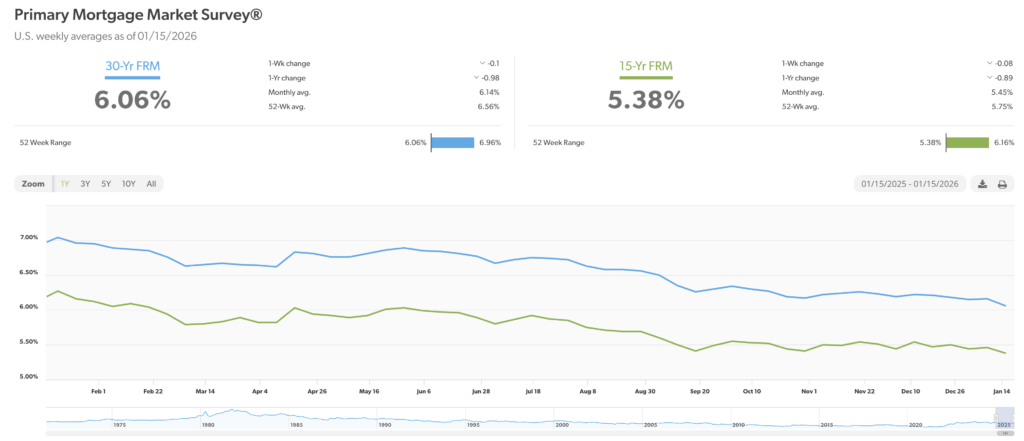

| Mortgage rates hit their lowest level in one year – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of January 15, 2026 were as follows: The 30-year fixed mortgage rate was 6.06%, down from 6.16% last week. The 15-year fixed was 5.38%, down from 5.46% last week.

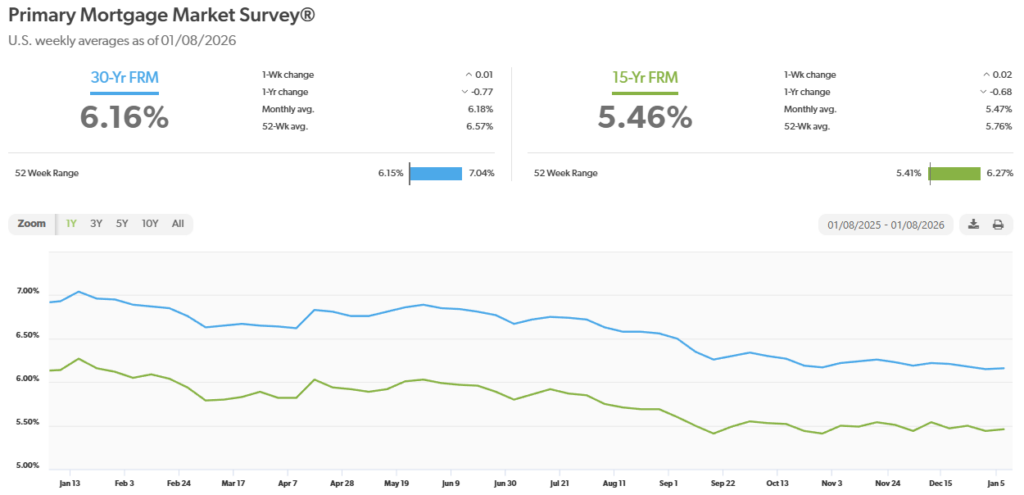

The graph below shows the trajectory of mortgage rates over the past year.

Consumer prices show inflation levels remained unchanged in December- The December Consumer Price Index (CPI) was released this week. It showed that consumer prices rose 2.7% from one year ago in December. This was slightly higher than analysts expectations of a 2.6% annual increase. Core CPI, which excludes volatile goods like food and energy rose 2.6% on an annualized basis. This was below the 2.7% increase experts forecasted The graph below shows the CPI rate since 2021

