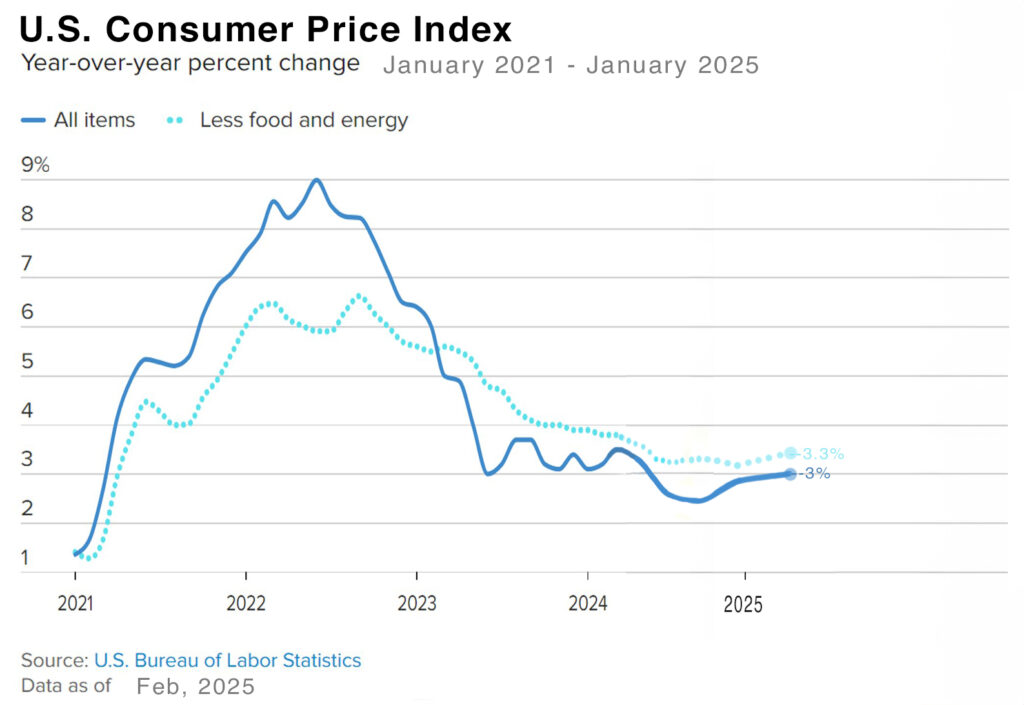

Inflation increased in January – The January Consumer Price Index (CPI) was released on Wednesday. It showed that consumer inflation increased 0.5% month-over-month. That marked the largest month-over-month increase since August 2023. The CPI index showed consumer prices were up 3% year-over-year. The CPI index peaked at 9.1% in May 2022 and worked its way down to 2.4% in August 2024, unfortunately, its risen every month since then and is now back up to 3%, a one-year high. Core CPI, which excludes volatile food and energy prices increased 0.4% month-over-month in January, its highest monthly increase since April 2023. It is currently up 3.3% year-over-year. On Thursday it was reported that the Producer Price Index (PPI) jumped 3.5% year-over-year in January, its highest increase since February 2023. Producer prices are wholesale prices. When producers have to pay more for goods and materials those increases are passed along to consumer prices. Bond yields and mortgage rates rose on Wednesday and Thursday following the inflation news.

Retail sales slumped in January – On Friday the Commerce Department reported that retail sales slipped 0.9% in January, down from a 0.7% gain in December. Normally when the unemployment rate drops and wages increase much higher than the inflation rates consumer spending increases which fuels inflation. Consumer spending has surged for several years now. A drop in consumer spending in January could be a sign that consumers are feeling less optimistic about their finances. Investors will look to future months to see if this was just an outlier or if consumers are beginning to curtail their shopping. This was good news for mortgage rates and bond yields which dropped on Friday to end the week unchanged from last week’s rates.

The graph below shows the CPI rate since 2021.

Stock markets – The Dow Jones Industrial Average closed the week at 44,546.08, up 0.5% from 44,303.40 last week. It is up 4.7% year-to-date. The S&P 500 closed the week at 6,114.63, up 1.5% from 6,025.99 last week. The S&P is up 4% year-to-date. The Nasdaq closed the week at 20,026.77, up 2.6% from 19,523.40 last week. It is up 3.7% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.47%, down slightly from 4.49% last week. The 30-year treasury bond yield ended the week at 4.69%, unchanged from 4.69% last week. We watch bond yields because mortgage rates follow bond yields.

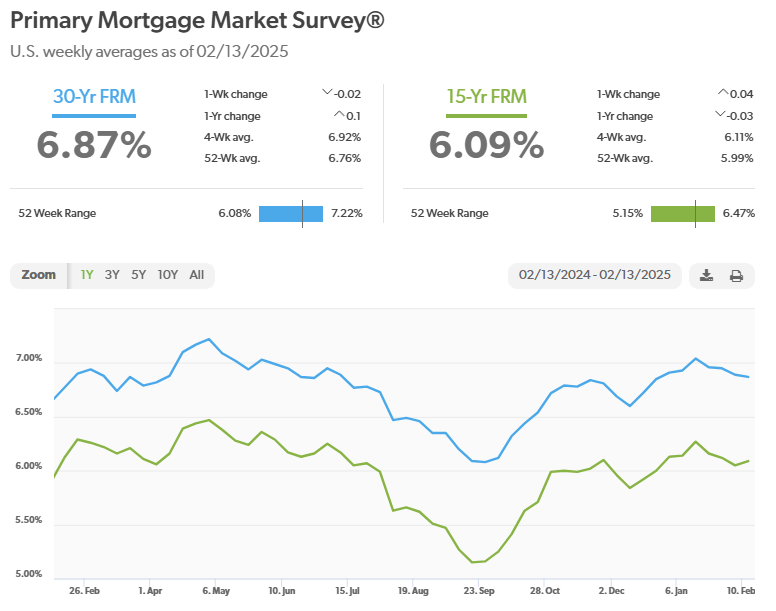

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of February 13, 2025, were as follows: The 30-year fixed mortgage rate was 6.87%, down slightly from 6.89% last week. The 15-year fixed was 6.09%, up slightly from 6.05% last week.

The graph below shows the trajectory of mortgage rates over the past year.

January’s home sales figures will be released next week by the California Association of Realtors and the National Association of Realtors. Those will be included in next week’s report. You can get the same data now for your city, county, or zip code from our website RodeoRe.com.