Economic news this week centered around hiring, jobs, and Tech stocks. The job market remained hot, but not as hot as it appeared last month. Tech stocks that have had a giant rally this year gave up some ground this week. There was really no news that led to a slight sell-off except for Investors taking profits. Perhaps they feel that the sector has been overbought. Next week the Consumer Price Index will be released. With the Fed looking mainly at the tight labor market as inflationary, investors are waiting to see if the inflation rate will continue to tick down. The lower the inflation level and the higher the unemployment rate, the sooner the Fed will begin lowering interest rates from their 24-year high.

February hiring points to another robust month of job growth, while a downward January revision indicates that the job market is not as “red hot” as it appeared a month ago. – The Department of Labor and Statistics reported that 275,000 new jobs were added in February. That was higher than the 200,000 new jobs that analysts expected, and it marked the third straight month with job gains above 200,000 and the 38th consecutive month of job growth. January’s new jobs number was adjusted downward from 353,000 new jobs to 229,000. That was much closer to the 175,000 experts expected in January. The Department of Labor gave no explanation for such a large difference between the initial number and the revised number. The unemployment rate rose to 3.9% in February, up from 3.7% in January. While that is the highest unemployment rate in two years, unemployment is still at a level not seen since the 1960s. The Fed is looking to get the unemployment rate to the low to mid 4% range. With employers struggling to find workers, wage gains are outpacing the inflation rate. That leads to higher consumer spending which fuels inflation. Average hourly wages increased 4.3% year-over-year in February, down from 4.5% in January. Economists expected a 4.4% increase. Bond yields and mortgage rates ended the week lower. Investors and experts reported that they now feel that a rate drop by the Fed could be sooner than they thought a month ago due to the January revision, the rise in unemployment, and the slight year-over-year drop in wages.

Stock markets – The Dow Jones Industrial Average closed the week at 38,722.69, down 0.9% from 39,087.38 last week. It is up 3.7% year-to-date. The S&P 500 closed the week at 5,123.69, down 0.3% from 5,137.08 last week. The S&P is up 7.7% year-to-date. The Nasdaq closed the week at 16,085.11, down 1.2% from 16,274.94 last week. It is up 8.4% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.09%, down from 4.19% last week. The 30-year treasury bond yield ended the week at 4.26%, down from 4.33% last week. We watch bond yields because mortgage rates follow bond yields.

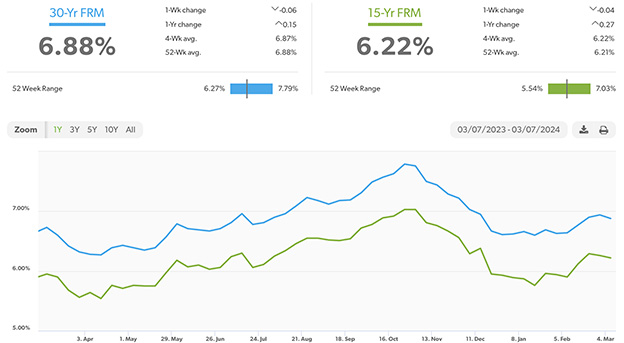

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of March 7, 2024, were as follows: The 30-year fixed mortgage rate was 6.88%, down from 6.94% last week. The 15-year fixed was 6.22%, down from 6.26% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.

Have a great weekend!

Remember that the time moves one hour forward at 2 AM on Sunday!