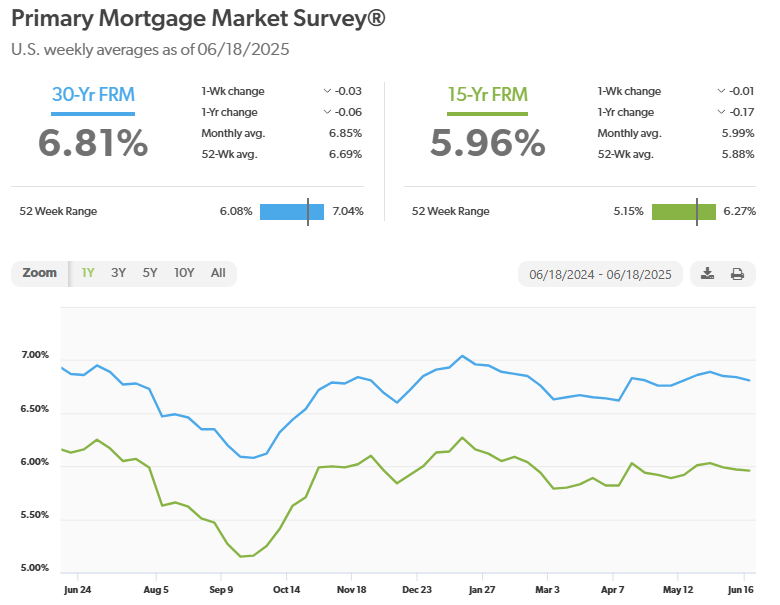

Stock markets -The Dow Jones Industrial Average closed the week at 42,206.82, down 1.3% from 42,762.87 last week. Year-to-date, it is down 5.3% from $ 44,544.66 as of December 31, 2024. The S&P 500 closed the week at 5,967.84, down 0.2% from 5,976.97 last week. Year-to-date the S&P is down 1.2% from 6,040.53 on December 31, 2024. The Nasdaq closed the week at 19,447.41, up 0.2% from 19,406.83 last week. Year-to-date it is down 0.9% from 19,627.44 on December 31, 2024. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.38%, down from 4.41% last week. The 30-year treasury bond yield ended the week at 4.89%, almost unchanged from 4.90% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of June 19, 2025, were as follows: The 30-year fixed mortgage rate was 6.81%, down slightly from 6.84% last week. The 15-year fixed was 5.96%, nearly unchanged from 5.97% last week. The graph below shows the trajectory of mortgage rates over the past year.

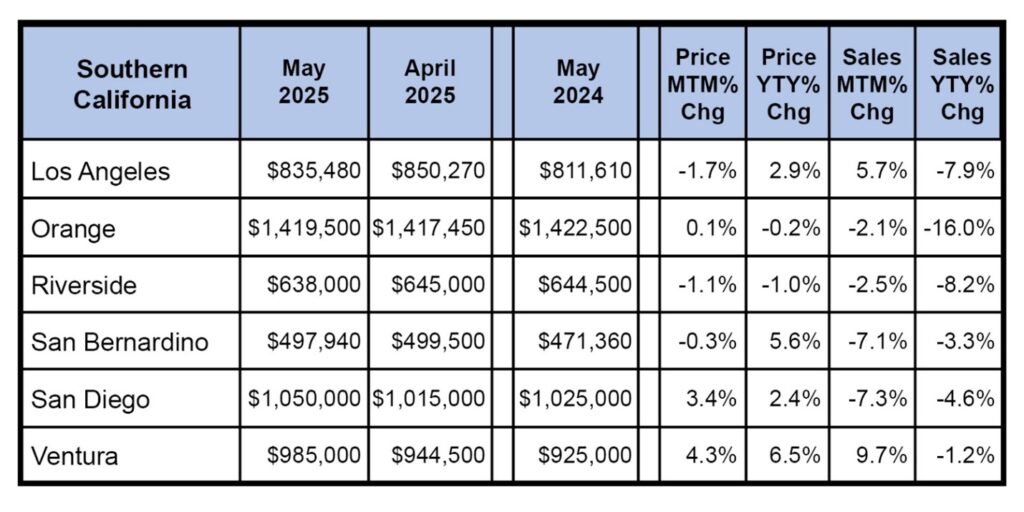

Home sales data is released on the third week of the month for the previous month by the California Association of Realtors and the National Association of Realtors. The California Association of Realtors released their figures on Wednesday the National Association of Realtors will release May’s figures next week. These are California’s May home sales figures. California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 254,100 on an annualized basis in May, down 5.1% from 267,710 in April. Year-over-year sales were down 4% from a revised 264,840 annualized homes one year ago. The statewide median price paid for a home was $900,170 in May, down 1.1% from $910,160 in April. Year-over-year, the statewide median price was down 0.9% from $908,000 in May 2024. There was a 3.8-month supply of homes for sale in May, up from a 3.5-month supply of homes for sale in April, and up from a 2.6-month supply of homes for sale last May. The graph below lists home sales data by county in Southern California.

Have a Great Weekend! |

News & Media