|

Stock markets – The Dow Jones Industrial Average closed the month at 33,874.85, up 2.4% from 33,066.96 at the end of March. It is up 10.7% year-to-date. The S&P 500 closed the month at 4,181.17, up 4.6% from 3,958.55 last month. It is up 11.3% year-to-date. The NASDAQ closed the month at 13,962.68, up 7% from 13,045.29 last month It is up 8.3% year-to-date.

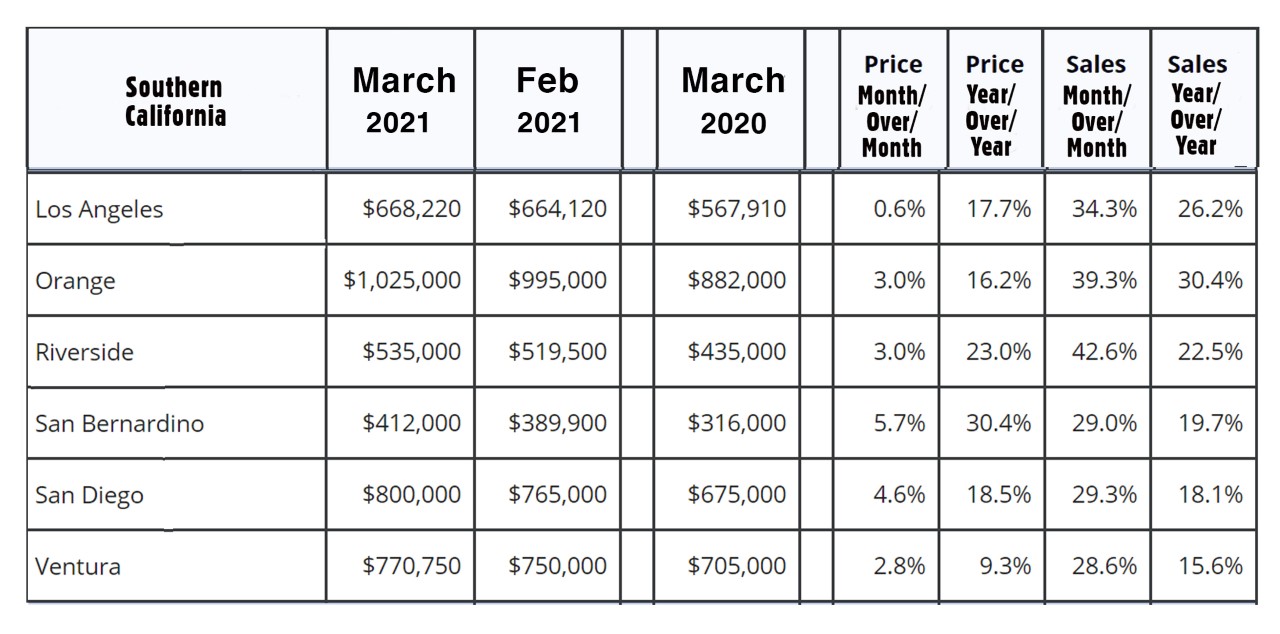

U.S. Treasury bond yields – The 10-year treasury bond closed the month yielding 1.65%, down from 1.74% last month. The 30-year treasury bond yield ended the month at 2.30%, down from 2.41% last month. We watch bond yields because mortgage rates often follow treasury bond yields. Mortgage rates – The April 29, 2021, Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows: The 30-year fixed mortgage rate was 2.98%, down from 3.18% last month. The 15-year fixed was 2.31%, down from 2.45% last month. The 5-year ARM was 2.64%, down from 2.94% last month. The April jobs report will be released next Friday. These are March’s results. U.S. employers added 916,000 jobs in March – The Department of Labor and Statics reported that 916,000 net new jobs were added in March. That number exceeded Dow Jones analysts’ expectations of 675,000 new jobs. The unemployment rate declined to 6% in March, down from 6.2%, in February. Home sales are released on the third week of each month for the previous month. Below are the March sales results. U.S. home sales and prices – March 2021- The National Association of Realtors reported that the number of existing-home sales rose 12.35% in March from the number of sales in March 2020. The median price paid for a home in March rose 17.25% from the median price one year ago. That marked 109 straight months of year-over-year increases in the median price. Inventory levels totaled 28.2% fewer homes on the market than one year ago. There was just a 2.1 month supply of homes for sale, down from a 3.3 month supply last March. First-time buyers accounted for 32% of the home sales. Second-home (vacation home) and investor purchases accounted for 15% of the sales. Foreclosure and short sales accounted for less than 1% of sales. California existing home sales in March – The California Association of Realtors reported that existing, single-family home sales totaled 446,410 on an annualized basis in March. That represented a year-over-year increase of 19.7% from the 373,070 annualized rate of homes sold in March 2020. The median price paid for a home climbed 8.6% month-over-month from the median price in February. The median price paid for a home in California was $758,990 up 23.9% from the median price of $612,440 last March. There was just a 1.6 month supply of homes for sale in March, down from a 2.6 month supply one year ago. Below please find a graph of regional statistics for Southern California. |