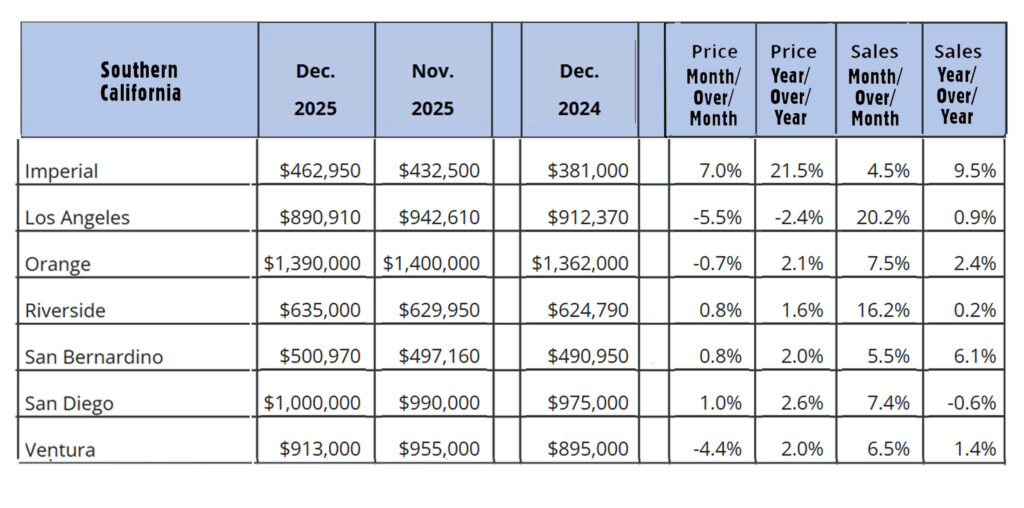

The Dow Jones Industrial Average closed the week at 49,359.33, down 0.3%from 49,504.07 last week. It is already up 2.7% from 48,063.29 on December 31, 2025. The S&P 500 closed the week at 6,940.01, down 0.4% from 6,966.28 last week. The S&P is up 1.4% from 6,845.50 on December 31, 2025. The Nasdaq closed the week at 23,515.39, down 0.2% from 23,702.88 last week. It is up 1.2% from 23,241.99 on December 31, 2024. The 10-year treasury bond closed the week yielding 4.24% up from 4.18% last week. The 30-year treasury bond yield ended the week at 4.83%, almost unchanged from 4.82% last week. We watch bond yields because mortgage rates follow bond yields. California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 288,200 on an annualized basis in December, up 2% from a revised 282,490 last December. The statewide median price paid for a home in was $850,680 in December, down 0.4% from $855,680 in November. The statewide median price peaked at $910,160 in April before falling steadily each month to end the year down 7% from its peak. Year-over-year the median price dropped 1.3% from $861,020 on December 31, 2024. California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 288,200 on an annualized basis in December, up 2% from a revised 282,490 last December. The statewide median price paid for a home in was $850,680 in December, down 0.4% from $855,680 in November. The statewide median price peaked at $910,160 in April before falling steadily each month to end the year down 7% from its peak. Year-over-year the median price dropped 1.3% from $861,020 on December 31, 2024.

Have a Great Weekend! |

Mortgage Rate Update | January 15, 2026

Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of January 15, 2026 were as follows:

The 30-year fixed mortgage rate was 6.06%, down from 6.16% last week. The 15-year fixed was 5.38%, down from 5.46% last week.

The graph below shows the trajectory of mortgage rates over the past year.

From NBC Sports AI to Google’s Veo 3.1 and More! | Tech News

Stay in sync with what’s happening in the world of tech! From NBC Sports AI to Google’s Veo 3.1 and more, we have you covered on this week’s headlines. Check out what’s happening from across the web below!

YouTube adds teen time limits for Shorts to parental controls

YouTube now lets parents set explicit time limits for kids’ and teens’ Shorts viewing, with presets from 15 minutes up to two hours and an option to set zero minutes soon — kids and teens won’t be able to disable those limits on their end. The feature extends YouTube’s broader effort to classify and restrict under-18 accounts, letting parents also set Bedtime and Take-a-Break reminders and manually choose the account’s age category during signup. It’s a familiar move in platform safety land — aligning YouTube with Instagram and TikTok’s earlier nudges toward under-18 restrictions — and it’s designed to reduce endless scrolling without requiring new hardware or extra apps. For families, the change is straightforward: more parental control over how long Shorts can be a background habit. Expect rollout to be gradual as YouTube tightens age estimation and account classification.

NBC Sports and Nippon TV lean on AI tracking to follow favorite players live

NBC Sports and Nippon Television are piloting AI-driven player tracking that lets viewers follow specific athletes in real time. Offering personalized camera feeds and mobile experiences, the NBC Sports tracking spotlights chosen players’ motion and statistics. The NBC Sports system combines computer vision and telemetry to identify and isolate athletes on the field. Likewise, this delivers view layers that can show replays, positional overlays, and player-centric angles. The new development from NBC Sports is great for fans who want a single-player focus. For rights holders and broadcasters, the tech opens new engagement windows and targeted ad opportunities. The approach by NBC Sports also highlights how augmented broadcast tooling can make linear sports feel more like a choose-your-own-camera experience. Privacy and data-use guardrails will matter as broadcasters refine how much personal tracking and derived metadata live inside viewer apps.

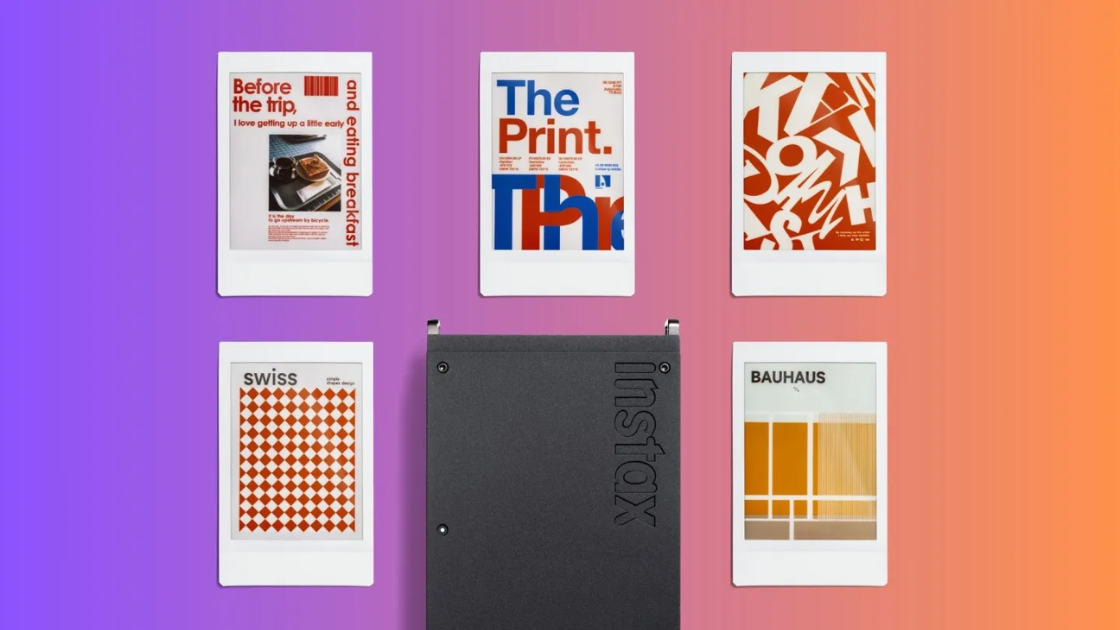

Fujifilm’s Instax Mini Evo Cinema Link Plus blends instant prints with cinema tricks

Fujifilm updated its Instax Mini Evo line with the Cinema Link Plus, a printer and companion workflow that leans into short video and cinematic stills — letting users pull clips, capture high-speed moments, and pair them with Instax prints for tactile keepsakes. The product keeps the charm of instant film while adding features aimed at creators who want shareable physical artifacts from their mobile video moments. It’s a reminder that analog formats still have cultural value when married to clever digital features that boost storytelling and shareability. For creators who love tangible content, the Evo Cinema Link Plus is a neat bridge between moving images and printed nostalgia. Pricing and availability put it squarely in the impulse-buy/gift category for makers who want to mix analog and digital play.

