U.S. employers added 206,000 jobs in June – The Department of Labor and Statistics reported that 206,000 new jobs were added in June, exceeding the 190,000 new jobs expected by economists. That marked the 42nd consecutive month of job growth. The unemployment rate rose to 4.1% in June, up from 4% in May. Although that is a historically low unemployment rate, it is the highest reading in almost three years. It is still above the Fed target, but investors feel that after two years of high interest rates, the job market is showing signs of coming into balance; however, there are still more job openings than workers to fill those jobs. Average hourly wages increased 3.9% year-over-year in June, down from 4.1% in May. That matched the 3.9% year-over-year increase in April, which was the smallest gain since 2021. Experts are now overwhelmingly predicting a Fed rate cut in September. It is widely felt that rate cuts will continue into 2025 as inflation continues to cool and the Fed moves to a less restrictive policy.

Stock markets – The Dow Jones Industrial Average closed the week at 39,375.87, up 0.1% from 39,118.36 last week. It is up 4.4% year-to-date. The S&P 500 closed the week at 5,567.19, up 2% from 5,460.48 last week. The S&P is up 16.7% year-to-date. The Nasdaq closed the week at 18,352.67, up 3.5% from 17,732.60 last week. It is up 22.3% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.28%, down from 4.36% last week. The 30-year treasury bond yield ended the week at 4.47% down from 4.51% last week. We watch bond yields because mortgage rates follow bond yields.

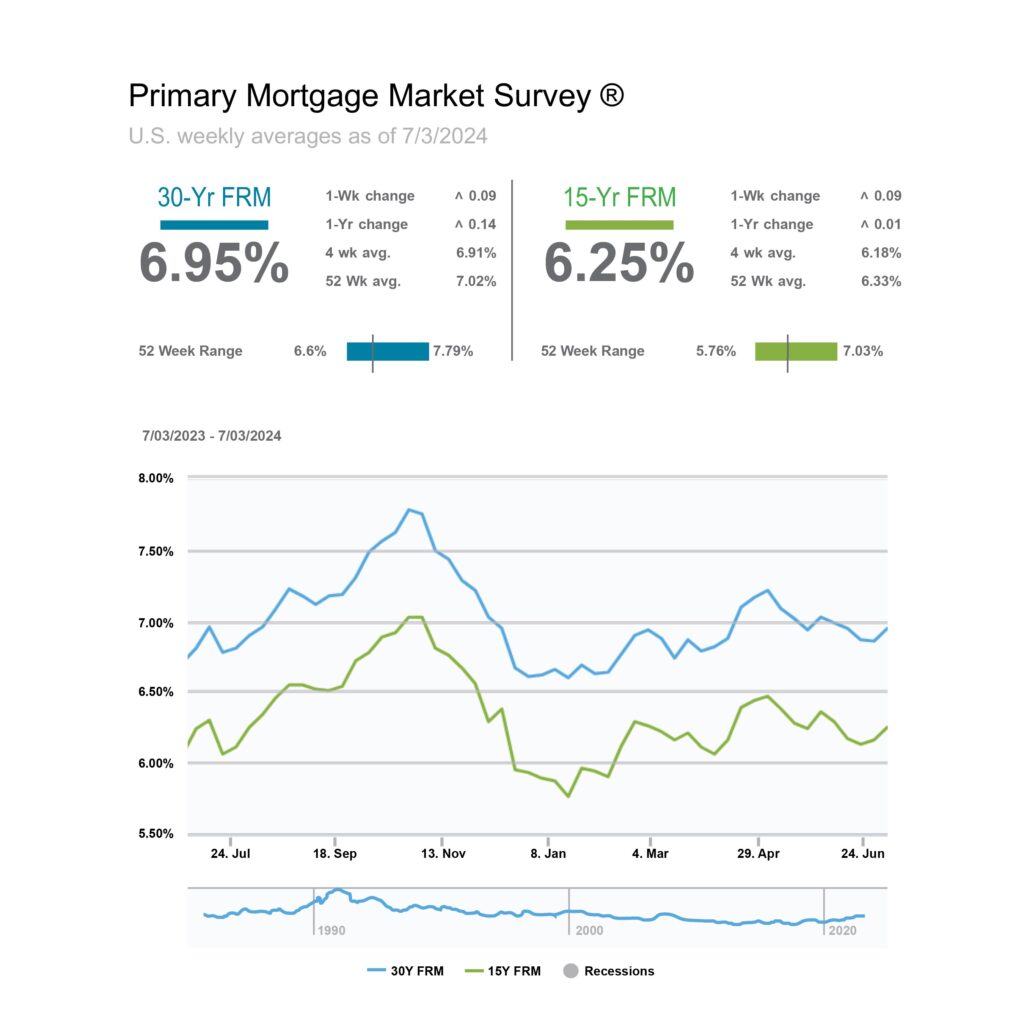

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of July 3, 2024, were as follows: The 30-year fixed mortgage rate was 6.95%, down from 6.86% last week. The 15-year fixed was 6.25%, up from 6.16% last week.

The graph below shows the trend of mortgage rates over the past year.