| Stock markets this week – Stock markets gave up some profits at the end of the week after hitting record highs on Wednesday. At one point the Dow went over 33,000 for the first time ever before dropping back. The Dow Jones Industrial Average closed the week at 32,697.97, down 0.5% from 32,778.64 last week. It is up 6.5% year-to-date. The S&P 500 closed the week at 3,913.10, down 0.2% from 3,943.34 last week. It is up 4.2% year-to-date. The NASDAQ closed the week at 13,215.24, down 0.8% from 13,319.86 last week. It is up 2.6% year-to-date.

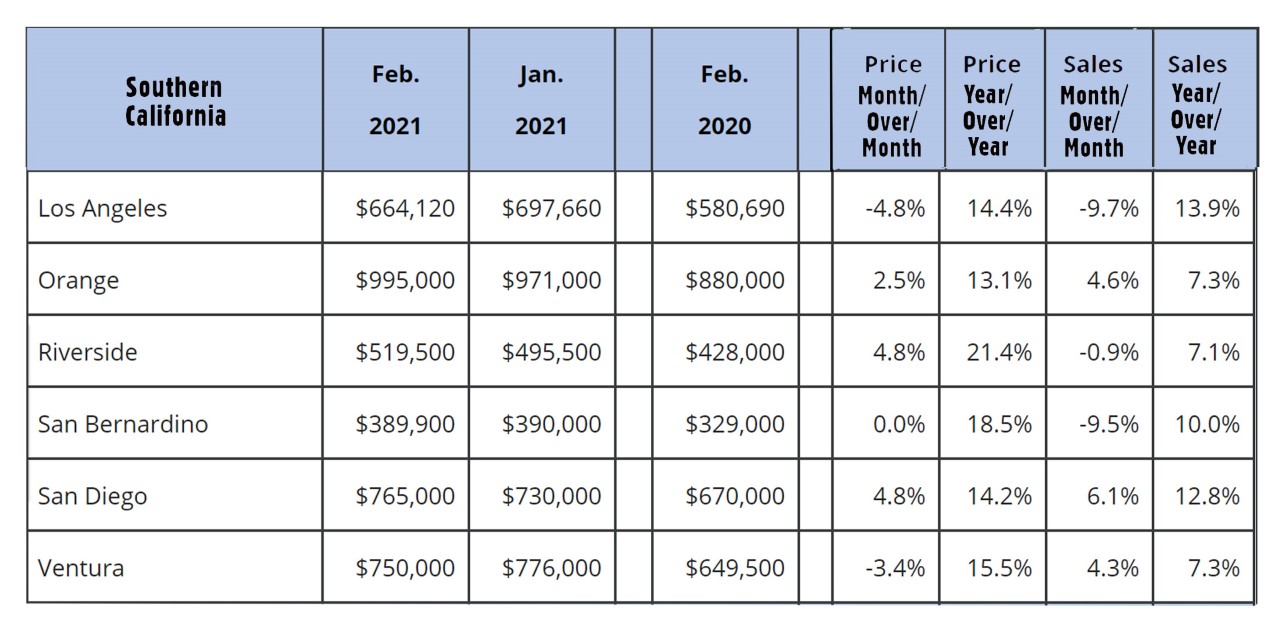

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 1.74%, up from 1.64% last week. The 30-year treasury bond yield ended the week at 2.45%, up from 2.40% last week. We watch bond yields because mortgage rates often follow treasury bond yields. Mortgage rates – The March 18, 2021, Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows: The 30-year fixed mortgage rate was 3.09%, up slightly from3.05% last week. The 15-year fixed was 2.40%, up slightly from 2.38% last week. The 5-year ARM was 2.79%, up slightly from 2.77% last week. California existing home sales – The California Association of Realtors reported that existing, single-family home sales totaled 462,720 on an annualized basis in February. That represented a year-over-year increase of 9.7% from the 421,670 annualized rate of homes sold in January 2020. The median price paid for a home in California was $699,000, up 20.6% from the median price of $579,770 last February. Inventory levels were lower than one year ago. There was just a 2.0-month supply of homes for sale in February, down from a 3.6-month supply one year ago. Below please find a graph of regional statistics for Southern California. |