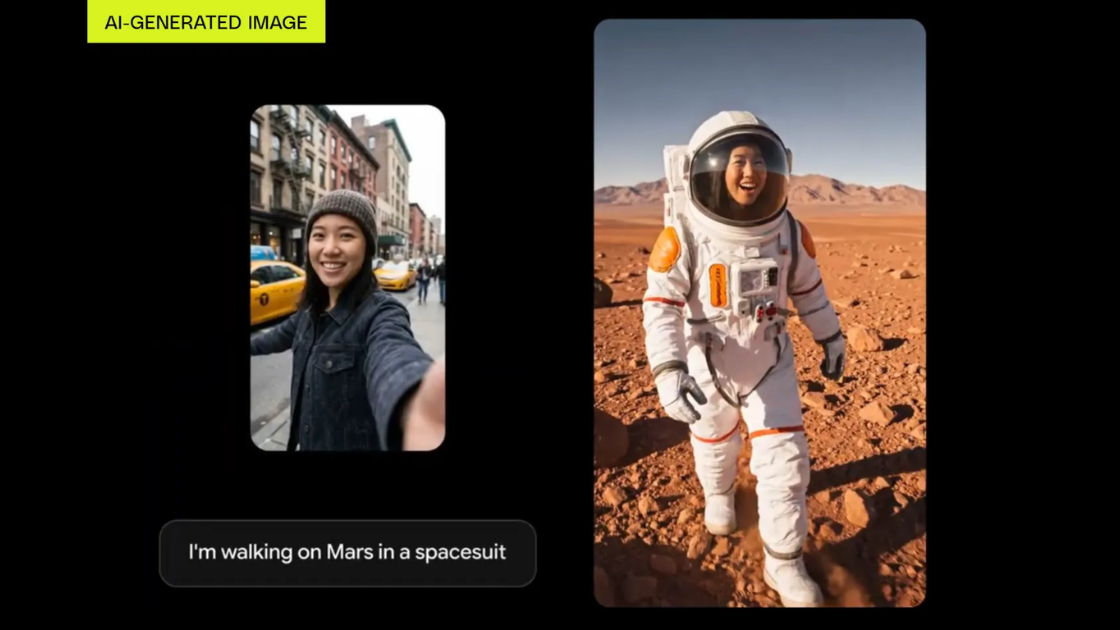

Google’s Veo 3.1 makes vertical AI videos out of portrait images

Google updated Veo to version 3.1, expanding its AI “video ingredients” toolkit to convert portrait photos into vertical, scroll-ready video clips and to provide creators with faster, more native outputs for short-form platforms. The update improves framing, motion synthesis, and audio-linked transitions so a still portrait can become a dynamic, mobile-ready clip without heavy manual editing. For social creators and publishers, it cuts production time by turning existing image assets into vertical-first content that fits modern discovery surfaces. As platforms prioritize short vertical formats, Veo’s enhancements underscore how image→video pipelines will be a central productivity lever for small teams and solo creators. Expect iterative quality improvements as Google refines motion realism and context preservation.

Apple’s Creator Studio apps aim to compete with Adobe for in-house creatives

Apple debuted a Creator Studio suite — apps and subscription tooling that help creators edit photos and videos, design assets, and publish across Apple platforms — positioning itself as a more integrated alternative to third-party suites like Adobe’s. The apps are built to take advantage of on-device silicon and Apple’s media frameworks, promising smooth performance and tight OS integration for iPhone, iPad, and Mac workflows. Apple pitches the suite as a simpler, cohesive home for creators who want fewer app handoffs and native optimization rather than plugin-driven workflows. For pro teams, the new tools won’t replace high-end packages overnight, but for many creators, the convenience of a unified Apple stack could be enough to justify a subscription. Watch how Adobe responds and whether the ecosystem shift nudges creators toward Apple’s vertical convenience.

Anker’s new whole-home backup system scales portable power into true home redundancy

Anker revealed a whole-home backup system that links modular battery units with power distribution so households can run essential circuits during outages without paying enterprise prices for full home batteries. The system is designed for easier installation and scalability — add modules to increase capacity and route critical loads through a simple interface — making emergency power more accessible to renters and homeowners who need temporary resilience. For people prepping for storms or relying on at-home healthcare devices, this lowers the barrier to dependable backup power without major remodeling. The tradeoffs remain cost, space, and the need for safe electrical installation, but as portable energy tech matures, product-fit and service integration get closer to mainstream adoption. Expect these systems to appeal to the growing market of pragmatic resilience buyers rather than luxury off-grid enthusiasts.

Weekend Events | January 16 – January 18, 2026

If you’re looking for ways to celebrate your holiday weekend, we have you covered! From MLK Jr. Day celebrations to the iHeart Radio’s 2026 ALTer Ego and more, there is something for all to enjoy! Check out what’s happening in your neighborhood from January 16 through January 18.

Los Angeles Weekend Events | January 16 – January 18

Smorgasburg LA

When: Through December 20, 2026

Where: DTLA

What: Every Sunday, ROW DTLA transforms into a bustling Brooklyn-style market where dozens of beloved pop-ups and rising foodie stars serve up everything from comfort classics to inventive mashups. This year, 13 new vendors join the roster — think Terrible Burger’s orange-chicken sandwiches, Franzl’s Viennese street eats, Mamani Pizza’s Neapolitan-meets-Persian pies, and plant-based corn dogs from Stick Talk — plus a family-friendly beer garden and shopping stalls with vintage finds and local jewelry; entry and the first two hours of parking are free.

