Legendary astronaut Buzz Aldrin has sold his Wilshire Corridor condo. As reported by the Los Angeles Times, Rodeo Realty’s Peter Maurice represented the buyer. The three-bedroom condo has an open floor plan and floor-to-ceiling windows with fantastic views of the city, the Wilshire Country Club golf course, and beyond. Aldrin, who is now 84, was the second man to walk on the moon in 1969.

Legendary astronaut Buzz Aldrin has sold his Wilshire Corridor condo. As reported by the Los Angeles Times, Rodeo Realty’s Peter Maurice represented the buyer. The three-bedroom condo has an open floor plan and floor-to-ceiling windows with fantastic views of the city, the Wilshire Country Club golf course, and beyond. Aldrin, who is now 84, was the second man to walk on the moon in 1969.

Rodeo Realty Agent Todd Jones Launches Real Estate Radio Show

Todd Jones, a Realtor with Rodeo Realty Studio City, recently launched a new radio show: Real Estate Radio LA. Todd’s show can be heard on AM1150 Sundays at noon. Todd interviews people about real-estate-related topics and has already had on a wide variety of guests including David Hatfield from CAST Locations to discuss how to make extra money by renting your home for films and commercials; Gary Morris, a Trust Attorney who discussed the importance of having a Living Trust; and Matt Moses to discuss the benefits of solar panels. His next broadcast will feature Charles Fleming, author of “Secret Stairs: A Walking Guide to the Historic Staircases of Los Angeles.” Mr. Fleming is also the entertainment industry business news editor at The Los Angeles Times.

Todd Jones, a Realtor with Rodeo Realty Studio City, recently launched a new radio show: Real Estate Radio LA. Todd’s show can be heard on AM1150 Sundays at noon. Todd interviews people about real-estate-related topics and has already had on a wide variety of guests including David Hatfield from CAST Locations to discuss how to make extra money by renting your home for films and commercials; Gary Morris, a Trust Attorney who discussed the importance of having a Living Trust; and Matt Moses to discuss the benefits of solar panels. His next broadcast will feature Charles Fleming, author of “Secret Stairs: A Walking Guide to the Historic Staircases of Los Angeles.” Mr. Fleming is also the entertainment industry business news editor at The Los Angeles Times.

For almost a decade Todd has been a top producing Realtor. From the beginning, his focus has been providing great customer service while informing and protecting his clients. Prior to selling Real Estate, Todd traveled the world working as a Producer of Television commercials for such clients as Home Depot, Chili’s, SONY, Chevrolet, and Jamaica Tourism to name only a few. Desiring to spend less time on the road and more time in Los Angeles with his family, Todd began working full time in his passion…real estate. Todd took to real estate immediately and was honored as Rookie of the Year for his first year, and he has continued as a top producer ever since.

For more info and to listen to past shows and view YouTube videos of the show please visit www.ToddJonesRadio.com.

Rodeo Realty Quoted In LA Times Article on Home Price Stablization

The real estate market is always changing. Right now the data seems to indicate that we are entering a time of market stablization (something Rodeo Realty president Syd Leibovitch began to predict late last year). The rapid growth of home prices has slowed and inventory still remains tight. Home sellers are testing the market and seeing multiple offers but the feeding frenzy of last year seems to have abated a bit. DataQuick’s latest numbers showed that the median price in Los Angeles County rose 10% in May to $450,000 from $410,000 a year earlier. This is significant but still lower than the big price jumps we were seeing last year.

The real estate market is always changing. Right now the data seems to indicate that we are entering a time of market stablization (something Rodeo Realty president Syd Leibovitch began to predict late last year). The rapid growth of home prices has slowed and inventory still remains tight. Home sellers are testing the market and seeing multiple offers but the feeding frenzy of last year seems to have abated a bit. DataQuick’s latest numbers showed that the median price in Los Angeles County rose 10% in May to $450,000 from $410,000 a year earlier. This is significant but still lower than the big price jumps we were seeing last year.

In an article on this phenomenon, Los Angeles Times reporter Tim Logan interviewed Mona Cohen of Rodeo Realty Brentwood for her hands-on view of the local market. Mona explained that she often has to explain to sellers that they need to be realistic about pricing.

“They still think they’re in that little bubble of 2013, where you’d put it on the market and have 15 offers,” Mona told the Times. “That still happens in pockets. But buyers have become a lot more savvy.”

