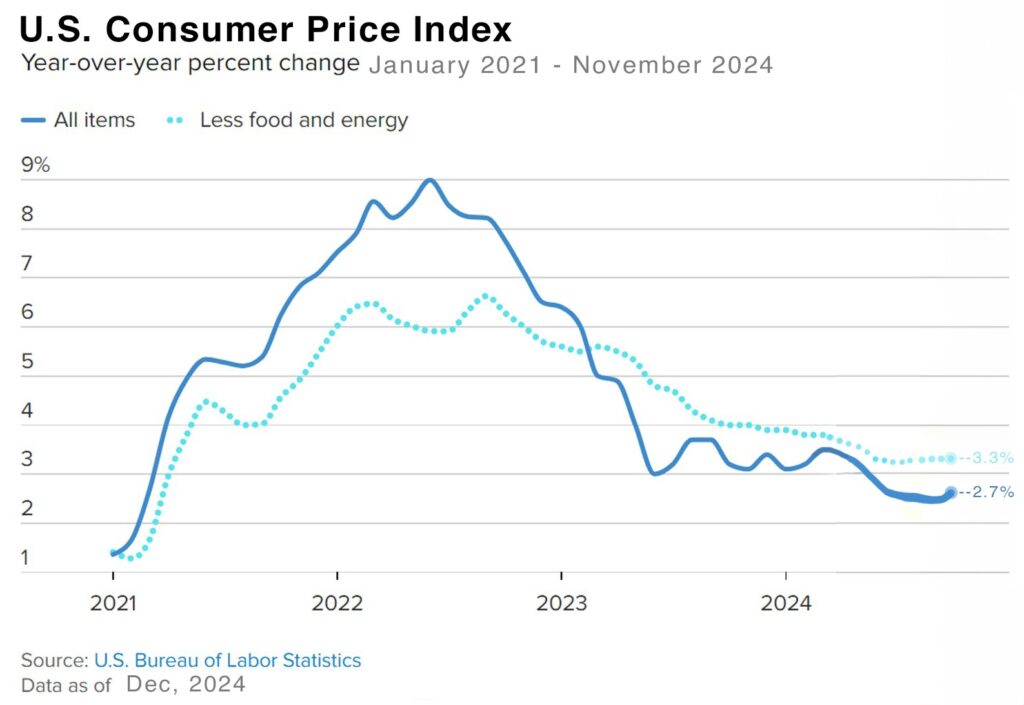

Reports released this week showed that inflation had ticked up in November – The Consumer Price Index (CPI) showed that consumer prices increased 2.7% year-over-year in November, up from a 2.6% year-over-year increase in October. The CPI peaked at 9.1% in June 2022 and worked its way down to a 2.4% year-over-year increase in September. Core CPI, which excludes volatile food and energy costs rose 3.3% year-over-year in November for the fourth consecutive month. The Produce Price Index (PPI) showed that wholesale prices increased 3% year-over-year in November, up from a 2.4% year-over-year increase in October. Core PPI increased 3.4% year-over-year in November, up from 3.1% in October. The Federal Reserve’s mandate is to control inflation and maximize employment. Their target inflation rate is a 2% year-over-year increase. While inflation has moved down considerably, it has begun to move up in the last two months. While many experts believe that the Fed may still drop interest rates at their meeting next week, future drops will be less often and not as low and as fast as expected in September when inflation rates were lower. Other data showed that jobless claims increased last week. The Fed does want to get the unemployment rate up, as we are still in an environment where there is a shortage of workers pushing wages up. They want wages to rise, but not at the rate they are currently rising, as consumer spending fuels inflation. Mortgage rates and bond yields rose this week.

The graph below shows the CPI rate since 2021

Stock markets – The Dow Jones Industrial Average closed the week at 43,828.06 down 1.8% from 44,642.52 last week. It is up 16.3% year-to-date. The S&P 500 closed the week at 6,051.09, down 0.6% from 6,090.27 last week. The S&P is up 26.9% year-to-date. The Nasdaq closed the week at 19,926.72, up 3.7% from 19,218.17 last week. It is up 32.7% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.49%, up from 4.15% last week. The 30-year treasury bond yield ended the week at 4.61%, up from 4.34% last week. We watch bond yields because mortgage rates follow bond yields.

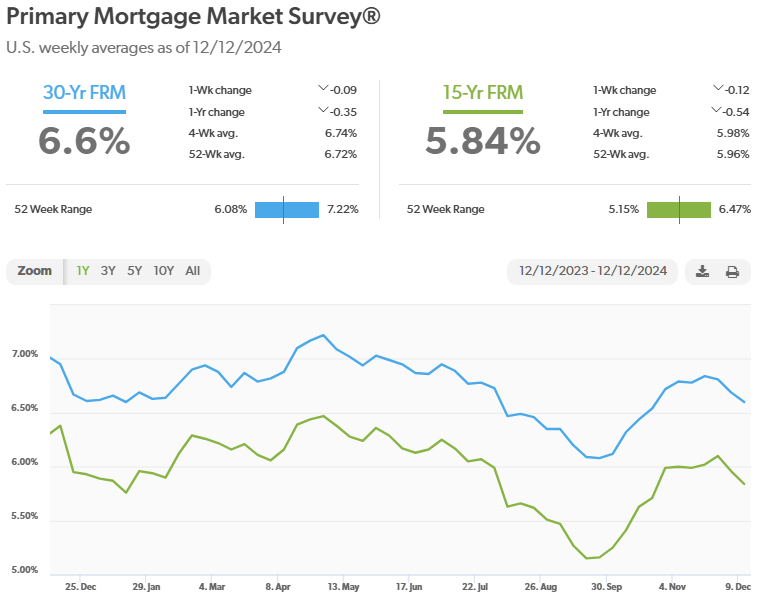

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of December 12th, 2024, were as follows:

The 30-year fixed mortgage rate was 6.6%, down from 6.69% last week. The 15-year fixed was 5.84%, down from 5.96% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Have a great weekend!