Melrose Alpine Club

When: Until January 31

Where: West Hollywood

What: E.P. & L.P.’s rooftop in West Hollywood flips between a buzzy bar, alfresco movie nights, and pop-up activities — and this January–February, it becomes an ice rink courtesy of Aussie brand Hello Molly. Hour-long sessions include skate rental and a sweet treat (plus seasonal cocktails and killer city views); kids are welcome weekends from noon–3 pm, and the rink is 21+ outside those hours.

The Notebook

Where: Hollywood

When: Through January 25, 2026

What: See a stage adaptation of The Notebook, based on Nicholas Sparks’ best-selling novel and reimagined as a musical. Featuring music and lyrics by Ingrid Michaelson, this emotional production brings the sweeping romance of Allie and Noah to life with stirring songs and heartfelt performances.

Westside & Beach Communities Weekend Events | January 16 – January 18

iHeartRadio ALTer Ego

When: January 17, 2026

Where: Inglewood

What: Get ready for a night of big hooks and bigger guitars as the iHeartRadio ALTer EGO festival returns to the Kia Forum. Headliners include Green Day, Twenty One Pilots, and Cage the Elephant, with Sublime, Good Charlotte, Myles Smith, Gigi Perez, and Almost Monday also hitting the stage. Can’t make it to Inglewood? You can catch the whole show live on ALT 98.7 on January 17.

Astra Lumina

When: Until January 31, 2026

Where: Rancho Palos Verdes

What: Wander through a glowing garden of stars at South Coast Botanic Garden’s year-end light show, where nine celestial-themed installations illuminate a dreamy Palos Verdes trail. While it’s not a traditional holiday display, the experience is both mesmerizing and meditative, especially with optional pre-walk breathwork classes offered on select nights. Expect a tranquil, wellness-inspired spin on L.A.’s after-dark botanical trend.

Ice at Santa Monica

When: Until January 19, 2026

Where: Santa Monica

What: Just steps from the beach, Ice at Santa Monica brings festive winter fun to the coast with its 8,000-square-foot outdoor skating rink. Open daily through mid-January at Fifth and Arizona, admission is $24 for a one-hour session with skate rentals included. Expect seasonal treats, cozy fire pit rentals, and themed events like classical music Sundays.

San Fernando Valley Weekend Events | January 16 – January 18

The Art of Fresh Pasta Making at The Green Room

Where: The Green Room | Burbank

When: January 16, 2026

What: If your idea of cooking is DoorDash and a prayer, it’s time to upgrade. For one night only, The Green Room at Castaway is hosting Italian chef Roberta D’Elia—flying in with Pasta Evangelists—to teach you how to make fresh cavatelli and orecchiette by hand. The night includes bottomless prosecco, an over-the-top antipasti spread, and dinner under the stars with the L.A. skyline as your backdrop.

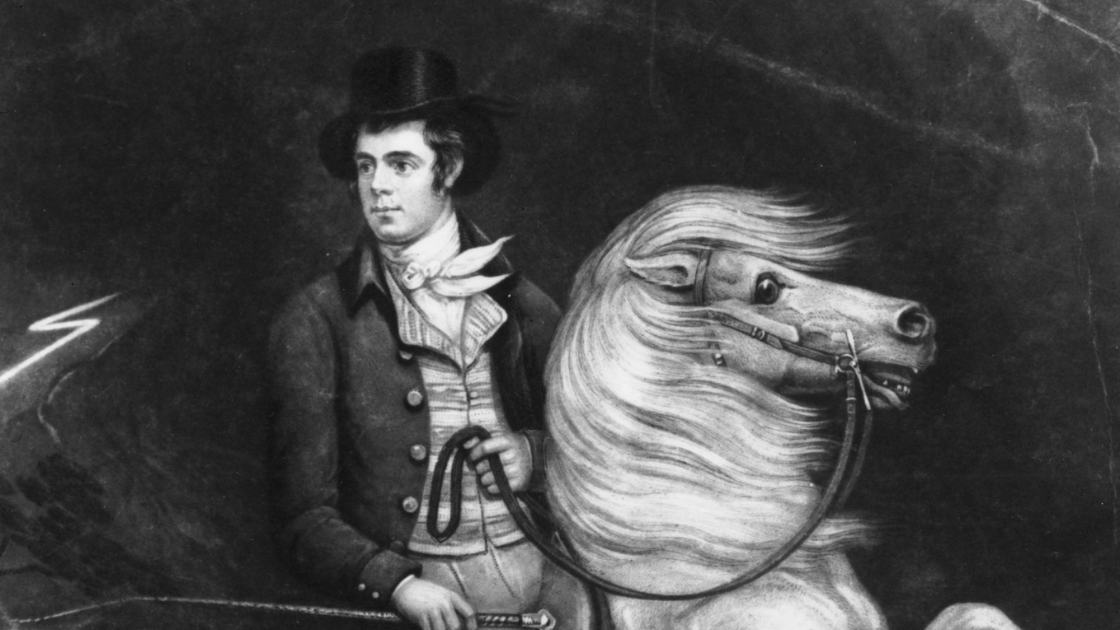

Celtic Arts Center’s 25th Annual Robert Burns Celebration

When: January 17

Where: The Mayflower Club | North Hollywood

What: Raise a glass to the Bard of Scotland at the Celtic Arts Center’s 25th Annual Robert Burns Celebration! This festive evening features a traditional Scottish supper, live music, poetry readings, and audience participation, from toasts to Burns songs. Choose from classic entrées like Bangers & Mash or Vegan Shepherd’s Pie, and don’t forget the haggis, whisky, and Highland piper to round out the night.

Community Day at the Farm

When: January 17

Where: Cottonwood Urban Farm | 8380 Ventura Canyon Avenue

What: Join Behind the Beet and Juntas Social for a family-friendly Community Day at Cottonwood Urban Farm in Panorama City. Enjoy a vibrant morning filled with a clothing swap, wellness and eco-friendly vendors, chai, kids’ nature crafts, and more—set among fruit trees, chickens, and bees at this serene urban oasis. Bring gently used clothes to swap, a reusable bag, and soak up the community vibes.

