Key inflation report comes in slightly better than forecasted – Due to the government shutdown there has been very limited data on the state of the economy. The data we have has been coming in later than usual. On Friday, the Bureau of Labor and Statics released the Personal Consumption Expenditure Index (PCE) for September, the Fed’s favorite gauge of inflation. It showed that headline PCE rose 0.3% in September from August. That was in line with economists’ expectations. On an annual basis, PCE rose 2.7% from September 2024, below the 2.8% expected. Core PCE, which does not include food and energy prices because those tend to be more volatile, increased 0.2% month-over-month in September. On an annual basis, it was up 2.8% from one year earlier. That was below the 2.9% economists expected. The BLS also announced that the November PCE report will be released as previously scheduled on December 22, 2025. There will not be an October report this year because the people who do the surveys to gather the data for the reports were furloughed due to the shutdown. They may give some information from October, but it will not be a full report. The September surveys were done before the shutdown. That’s why they had the data to formulate that report, but they will never have the data for an October report. It is odd to be talking about September inflation data in December. Investors are uncertain about the state of the economy, job market, inflation, retail sales, etc., because the data is not current. It looks like the government will have caught up by the end of the month.

Stock Markets – The Dow Jones Industrial Average closed the week at 47,954.99, up 0.5% from 47,716.42 last week. Year-to-date, it is up 7.7% from 44,544.66 on December 31, 2024. The S&P 500 closed the week at 6,870.40, up 0.3% from 6,849.09 last week. Year-to-date, the S&P is up 13.7% from 6,040.53 on December 31, 2024. The Nasdaq closed the week at 23,578.13, up 0.9% from 23,365.69 last week. Year-to-date, it is up 20.1% from 19,627.44 on December 31, 2024.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.14%, up from 4.02% last week. The 30-year treasury bond yield ended the week at 4.79% up from 4.67% last week. We watch bond yields because mortgage rates follow bond yields.

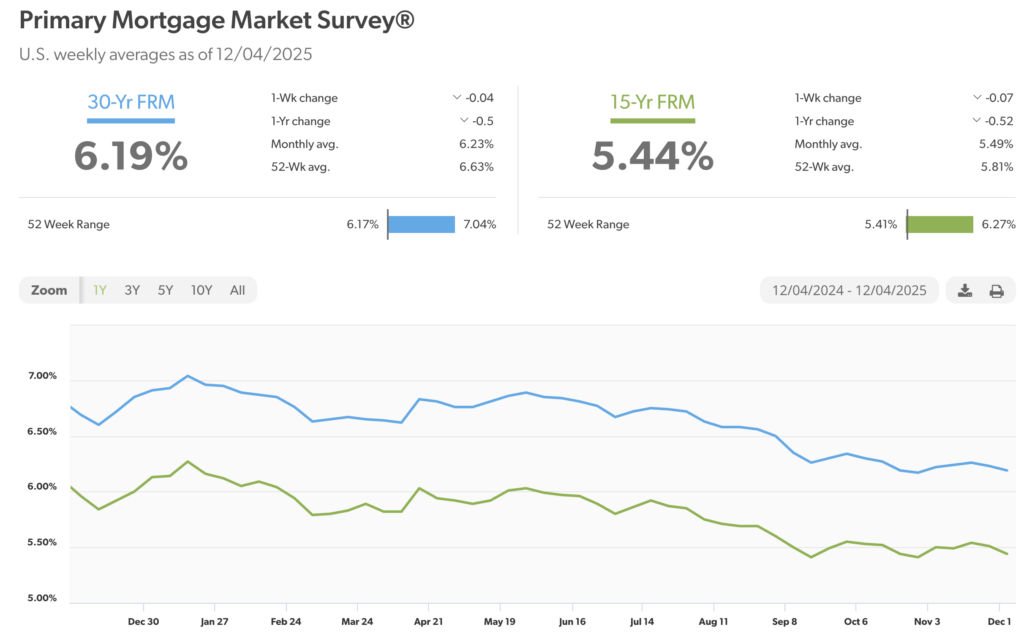

Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 4, 2025, were as follows: The 30-year fixed mortgage rate was 6.19%, down from 6.23% last week. The 15-year fixed was 5.44%, down from 5.51% last week.

The graph below shows the trajectory of mortgage rates over the past year.