Economic news this week – This week it looked like interest rates were going to begin to fall. The 10-year bond yield and mortgage rates dropped every day. The 10-year fell to 4.28% from 4.51% last Friday, as it began to appear that the economy was finally slowing. Several key reports were released. The week started off with a report from the Labor Department showing that April Job openings, a measure of labor demand, were down to the lowest level since February 2021. There were 1.24 openings for every person unemployed in April, down from 1.3 positions for every person unemployed in March, and the lowest since June 2021. Another report showed that manufacturing fell for a second consecutive month in May. Experts felt that manufacturing was struggling with higher interest rates and weaker consumer spending. Disposable personal income fell 0.1% in April, from the previous month. The personal savings rate was 3.6% in April and March, the lowest since December 2022. Also, the Q1 2024 GDP was revised downward from 1.6% to 1.4%, indicating that the economy was finally showing signs of slowing after one of the most aggressive campaigns of interest rate hikes and other tightening measures by the Fed in decades. Consumer spending reports showed that consumer spending finally showed signs of slowing, as retail sales decreased in March and April. Unfortunately, on Friday, a blockbuster May Jobs report was released showing that job growth and wages surged in May. Investors who were beginning to believe that the economy was finally slowing and inflation settling, were shocked by the surge in job growth and wages, and now feel that a rate drop by the Fed is months away. Bond yields and mortgage rates rose sharply on Friday after the jobs report was released.

U.S. Job growth surged in May – The Department of Labor and Statistics reported that 272,000 new jobs added in May. That shocked experts who expected 165,000-180,000 new jobs. May marked the 41st consecutive month of job growth. The unemployment rate rose to 4% in May, up from 3.9% in April, ending a 27 straight month streak with the unemployment rate below 4%. That has not happened since the 1960s. Had May’s unemployment remained below 4%, that would have marked the longest streak in history with unemployment under 4%. After two years of high interest rates it was widely felt that job growth would finally be slowing, but May’s blowout jobs report shocked everyone. Average hourly wages increased 4.1% year-over-year in May, up from a 3.9% year-over-year increase in April. The Fed is looking to get the unemployment rate up to the mid-4% range in order to slow wage growth to combat inflation. This report will give the Fed pause. At this point it is now if the Fed will bring interest rates down from a 24-year high but when they enter a new phase of rate drops. A blowout jobs report gives the Fed a reason to hold rates steady and not begin the phase of rate reductions yet.

Stock markets – The Dow Jones Industrial Average closed the week at 38,798.99, up 0.3% from 38,686.32 last week. It is up 2.9% year-to-date. The S&P 500 closed the week at 5,346.99, up 1.3% from 5,277.51 last week. The S&P is up 12.1% year-to-date. The Nasdaq closed the week at 17,133.13, up 2.4% from 16,735.02 last week. It is up 14.1% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.43%, down from 4.51% last week. The 30-year treasury bond yield ended the week at 4.55%, down from 4.65% last week. We watch bond yields because mortgage rates follow bond yields. The 10-year was 4.28% on Thursday and shot up to 4.43% Friday after the hot jobs report was released.

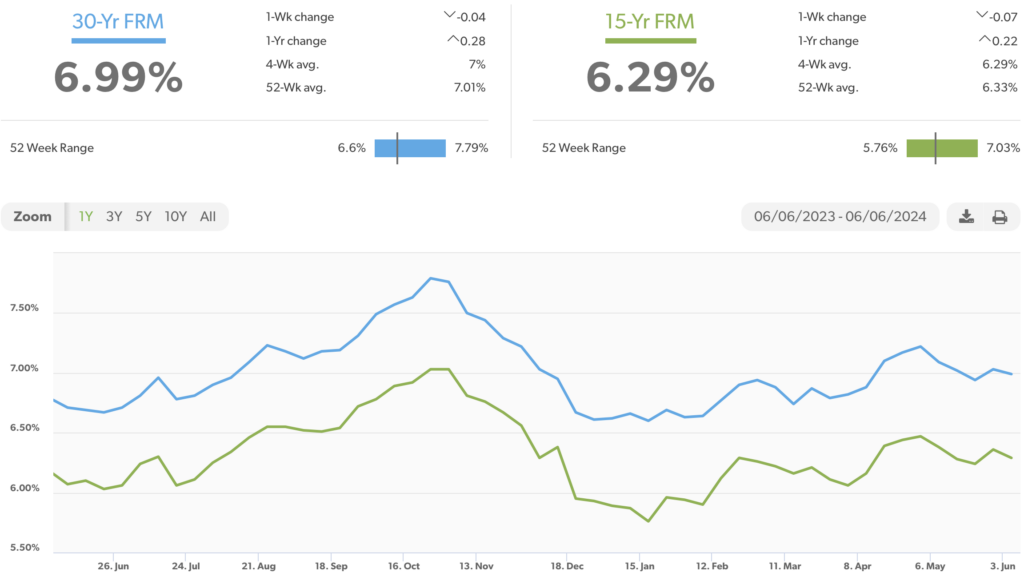

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey report

ed that mortgage rates for the most popular loan products as of June 6, 2024, were as follows: The 30-year fixed mortgage rate was 6.99%, down from 7.03% last week. The 15-year fixed was 6.29%, down from 6.36% last week. Rates rose after the jobs report was released on Friday. The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

News & Media