Conejo Valley Weekend Events | January 16 – January 18

Underwater Parks Day Festival at Sea Center

When: January 17, 2026

Where: 211 Stearns Wharf, Santa Barbara

What: Celebrate marine conservation at the Santa Barbara Museum of Natural History Sea Center’s Underwater Parks Day on Saturday, January 17, 2026. This free, family-friendly event highlights California’s marine protected areas with hands-on activities, educational booths, and engaging talks from ocean scientists and conservationists. Enjoy a day of ocean discovery on Stearns Wharf and learn how to get involved in protecting our coastal ecosystems.

Free Sound Meditations Event in Ventura

When: January 17, 2026

Where: 175 S Ventura Ave, Ventura

What: Sound Meditations offers a restorative evening where sacred music and mindful sound practices converge. The event is hosted by Sound and Song Retreats and the Ventura County Vibe Well Initiative. Likewise, this immersive program blends choral music, chant, breathwork, Alexander Technique, and sound therapy. Featuring Seraphour and artists from Los Robles Children’s Choir, the free event invites guests to relax, reflect, and reconnect through a rich, calming soundscape that supports balance and inner peace.

Ventura County’s Annual Martin Luther King, Jr. Celebration

When: January 19, 2026

Where: 800 Hobson Way, Oxnard

What: Honor the life and legacy of Dr. Martin Luther King, Jr. at the 40th Annual Ventura County MLK Celebration on Monday, January 19, 2026. The morning begins with a Freedom March from Plaza Park in Downtown Oxnard to the Oxnard Performing Arts Center. The celebration will feature a commemorative program, featuring keynote speaker Dr. Gaye Theresa Johnso, which will follow at 9 a.m. Admission is $10 and includes refreshments.

New Local Dining Spots | L.A. Eats

Craving something new? L.A.’s local dining scene continues to deliver with fresh, buzzworthy openings across the city. From upscale Thai to modern Korean comfort food and buzzy pizza joints, these ten newcomers are worth a spot on your next dining itinerary.

Holy Basil Santa Monica

Location: 2828 Santa Monica Boulevard, Santa Monica, CA 90404

After nearly a year of anticipation, chefs Arpapornnopparat and Yuon bring their acclaimed Thai concept to the Westside. The new local Santa Monica location of Holy Basil delivers bold dishes like tom yum risotto and wagyu gra pow, along with inventive non-alcoholic drinks such as dragonfruit rosemary soda. Beer, wine, and sake will soon join the lineup, making this one of the most exciting new restaurants in Los Angeles.

Broken Spanish Comedor

Location: 12565 W Washington Boulevard, Los Angeles, CA 90066

Chef Ray Garcia revives his Alta California concept in Culver City with Broken Spanish Comedor. Signature plates like chicharrón and refried lentils return alongside smoky Caesar salad and shrimp in spiced tomato broth. Sip on Palomas, wine, or housemade zero-proof orange Fanta while soaking up the sophisticated ambiance.

The Mulberry

Location: 1800 Sawtelle Boulevard, Los Angeles, CA 90025

A new local Korean American bistro with a California twist, The Mulberry serves home-style dishes updated with seasonal ingredients. Try the aguachile with cold kimchi broth or the spicy braised black cod. Cocktails are curated to match the flavors, making it a modern standout on Sawtelle.

Super Peach

Location: 10250 Santa Monica Boulevard, Los Angeles, CA 90067

Located in Westfield Century City, Super Peach is David Chang’s take on laid-back, upscale dining. With Korean fried chicken, lobster noodles, and gimbap on the menu, plus creative cocktails like the red miso michelada, it’s quickly become a go-to destination for foodies exploring new restaurants in Los Angeles.

Fiorelli Pizza

Location: 8236 W 3rd St, Los Angeles, CA 90048

Fiorelli Pizza transitions from pop-up to permanent Beverly Grove local eatery with a craveable menu of white pies, vegan options, and classic pepperoni. Add in tinned fish, meatballs, and a rotating list of seasonal specials (like the octopus sandwich), and you’ve got a pizza spot worth bookmarking.

The Night We Met

Location:788 S La Brea Avenue, Los Angeles, CA 90036

From the team behind Met Her at a Bar, this Asian fusion concept offers comforting yet elevated fare. Soft shell crab curry, tuna crudo, and crying tiger rib-eye headline the menu. Enjoy it all with pandan-spiked cocktails in a stylish Wilshire setting.

Maydan Market

Location: 4301 W Jefferson Boulevard, Los Angeles, CA 90016

This massive local West Adams food hall is home to a full-service restaurant and several vendors offering globally inspired eats. From D.C.’s Michelin-recognized Maydan to tamales and tlayudas, Maydan Market is a true culinary destination.

Little Fish Melrose Hill

Location: 5035 Melrose Avenue, Los Angeles, CA 90038

From fish sandwiches to soy-cured mussels, this sunny Melrose Hill expansion delivers fresh takes on West Coast seafood. Come for lunch or dinner and stay for a glass of wine paired with abalone rice-stuffed cabbage.

Chainsaw Cafe

Location: 5022 Melrose Avenue, Los Angeles, CA 90038

What began as a dinner party pop-up now has a permanent home. Chef Karla Subero Pittol dishes out Venezuelan favorites like empanadas, arepas, and passionfruit lime icebox pie. Open morning and night, Chainsaw brings flair to Melrose Hill.

Corridor 109

Location: 641 N Western Avenue, Los Angeles, CA 90004

This intimate 10-seat tasting counter in Melrose Hill offers an 11-course seafood-forward menu crafted by chef Brian Baik. Expect refined bites like aji toast and ikura tartlets with thoughtfully paired wines and sake.

