Round out the week with the top tech headlines from around the globe! From Apple Sports to Waymo and more, we have you covered with this week’s major news in the world of tech. Stay connected and read this week’s blog!

Bookshop.org Expands into Ebooks to Challenge Amazon

Launched in early 2020 as a way to support independent bookstores, Bookshop.org is now expanding into ebooks with a new app for Android, iOS, and the web. The app follows the same model as its physical book sales: customers choose a local bookstore to support, and that store earns a share of the profits. Founder and CEO Andy Hunter sees this as a necessary step in the digital age, challenging Amazon’s dominance over the ebook market, which accounts for 75% of sales. Bookshop.org has secured deals with major publishers and will launch with around a million titles, with plans to support self-published authors soon. A standout feature allows users to share quotes from ebooks directly to social media, making books more discoverable. While a Kindle competitor isn’t on the immediate horizon, Bookshop.org’s entry into ebooks could disrupt the status quo and provide indie bookstores with a much-needed foothold in the digital market.

Vodafone Tests Satellite Video Calls for Standard Smartphones

Vodafone has successfully conducted what it claims is the world’s first satellite video call using a standard smartphone, leveraging AST SpaceMobile’s satellite network to enable 4G and 5G connectivity without specialized hardware. The call, made from a remote mountain region in Wales with no prior mobile coverage, showcased stable—though slightly lagging—video quality. AST SpaceMobile, which has partnerships with Vodafone, AT&T, and Verizon, plans to roll out the service in Europe by late 2025 and in the U.S. thereafter. Unlike existing satellite services on iPhones and Google Pixel devices, which are limited to emergency messaging, Vodafone promises a full mobile broadband experience with speeds up to 120 Mbps. The technology aims to eliminate coverage gaps, offering connectivity even in remote areas and at sea. While SpaceX’s Starlink has also demonstrated satellite video calls, Vodafone’s test highlights its potential for widespread consumer use. Pricing details for the service remain undisclosed, but Vodafone sees it as a major step toward closing the digital divide across Europe.

