The Federal Reserve cut rates again this week – The Fed cut its key interest rates at the conclusion of its policy meeting on Wednesday. The 1/4% rate cut, marked its third meeting in a row that ended with a 1/4% drop, following no cuts in the first three quarters of 2025. That brings the Federal Funds rate to 3.5%-3.75%. That’s down from 4.25%-4.5% at the start of 2025. The Fed Funds rate peaked at 5.25%-5.5% in 2024. The Federal Funds Rate is the overnight rates banks pay. It’s the shortest of short-term rates. It directly impacts the prime lending rate which is an index that is commonly used for business loans and lines of credit, and very short term rates. The prime peaked at 8% in 2024 and now stands at 6.75%. Unfortunately, long-term rates do not follow the Federal Funds Rate. Mortgage rates did not drop after the Fed’s rate drop but we do expect them to drop further in 2026.

Economic news next week – Due to the government shutdown, there has not been inflation or jobs reports for October or November. Next Tuesday the Bureau of Labor and Statistics will release the November Jobs and unemployment report. This would usually be released on the first Friday of the month for the previous month. On Wednesday the Consumer Price Index report will be released. On Thursday we will get the retail sales report. Fed officials , economists, and investors are eagerly awaiting this data. We will know a lot more about the state of the economy, unemployment rate, and inflation next week.

Stock Markets – The Dow Jones Industrial Average closed the week at 48,458.05, up 1.1% from 47,945.99 last week. Year-to-date, it is up 8.8% from 44,544.66 on December 31, 2024. The S&P 500 closed the week at 6,827.41, down 0.6% from 6,870.40 last week. Year-to-date, the S&P is up 13% from 6,040.53 on December 31, 2024. The Nasdaq closed the week at 23,195.17, down 1.6% from 23,578.13 last week. Year-to-date, it is up 18.2% from 19,627.44 on December 31, 2024.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.19%, up from 4.14% last week. The 30-year treasury bond yield ended the week at 4.85%, up from 4.79% last week. We watch bond yields because mortgage rates follow bond yields.

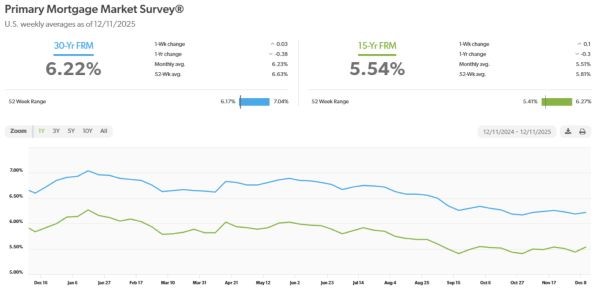

Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 11, 2025 were as follows: The 30-year fixed mortgage rate was 6.22%, up slightly from 6.19% last week. The 15-year fixed was 5.54%, up from 5.44% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Have a Great Weekend!

Have a Great Weekend!