Rodeo Realty Sells Jayceon Taylor's Home

Rodeo Realty’s Ed Dolce and Kenneth Marker have sold the Glendale home of Jayceon Taylor, the rap musician and reality TV actor known as Game or the Game as reported by the LA Times. The home sold for $1.63 million.

Rodeo Realty’s Ed Dolce and Kenneth Marker have sold the Glendale home of Jayceon Taylor, the rap musician and reality TV actor known as Game or the Game as reported by the LA Times. The home sold for $1.63 million.

The four-bedroom house was built in 1958 and has an open floor plan that includes a gourmet kitchen with maple cabinets. The master suite includes lots of closet space and an entertainment center. The family room has custom built-ins and there is also a game room. The entertainer’s backyard includes a pool and custom barbecue area. Congratulations to the new owner!

Rodeo Realty Local Market Report–San Fernando Valley–May 2014

Below is the local market report for the San Fernando Valley for May 2014. The report details real estate market statistics with year-over-year data on median price and days on market.

Rodeo Realty Conejo Valley Local Market Report–May 2014

Below is the Conejo Valley Market Report for May 2014 detailing local real estate market statistics and including year-over-year data:

Rodeo Realty Westside Los Angeles Local Market Report–May 2014

Below is the Los Angeles Westside Market Report for May 2014 detailing local real estate market statistics and including year-over-year data:

Rodeo Realty Lists Jack Black's Former House

This gorgeous architectural newly listed by Joe Babajian and Stephen Walton of Rodeo Realty has quite the celebrity history. As Zillow reports, the modern home on a private cul-de-sac in Los Feliz was previously owned by actor Jack Black and his wife Tanya Haden. Black bought in 2006 and he and Hayden did a major remodel. They sold the home once they had children.

This gorgeous architectural newly listed by Joe Babajian and Stephen Walton of Rodeo Realty has quite the celebrity history. As Zillow reports, the modern home on a private cul-de-sac in Los Feliz was previously owned by actor Jack Black and his wife Tanya Haden. Black bought in 2006 and he and Hayden did a major remodel. They sold the home once they had children.

The home has walls of glass, steel commercial beams, and concrete floors. The gourmet kitchen opens to the great room. The master suite includes a spa-like bath. Outside there is a large swimmer’s pool, water elements, and outdoor dining pavilions that are the perfect spot to entertain. It is listed for $2.899 million.

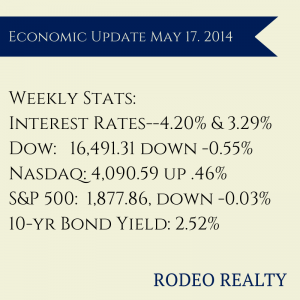

Economic Update For The Week Ending May 17th, 2014 By Syd Leibovitch

Home mortgage rates dropped this week to the lowest levels of the year! This was due to a combination of some lower than expected profits on Wall Street, worries that the stock market may be topping out, and an influx of foreign money looking for safety. Money moving to treasury bonds rather than stocks drives rates down.

Home mortgage rates dropped this week to the lowest levels of the year! This was due to a combination of some lower than expected profits on Wall Street, worries that the stock market may be topping out, and an influx of foreign money looking for safety. Money moving to treasury bonds rather than stocks drives rates down.Rodeo Realty's Ben Salem Featured In San Fernando Valley Business Journal

Rodeo Realty’s Ben Salem was recently featured in the San Fernando Busisness Journal for breaking ground on what will be the first of three upscale multi-family projects. The Weddington Villas is a a seven-unit townhome complex on Sepulveda Boulevard near the Sherman

Rodeo Realty’s Ben Salem was recently featured in the San Fernando Busisness Journal for breaking ground on what will be the first of three upscale multi-family projects. The Weddington Villas is a a seven-unit townhome complex on Sepulveda Boulevard near the Sherman

Oaks Galleria that will have 2,000-square-foot units with the latest amenities. Ben was quoted in the article describing the units saying that he wanted to do something that has never been done in the Valley before. “This is going to be super sexy and sort of New York,” he told the Journal. “Elevators going directly into the buildings, terraces on the roof, a lot of exposed steel – something very young and hip.”

The project should be completed in November and units will be priced between $700,000 and $800,000. Ben and his partners have two other projects in the works: Hermitage Town Homes, a five-unit development of 2,000-square-foot townhomes in Valley Village; and

the Coldwater Villas in Studio City, an eight-unit complex of 1,600-square-foot condos.