Where to Enjoy a Winter Hike | Out & About

While some cities retreat indoors for winter, Los Angeles embraces the season with crisp air, clear skies, and perfect conditions for outdoor exploration. Winter is arguably the best time to hit the trails in Southern California for a nice winter hike. If you’re craving movement and views that stop you in your tracks, these outdoor winter hikes deliver both with plenty of fresh air and photo ops.

Solstice Canyon

Location: Malibu

Solstice Canyon is a perennial favorite for hikers in Malibu, and winter makes it even better. The trail is mostly shaded and offers a leisurely 3-mile loop for a lovely winter hike. Stroll through lush greenery, crumbling ruins of historic homes, and a seasonal waterfall that comes to life after a good rain. The cooler weather means fewer bugs, less sunburn, and more time to linger at the falls or take in views of the Santa Monica Mountains. Pro tip: Go early in the day for golden light filtering through the trees.

Escondido Falls

Location: Malibu

Escondido Falls is one of the most scenic outdoor winter hike spots in LA County—especially when recent rain brings the cascading waterfall back to life. The lower falls are accessible via a relatively easy 3.8-mile round-trip hike through oak groves and open meadows. Winter rains transform the trail into a lush wonderland, and the final reward is a dramatic 150-foot waterfall surrounded by mossy rock walls. Wear sturdy shoes, as parts of the trail can get muddy.

Griffith Park Trails

Location: Los Feliz/Hollywood

With over 50 miles of trails, Griffith Park is a local go-to year-round, but winter is prime time to explore its panoramic paths without breaking a sweat. The winter hike to Griffith Observatory or Mount Hollywood offers sweeping views of Downtown LA, the Pacific Ocean, and the San Gabriel Mountains—often dusted with snow in January. Cooler temperatures make the uphill climbs easier, and parking is usually less of a headache. Pack a thermos of coffee and enjoy sunrise or sunset with a view.

Baldwin Hills Scenic Overlook

Location: Culver City

This urban gem, also known as the Culver City Stairs, offers a short but steep workout with a huge payoff. The 282 uneven steps lead to a summit with incredible views of LA. Likewise, think skyline, ocean, and mountains all in one sweeping panorama. Winter is ideal for this exposed hike, as summer sun can be brutal. There’s also a winding switchback trail if stairs aren’t your thing. Whichever route you choose, the Baldwin Hills Scenic Overlook offers a fun challenge with a side of cityscape.

From waterfalls to city views, an outdoor winter hike in Los Angeles offers a chance to recharge, reconnect, and experience a side of the city that often gets overlooked. Layer up, grab your water bottle, and hit the trails. Winter hiking season is in full swing, and the views are better than ever!

Economic Update | Week Ending January 10, 2025

| It was a wild first week of the year. It began with US military action in Venezuela with the promise of returning US oil companies to run oil production, in what is believed to be the largest reserves of oil in the world. Followed by an announcement by President Trump to purchase mortgage securities to drop long-term interest rates, an estimate of fourth-quarter GDP that was off the charts, and a mixed December jobs report. This all caused stocks to surge to record highs.

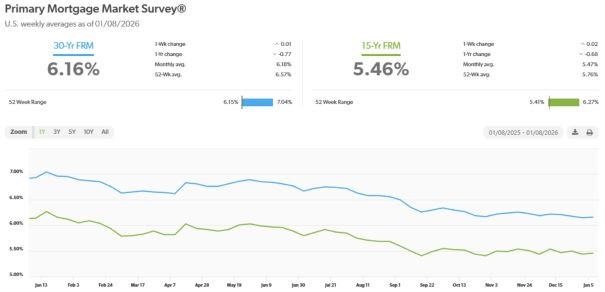

Housing & Mortgage Rates: President Trump announced a plan directing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities, a move aimed at putting downward pressure on mortgage rates and improving affordability. The idea is to help offset the Federal Reserve’s ongoing pullback from the mortgage market and narrow the spread between mortgage rates and Treasury yields. Still, the announcement has been viewed positively by markets as a signal of increased policy support for housing. We saw 30-year mortgage rates drip to under 6% on Friday after Thursday’s announcement, the lowest rate since 2022. Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of January 8, 2026, were as follows: The 30-year fixed mortgage rate was 6.16%, nearly unchanged from 6.15% last week. The 15-year fixed was 5.46%, nearly unchanged from 5.44% last week. If Friday’s rates hold, we will see a big dip in next week’s survey rates. The graph below shows the trajectory of mortgage rates over the past year.

December Jobs report shows hiring was sluggish while the unemployment rate dipped – Recent labor market data point to a continued moderation in U.S. hiring activity. The Bureau of Labor Statistics reported that 50,000 new jobs were added in December. That was below analyst’s expectations of 70,000. Revisions to the prior two months reduced reported job gains by a combined 76,000. As a result, average monthly job growth for 2025 stands at 49,000, down from 168,000 in 2024, and the three-month average has turned modestly negative. For the year employers added just 584,000 jabs last year, down from 2.2 million new jobs in 2024, marking its worst non-recession year of job growth since 2003. At the same time, the unemployment rate dropped to 4.4% in December, down from a revised 4.5% in November. That is better than economists’ expectations of 4.5% and below the long-term historical average of approximately 5.5%. Despite the slowdown in hiring, average hourly earnings rose 3.8% compared to one year ago. Estimated 4th quarter U.S. GDP suggest a surge in output – The Federal Reserve Bank of Atlanta’s GDPNow model sharply revised its estimate for U.S. fourth-quarter GDP growth to 5.4% annualized, up from roughly 2.7% just days earlier, driven by an unexpected plunge in the U.S. trade deficit and stronger consumer spending data. This dramatic jump reflects the trade gap narrowing to its lowest level since 2009, turning what had been a drag on growth into a significant contributor. While the GDPNow figure is a real-time nowcast rather than an official BEA release, it signals potentially robust economic momentum as we close out 2025 and reshapes market and policy expectations heading into 2026. Oil industry news – President Trump announced a US military action in Venezuela capturing and arresting President Nicolas Maduro over narcotic trafficking charges. This laid the groundwork for President Trump to announce that the US had control over Venezuelan oil and that US oil companies, who’s interests and investments in oil production was taken from them in 1976 when then President Carlos Andres Perez nationalized the oil industry, would be returned to US companies. Venezuela has the largest known oil reserves in the world. On Friday Trump hosted oil executives to formulate a plan to encourage investment to US oil companies into Venezuela promising security and cooperation from the Venezuelan government. The Dow Jones Industrial Average closed the week at 49,504.07 up 2.3% from 48,382.39 last week. It is already up 3% from 48,063.29 on December 31, 2025. The S&P 500 closed the week at 6,966.28, up 1.6% from 6,858.47 last week. The S&P is up 1.8% from 6,845.50 on December 31, 2025. The Nasdaq closed the week at 23,702.88, up 2% from 23,235.63 last week. It is up % from 23,241.99 on December 31, 2025. The 10-year treasury bond closed the week yielding 4.18%, almost unchanged from 4.19% last week. The 30-year treasury bond yield ended the week at 4.82%, down from 4.86% last week. We watch bond yields because mortgage rates follow bond yields. Have a Great Weekend! |

