The S&P closed above 5,000 for the first time ever – With the consensus of economists that the economy is growing at a healthy pace with no slowing in sight, stock markets notched another impressive week. In fact, the S&P and Nasdaq have closed higher for 14 out of the last 15 weeks. For the S&P that is a feat not seen since 1972 and for the Nasdaq it’s the best streak since 1997. January CPI will be released on Tuesday and PPI on Friday. Those reports are important to see where inflation is moving. If inflation keeps moving lower there is a good chance that the Fed will drop interest rates sooner than if the inflation rate begins to tick up again. The Dow Jones Industrial Average closed the week at 38,671.69, almost unchanged from 38,654.42 last week. It is up 2.6% year-to-date. The S&P 500 closed the week at 5,026.61, up 1.4% from 4,958.61 last week. The S&P is up 5.4% year-to-date. The Nasdaq closed the week at 15,990.66, up 2.3% from 15,628.95 last week. It is up 6.5% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.17%, up from 4.03% last week. The 30-year treasury bond yield ended the week at 4.37%, up from 4.22% last week. We watch bond yields because mortgage rates follow bond yields.

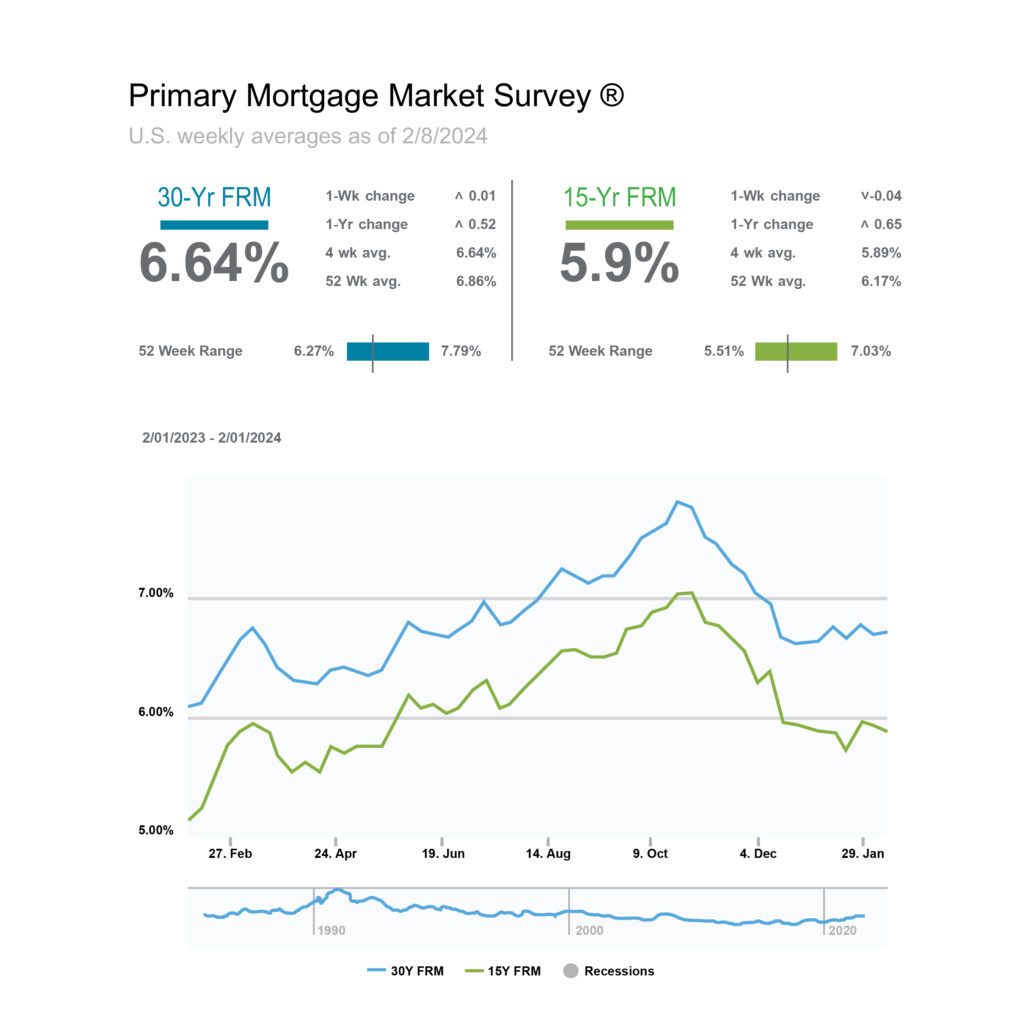

Mortgage rates – Every Thursday Freddie Mac publishes an interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of February 8, 2024, were as follows: The 30-year fixed mortgage rate was 6.64%, almost unchanged from 6.63% last week. The 15-year fixed was 5.90%, down from 5.94% last week.

January housing data should be released by the end of next week by the California Association of Realtors and the following week by the National Association of Realtors. You can get housing data now for your city or zip code on our website RodeoRe.com.

Have a great weekend!