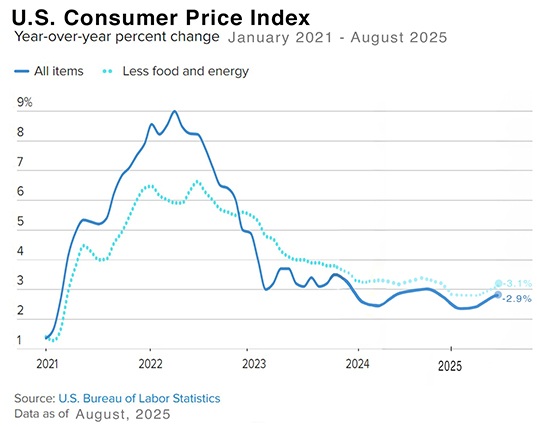

| Inflation indexes showed mixed results this week – On Thursday, the Consumer Price Index (CPI) for August was released. It showed that consumer prices rose 2.9% from one year ago, up from a 2.7% annual increase in July, but in line with analysts’ expectations. The CPI rate bottomed out at 2.3% in April but has risen steadily. This rise has been attributed to tariffs by both the Fed and economists. The core CPI rate, which excludes food and energy, rose 3.1% from one year ago, unchanged from July’s 12-month increase. Investors tend to look at Core CPI more than headline CPI because food and energy prices fluctuate in a more volatile manner, so remaining flat was viewed positively. The Producer Price Index (PPI) was released on Wednesday. Wholesale prices declined 0.1% for the month in August. This was a big relief to the markets after July’s 0.7% month-over-month increase. Year-over-year headline PPI was up 2.6% in August, down from an annual 3.3% increase in July. Core PPI showed wholesale prices were up 2.8% from one year ago, down from an annualized 3.7% in July. Wholesale inflation is usually a precursor to consumer inflation, as the increase in costs is later passed on to the consumer.

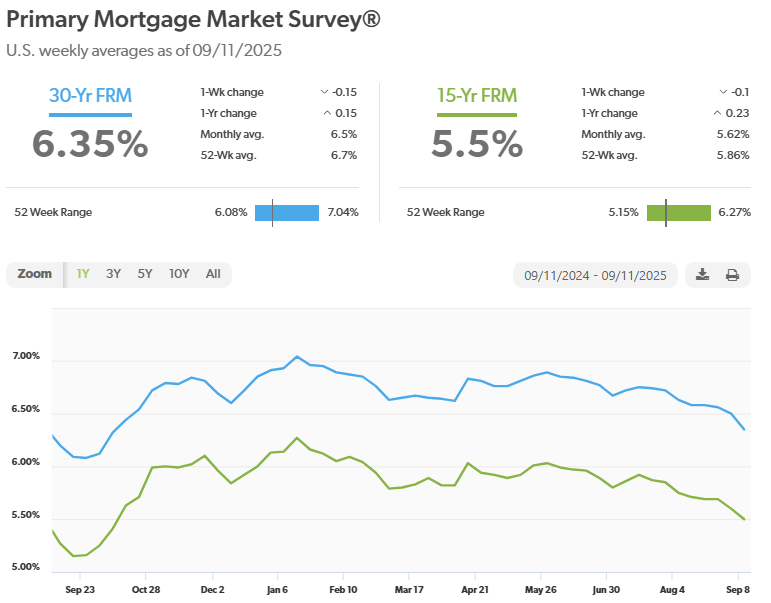

Stock Markets – Stock markets continued to rise – Expectations of lower interest rates fueled another rally in stock markets this week – The Nasdaq ended another week at record highs, and the Dow and S&P ended the week just below Thursday’s record highs. The Dow Jones Industrial Average closed the week at 45,844.32, up 1% from 45,400.86 last week. Year-to-date, it is up 2.9% from 44,544.66 on December 31, 2024. The S&P 500 closed the week at 6,584.29, up 1.6% from 6,481.50 last week. Year-to-date, the S&P is up 9% from 6,040.53 on December 31, 2024. The Nasdaq closed the week at 22,147.10, up 2.1% from 21,700.39 last week. Year-to-date, it is up 12.8% from 19,627.44 on December 31, 2024. U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.06%, down from 4.10% last week. The 30-year treasury bond yield ended the week at 4.68%, down from 4.78% last week. We watch bond yields because mortgage rates follow bond yields. Mortgage rates – Every Thursday, Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of September 11, 2025, were as follows: The 30-year fixed mortgage rate was 6.35%, down from 6.5% last week. The 15-year fixed was 5.5%, down from 5.6% last week. The graph below shows the trajectory of mortgage rates over the past year.

Have a Great Weekend! |

News & Media