Winter Home Wellness | Home Tips

As the days grow shorter and temperatures dip, our homes become more than just a place to escape the cold; they become a refuge for our well-being. The concept of winter home wellness goes beyond simple comfort; it’s about cultivating a space that nurtures your mind, body, and spirit. Whether you’re seeking stillness after a busy year or craving more balance in your daily routine, small changes can lead to big emotional shifts. Here are some holistic enhancements to help turn your home into a cozy sanctuary this winter.

-

Start with Scent: Aromatherapy That Soothes

Scent is one of the quickest ways to shift your mood and create a sense of peace. Essential oil diffusers are a staple in winter home wellness, offering both functional and emotional benefits. Try grounding oils like cedarwood or frankincense to evoke calm, or energizing citrus blends to brighten gray afternoons. Ultrasonic diffusers also double as humidifiers, which can help with dry winter air.

-

Let There Be (Soft) Light

Lighting plays a major role in regulating mood and energy levels. Swap harsh overhead lights for soft, warm-toned lamps and candles. Himalayan salt lamps are a favorite for wellness enthusiasts, said to release negative ions and improve air quality. They also emit a calming amber glow that enhances any room. Cluster them in reading nooks, bedrooms, or meditation corners for a gentle touch of magic.

-

Breathe Easier with Air-Purifying Plants

Indoor plants are a year-round wellness win, but in winter, when windows are closed and heating systems run full throttle, they become even more essential. Snake plants, pothos, and peace lilies are low-maintenance options that naturally cleanse the air while adding color and life to your home. Group several together for a mini indoor jungle, or place one on your bedside table for a touch of serenity.

-

Design a Cozy Meditation or Reading Corner

One of the most impactful winter home wellness upgrades? Carving out a corner dedicated to quiet. Whether you meditate, journal, read, or just sip tea while doing nothing at all, having a designated space for stillness signals your brain to slow down. All you need is a soft floor cushion, a warm throw blanket, and perhaps a small shelf for candles or books. The goal isn’t perfection, it’s peace.

-

Incorporate Texture and Warmth

Wellness is sensory. Add plush textures through faux fur throws, wool rugs, velvet pillows, or soft flannel sheets. These tactile elements not only look inviting but also engage your sense of touch, a grounding force during times of stress. Layering fabrics and materials also helps your home feel more intimate and cocoon-like, perfect for chilly evenings.

-

Clear the Clutter, Clear the Mind

Lastly, give yourself the gift of space. A tidy environment can do wonders for your mental health, especially during the winter months when we spend more time indoors. Embrace small, manageable decluttering projects, like organizing a drawer or clearing off a countertop, to create breathing room for both your home and your headspace.

This winter, let your home support your inner world. By integrating elements of winter home wellness, you can create a space that not only protects you from the cold but also actively restores and rebalances you each day.

From Nintendo My Mario Merch to Microsoft CoPilot and More! | Tech News

Dive into this week’s leading tech news headlines. From Nintendo My Mario Merch to Microsoft CoPilot and more, we have you covered on the latest news. Check out what’s happening from across the web!

Microsoft’s Copilot now lets you buy without leaving chat

Microsoft unveiled Copilot Checkout, a new in-chat purchase flow that surfaces “Buy” buttons inside Copilot so you can choose a product, enter shipping and payment details, and complete checkout without opening a retailer’s site. The feature is rolling out with select partners (think Urban Outfitters, Anthropologie, and some Etsy sellers) and taps payment providers like PayPal, Stripe, and Shopify to power transactions. It’s part of a larger trend—agents moving from suggestion to action—so expect more assistants to blur discovery and commerce into one conversational loop. For shoppers, the convenience is obvious; for merchants, it’s a new placement to win conversions (and a new place to think about brand control and data). Keep an eye on how receipts, returns, and post-purchase service get handled when the cart never actually leaves the chat.

Nintendo brings My Mario merch to the U.S. Market

Nintendo is expanding its My Mario line in the U.S. next month with apparel, toys, books, and a mobile app. Likewise, this debut from Nintendo packages the brand’s cozy, character-driven merch into an owned-brand moment. The Nintendo initiative feels designed to turn fandom into low-friction, everyday touchpoints. Of course, think soft hoodies you actually want to wear and small toys that make for shareable social posts. For brand teams, it’s a reminder that IP monetization now lives across product, content, and companion apps rather than just game sales. The move by Nintendo also taps into nostalgia and collectible culture. If you’re curating lifestyle content, expect a new wave of Nintendo Mario-themed flatlays and influencer fits.

