Inflation shows signs of cooling – This month several reports suggested that inflation was cooling after picking up earlier in the year. Key inflation data released this month included: The Consumer Price Index (CPI) showed that consumer prices increased 3.3% year-over-year in May, down from a 3.4% year-over-year increase in April. On a month-over-month basis, consumer prices held flat for the first time since July 2022. Core CPI, which excludes food and energy, increased 3.4% year-over-year, its smallest annual increase since April 2021. CPI peaked in June of 2022 at 9.1%, worked its way down to 3% in June 2023, but worked its way back up to 3.5% year-over-year in March 2024. It has remained stubborn, but the year-over-year increase has moderated for three straight months. The Producer Price Index (PPI), a gauge of prices that producers get for their goods and services in the open market, showed that wholesale prices declined 0.2% month-over-month in May, following April’s surprise 0.5% increase. Year-over-year the PPI increased 2.2%. The core PPI increased 2.3% year-over-year. Economists had expected a 2.5% increase, so this was also good news. The Personal Consumption Expenditure Index (PCE), the Fed’s preferred gage of inflation, was released on June 28. It showed that the 12-month inflation rate was 2.6%. The Core PCE, which strips out volatile food and energy prices, also showed a 2.6% year-over-year increase. The Fed is looking to get this index down to their 2% target rate and it is finally beginning to look like they are making significant progress. Experts feel that they will begin to cut their key interest rates from their 25-year high levels later in the year.

The graph below shows the trend of the CPI rate since 2021.

Stock Markets – The Dow Jones Industrial Average closed the month at 39,118.86, up 1.1% from 38,686.32, on May 31, 2024. It is up 3.8% year-to-date. The S&P 500 closed the month at 5,460.48, up 3.5% from 5,277.51 last month. It is up 14.5% year-to-date. The NASDAQ closed the month at 17,732.60, up 6% from 16,735.02 last month. It is up 18.1% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the month yielding 4.36%, down from 4.51% last month. The 30-year treasury bond yield ended the month at 4.51%, down from 4.64% last month. We watch bond yields because mortgage rates often follow treasury bond yields.

