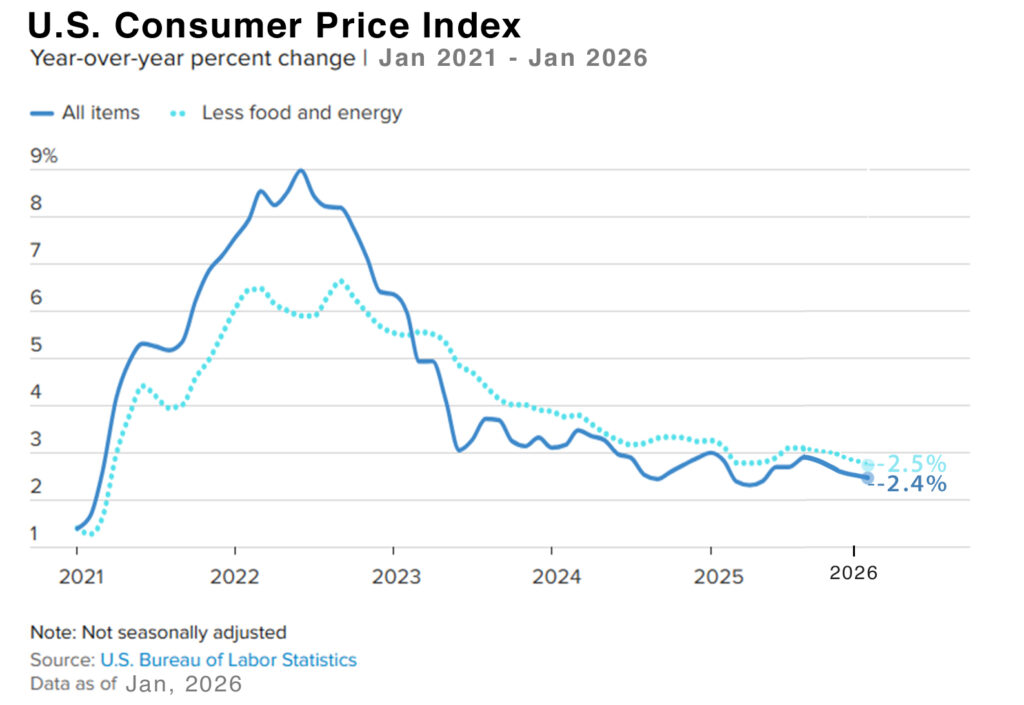

Inflation cooled in January – The consumer price index (CPI) was released on Friday it showed that consumer prices grew at an annual rate of 2.4% in January, down from a 2.7% annual increase in December. The core (CPI), which excludes food and energy increased 2.5% from one year ago, down from 2.6% in December.

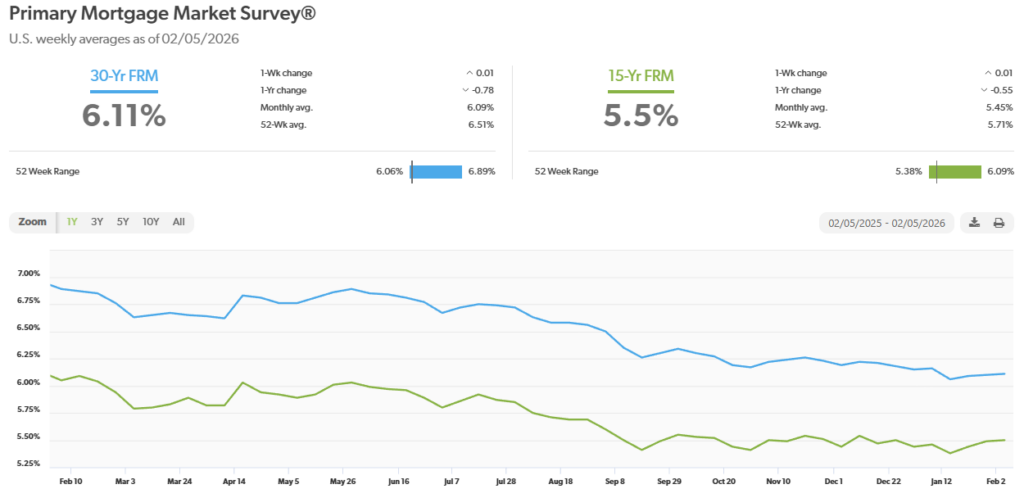

Mortgage rates – Mortgage rates dropped on Friday after the CPI report showed inflation is cooling – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of February 5, 2026 were as follows: The 30-year fixed mortgage rate was 6.11%, nearly unchanged from 6.1% last week. The 15-year fixed was 5.5 %, nearly unchanged from 5.49% last week.Rates dropped on Thursday and Friday and ended the week with the 30-year dropping below 6%.

The graph below shows the trajectory of mortgage rates over the past year.

Hiring picked up in January – The Bureau of Labor and Statistics released the January jobs report on Wednesday. It showed that 130,000 new jobs were created in January. This was more than double the 55,000 new jobs that economists surveyed expected. The unemployment rate dropped to 4.3%, from 4.4% in December. Additionally, data from 2025 was revised downward, showing total non-farm employment growth for the year was only 181,000, marking 2025 as the fewest new jobs created in a non-recession year.

Stock markets finished the week lower – After closing above 50,000 for the first time ever last week the Dow had a losing week and closed well below that 50,000 milestone. Much of the loss was attributed to profit taking. There was also some loses in the technology sector as fears that AI may make some programing and other non-hardware tech companies obsolete. The Dow Jones Industrial Average closed the week at 49,500.93, down 1.2% from 50,115.67 last week. It is up 3% year-to-date from 48,063.29 on December 31, 2025. The S&P 500 closed the week at 6,936.76, down 0.1% from 6,932.30 last week. The S&P is up 1.3% year-to-date from 6,845.50 on December 31, 2025. The Nasdaq closed the week at 22,546.67, down 2.1% from 23,031.63 last week. It is down 3% year-to-date from 23,241.99 on December 31, 2025.

The 10-year treasury bond closed the week yielding 4.04%, down from 4.22% last week. The 30-year treasury bond yield ended the week at 4.69%, down slightly from 4.85% last week. We watch bond yields because mortgage rates follow bond yields.

January home sales and prices – Home sales data is released on the third week of the month for the previous month by the National Association of Realtors and the California Association of Realtors. A summary of their home sales reports will be in next week’s update. We tabulate the same data from information derived from the local MLS systems on the 9th of each month for the previous month. You can get a report now for your city or zip code on our site RodeoRe.com.