| Interest rate concerns continued to lead markets this week, as has been the case since 2022. With inflation rising since the beginning of the year, hopes of a Fed rate reduction soon have all but ended. This week various Fed members have made comments that have investors wondering if there will be any interest rate reductions this year. On Thursday the initial estimate of the first quarter of U.S. GDP showed that the economy grew at just a 1.6% pace, its slowest pace of growth in two years and well-off economists’ expectations of a 2.5% increase. In a bad news is good news for interest rates environment, slower growth would have been good news, except that the report also included that the “core” Personal Consumption Expenditures index (PCE) grew by 3.7% in the first quarter. Economists had expected a 3.4% gain, and the core PCE growth rate was just 2% in the previous quarter. It appeared that inflation had picked up dramatically in the quarter. Fortunately, on Friday the core Personal Consumption Expenditure index for March was released. It showed that consumer prices rose 2.7% year-over-year in March, up from February’s 2.5% rise, but a welcome relief for investors who one day earlier were informed that the same index rose 3.7% in the first quarter of 2024. Treasury bond yields settled down a little and stocks rebounded on Friday to close the week higher.

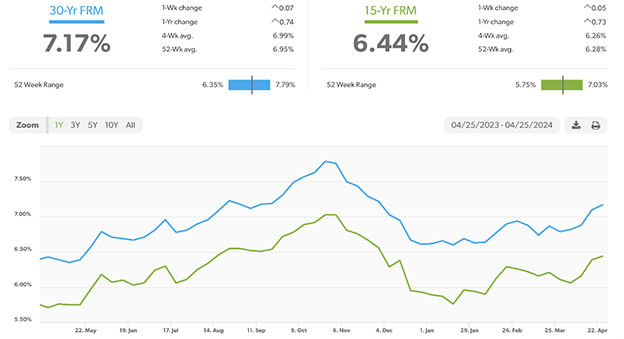

Stock markets – The Dow Jones Industrial Average closed the week at 38,239.66, up 0.7% from 37,986.49 last week. It is up 1.5% year-to-date. The S&P 500 closed the week at 5,099.96, up 2.7% from 4,967.23 last week. The S&P is up 6.9% year-to-date. The Nasdaq closed the week at 15,927.90, up 4.2% from 15,281.01 last week. It is up 6.1% year-to-date. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.68% up from 4.62% last week. The 30-year treasury bond yield ended the week at 4.78%, up from 4.72% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of April 25, 2024, were as follows: The 30-year fixed mortgage rate was 7.17%, up from 7.10% last week. The 15-year fixed was 6.44%, up from 6.39% last week. The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders supporting homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S. U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 4.19 million units on a seasonally adjusted annualized rate in March, down 3.7% from an annualized rate of 4.35 million in March 2023. The median price for a home in the U.S. in March was, up 5.7% from last March. There was a 3.2-month supply of homes for sale in March, up from a 2.7-month supply one year ago. First-time buyers accounted for 32% of all sales. Investors and second-home purchases accounted for 15% of all sales. All-cash purchases accounted for 28% of all sales. Foreclosures and short sales accounted for 2% of all sales this week. Have a great weekend! |

News & Media