Bose open-sources old SoundTouch smart speakers

Bose surprised many by choosing to open-source the software for older SoundTouch smart speakers that were losing official cloud support, giving owners and hobbyist devs a route to keep devices useful rather than forcing e-waste. The code release lets community maintainers run local or self-hosted services, effectively turning obsolescence into an opportunity for DIY longevity. It’s a rare corporate move that respects customer hardware investments and empowers privacy-minded users to retain features without vendor lock. For the sustainability crowd, this is an encouraging precedent: when companies can’t or won’t keep cloud hooks live, handing control back to users is a practical, less-wasteful path. Watch whether other audio and smart-home brands follow Bose’s example when clouds fade.

Disney Plus tests vertical video to meet the short-form moment

Disney Plus is experimenting with vertical video formats — a nod to short-form viewing habits — so that bite-sized, portrait-first clips can live inside the streaming app alongside traditional widescreen fare. This is about more than orientation: it’s a play to surface snackable moments from franchises and to keep eyeballs inside Disney’s ecosystem when users are in a scroll mindset. Creators and social teams will appreciate another official home for repurposed clips and discovery loops that feed back into long-form viewing. For viewers, the experience should feel more native for mobile-first browsing, though the challenge is preserving cinematic intent while slicing content into portrait frames. Expect creative teams to test repackaged scenes, micro-edits, and vertical trailers as the format matures.

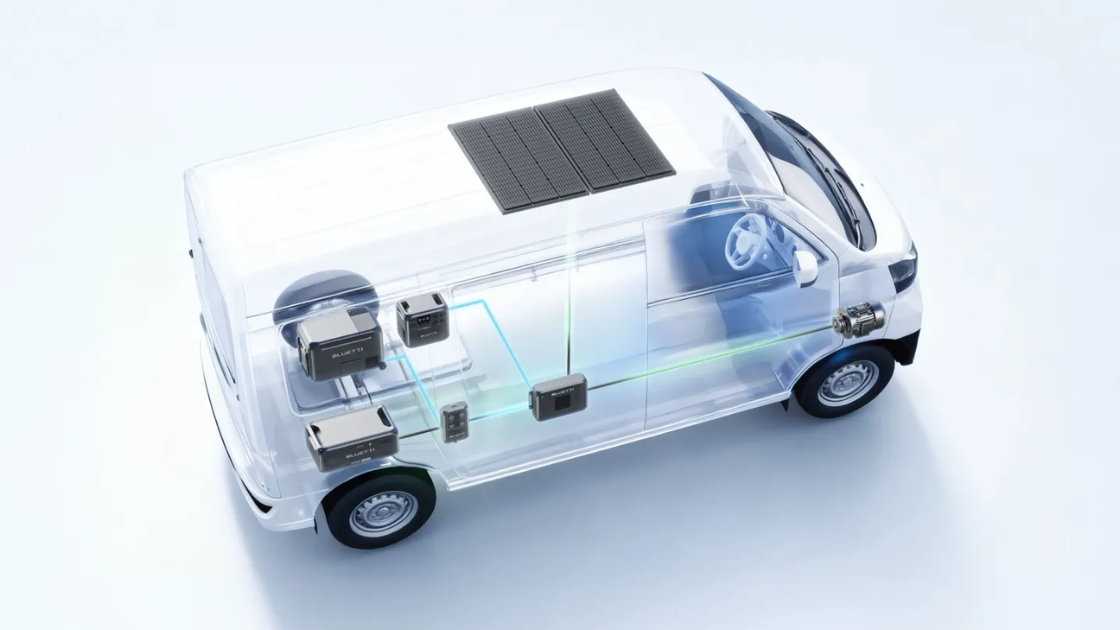

Bluetti lets you fast-charge power stations from your car at up to 1,200W

Bluetti updated its car-charging support so compatible power stations can now accept up to 1,200W from a vehicle’s inverter, dramatically cutting refill times on road trips and emergency runs. That change turns a car into a far more useful mobile charging hub for large batteries, making portable power stations actually practical for overnight uses or power interruptions while traveling. The tradeoffs are about vehicle wiring and inverter quality—this kind of throughput demands robust electrical systems and safe cabling—so installers and users should proceed with care. For overlanders, vanlifers, and emergency planners, the feature meaningfully shrinks the “refill” pain point and makes off-grid power more usable without long wait times. It’s another small step toward making portable energy feel less like camping gear and more like dependable mobile infrastructure.

L’Oréal’s Light Straight uses infrared to speed hairstyling

At CES, L’Oréal demoed Light Straight, a handheld styler that leverages targeted infrared heat to smooth hair faster with less thermal exposure than traditional flat irons. Early hands-on notes highlight quicker styling passes and a gentler feel on brittle hair, suggesting that light-based thermal strategies might be a real haircare innovation rather than a gimmick. For beauty tech product teams, the gadget is proof that category incumbents can meaningfully reengineer everyday rituals with science-backed heating methods. Consumers should expect premium pricing at first, but if the tech proves kinder to hair over time, adoption could spread beyond early adopters. Regulatory and safety testing will be important to watch as the category shifts from brute-force heat to smarter thermal delivery.

Amazon refreshes the Dash Cart for Whole Foods

Amazon unveiled a redesigned Dash Cart for Whole Foods that’s lighter, carries more, and includes tap-to-pay so shoppers can breeze through checkout even more smoothly than before. The cart’s iteration leans into convenience: improved sensors, better ergonomics, and a payment flow that reduces friction for fresh grocery runs. For retailers and in-store marketers, the cart remains an experiment in blending physical retail with digital ease—data from instrumented carts can inform aisle layout, promotions, and inventory. Privacy questions linger about in-store tracking, but the value proposition for a frictionless grab-and-go experience is undeniable for busy shoppers. Expect Amazon to keep iterating on the hardware and software interplay as it learns usage patterns at scale.

Mortgage Rate Update | January 8, 2026

Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of January 8, 2026 were as follows:

The 30-year fixed mortgage rate was 6.16%, nearly unchanged from 6.15% last week. The 15-year fixed was 5.46%, nearly unchanged from 5.44% last week.

The graph below shows the trajectory of mortgage rates over the past year.