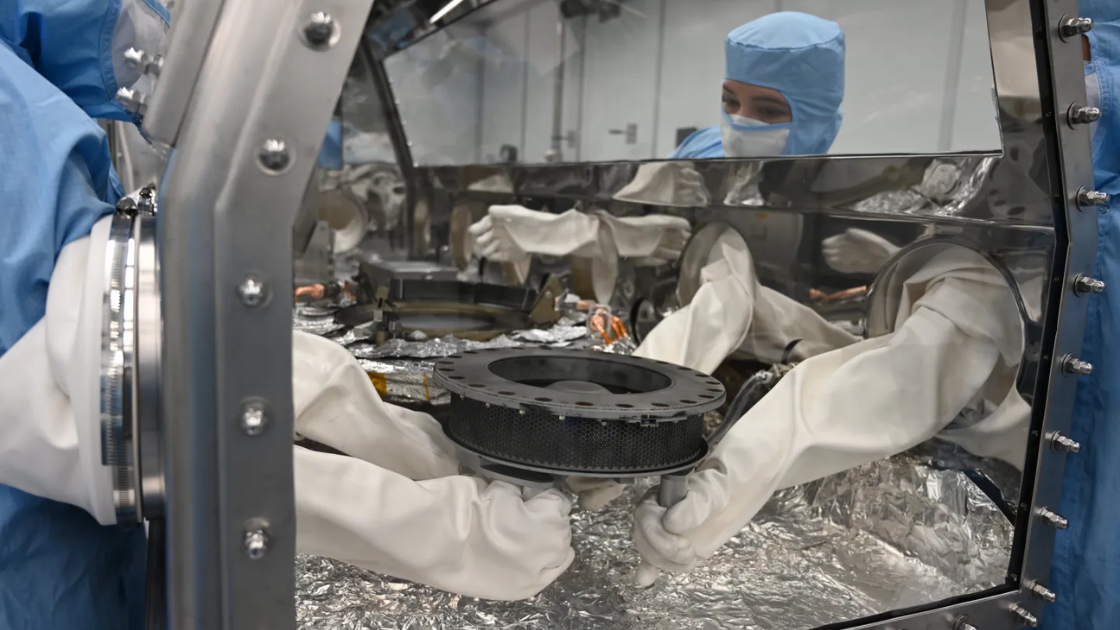

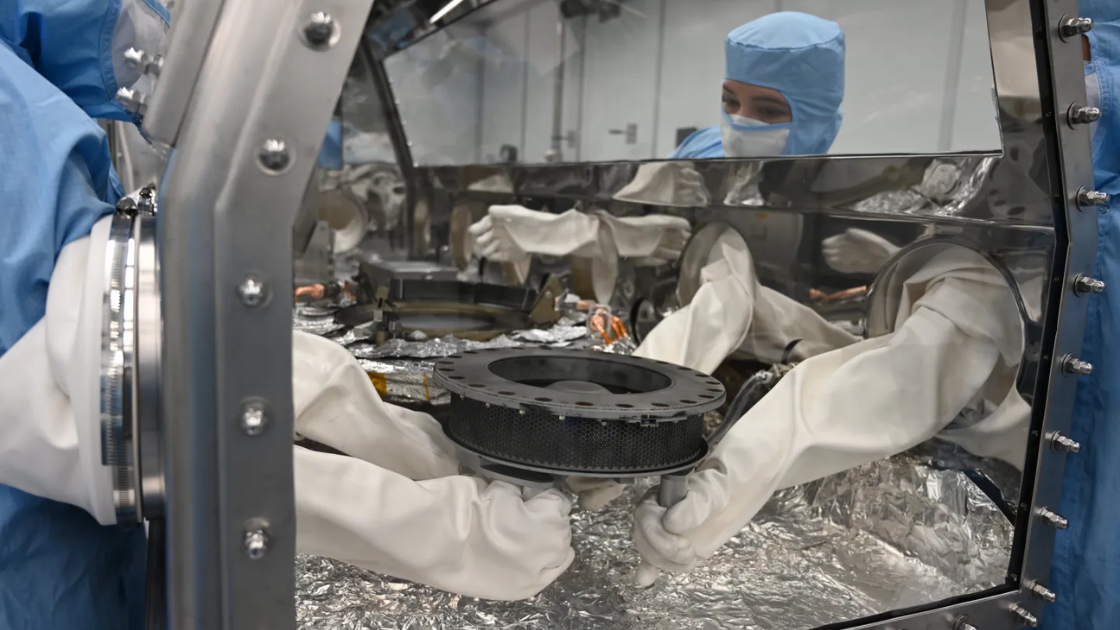

NASA Finds Building Blocks of Life in Bennu Asteroid Sample

Scientists analyzing the Bennu asteroid sample, which returned to Earth in September 2023, have discovered amino acids and other molecules essential for life. Research published in Nature and Nature Astronomy suggests that conditions necessary for life’s emergence were widespread in the early solar system, supporting theories that key organic compounds may have originated in space. The sample contained 14 of the 20 amino acids used in Earthly proteins, nucleobases for DNA and RNA, and minerals indicating a history of saltwater, which could have facilitated complex chemical reactions. These findings stem from NASA’s OSIRIS-REx mission, which launched in 2016, collected the sample in 2020, and successfully returned it in 2023. While not proof of extraterrestrial life, the discovery strengthens the possibility that life’s ingredients may have formed elsewhere in the cosmos.

Waymo Expands Autonomous Vehicle Testing to 10 New Cities in 2025

Waymo is set to expand its autonomous vehicle testing to 10 new cities in 2025, beginning with Las Vegas and San Diego, as part of an effort to assess how its self-driving system adapts to different environments. While these manually driven test runs won’t necessarily lead to immediate robotaxi launches, they will help refine Waymo’s ability to operate in diverse urban conditions. Las Vegas presents challenges like dense traffic and unconventional road layouts, while San Diego serves as a benchmark for how Waymo’s system performs with minimal prior data. The Alphabet-owned company is focused on “generalizability,” aiming to streamline the process of deploying robotaxis in new cities with minimal testing. Waymo will send fewer than 10 vehicles to each city for a few months, primarily in commercial districts, and will work closely with local officials. With plans for future launches in Austin, Atlanta, and Miami, this expansion signals Waymo’s ambition to scale its autonomous technology nationwide.

Boom Supersonic’s XB-1 Breaks Sound Barrier in Historic Test Flight

Boom Supersonic’s prototype test plane, the XB-1, successfully broke the sound barrier three times during its 12th flight. Likewise, this marks a major milestone for the private aviation company. The 63-foot-long demonstrator aircraft, designed to pave the way for Boom’s planned Overture supersonic airliner, reached Mach 1.1. This achievement makes it the first civil aircraft to go supersonic. This of course distinguishes it from the government-backed Concorde, which last flew in 2003. The flight, lasting 34 minutes, took place in the Bell X-1 Supersonic Corridor, named after the first aircraft to break the sound barrier. Powered by three General Electric J85-15 turbojet engines, the XB-1 serves as a testbed for the Overture. Boom aims to launch the Overture by 2030. The company has already secured over $700 million in funding and orders for a combined 35 aircraft. Overall, this signals growing confidence in the return of commercial supersonic travel.

Apple Sports App Update Adds Faster Navigation, More Soccer Coverage, and TV Listings

Apple has updated its iOS Sports app with improved navigation, expanded soccer coverage, and new broadcast information for games in the U.S. Users can now swipe left or right to quickly browse their followed leagues and teams. In addition, game pages will display details on where to watch live broadcasts, such as NHL Network or TNT. The update also adds coverage for the UK’s FA Cup, EFL Championship, and League Cup. Since its launch in February, Apple Sports has steadily expanded. The app has added NFL and college football tracking, live scores, play-by-play updates, and Key Plays summaries. The latest enhancements continue Apple’s push to make the app a comprehensive hub for sports fans.