Stock markets dropped again this week – Stock markets, after posting historic gains in the first seven months of the year, stalled in August. While some of the selling is simply investors that feel stocks have become overvalued and are taking profits, there may be other structural problems in the economy emerging. Bond yields and mortgage rates, which were dropping on positive inflation news, have risen since the U.S. credit rating was downgraded by Fitch three weeks ago. They cited the ballooning national debt, an unwillingness to cut spending, and political uncertainty. This led to less demand for U.S. treasury bonds. Bond yields hit a 16 -year high on Thursday. Mortgage rates have hit their highest rates since 2002 this week. The Dow Jones Industrial Average closed the week at 34,500.66, down 2.2% from 35,281.40 last week. It is up 4.1% year-to-date. The S&P 500 closed the week at 4,369.71, down 2.1% from 4,464.05 last week. It is up 13.8% year-to-date. The Nasdaq closed the week at 13,290.78, down 2.6% from 13,644.85 last week. It is up 27% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.26%, up from 4.16% last week. The 30-year treasury bond yield ended the week at 4.38%, up from 4.27% last week. We watch bond yields because mortgage rates follow bond yields.

Mortgage rates – The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of August 17, 2023, were as follows: The 30-year fixed mortgage rate was 7.09%, up from 6.91% last week. The 15-year fixed was 6.46%, up from 6.34% last week.

California existing-home sales – The California Association of Realtors reported that existing–home sales totaled 269,180 on a seasonally adjusted annualized basis in July. That marked the tenth straight month on sales dropping under 300,000 on an annualized basis. The number of sales is down approximately 40% from July 2021. Year-to-date the number of homes sold was down 30.3% from the first seven months of 2022. The statewide median price paid for a home in July was $832,390, up 0.2% from $830,870 last July. There was a 2.5-month supply of single-family homes for sale in July, down from a 3.1-month supply one year ago.

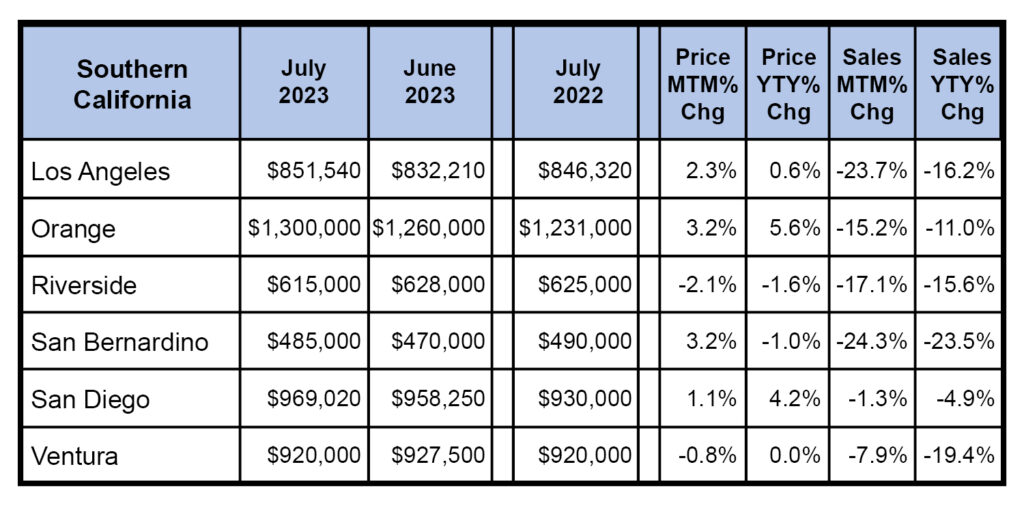

The graph below has sales data for Southern California by region. This was compiled by the California Association of Real Estate