Stocks continued their unprecedented rise again this week – A surge in consumer spending, increasing corporate profits, and inflation all point to the economy recovering much quicker than expected. That added to the effects of the nearly $2 trillion of stimulus that will be disbursed over the next 24 months, and possibly a giant infrastructure package has investors bullish on the economy. The Dow Jones Industrial Average topped 34,000 for the first time in history. It closed the week at 34,200.67, up 1.2%from 33,800.60 last week. It is up 11.6% year-to-date. The S&P 500 closed the week at 4,185.87, up 1.4% from 4,128.80 last week. It is up 11.3% year-to-date. The NASDAQ closed the week at 14,052.34, up 1.1% from 13,900.19 last week. It is up 8.6% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 1.59%, down from 1.67% last week. The 30-year treasury bond yield ended the week at 2.26%, down from 2.34% last week. We watch bond yields because mortgage rates often follow treasury bond yields.

Mortgage rates – The April 15, 2021, Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows: The 30-year fixed mortgage rate was 3.04%, down from 3.13% last week. The 15-year fixed was 2.35%, down from 2.42% last week. The 5-year ARM was 2.80%, down from 2.93% last week.

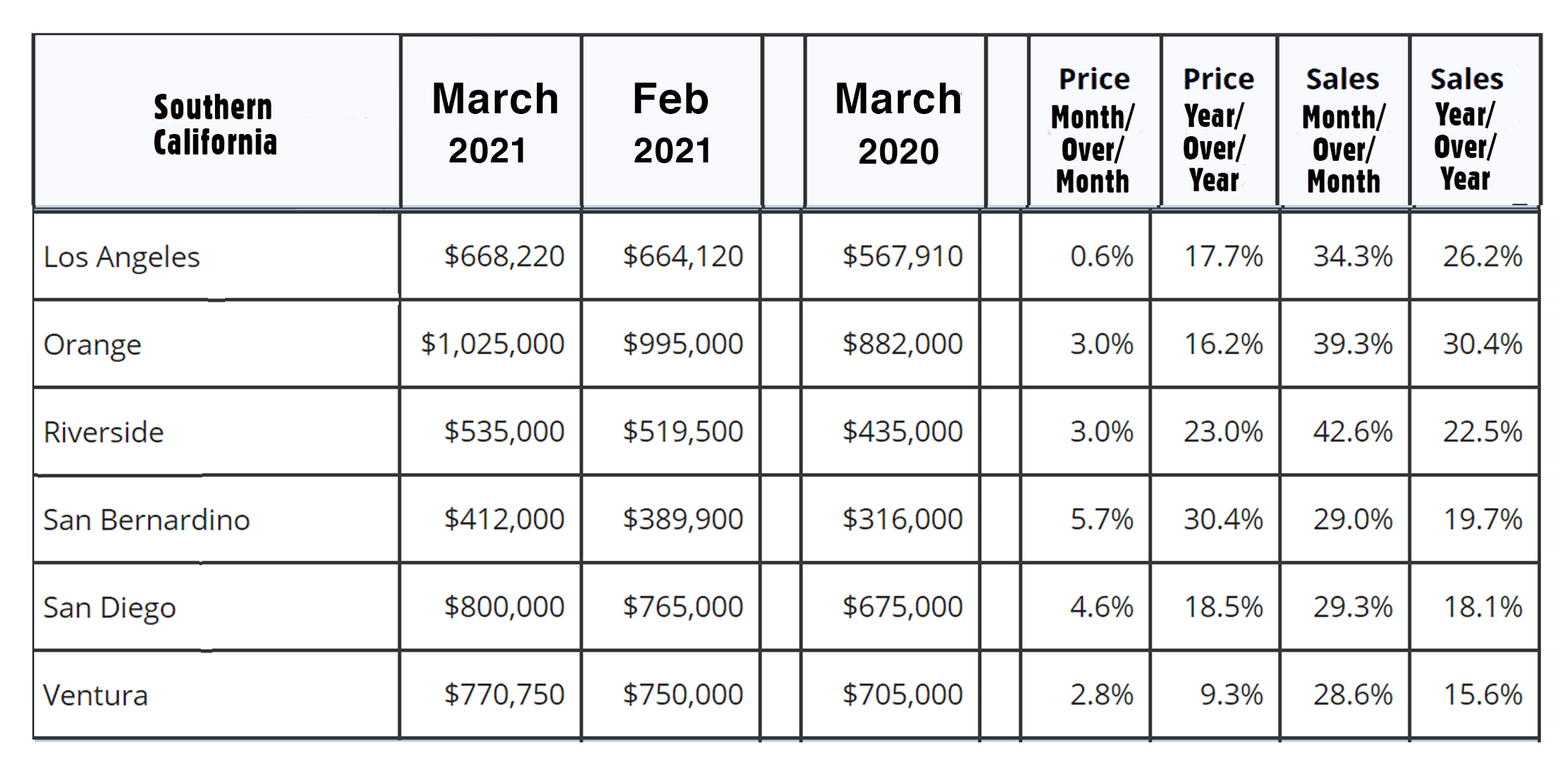

California existing home sales in March – The California Association of Realtors reported that existing, single-family home sales totaled 446,410 on an annualized basis in March. That represented a year-over-year increase of 19.7% from the 373,070 annualized rate of homes sold in March 2020. The median price paid for a home climbed 8.6% month-over-month from the median price in February. The median price paid for a home in California was $758,990 up 23.9% from the median price of $612,440 last March. There was just a 1.6 month supply of homes for sale in March, down from a 2.6 month supply one year ago. Below please find a graph of regional statistics for Southern California.