Stock markets were lower last week – Stock markets dropped on fears of higher interest rates following comments from the Federal Reserve. The Fed acknowledged that inflation had hit a 40-year high and that the accommodative loosening of the money supply was no longer needed. They stated that they were going to pull back on their bond-buying program that injects money into the economy and helps keep long term rates down. They also made comments that led investors to believe that there would be three rate hikes on their key overnight rates that currently stand near 0% to keep the economy from remaining overheated. The Dow Jones Industrial Average closed the week at 35,365.44, down 0.6% from 35,970.99 last week. It is up 15.5% year-to-date. The S&P 500 closed the week at 4,620.64, down 2.0% from 4,712.02 last week. It is up 23.0% year-to-date. The NASDAQ closed the week at 15,169.96, down 3.0% from 15,630.60 last week. It is up 17.7% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 1.41%, down from 1.48% last week. The 30-year treasury bond yield ended the week at 1.82%, down from 1.86% last week. We watch bond yields because mortgage rates often follow treasury bond yields.

Mortgage rates – The December 16, 2021, Freddie Mac Primary Mortgage Survey reported mortgage rates for the most popular loan products as follows: The 30-year fixed mortgage rate was 3.12%, unchanged from 3.10% last week. The 15-year fixed was 2.34% up from 2.38% last week. The 5-year ARM was 2.45%, unchanged from 2.45% last week.

November California existing-home sales – The California Association of Realtors reported that existing-home sales totaled 454,450 on a seasonally adjusted annualized rate in November. That marked a month-over-month increase of 4.7% over the seasonally annualized rate of 434,170 in October. Year-to-date sales are up 10.6% from the same period last year. The median price paid for an existing home in November was $782,440, up 11.9% from last November when the median price was $698,980. There was a 1.6-month supply of homes for sale in November, down from a 1.9 month supply of homes for sale one year ago.

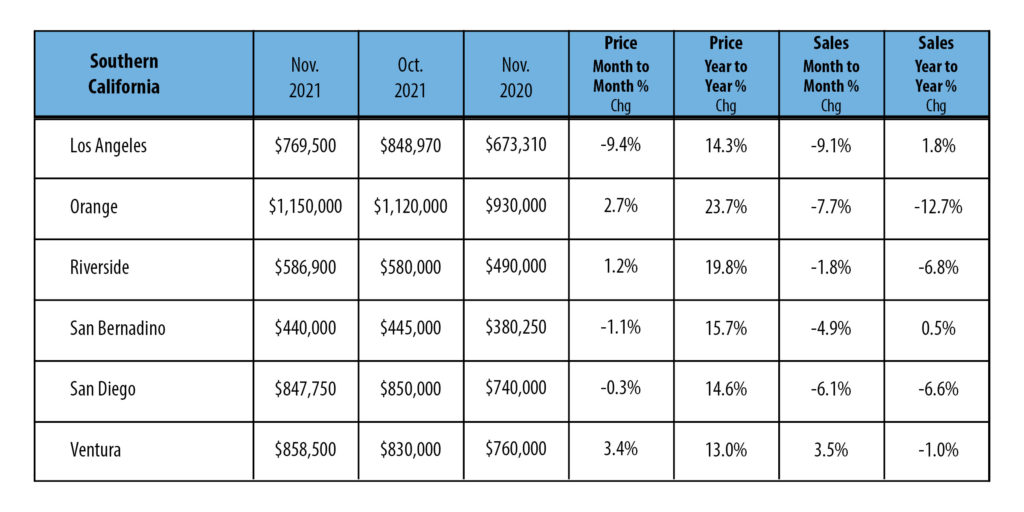

Below are regional figures.