It was a tough week for stock markets and interest rates. Stock markets dropped steadily all week before rebounding on Friday, but still ended the week lower. Bond yields and mortgage rates also rose this week on fears that inflation was not dropping as quickly as hoped. Comments from the Federal Reserve which included the release of their “ Beige Book” that stated that stubborn inflation will keep rates higher for longer than expected earlier in the year was not well received by investors as stocks sold off. One Fed official even stated that there was a possibility of a rate increase if inflation continued to pick up. On Friday the Personal Consumption Index (PCE) was released. It showed that personal-consumption expenditures rose by 2.7% year-over-year in April. That was in line with expectations and indicated that inflation was slowing down and stock markets recovered from some of their steep losses in the final 10 days of the month.Bond yields and mortgage rates dropped slightly. All eyes are on the job market. The May jobs report will be released next Friday. The hope is that hiring continued to slow in May from its torrid pace in March. New unemployment claims remain low and it is feared that the unemployment rate will remain below 4% for a 28thconsecutive month setting a new record for the country. Such a low unemployment rate is considered a major contributor to inflation by the Federal Reserve, as people with jobs and no fear of losing their job spend more freely which causes price increases. Next Friday we will get the May jobs numbers. That will be an indicator of whether the economy is finally beginning to slow.

Stock markets – The Dow Jones Industrial Average closed the week at 38,686.32, down 1% from 39,069.59 last week. It is up 2.4% year-to-date. The S&P 500 closed the week at 5,277.51, down 0.6% from 5,304.72 last week. The S&P is up 10.7% year-to-date. The Nasdaq closed the week at 16,735.02, down 1.1% from 16,920.80 last week. It is up 11.5% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the week yielding 4.46%, up from 4.46% last week. The 30-year treasury bond yield ended the week at 4.57, almost unchanged from 4.57% last week. We watch bond yields because mortgage rates follow bond yields.