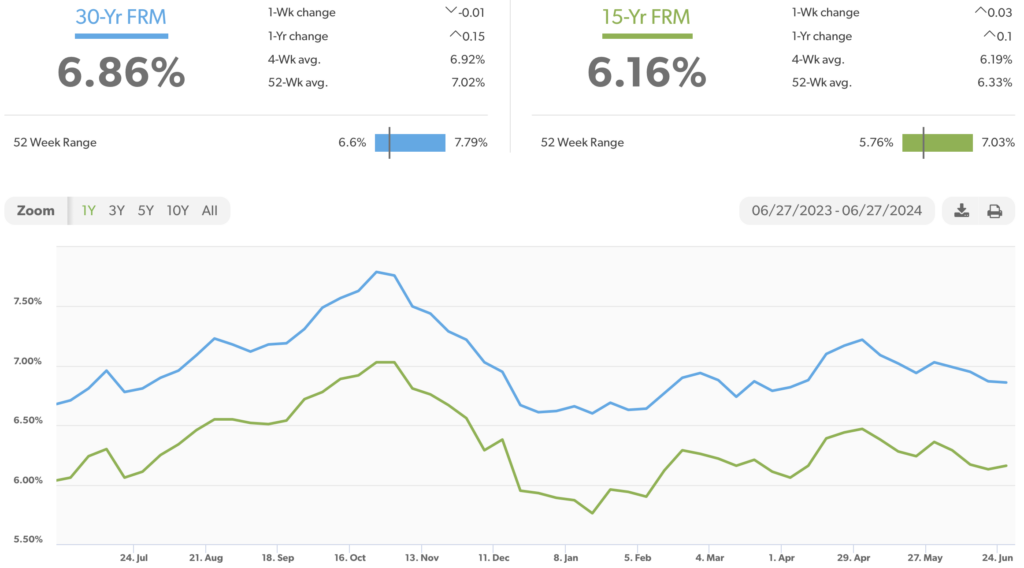

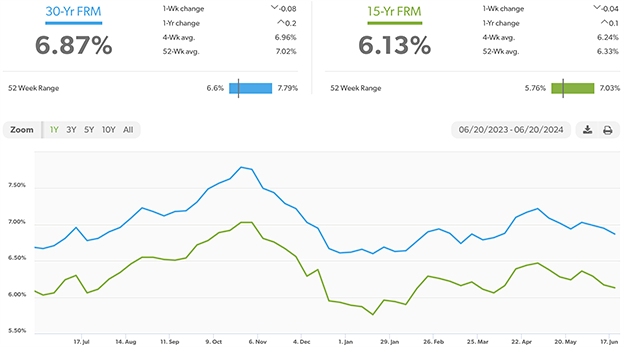

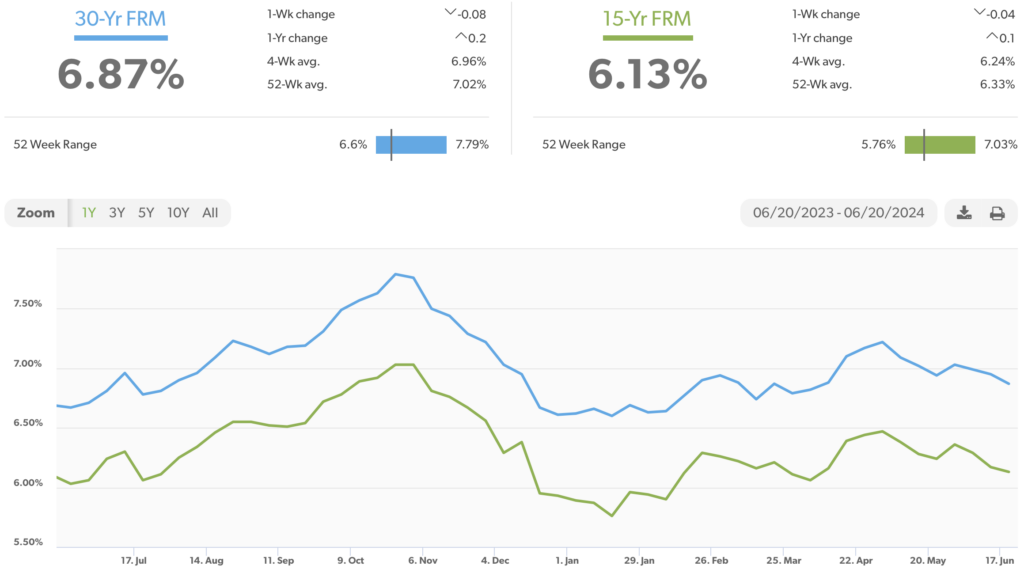

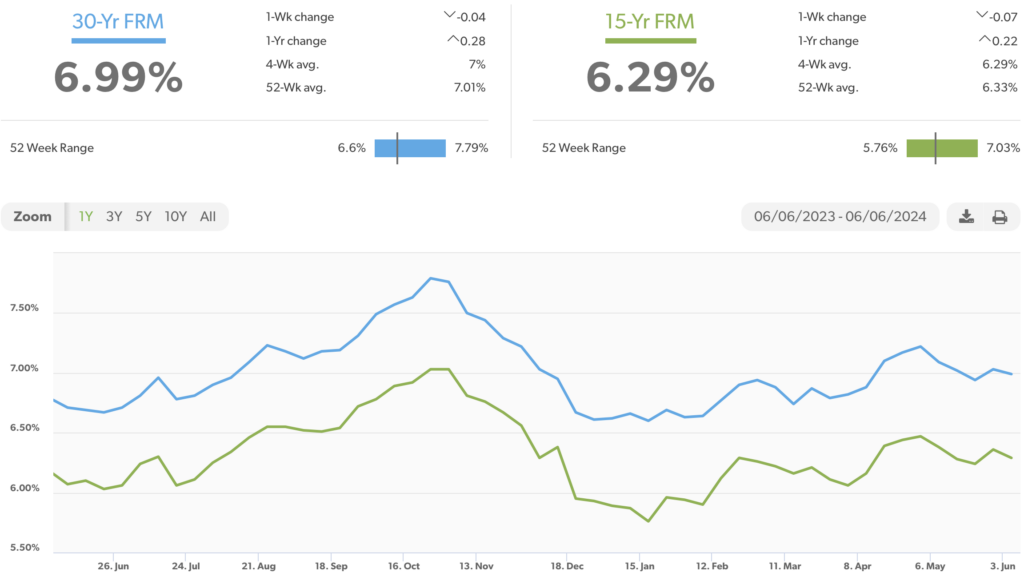

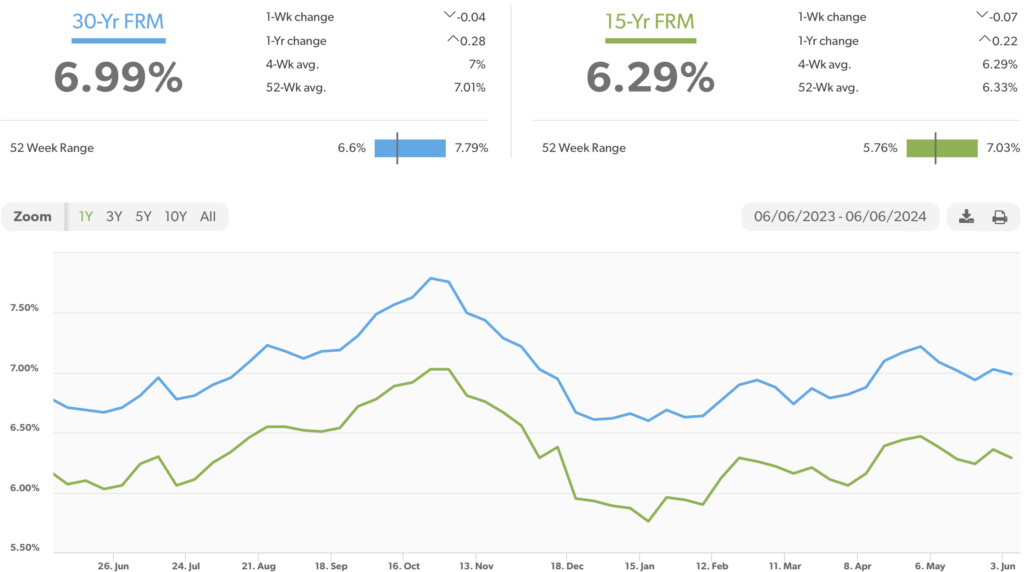

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Surveyreported that mortgage rates for the most popular loan products as of June 27, 2024, were as follows: The 30-year fixed mortgage rate was 6.86%, down from 7.03% at the end of May. The 15-year fixed was 6.16%, down from 6.36% last month.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

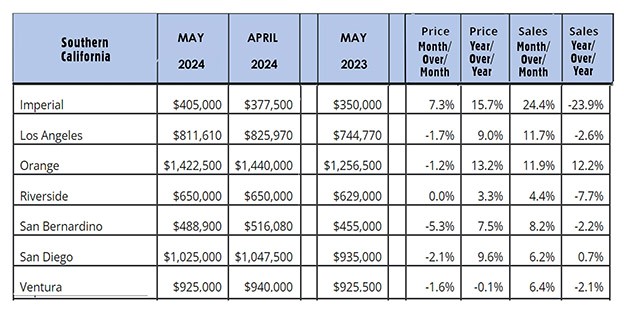

Home sales data is released on the third week of the month for the previous month by the National Association of Realtors and the California Association of Realtors. These are May’s home sales figures.

U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 4.11 million units on a seasonally adjusted annualized rate in May, down 2.8% from an annualized rate of 4.23 million last May. The median price for a home in the U.S. in May was $419,300, up 5.8% from $396,500 one year ago. There was a 3.8-month supply of homes for sale in May, up from a 3.1-month supply one year ago. First-time buyers accounted for 32% of all sales. Investors and second-home purchasesaccounted for 16% of all sales. All-cash purchases accounted for 28% of all sales. Foreclosures and short sales accounted for 2% of all sales.

Year-over-year California home prices jumped 8.7% in May – The California Association of Realtors reported that existing-home sales totaled 277,410 on an annualized rate in May, down 6% from a revised 298,860 homes sold on an annualized basis last May. There was a 2.6-month supply of homes for sale, up from a 2.1-month supply one year ago. The statewide median price paid for a home in April was $908,040, up 8.7% from a revised median price of $835,280 one year ago.

The graph below shows sales data by county in Southern California.