|

Stock markets hit record highs before dropping at the end of January to end the month lower – Stock market indexes reached record-high levels in January, only to lose all of their gains in the last week of the month. Markets suffered their worst week since October as investors digested comments by the Fed, a disappointing fourth-quarter GDP report, increasing job losses, and a pullback in consumer spending. The Fed shocked investors early in the week when they made comments suggesting that their key overnight rates would remain at or near zero percent for an extended period which could last years after the pandemic is over. This suggested that the Fed has data that the impact of the pandemic on the economy would last longer than investors believed. On Friday a preliminary GDP report revealed that the economy contracted for the first time since the financial crisis, and suffered its largest yearly contraction since 1946. Retail and service sales reports showed that consumers had pulled back on purchases for goods and services in the fourth quarter, reversing a historic 33% quarter-over-quarter increase in the third quarter. Business investment, and residential real estate were sectors that surged in 2020, according to the GDP report. Job losses also increased in December and January as much of the country instituted more restrictions on business, including some states re-issuing stay-at-home orders. Fortunately, it’s widely believed that the $900 billion in stimulus from the CARES Act 2 that will be distributed in the first quarter of 2021 will increase consumer spending and grow the economy. Investors remain optimistic and expect the effects of the stimulus, the drop in COVID cases nationwide which has led to a loosening of restrictions and reopenings, increased vaccine disbursement, and future stimulus to continue to revive the economy, and boost hiring. The Dow Jones Industrial Average ended the month at 29,982.62, down 2.0% from 30,606.48 on December 31. The S&P 500 closed the month at 3,714.24, down 1.1% from 3,230.78 at the end of December. The NASDAQ closed the month at 13,079.69, up 1.4% from 12,888.28 on December 31, 2020.

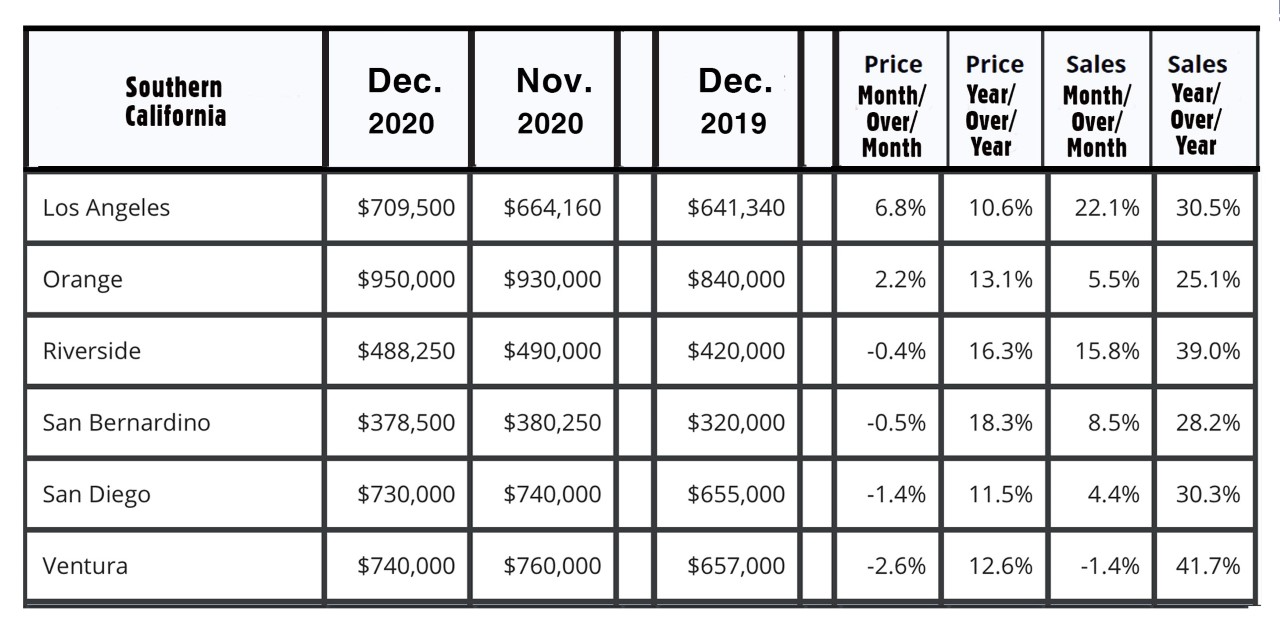

U.S. Treasury Bond Yields dropped sharply in 2020 – The 10-year U.S. treasury bond yield closed the year at 1.11%, up from 0.93% On December 31, 2019. The 30-year treasury yield ended the year at 1.87%, up from 1.65% on Dec. 31, 2019. We watch bond yields because mortgage rates follow treasury bonds. The U.S. Economy lost 140,000 jobs in December – Jobs data is reported on the first Friday of every month. This is the data for December. The Department of Labor Statistics reported that 140,000 non-farm jobs were lost in December. This marked the first month of net job losses since April. As COVID-19 cases continue to spike, most states and local governments have entered more restrictive shutdowns. This has caused another round of layoffs. The unemployment rate in December was 6.7%. Mortgage Rates – The January 28, 2021, Freddie Mac Primary Mortgage Survey reported that the 30 year fixed rate mortgage average was 2.73%, up from 2.67% on December 28, 2020. The 15-year fixed was 2.20%, up from 2.17% last month. The 5-year ARM was 2.80%, up from 2.71% at the end of December. Home sales data is reported on the third week of each month for the previous month. These are December’s results. 2020 marked the highest number of U.S. existing-home sales since 2006 – The National Association of Realtors reported that the number of homes sold in December was 22.2% above the number of homes sold last December. Despite the pandemic, 2020 marked the highest number of homes sold since 2006. The median price paid for a home in December was $309,800, up 12.9% from $274,500 in December 2019. With new listings surging, but not able to keep pace with buyer demand, inventory shrunk to record low housing supplies in 2020. There was just a 1.9 month supply of homes for sale in December, down from a 3.0 month supply one year ago. California existing home sales – The California Association of Realtors reported that existing, single-family home sales totaled 509,750 on an annualized basis in December. That represented a year-over-year increase of 28% from the 398,370 annualized rate of homes sold in December 2019. It was the highest number of monthly home sales in 15 years, and the most homes ever sold in December. Home sales are homes that closed escrow. Pending home sales are new contracts signed. Those are at near-record levels as well. For the entire year, 411,870 homes sold, up 3.5% from 397,960 homes sold in 2019. That number is pretty incredible considering home sales were down almost 30% at the end of June. There was a record number of sales in the second half of the year. The median price paid for a home in California was $717,930, up 16.8% from the median price of $659,380 last December. Inventory levels were lower than one year ago. There was just a 1.3-month supply of homes for sale in December, down from a 2.5-month supply one year ago. The current supply of homes was almost unchanged from September and October, as a record number of new listings were taken in November but sold quickly. Below please find a graph of regional statistics for Southern California. |