Stock markets ended the week higher – Most companies that have reported second-quarter profits beat earnings estimates. That gave a boost to stocks this week. Even tech stocks, which have been beaten down significantly, had a great week. The news was not all good for tech stocks. Tesla beat expectations but Snap did not. Snap dropped 39% on Friday which spilled over to other sectors and stock markets ended lower on Friday, ending a three-day rally. Investors were also feeling optimistic that dropping gas prices, some settling in food prices, easing of supply-chain shortages, and some economic data indicating that businesses may be pulling back on spending may keep the Fed from being as aggressive with interest rate hikes as thought just a week ago when the CPI report was released. Some feared a full point rate hike at the next meeting. That seems very unlikely now. The Dow Jones Industrial Average closed the week at 31,899.29, up 1.9% from 31,288.26 last week. It is down 12.2% year-to-date. The S&P 500 closed the week at 3,961.63, up 2.5% from 3,863.19 last week. The S&P is down 16.9% year-to-date. The NASDAQ closed the week at 11,834.11, up 3.3%from 11,452.42 last week. It is down 24.6%, year-to-date.

U.S. Treasury bond yields higher this week – The 10-year treasury bond closed the week yielding 3.00% down from 2.93% last week. The 30-year treasury bond yield ended the week at 3.10%, down from 3.10% last week. We watch bond yields because mortgage rates often follow treasury bond yields.

Mortgage rates – The Freddie Mac Primary Mortgage Survey reported that mortgage rates as of July 21, 2022, for the most popular loan products were as follows: The 30-year fixed mortgage rate was 5.54%, up slightly from 5..51% last week. The 15-year fixed was 4.75%, up from 4.67% last week. The 5-year ARM was 4.31%, down from 4.35% last week.

U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 5.4 million units on a seasonally adjusted annualized rate in June, down 5.4% month-over-month from the annualized number of sales in May. Year-over-year sales were down 14.3%from the annualized rate of 5.97 million in June 2021. The median price of a home in the U.S. in June was $416,000 up 13.4% from $366,900 one year ago. June marked a record 124 consecutive months of year-over-year increases in the median price. There was a 3-month supply of homes for sale in June, up from a 2.5-month supply last June. First-time buyers accounted for 30% of all sales. Investors and second-home purchases accounted for 14% of all sales. All-cash purchases accounted for 25% of all sales. Foreclosure and short sales accounted for less than 1% of all sales remaining at a historic low.

California existing-home sales – The number of single-family homes sold in June declined 21% year-over-year -The California Association of Realtors reported that existing- home sales totaled 344,970 on a seasonally adjusted annualized rate in June, down 8.4% from May, and down 20.9% from last June. Excluding two months during the pandemic shutdown, this marked the fewest number of homes closed escrow in a month since April 2008. Existing-home sales through June are down 10.9% from the number of homes sold in the first half of 2021.

The statewide median price paid for a home in June was $863,790, up 5.4% from $819,630 in June 2021.

There was a 2.5-month supply of homes for sale in June, up from a 2.1-month supply of homes for sale in May, and a 1.7-month supply in June 2021. While up slightly, a 2.5-month supply is still a low level. A normal market has a 5-6 month supply of homes on the market.

We have seen more homes come on the market in the past few weeks. Perhaps sellers feel that prices have topped out. Those listings are selling quickly if they are priced correctly. The vast majority of the homes sold are still receiving multiple offers, but they are not receiving the number of offers that they would have received a couple of months ago. We are seeing two to four offers, not twenty! The homes priced too high are sitting. Once reduced to the correct price those are selling as well, but not with the excitement and urgency a new listing gets. These new listings will begin to close in August. I expect that the number of sales will increase in August from the anemic number of sales we saw in June and that I expect in July, which seems to also be shaping up as a month with a low number of sales. June and July should be the fewest number of sales we see in a month for a long time. That’s what I am seeing on the street.

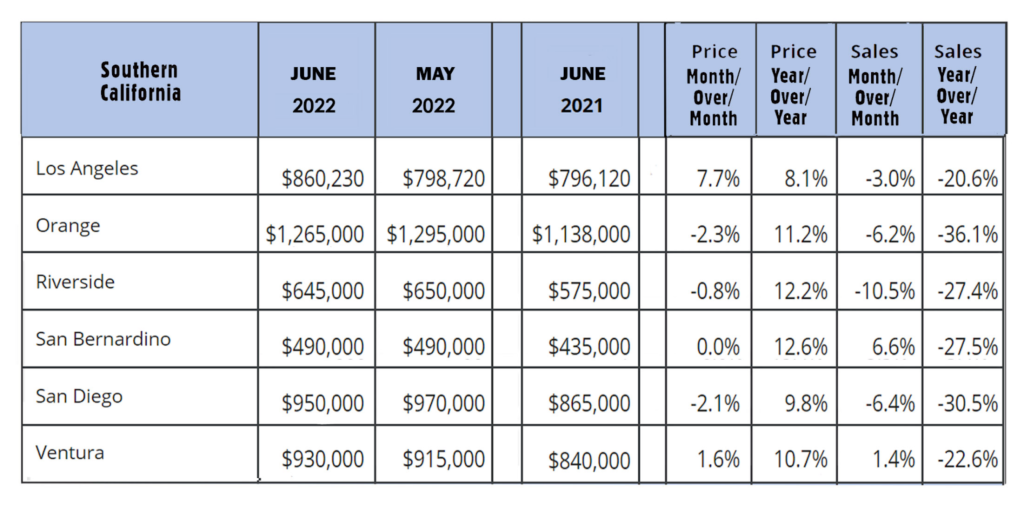

The graph below shows regional figures by county in Southern California.