Economic news this week – It was a tough week for the Dow Jones Industrial Average. After five straight weeks of gains, the Dow ended the week down 2.4% from last week’s record high when the Dow closed over 40,000 for the first time. While some of this week’s sell-off can be attributed to profit-taking, interest rate fears were a factor as well. The Dow dropped 604 points on Thursday, its biggest single-day drop in 2024, following minutes released from the last Federal Reserve policy meeting. Fed comments included that inflation was more stubborn than expected and that the Fed now expects just one interest rate drop this year, down from their guidance of four expected drops at the start of 2024. Goldman also changed their forecast from a Fed rate drop in July to no rate drop until September. While there have finally been some signs that the economy may have begun to lose steam, the Commerce Department reported Friday that durable goods purchases surged in April. Durable goods purchases, which include things like cars, trucks, appliances, etc. shot up 0.7% month-over-month in April. Experts forecasted a 1% decline. Contrasting that was consumer confidence which had the lowest reading since last November. Next week the Personal Consumption Expenditure (CPE) index will be released. That will give us more insight into where inflation is heading.

Stock markets – The Dow Jones Industrial Average closed the week at 39,069.59, down 2.4% from 40,003.59 last week. It is up 3.7% year-to-date. The S&P 500 closed the week at 5,304.72, unchanged from 5,303.27 last week. The S&P is up 11.2% year-to-date. The Nasdaq closed the week at 16,920.80, up 1.4% from 16,684.97 last week. It is up 12.7% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.46%, up from 4.42% last week. The 30-year treasury bond yield ended the week at 4.57, almost unchanged from 4.56% last week. We watch bond yields because mortgage rates follow bond yields.

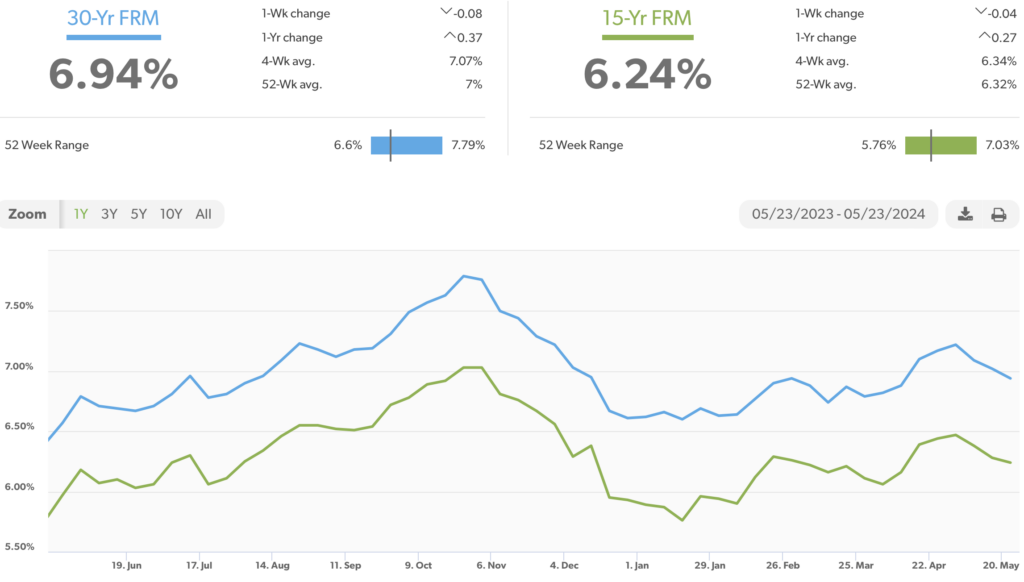

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of May 23, 2024, were as follows: The 30-year fixed mortgage rate was 6.94%, down from 7.02% last week. The 15-year fixed was 6.24%, down from 6.28% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 4.14 million units on a seasonally adjusted annualized rate in April, down 1.95 from an annualized rate of 4.22 million in April 2023. The median price for a home in the U.S. in April was $407,600, up 5.7% from $385,800 last April. There was a 3.5-month supply of homes for sale in April, up from a 3-month supply one year ago. First-time buyers accounted for 33% of all sales. Investors and second-home purchases accounted for 16% of all sales. All cash purchases accounted for 28% of all sales. Foreclosures and short sales accounted for 2% of all sales.

Have a great weekend!