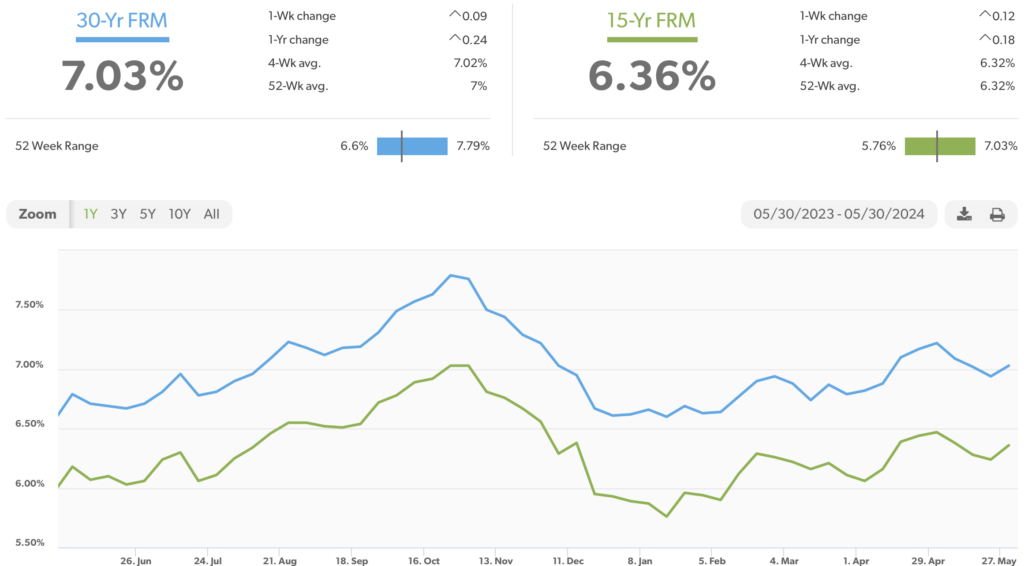

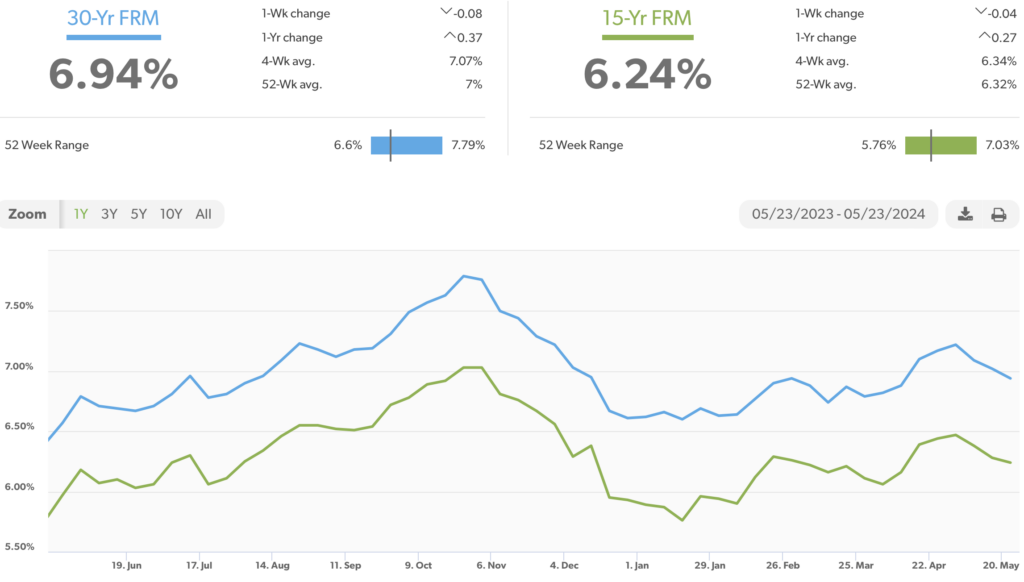

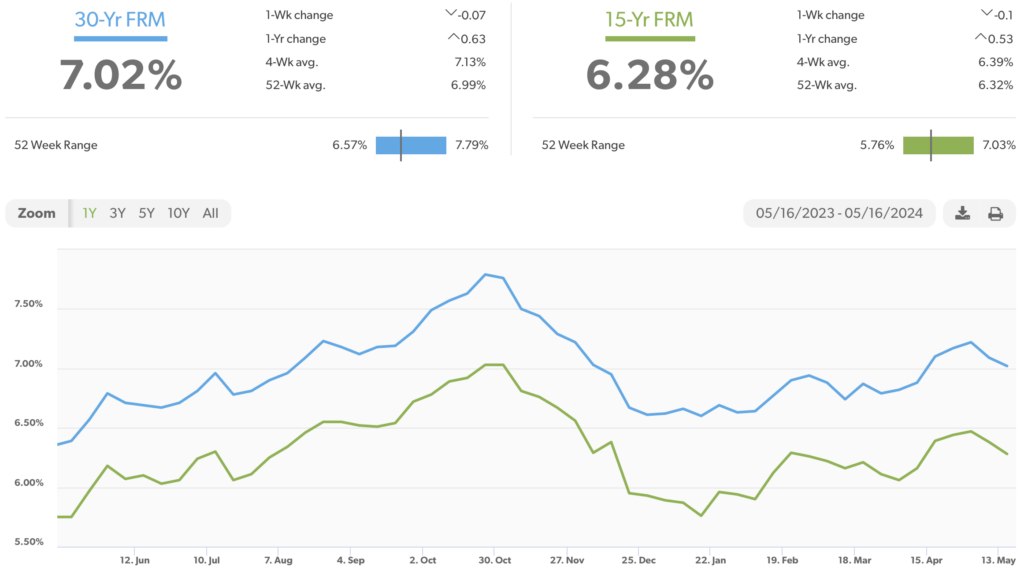

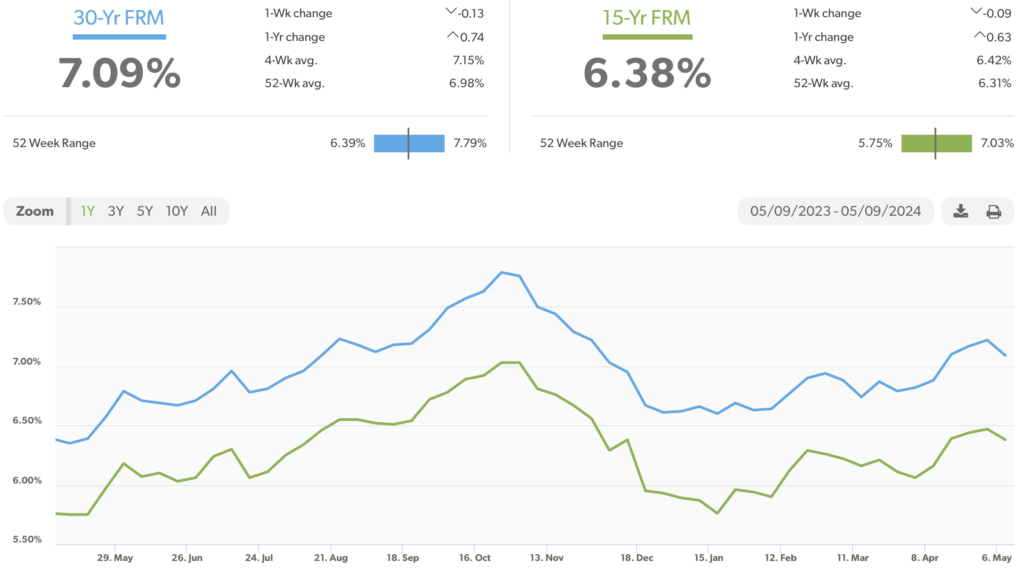

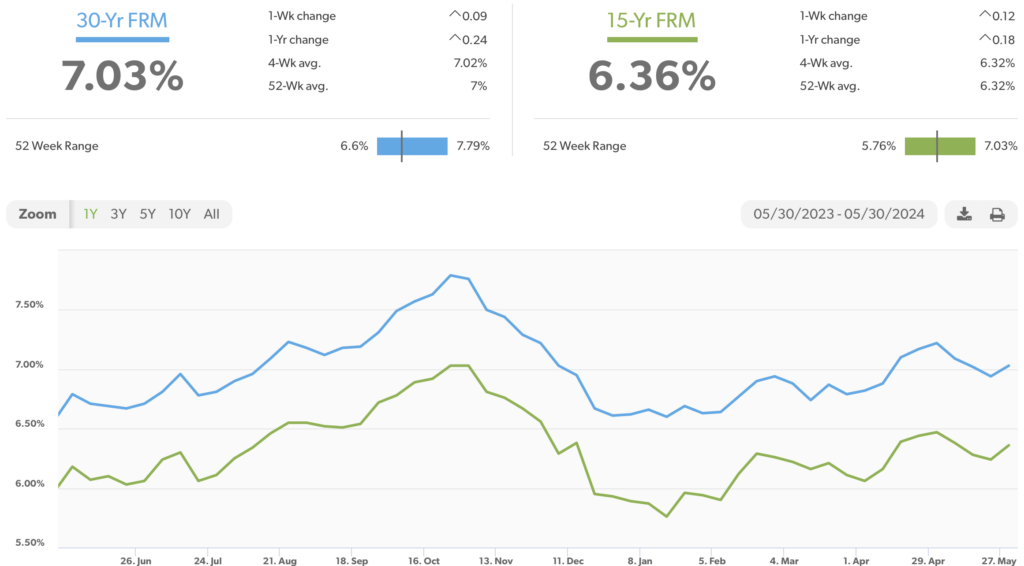

Mortgage rates – Every Thursday Freddie Mac publishes interest rates based on a survey of mortgage lenders throughout the week. The Freddie Mac Primary Mortgage Survey reported that mortgage rates for the most popular loan products as of May 30, 2024, were as follows: The 30-year fixed mortgage rate was 7.03%, up from 6.94% last week. The 15-year fixed was 6.36%, up from 6.24% last week.

The graph below shows the trajectory of mortgage rates over the past year.

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Their mandate is to provide liquidity, stability, and affordability to the U.S.