Economic news this month was largely in line with expectations. Inflation news showed that inflation indexes showed that both consumer and producer prices held steady at just over a 3% year-over-year increase. That was what analysts expected. Inflation is above the Fed’s 2% target, but well off its highs of a 9% year-over-year peak in June 2022. Unfortunately, it has hovered above 3% since last June. That last 1% to get to the Fed’s target of 2% has been very stubborn despite the highest interest rates in 24 years. The labor market has remained tight although the unemployment rate ticked up above its 60-year low to a 50-year low in February. Investors who felt that the Fed would soon begin to lower rates have been disappointed by the strength of the economy and labor market. It was widely felt that the Fed would begin lowering rates in March just a few months ago. Some investors felt that it was possible to not see a drop this year, but the Fed stated that they still expect to make three .25% rate reductions this year. The latest poll of economists had about 65% expecting the first drop in June. Real Estate sales have picked up as buyer sentiment has increased from its low levels last year, and more sellers are beginning to put their homes on the market.

Stock Markets – The Dow Jones Industrial Average closed the month at 39,807.37 up 2% from 38,996.39 on January 31, 2023. It is up 5.6% year-to-date. The S&P closed the month at 5,254.35, up 3.1% from 5,096.27 last month. It is up 10.2% year-to-date. The NASDAQ closed the month at 16,379.46, up 1.8% from 16,091.92 last month. It is up 9.1% year-to-date.

U.S. Treasury bond yields – The 10-year treasury bond closed the month yielding 4.20%, down from 4.25% last month. The 30-year treasury bond yield ended the month at 4.34%, down from 4.38% last month. We watch bond yields because mortgage rates often follow treasury bond yields.

