California home prices continue to surge while the number of sales dropped in August

The California Association of Realtors reported that existing home sales totaled 414,860 on a seasonally adjusted annualized rate in August. That marks a 3.3% decline from the number of sales in July, and a drop of 10.9% from the number of sales in August 2020. August existing home sales were the lowest number of sales in 14 months, but are similar to number of sales that California saw in 2018 and 2019, which was a very healthy real estate market. Year-to-date sales are up 21.3% from the same period last year.

The median price paid for an existing home in August was $827,940, up 2.1% from July’s median price of $811,170, and up 17.1% from last August when the median price was $706,900.

The California Association of Realtors tracks inventory levels based on how many months it would take to sell the active listings in all MLS systems at the current sales level. There was a 1.9 month supply of homes for sale in August, down from a 2.1 month supply of homes for sale last August.

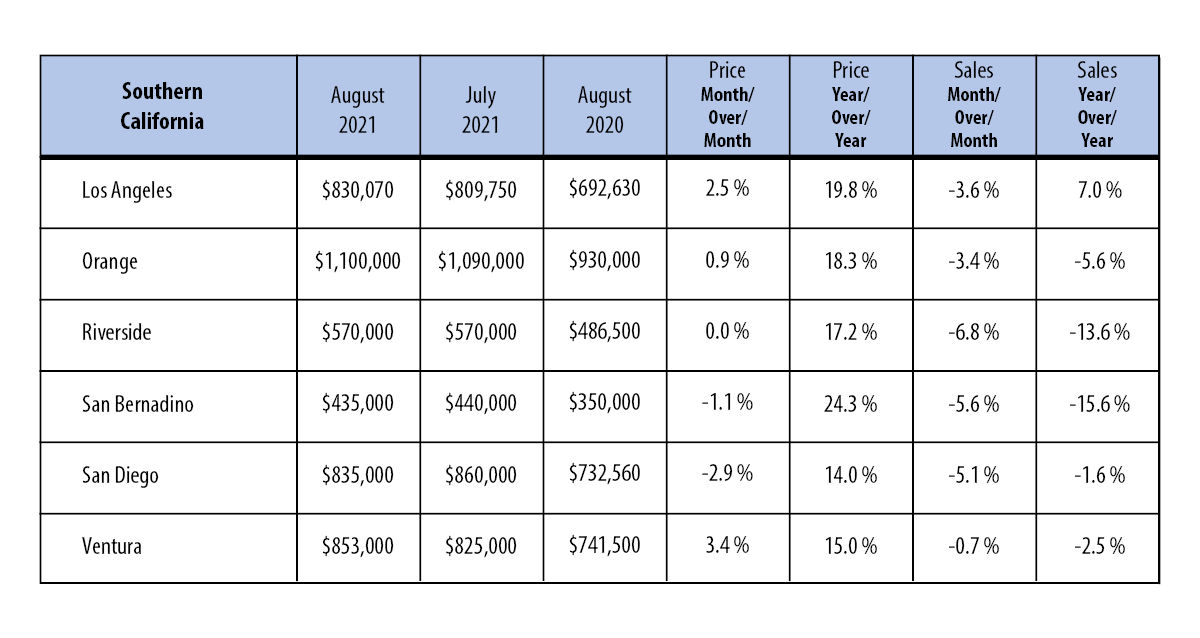

The graph below shows activity by County for Southern California.