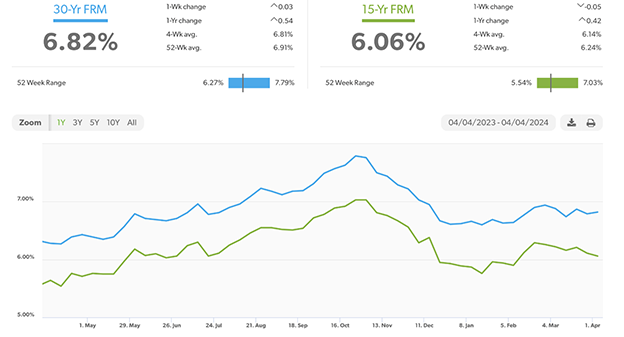

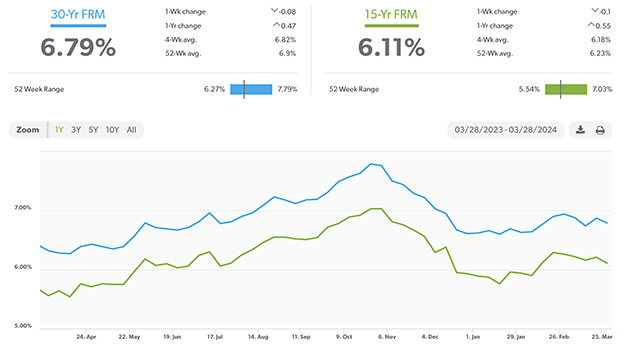

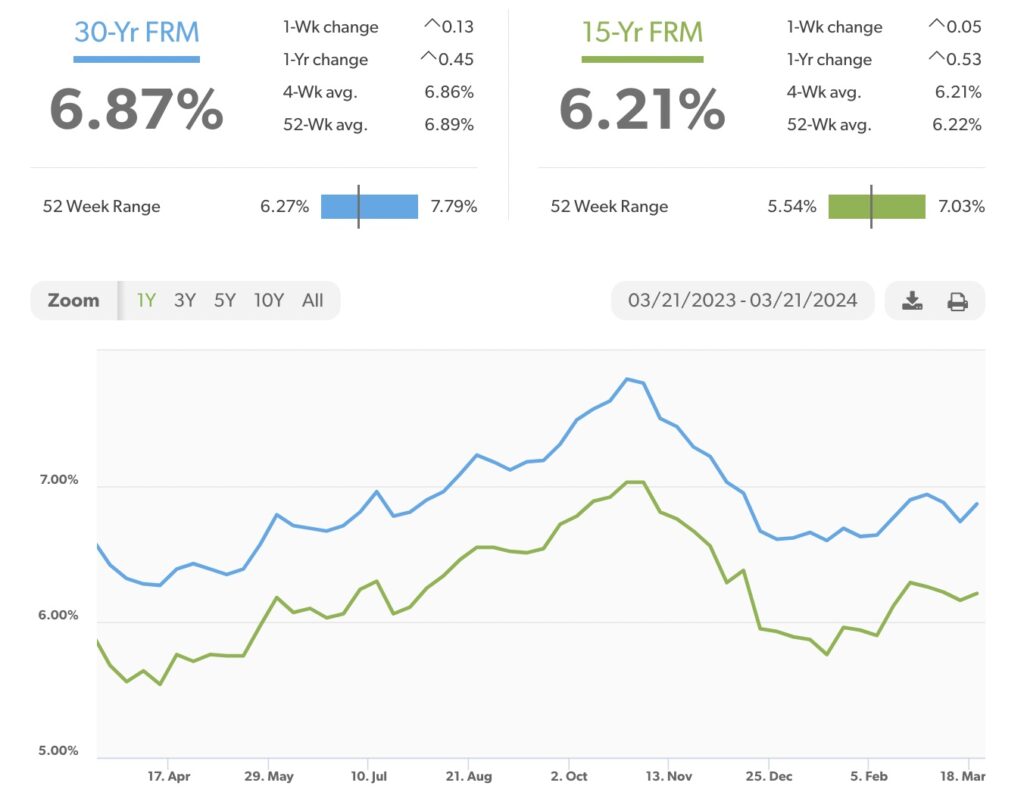

Mortgage rates – The Freddie Mac Primary Mortgage Survey reported that mortgage rates as of March 28, 2024, for the most popular loan products were as follows: The 30-year fixed mortgage rate was 6.79%, down from 6.94% at the end of February. The 15-year fixed was 6.11%, down from 6.26% last month.

The graph below shows the trajectory of mortgage rates over the past year.

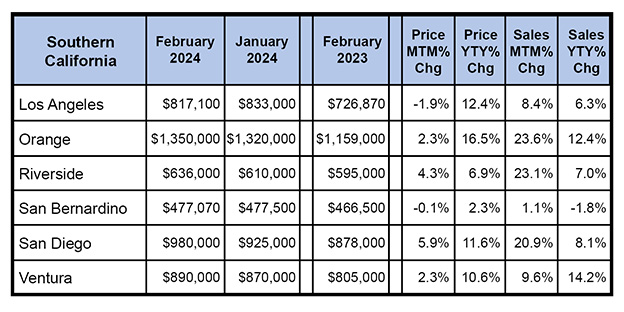

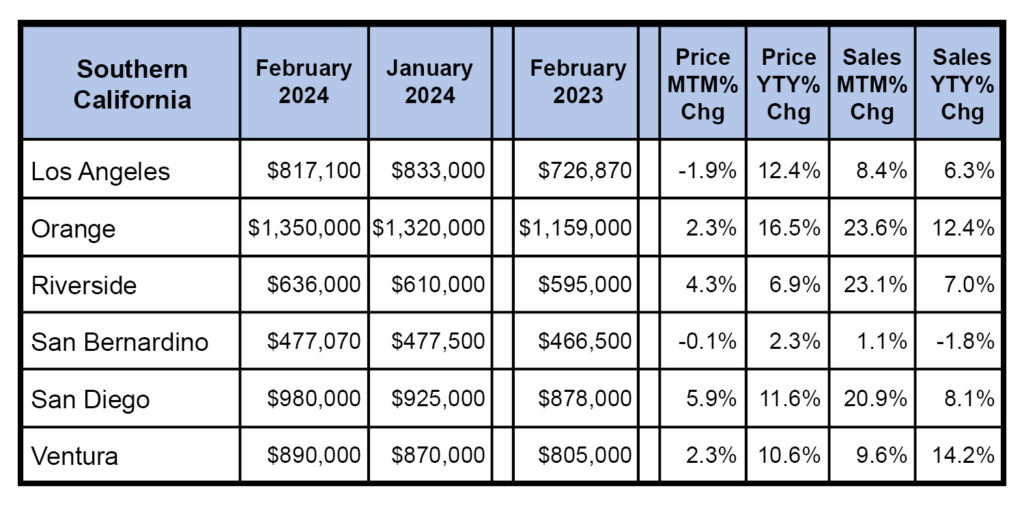

Home sales data is released on the third week of the month for the previous month by the National Association of Realtors and the California Association of Realtors. These are February’s home sales figures.

U.S. existing-home sales – The National Association of Realtors reported that existing-home sales totaled 4.38-million units on a seasonally adjusted annualized rate in February, down 3.3% from an annualized rate of 4.53 million in February 2023. The median price for a home in the U.S. in January was 384,100, up 5.7% from $363,600 last February. There was a 2.9-month supply of homes for sale in February, up from a 2.6-month supply one year ago. First-time buyers accounted for 32% of all sales. Investors and second-home purchases accounted for 21% of all sales. All-cash purchases accounted for 33% of all sales. Foreclosures and short salesaccounted for 3% of all sales.

Year-over-year home prices jumped almost 10% in California – The California Association of Realtors reported that existing-home sales totaled 290,020 in February, up 12.8% from 257,040 closed sales in January and up 1.3% from a revised 286,290 homes sold on an annualized basis last January. There was a 3-month supply of homes on the market in February, down up from a 3.2-month month supply of homes in January and down from a 3.1-month supply one year ago. The statewide median price paid for a home in February was $809,460, up 9.7% from a revised median price of $789,480 last February.

The graph below shows home sales figures by county in Southern California.